Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Program Requirements 1. Nova Scotia's Income Tax Calculator: Employees within the province of Nova Scotia are taxed at different levels - Federal and Provincial.

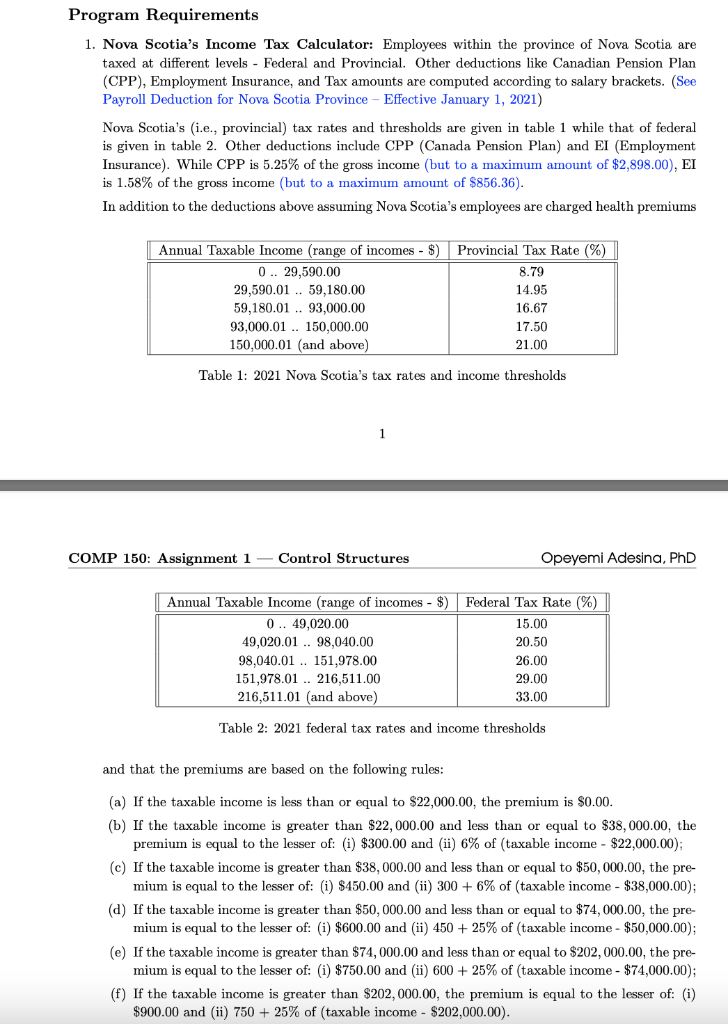

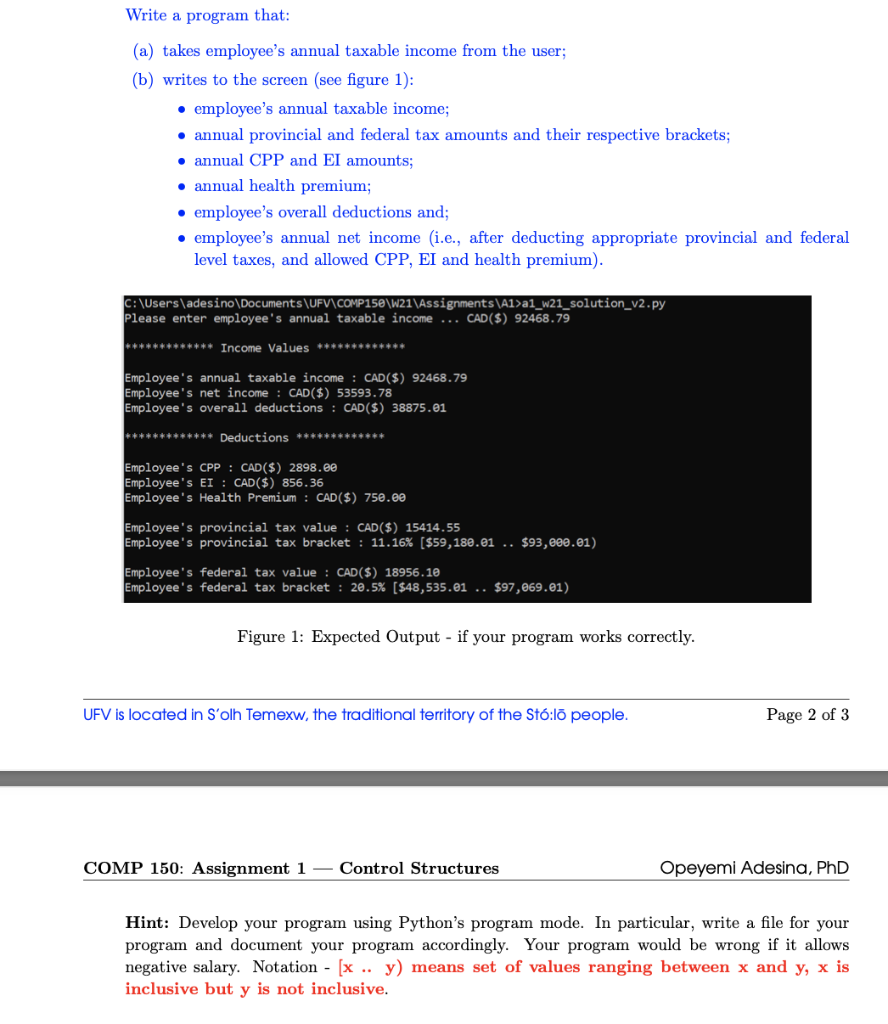

Program Requirements 1. Nova Scotia's Income Tax Calculator: Employees within the province of Nova Scotia are taxed at different levels - Federal and Provincial. Other deductions like Canadian Pension Plan (CPP), Employment Insurance, and Tax amounts are computed according to salary brackets. (See Payroll Deduction for Nova Scotia Province - Effective January 1, 2021) Nova Scotia's (i.e., provincial) tax rates and thresholds are given in table 1 while that of federal is given in table 2. Other deductions include CPP (Canada Pension Plan) and EI (Employment Insurance). While CPP is 5.25% of the gross income (but to a maximum amount of $2,898.00), EI is 1.58% of the gross income (but to a maximum amount of $856.36). In addition to the deductions above assuming Nova Scotia's employees are charged health premiums Annual Taxable Income (range of incomes - $) Provincial Tax Rate (%) 8.79 14.95 16.67 17.50 21.00 0.. 29,590.00 29,590.01 59,180.00 59,180.01 93,000.00 93,000.01. 150,000.00 150,000.01 (and above) Table 1: 2021 Nova Scotia's tax rates and income thresholds COMP 150: Assignment 1 1 Control Structures Opeyemi Adesina, PhD Annual Taxable Income (range of incomes - $) 0.. 49.020.00 49,020.01. 98,040.00 98,040.01. 151,978.00 151,978.01. 216,511.00 216,511.01 (and above) Table 2: 2021 federal tax rates and income thresholds Federal Tax Rate (%) 15.00 20.50 26.00 29.00 33.00 and that the premiums are based on the following rules: (a) If the taxable income is less than or equal to $22,000.00, the premium is $0.00. (b) If the taxable income is greater than $22,000.00 and less than or equal to $38,000.00, the premium is equal to the lesser of: (i) $300.00 and (ii) 6% of (taxable income - $22,000.00); (c) If the taxable income is greater than $38,000.00 and less than or equal to $50,000.00, the pre- mium is equal to the lesser of: (i) $450.00 and (ii) 300 + 6% of (taxable income - $38,000.00); (d) If the taxable income is greater than $50,000.00 and less than or equal to $74, 000.00, the pre- mium is equal to the lesser of: (i) $600.00 and (ii) 450 + 25% of (taxable income - $50,000.00); (e) If the taxable income is greater than $74, 000.00 and less than or equal to $202, 000.00, the pre- mium is equal to the lesser of: (i) $750.00 and (ii) 600 + 25% of (taxable income - $74,000.00); (f) If the taxable income is greater than $202, 000.00, the premium is equal to the lesser of: (i) $900.00 and (ii) 750 + 25% of (taxable income - $202,000.00). Write a program that: (a) takes employee's annual taxable income from the user; (b) writes to the screen (see figure 1): employee's annual taxable income; annual provincial and federal tax amounts and their respective brackets; annual CPP and EI amounts; annual health premium; employee's overall deductions and; employee's annual net income (i.e., after deducting appropriate provincial and federal level taxes, and allowed CPP, EI and health premium). C:\Users\adesino\Documents\UFV\COMP150\W21\Assignments\A1>a1_w21_solution_v2.py Please enter employee's annual taxable income ... CAD ($) 92468.79 ***** Income Values ************* Employee's annual taxable income : CAD($) 92468.79 Employee's net income: CAD ($) 53593.78 Employee's overall deductions : CAD ($) 38875.01 ***** Deductions ************* Employee's CPP CAD ($) 2898.00 Employee's EI: CAD($) 856.36 Employee's Health Premium : CAD ($) 750.00 Employee's provincial tax value : CAD ($) 15414.55 Employee's provincial tax bracket: 11.16% [$59,180.01 .. $93,000.01) Employee's federal tax value : CAD ($) 18956.10 Employee's federal tax bracket: 20.5% [$48,535.01 .. $97,069.01) Figure 1: Expected Output - if your program works correctly. UFV is located in S'olh Temexw, the traditional territory of the St:l people. COMP 150: Assignment 1 Control Structures Page 2 of 3 Opeyemi Adesina, PhD Hint: Develop your program using Python's program mode. In particular, write a file for your program and document your program accordingly. Your program would be wrong if it allows negative salary. Notation - [x .. y) means set of values ranging between x and y, x is inclusive but y is not inclusive.

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Coding is performed in Python PrintPlease enter employees annual taxable income CAD xglideinput x is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started