Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Novak Inc. wants to replace its current equipment with new high-tech equipment. Th. at a cost of $129,000. At that time, the equipment had an

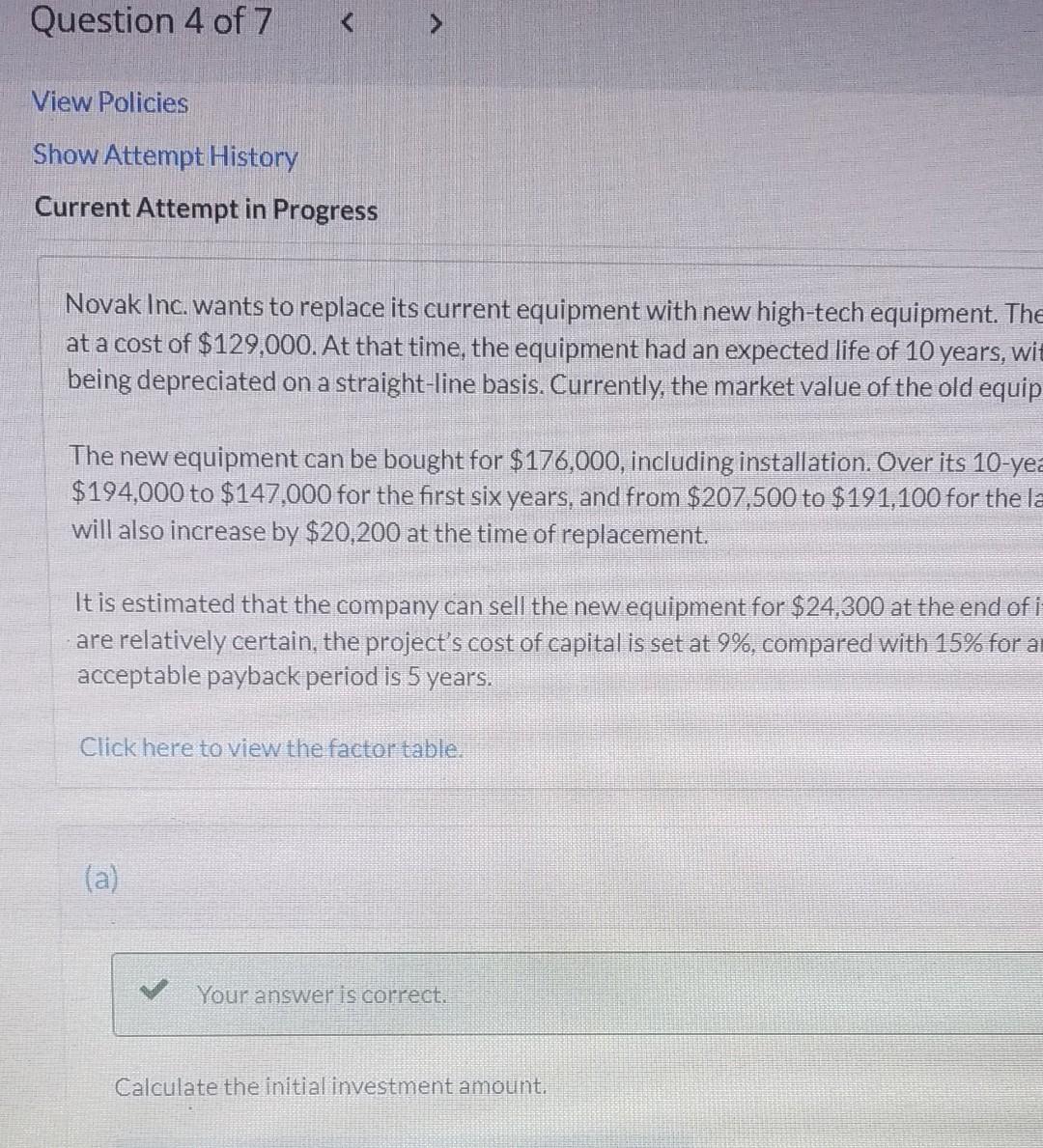

Novak Inc. wants to replace its current equipment with new high-tech equipment. Th. at a cost of $129,000. At that time, the equipment had an expected life of 10 years, wi being depreciated on a straight-line basis. Currently, the market value of the old equip The new equipment can be bought for $176,000, including installation. Over its 10 -ye $194,000 to $147,000 for the first six years, and from $207,500 to $191,100 for the will also increase by $20,200 at the time of replacement. It is estimated that the company can sell the new equipment for $24,300 at the end of are relatively certain, the project's cost of capital is set at 9%, compared with 15% for a acceptable payback period is 5 years. Click here to view the factor table. (a) Your answer is correct. Calculate the initial investment amount. Novak Inc. wants to replace its current equipment with new high-tech equipment. Th. at a cost of $129,000. At that time, the equipment had an expected life of 10 years, wi being depreciated on a straight-line basis. Currently, the market value of the old equip The new equipment can be bought for $176,000, including installation. Over its 10 -ye $194,000 to $147,000 for the first six years, and from $207,500 to $191,100 for the will also increase by $20,200 at the time of replacement. It is estimated that the company can sell the new equipment for $24,300 at the end of are relatively certain, the project's cost of capital is set at 9%, compared with 15% for a acceptable payback period is 5 years. Click here to view the factor table. (a) Your answer is correct. Calculate the initial investment amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started