Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Novaks Inc, a publicly traded manufacturing company in the technology industry, has a November 30 fiscal year end. The company grew rapidly in its first

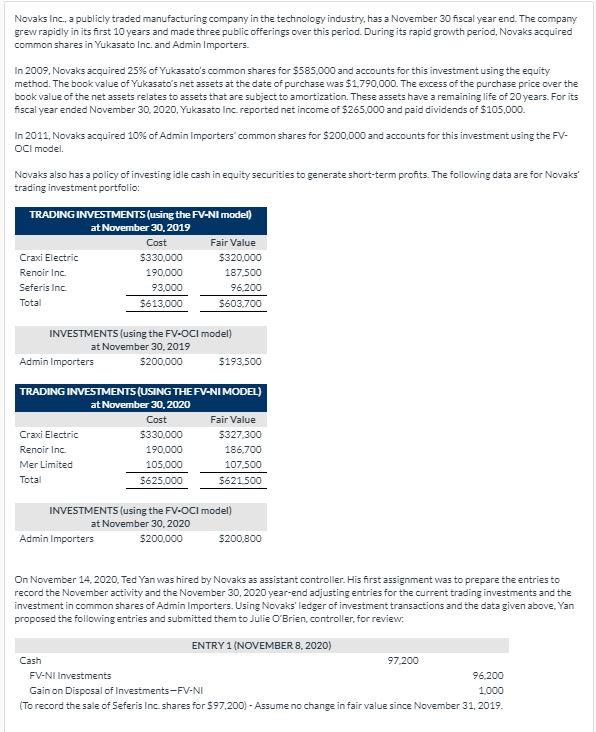

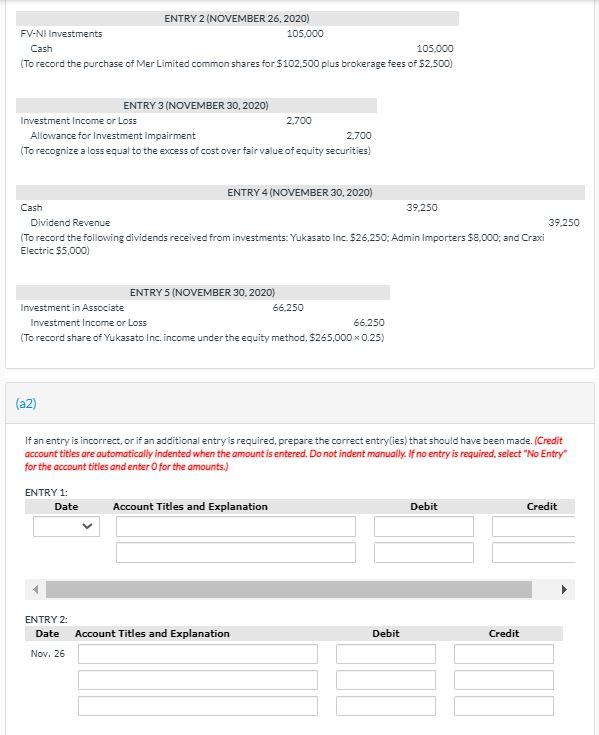

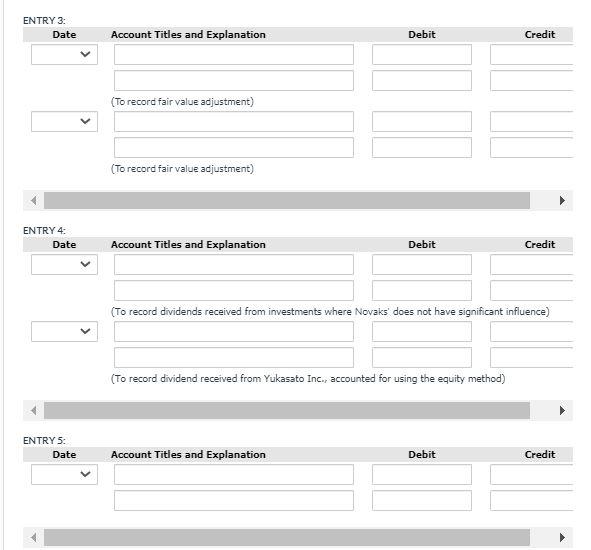

Novaks Inc, a publicly traded manufacturing company in the technology industry, has a November 30 fiscal year end. The company grew rapidly in its first 10 years and made three public offerings over this period. During its rapid growth period. Novaks acquired common shares in Yukasato Inc. and Admin Importers. in 2009, Novaks acquired 25% of Yukasato's common shares for $585.000 and accounts for this investment using the equity method. The book value of Yukasato's net assets at the date of purchase was $1.790,000. The excess of the purchase price over the book value of the net assets relates to assets that are subject to amortization. These assets have a remaining life of 20 years. For its fiscal year ended November 30, 2020, Yukasato Inc reported net income of $265.000 and paid dividends of $105.000. In 2011, Novaks acquired 10% of Admin Importers' common shares for $200,000 and accounts for this investment using the FV- OCI model Novaks also has a policy of investing idle cash in equity securities to generate short-term profits. The following data are for Novaks trading investment portfolio: TRADING INVESTMENTS (using the FV-Nl model) at November 30, 2019 Cost Fair Value Craxi Electric $330.000 Renoir Inc 190.000 187.500 Seferis Inc Total $613,000 $603,700 $320,000 93,000 96.200 INVESTMENTS (using the FV-OCI model) at November 30, 2019 Admin Importers $200,000 $193.500 TRADING INVESTMENTS (USING THEFV-NI MODEL) at November 30.2020 Cost Fair Value Craxi Electric $330.000 $327.300 Renoir Inc 190.000 186,700 Mer Limited 105,000 107.500 Tota $625.000 $621500 INVESTMENTS (using the FV-OCI model) at November 30, 2020 Admin Importers $200.000 $200.800 On November 14,2020, Ted Yan was hired by Novaks as assistant controller. His first assignment was to prepare the entries to record the November activity and the November 30, 2020 year-end adjusting entries for the current trading investments and the investment in common shares of Admin Importers. Using Novaks" ledger of investment transactions and the data given above. Yan proposed the following entries and submitted them to Julie O'Brien, controller, for review. ENTRY 1 (NOVEMBER 8, 2020) Cash 97200 FV-NI Investments 96.200 Gain on Disposal of Investments-FV-NI 1.000 (To record the sale of Seferis Inc shares for $97.200) - Assume no change in fair value since November 31, 2019. ENTRY 2 (NOVEMBER 26, 2020) FV-Nl Investments 105,000 Cash 105.000 (To record the purchase of Mer Limited common shares for S102.500 plus brokerage fees of $2.500) ENTRY 3 (NOVEMBER 30, 2020) Investment Income or Loss 2.700 Allowance for Investment impairment 2,700 (To recognize a loss equal to the excess of cost over fair value of equity securities ENTRY 4 (NOVEMBER 30, 2020) Cash 39,250 Dividend Revenue 39,250 (To record the following dividends received from investments: Yukasato Inc. 526,250: Admin Importers $8,000; and Craxi Electric $5,000) ENTRY 5 (NOVEMBER 30,2020) Investment in Associate 66,250 Investment Income or Loss 66.250 (To record share of Yukasato Inc. income under the equity method, $265,000x0.25) (a2) If an entry is incorrect, or if an additional entry is required, prepare the correct entrylies) that should have been made. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) ENTRY 1: Date Account Titles and Explanation Debit Credit ENTRY 2: Date Account Titles and Explanation Debit Credit Nov. 26 ENTRY 3: Date Account Titles and Explanation Debit Credit (To record fair value adjustment) (To record fair value adjustment) ENTRY 4: Date Account Titles and Explanation Debit Credit (To record dividends received from investments where Novaks does not have significant influence) (To record dividend received from Yukasato Inc., accounted for using the equity method) ENTRY 5: Date Account Titles and Explanation Debit Credit Novaks Inc, a publicly traded manufacturing company in the technology industry, has a November 30 fiscal year end. The company grew rapidly in its first 10 years and made three public offerings over this period. During its rapid growth period. Novaks acquired common shares in Yukasato Inc. and Admin Importers. in 2009, Novaks acquired 25% of Yukasato's common shares for $585.000 and accounts for this investment using the equity method. The book value of Yukasato's net assets at the date of purchase was $1.790,000. The excess of the purchase price over the book value of the net assets relates to assets that are subject to amortization. These assets have a remaining life of 20 years. For its fiscal year ended November 30, 2020, Yukasato Inc reported net income of $265.000 and paid dividends of $105.000. In 2011, Novaks acquired 10% of Admin Importers' common shares for $200,000 and accounts for this investment using the FV- OCI model Novaks also has a policy of investing idle cash in equity securities to generate short-term profits. The following data are for Novaks trading investment portfolio: TRADING INVESTMENTS (using the FV-Nl model) at November 30, 2019 Cost Fair Value Craxi Electric $330.000 Renoir Inc 190.000 187.500 Seferis Inc Total $613,000 $603,700 $320,000 93,000 96.200 INVESTMENTS (using the FV-OCI model) at November 30, 2019 Admin Importers $200,000 $193.500 TRADING INVESTMENTS (USING THEFV-NI MODEL) at November 30.2020 Cost Fair Value Craxi Electric $330.000 $327.300 Renoir Inc 190.000 186,700 Mer Limited 105,000 107.500 Tota $625.000 $621500 INVESTMENTS (using the FV-OCI model) at November 30, 2020 Admin Importers $200.000 $200.800 On November 14,2020, Ted Yan was hired by Novaks as assistant controller. His first assignment was to prepare the entries to record the November activity and the November 30, 2020 year-end adjusting entries for the current trading investments and the investment in common shares of Admin Importers. Using Novaks" ledger of investment transactions and the data given above. Yan proposed the following entries and submitted them to Julie O'Brien, controller, for review. ENTRY 1 (NOVEMBER 8, 2020) Cash 97200 FV-NI Investments 96.200 Gain on Disposal of Investments-FV-NI 1.000 (To record the sale of Seferis Inc shares for $97.200) - Assume no change in fair value since November 31, 2019. ENTRY 2 (NOVEMBER 26, 2020) FV-Nl Investments 105,000 Cash 105.000 (To record the purchase of Mer Limited common shares for S102.500 plus brokerage fees of $2.500) ENTRY 3 (NOVEMBER 30, 2020) Investment Income or Loss 2.700 Allowance for Investment impairment 2,700 (To recognize a loss equal to the excess of cost over fair value of equity securities ENTRY 4 (NOVEMBER 30, 2020) Cash 39,250 Dividend Revenue 39,250 (To record the following dividends received from investments: Yukasato Inc. 526,250: Admin Importers $8,000; and Craxi Electric $5,000) ENTRY 5 (NOVEMBER 30,2020) Investment in Associate 66,250 Investment Income or Loss 66.250 (To record share of Yukasato Inc. income under the equity method, $265,000x0.25) (a2) If an entry is incorrect, or if an additional entry is required, prepare the correct entrylies) that should have been made. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) ENTRY 1: Date Account Titles and Explanation Debit Credit ENTRY 2: Date Account Titles and Explanation Debit Credit Nov. 26 ENTRY 3: Date Account Titles and Explanation Debit Credit (To record fair value adjustment) (To record fair value adjustment) ENTRY 4: Date Account Titles and Explanation Debit Credit (To record dividends received from investments where Novaks does not have significant influence) (To record dividend received from Yukasato Inc., accounted for using the equity method) ENTRY 5: Date Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started