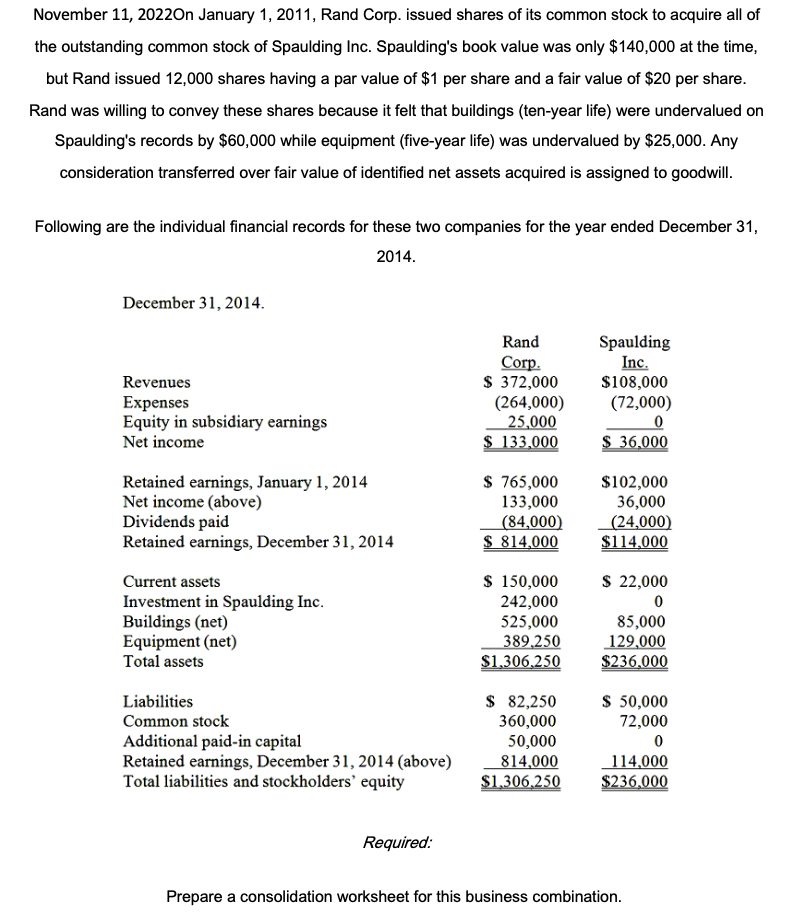

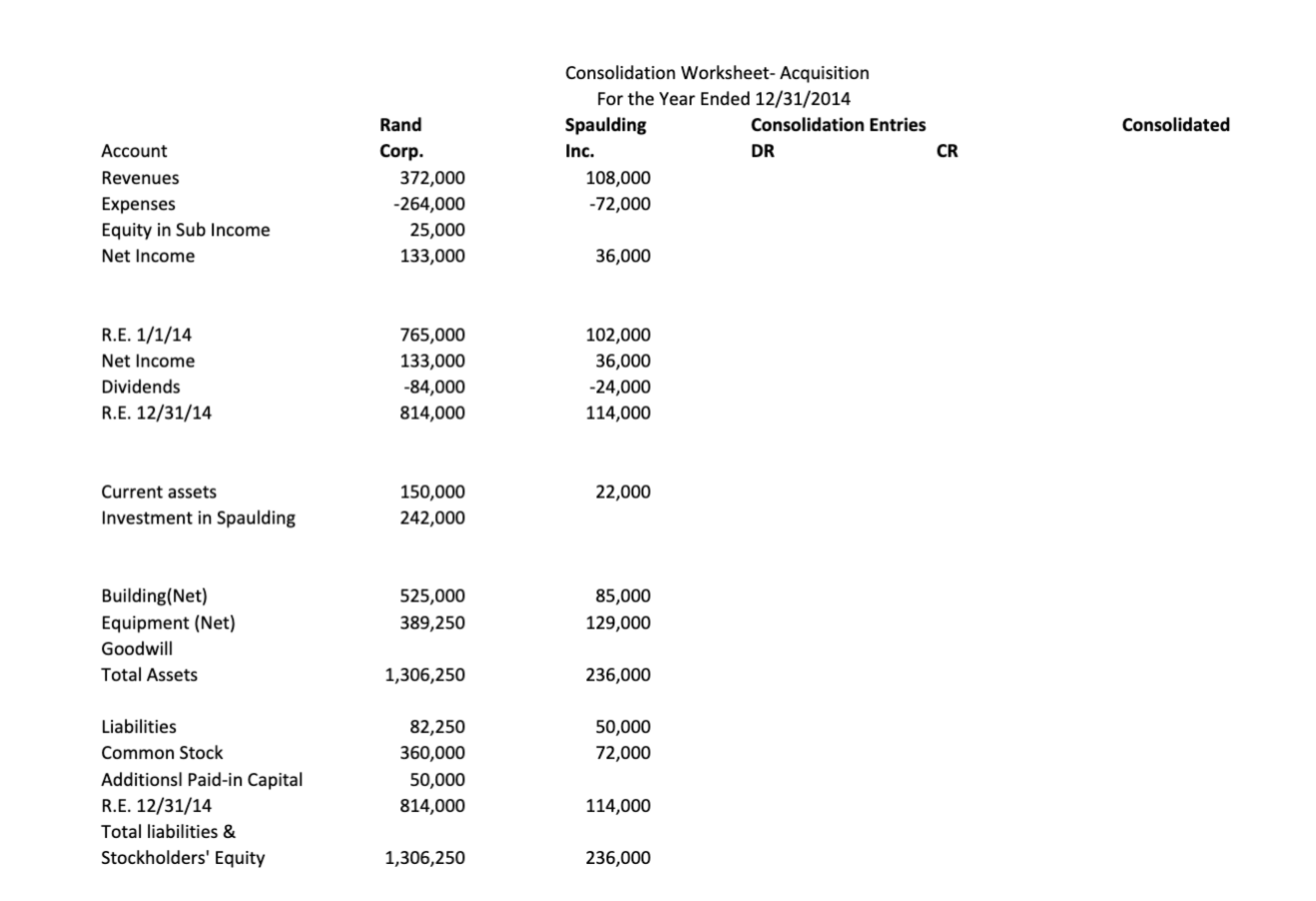

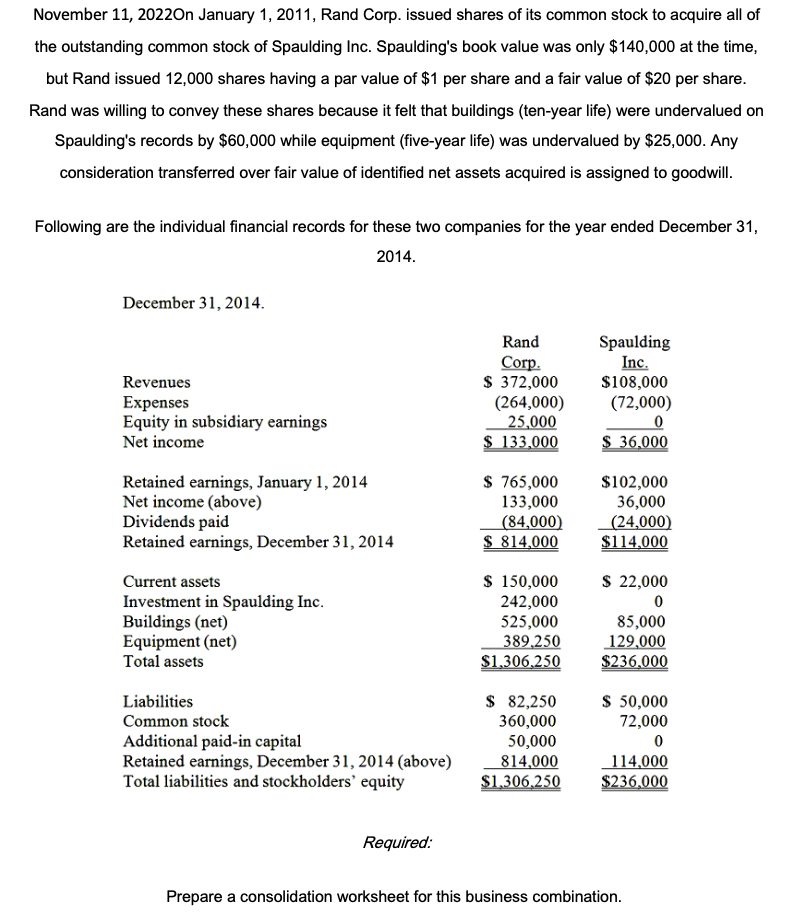

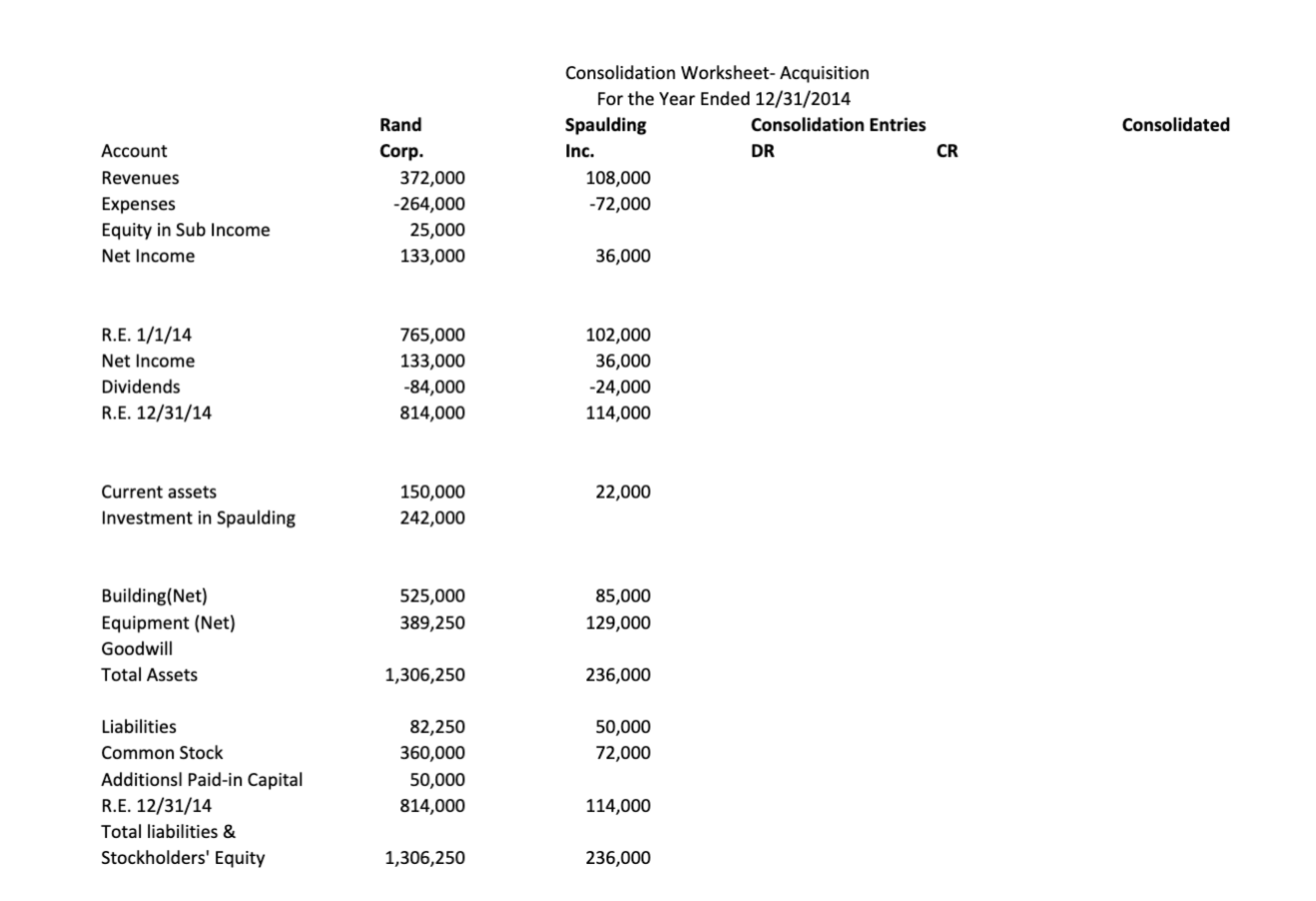

November 11,20220 n January 1,2011 , Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill. Following are the individual financial records for these two companies for the year ended December 31 , 2014. December 31, 2014. Required: Prepare a consolidation worksheet for this business combination. Consolidation Worksheet- Acquisition For the Year Ended 12/31/2014 R.E.1/1/14NetIncomeDividendsR.E.12/31/14765,000133,00084,000814,000102,00036,00024,000114,000 Currentassets150,00022,000 Investment in Spaulding 242,000 Building(Net)Equipment(Net)GoodwillTotalAssets525,000389,2501,306,25085,000129,000236,000 Liabilities82,25050,000 CommonStock360,00072,000 Additionsl Paid-in Capital R.E. 12/31/14 50,000 Total liabilities \& StockholdersEquity1,306,250236,000 November 11,20220 n January 1,2011 , Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill. Following are the individual financial records for these two companies for the year ended December 31 , 2014. December 31, 2014. Required: Prepare a consolidation worksheet for this business combination. Consolidation Worksheet- Acquisition For the Year Ended 12/31/2014 R.E.1/1/14NetIncomeDividendsR.E.12/31/14765,000133,00084,000814,000102,00036,00024,000114,000 Currentassets150,00022,000 Investment in Spaulding 242,000 Building(Net)Equipment(Net)GoodwillTotalAssets525,000389,2501,306,25085,000129,000236,000 Liabilities82,25050,000 CommonStock360,00072,000 Additionsl Paid-in Capital R.E. 12/31/14 50,000 Total liabilities \& StockholdersEquity1,306,250236,000