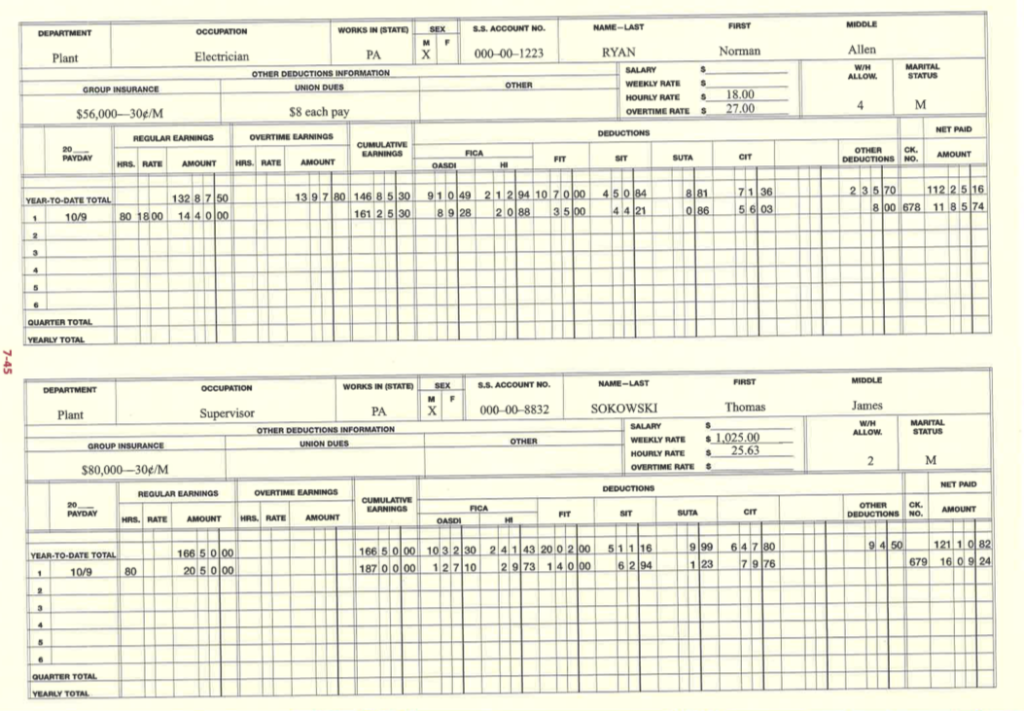

NOVEMBER 13 PAYROLL

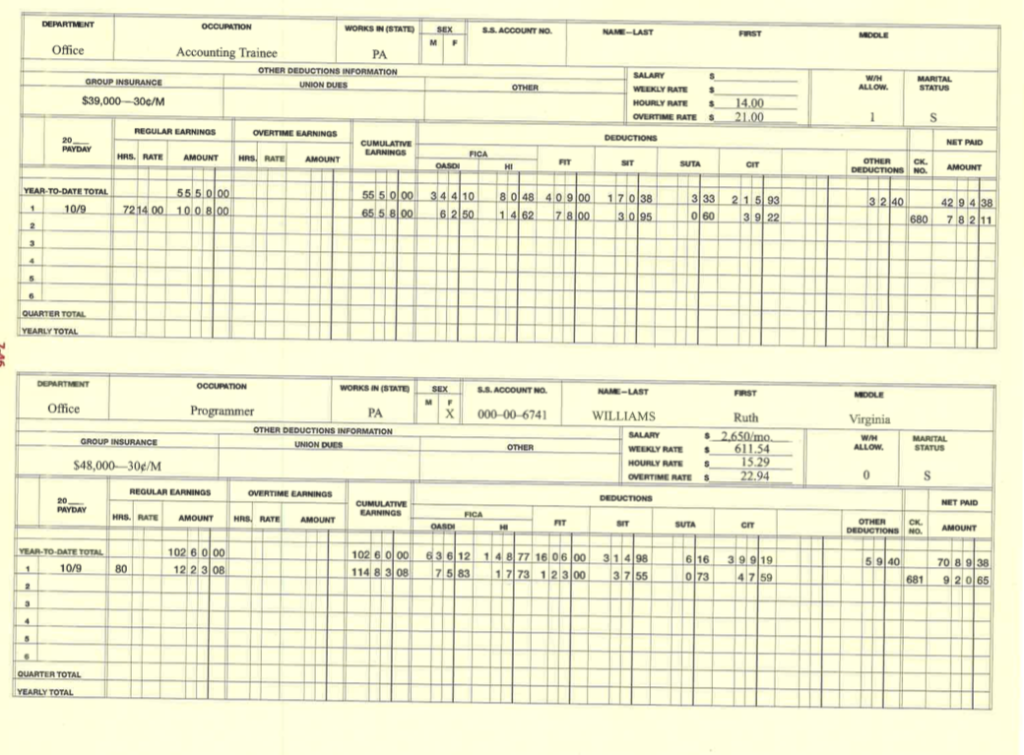

1.What is the amount of FIT withheld for Ruth V. Williams?

2.What is Ruth V. Williams' current net pay?

3.What is the amount of CIT withheld for Ruth V. Williams?

4.What is the amount of Ruth V. Williams Group Insurance withheld?

5.What is the amount of the debit to Payroll Taxes?

6.What is the total amount of Payroll Taxes (account number 56) to date?

7.What is the balance in the FICA Taxes PayableHI account?

8.What is the balance in the Cash Account?

9.What is the balance in the Employees FIT Payable account?

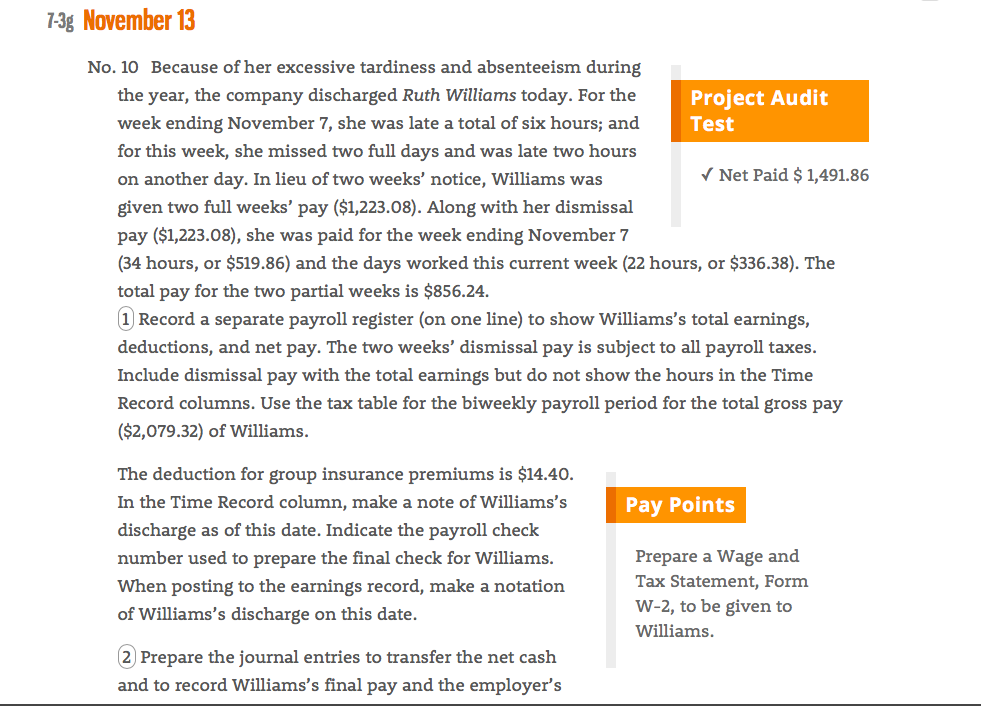

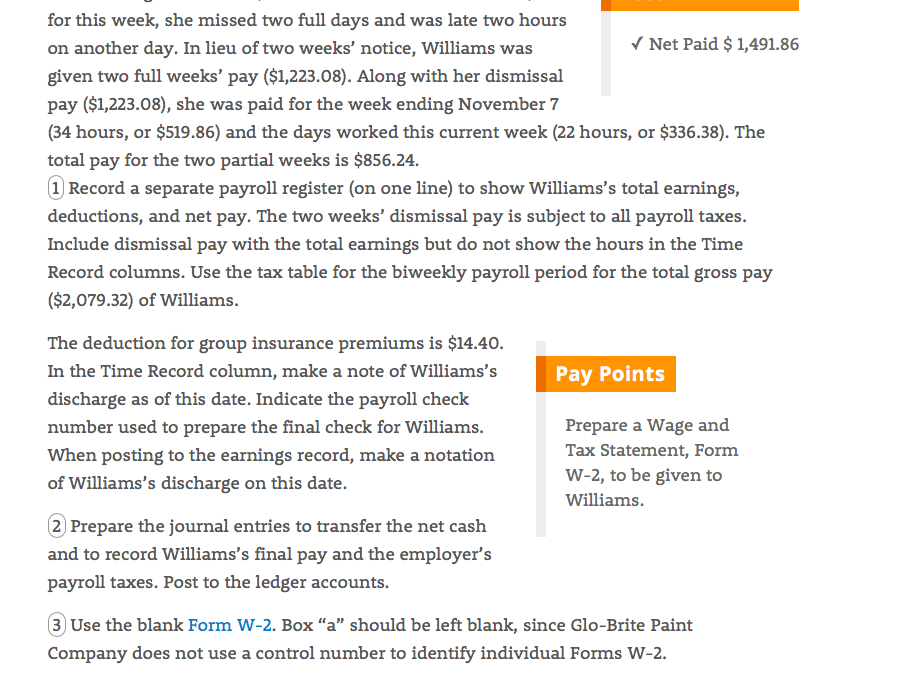

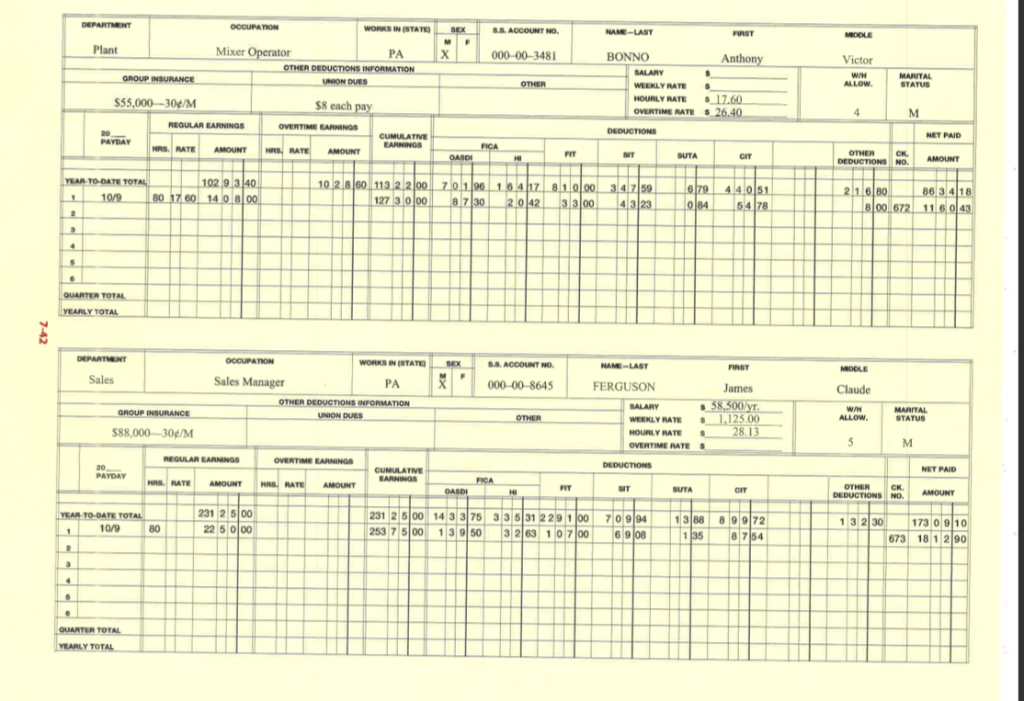

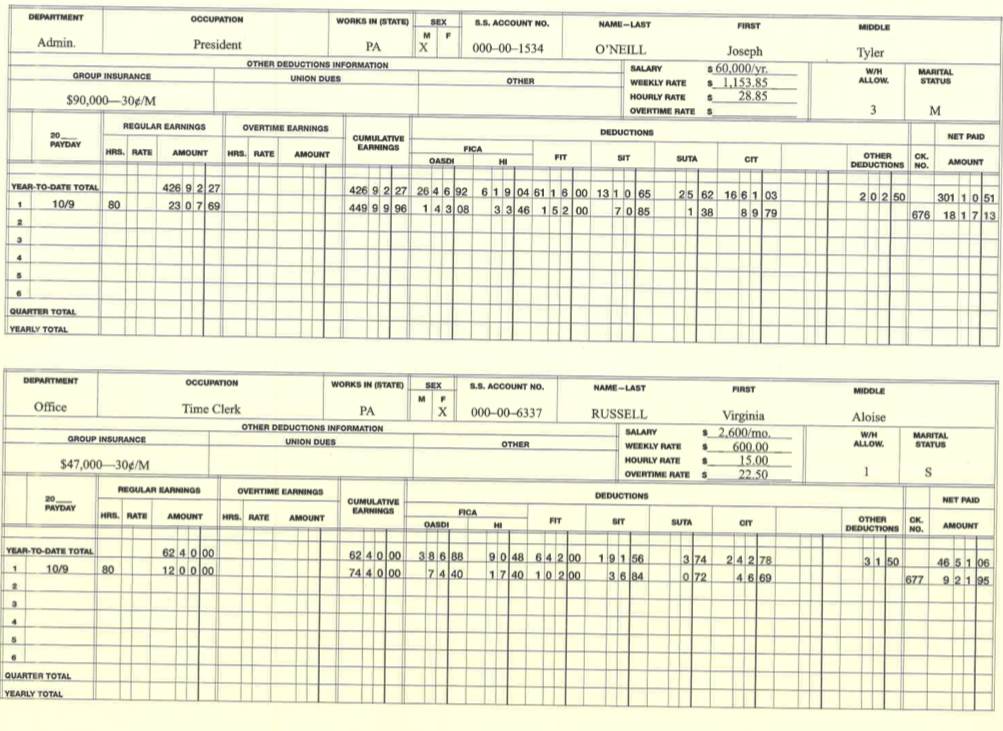

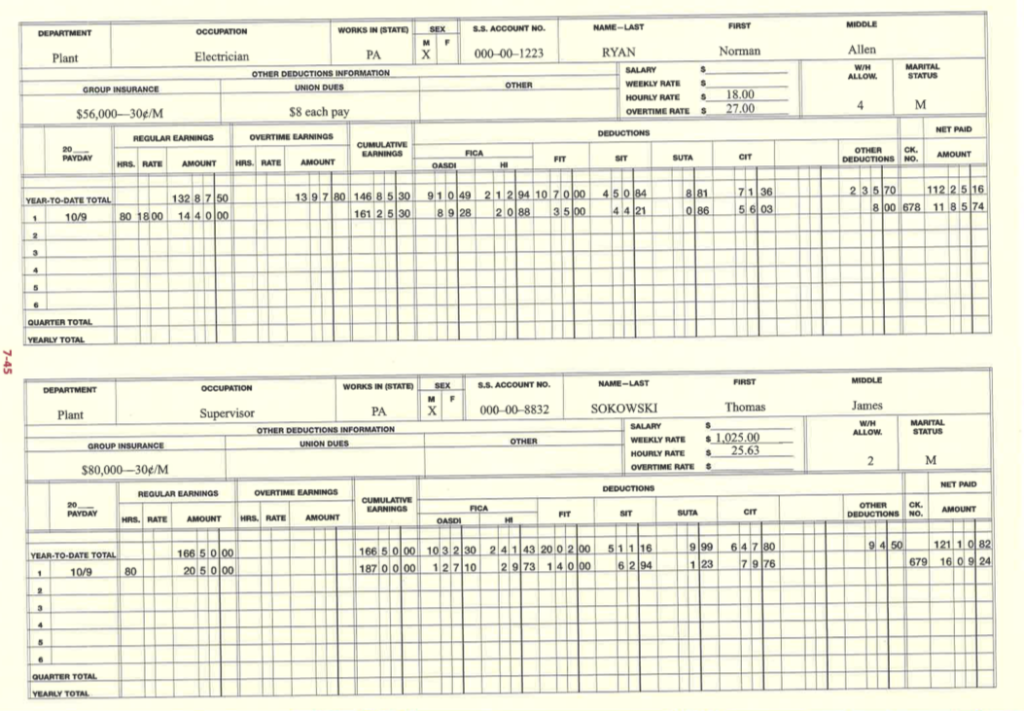

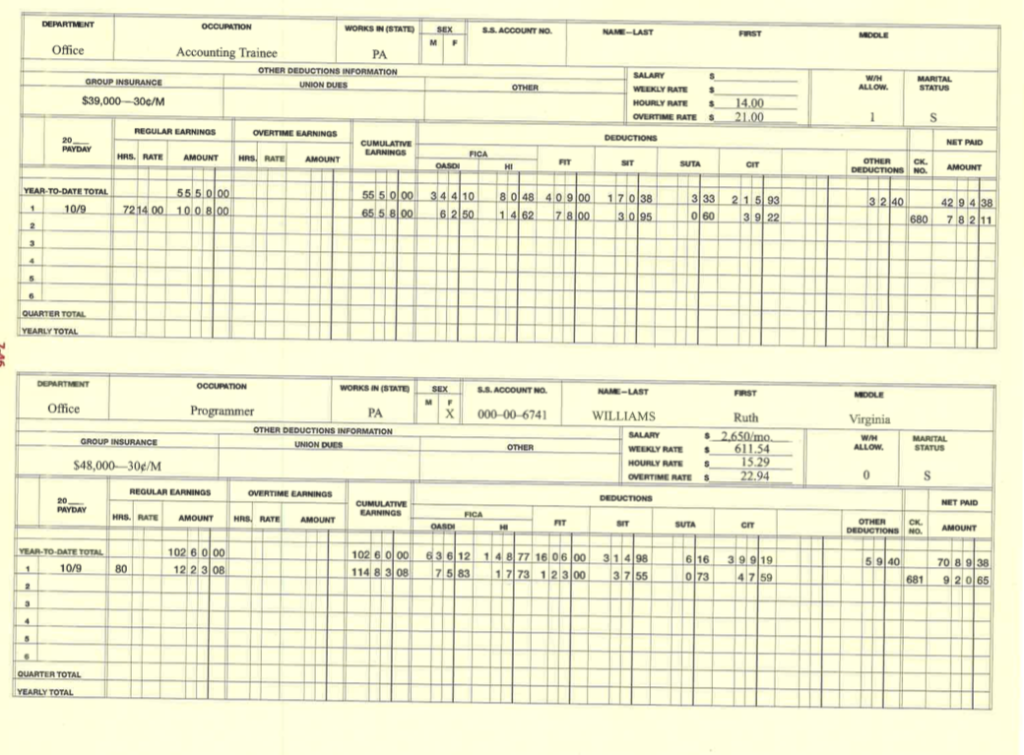

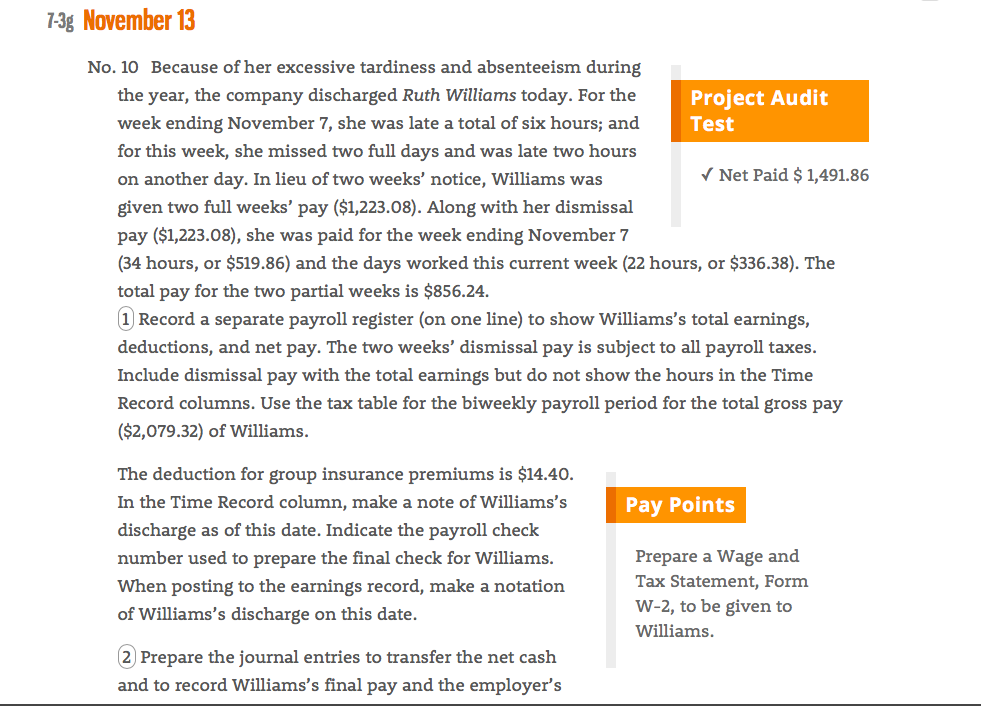

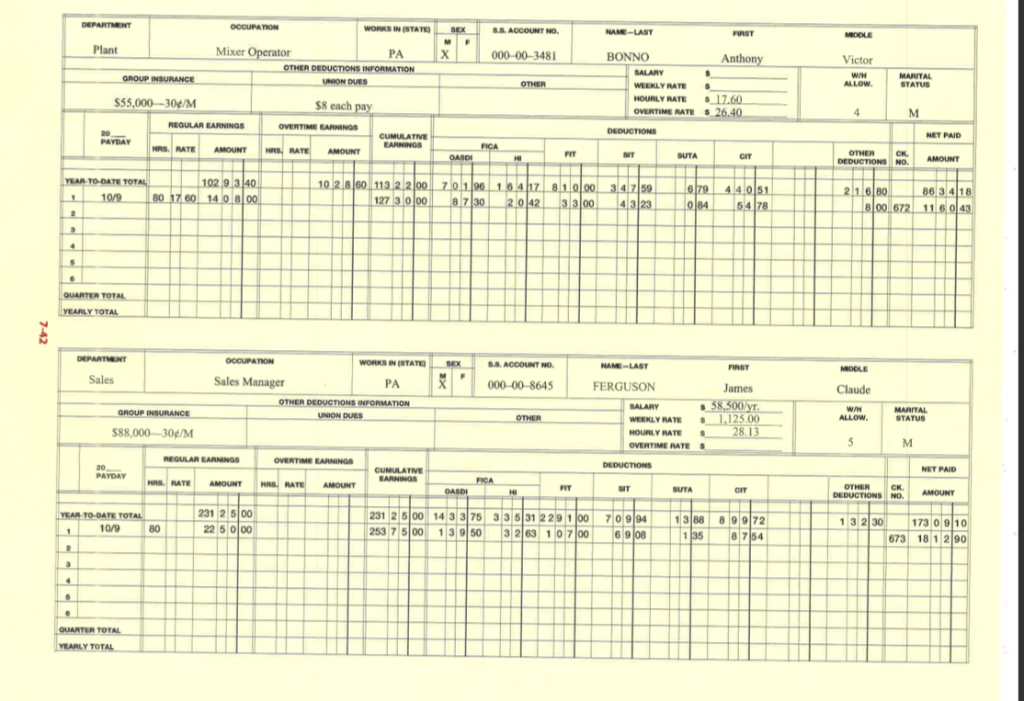

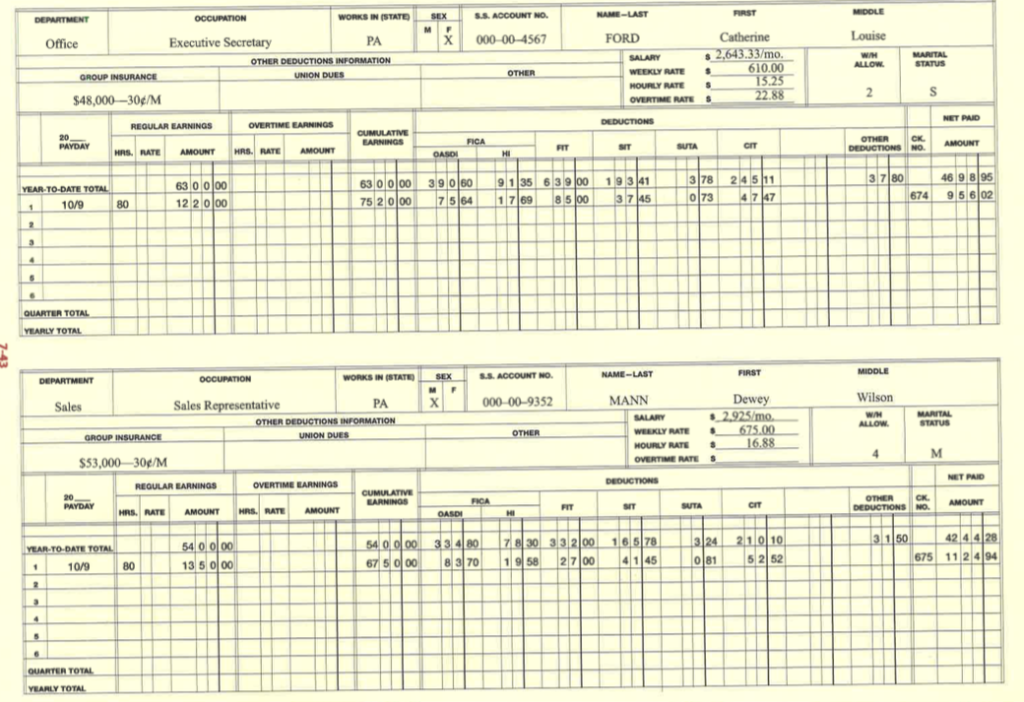

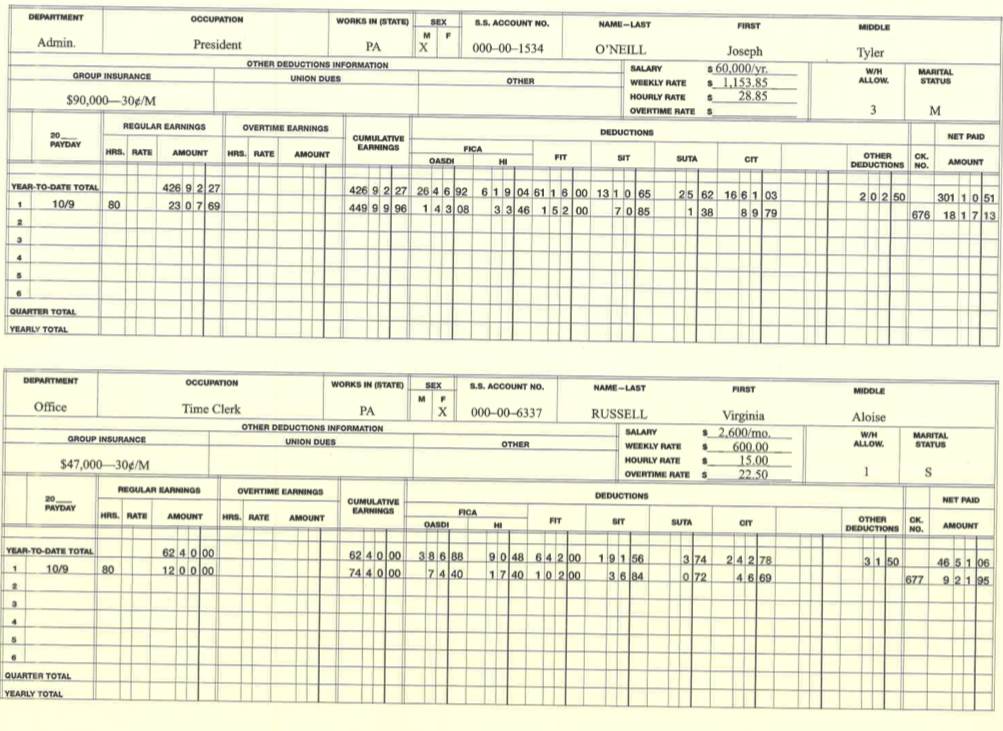

13g November 13 No. 10 Because of her excessive tardiness and absenteeism during the year, the company discharged Ruth Williams today. For the week ending November 7, she was late a total of six hours; and for this week, she missed two full days and was late two hours on another day. In lieu of two weeks' notice, Williams was given two full weeks' pay ($1,223.08). Along with her dismissal pay ($1,223.08), she was paid for the week ending November 7 (34 hours, or $519.86) and the days worked this current week (22 hours, or $336.38). The total pay for the two partial weeks is $856.24. 1 Record a separate payroll register (on one line) to show Williams's total earnings, deductions, and net pay. The two weeks' dismissal pay is subject to all payroll taxes. Include dismissal pay with the total earnings but do not show the hours in the Time Record columns. Use the tax table for the biweekly payroll period for the total gross pay ($2,079.32) of Williams. Project Audit Test Net Paid $ 1,491.86 The deduction for group insurance premiums is $14.40. In the Time Record column, make a note of Williams's discharge as of this date. Indicate the payroll check number used to prepare the final check for Williams. When posting to the earnings record, make a notation of Williams's discharge on this date. Pay Points Prepare a Wage and Tax Statement, Form W-2, to be given to Williams. 2 Prepare the journal entries to transfer the net cash and to record Williams's final pay and the employer's for this week, she missed two full days and was late two hours on another day. In lieu of two weeks' notice, Williams was given two full weeks' pay ($1,223.08). Along with her dismissal pay ($1,223.08), she was paid for the week ending November 7 (34 hours, or $519.86) and the days worked this current week (22 hours, or $336.38). The total pay for the two partial weeks is $856.24. 1 Record a separate payroll register (on one line) to show Williams's total earnings, deductions, and net pay. The two weeks' dismissal pay is subject to all payroll taxes. Include dismissal pay with the total earnings but do not show the hours in the Time Record columns. Use the tax table for the biweekly payroll period for the total gross pay ($2,079.32) of Williams Net Paid $ 1,491.86 The deduction for group insurance premiums is $14.40. In the Time Record column, make a note of Williams's discharge as of this date. Indicate the payroll check number used to prepare the final check for Williams. When posting to the earnings record, make a notation of Williams's discharge on this date. Pay Points Prepare a Wage and Tax Statement, Form W-2, to be given to Williams. 2 Prepare the journal entries to transfer the net cash and to record Williams's final pay and the employer's payroll taxes. Post to the ledger accounts. 3 Use the blank Form w-2. Box "a should be left blank, since Glo-Brite Paint Company does not use a control number to identify individual Forms W-2 NAME-LAST WORKS IN ISTATE SA ACCOUNT NO OCCUPATION Victor 000-00-3481 PA Mixer Plant STATUS HOURLY RATE OVERTIME RATE $8 each S 55,000-30e/M NET PAID CUMULATME OTHERCK. 6 80 96 1.64 30 13 2 2 0293 YEAR TO-DATE SS. ACCOUNT NO WORKS IN (STATE Claude FERGUSON Sales Manager PA Sales STATUS 25.00. WEEKLY RATE HOURLY RATE OVERTIME RATE 88,000-30e/M NET PAND CUMULATINE OTHER CKAMOUNT DEDUCTIONS NO 3 2 30 73 0910 73 18 1 2 90 231 2 5 00 14 3 3 75 33 5 31 229 253 7 5 00 13 9 50 3 2 63 1 0 388 89972 8 754 0 994 6 9 231 2 5 00 22 5 0 00 10/9 YEARLY SS ACCOUNT NO WORKS IN (STATE M F FORD X 000-00-4567 PA Executive Secretary Office 610.00 WEEKLY RATE HOURLY RATES OVERTIME RATE $48,000-30e/M NET PAID REGULAR EARNINGS RS RATE AMOUNTHRS RATE AMOUNT 469 8 95 74 9 5 6 02 3 7 80 63010100-39.60. -9. 1135. 6.39 75 2 0 00 7 5 64176985 3 78 24511 0 737 47 19 3 41 63 0 000 122 0 YEAR TO-DATE 10/9 80 NAME-LAST WORKS IN (STATE Wilson MANN 000-00-9352 PA Sales R WEEKLY RATE675.00 HOURLY RATE OVERTIME RATE $53,000 30e/M OVERTIME EARNINGS REGULAR EARNINGS CK RAT AMOUNTEARNINGS HRS, RATE AMOUNT 501 42.4.4 YEAR TO-DATE 675 11 2 4 9 5 2 52 00 8 3 701 9 58 27 004 1 45 0 81 13 5 0 00 80 10/9 WORKS IN (STATE S.S. ACCOUNT NO. NAME-LAST PA 000-00-1534 O'NEILL Tyler WEEKLY RATE 1153.8 HOURLY RATES OVERTIME RATE S 90,000 30e/M REQULAR EARNINGS OVERTIME EARNINGS NET PAID AINGS HRS. RATE AMOUNT RATEAMOUNT FIT CIT YEAR TO-DATE WORKS IN ISTATE S.S. ACCOUNT NO. NAME-LAST FIRST M F Office Time Clerk PA RUSSELL Virginia WEEKLY RATE HOURLY RATES OVERTIME RATE $47,000 30eM OVERTIME EARNINGS NET PAID HRS RATE AMOUNT RATE AMOUNT FIT SIT YEAR-TO-DATE TOTAL WORKS IN (STATE S5. ACCOUNT NO M F Office PA WEEKLY RATE 39,00030c/M OVERTIME RATE S NET PAID RS RATE AMOUNT OTHERCKAMOUNT 55.50 14 5.8 680 WORKS IN (STATE Office PA X 000-00 6741 WILLIAMS Ruth WEEKLY RATE611.54 HOURLY RATE 48,000 30d/M NET PAID RATEAMOUNT OTHERKAMOUNT 16 06 9 40 13g November 13 No. 10 Because of her excessive tardiness and absenteeism during the year, the company discharged Ruth Williams today. For the week ending November 7, she was late a total of six hours; and for this week, she missed two full days and was late two hours on another day. In lieu of two weeks' notice, Williams was given two full weeks' pay ($1,223.08). Along with her dismissal pay ($1,223.08), she was paid for the week ending November 7 (34 hours, or $519.86) and the days worked this current week (22 hours, or $336.38). The total pay for the two partial weeks is $856.24. 1 Record a separate payroll register (on one line) to show Williams's total earnings, deductions, and net pay. The two weeks' dismissal pay is subject to all payroll taxes. Include dismissal pay with the total earnings but do not show the hours in the Time Record columns. Use the tax table for the biweekly payroll period for the total gross pay ($2,079.32) of Williams. Project Audit Test Net Paid $ 1,491.86 The deduction for group insurance premiums is $14.40. In the Time Record column, make a note of Williams's discharge as of this date. Indicate the payroll check number used to prepare the final check for Williams. When posting to the earnings record, make a notation of Williams's discharge on this date. Pay Points Prepare a Wage and Tax Statement, Form W-2, to be given to Williams. 2 Prepare the journal entries to transfer the net cash and to record Williams's final pay and the employer's for this week, she missed two full days and was late two hours on another day. In lieu of two weeks' notice, Williams was given two full weeks' pay ($1,223.08). Along with her dismissal pay ($1,223.08), she was paid for the week ending November 7 (34 hours, or $519.86) and the days worked this current week (22 hours, or $336.38). The total pay for the two partial weeks is $856.24. 1 Record a separate payroll register (on one line) to show Williams's total earnings, deductions, and net pay. The two weeks' dismissal pay is subject to all payroll taxes. Include dismissal pay with the total earnings but do not show the hours in the Time Record columns. Use the tax table for the biweekly payroll period for the total gross pay ($2,079.32) of Williams Net Paid $ 1,491.86 The deduction for group insurance premiums is $14.40. In the Time Record column, make a note of Williams's discharge as of this date. Indicate the payroll check number used to prepare the final check for Williams. When posting to the earnings record, make a notation of Williams's discharge on this date. Pay Points Prepare a Wage and Tax Statement, Form W-2, to be given to Williams. 2 Prepare the journal entries to transfer the net cash and to record Williams's final pay and the employer's payroll taxes. Post to the ledger accounts. 3 Use the blank Form w-2. Box "a should be left blank, since Glo-Brite Paint Company does not use a control number to identify individual Forms W-2 NAME-LAST WORKS IN ISTATE SA ACCOUNT NO OCCUPATION Victor 000-00-3481 PA Mixer Plant STATUS HOURLY RATE OVERTIME RATE $8 each S 55,000-30e/M NET PAID CUMULATME OTHERCK. 6 80 96 1.64 30 13 2 2 0293 YEAR TO-DATE SS. ACCOUNT NO WORKS IN (STATE Claude FERGUSON Sales Manager PA Sales STATUS 25.00. WEEKLY RATE HOURLY RATE OVERTIME RATE 88,000-30e/M NET PAND CUMULATINE OTHER CKAMOUNT DEDUCTIONS NO 3 2 30 73 0910 73 18 1 2 90 231 2 5 00 14 3 3 75 33 5 31 229 253 7 5 00 13 9 50 3 2 63 1 0 388 89972 8 754 0 994 6 9 231 2 5 00 22 5 0 00 10/9 YEARLY SS ACCOUNT NO WORKS IN (STATE M F FORD X 000-00-4567 PA Executive Secretary Office 610.00 WEEKLY RATE HOURLY RATES OVERTIME RATE $48,000-30e/M NET PAID REGULAR EARNINGS RS RATE AMOUNTHRS RATE AMOUNT 469 8 95 74 9 5 6 02 3 7 80 63010100-39.60. -9. 1135. 6.39 75 2 0 00 7 5 64176985 3 78 24511 0 737 47 19 3 41 63 0 000 122 0 YEAR TO-DATE 10/9 80 NAME-LAST WORKS IN (STATE Wilson MANN 000-00-9352 PA Sales R WEEKLY RATE675.00 HOURLY RATE OVERTIME RATE $53,000 30e/M OVERTIME EARNINGS REGULAR EARNINGS CK RAT AMOUNTEARNINGS HRS, RATE AMOUNT 501 42.4.4 YEAR TO-DATE 675 11 2 4 9 5 2 52 00 8 3 701 9 58 27 004 1 45 0 81 13 5 0 00 80 10/9 WORKS IN (STATE S.S. ACCOUNT NO. NAME-LAST PA 000-00-1534 O'NEILL Tyler WEEKLY RATE 1153.8 HOURLY RATES OVERTIME RATE S 90,000 30e/M REQULAR EARNINGS OVERTIME EARNINGS NET PAID AINGS HRS. RATE AMOUNT RATEAMOUNT FIT CIT YEAR TO-DATE WORKS IN ISTATE S.S. ACCOUNT NO. NAME-LAST FIRST M F Office Time Clerk PA RUSSELL Virginia WEEKLY RATE HOURLY RATES OVERTIME RATE $47,000 30eM OVERTIME EARNINGS NET PAID HRS RATE AMOUNT RATE AMOUNT FIT SIT YEAR-TO-DATE TOTAL WORKS IN (STATE S5. ACCOUNT NO M F Office PA WEEKLY RATE 39,00030c/M OVERTIME RATE S NET PAID RS RATE AMOUNT OTHERCKAMOUNT 55.50 14 5.8 680 WORKS IN (STATE Office PA X 000-00 6741 WILLIAMS Ruth WEEKLY RATE611.54 HOURLY RATE 48,000 30d/M NET PAID RATEAMOUNT OTHERKAMOUNT 16 06 9 40