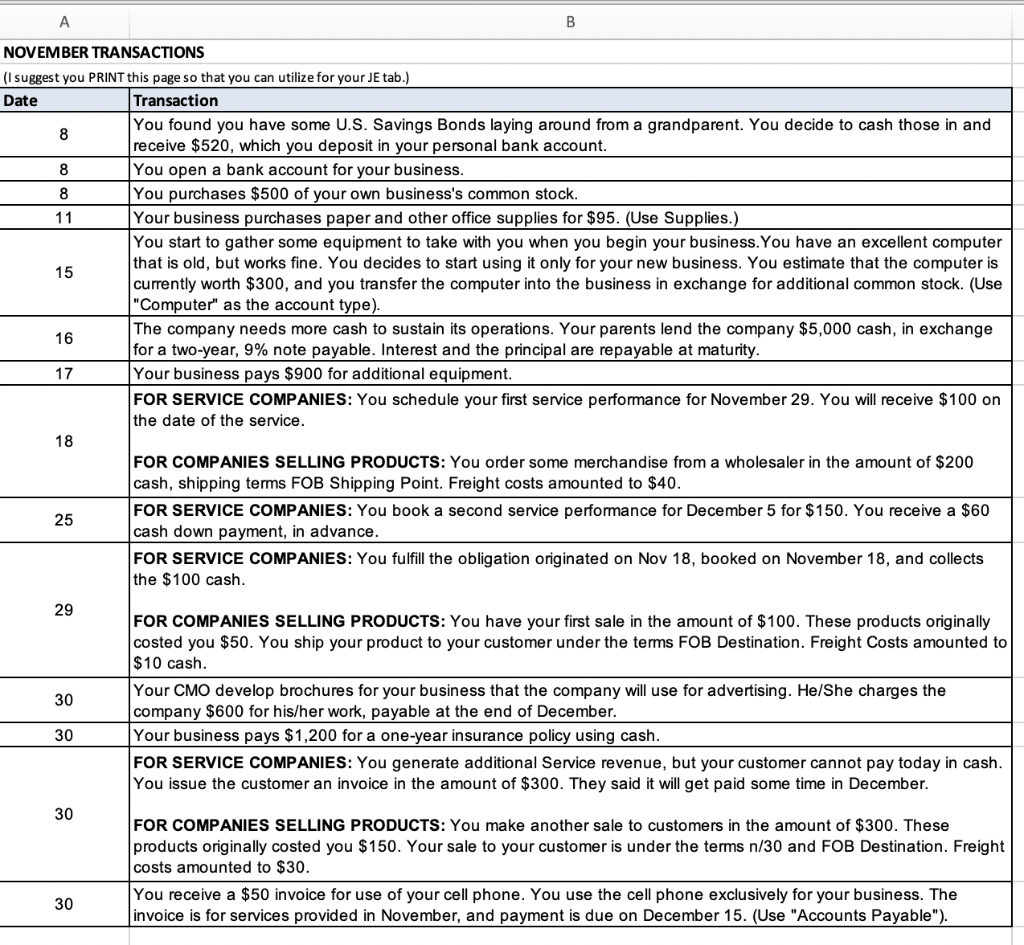

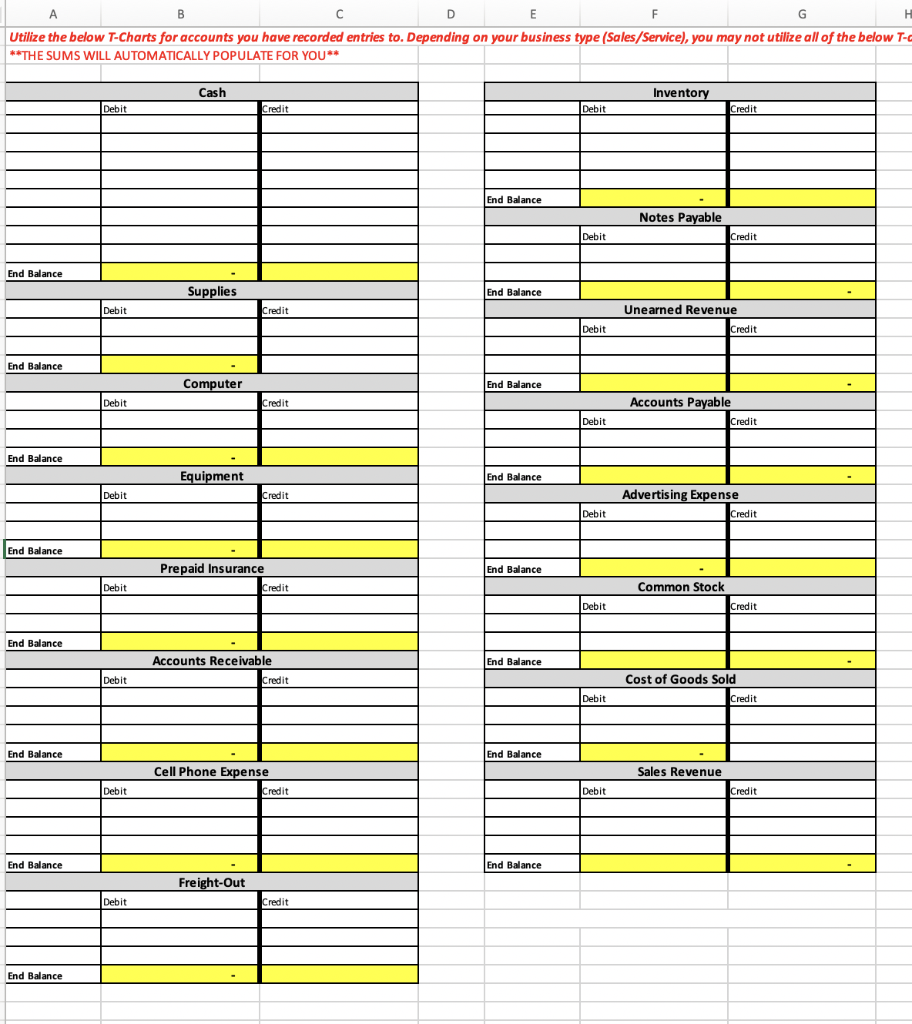

NOVEMBER TRANSACTIONS (I suggest you PRINT this page so that you can utilize for your JE tab.) Date Transaction You found you have some U.S. Savings Bonds laying around from a grandparent. You decide to cash those in and receive $520, which you deposit in your personal bank account. You open a bank account for your business. You purchases $500 of your own business's common stock. Your business purchases paper and other office supplies for $95. (Use Supplies.) You start to gather some equipment to take with you when you begin your business. You have an excellent computer that is old, but works fine. You decides to start using it only for your new business. You estimate that the computer is currently worth $300, and you transfer the computer into the business in exchange for additional common stock. (Use "Computer" as the account type). The company needs more cash to sustain its operations. Your parents lend the company $5,000 cash, in exchange for a two-year, 9% note payable. Interest and the principal are repayable at maturity. Your business pays $900 for additional equipment. FOR SERVICE COMPANIES: You schedule your first service performance for November 29. You will receive $100 on the date of the service. FOR COMPANIES SELLING PRODUCTS: You order some merchandise from a wholesaler in the amount of $200 cash, shipping terms FOB Shipping Point. Freight costs amounted to $40. FOR SERVICE COMPANIES: You book a second service performance for December 5 for $150. You receive a $60 cash down payment, in advance. FOR SERVICE COMPANIES: You fulfill the obligation originated on Nov 18, booked on November 18, and collects the $100 cash. FOR COMPANIES SELLING PRODUCTS: You have your first sale in the amount of $100. These products originally costed you $50. You ship your product to your customer under the terms FOB Destination. Freight Costs amounted to $10 cash. Your CMO develop brochures for your business that the company will use for advertising. He/She charges the company $600 for his/her work, payable at the end of December. Your business pays $1,200 for a one-year insurance policy using cash. FOR SERVICE COMPANIES: You generate additional Service revenue, but your customer cannot pay today in cash. You issue the customer an invoice in the amount of $300. They said it will get paid some time in December. FOR COMPANIES SELLING PRODUCTS: You make another sale to customers in the amount of $300. These products originally costed you $150. Your sale to your customer is under the terms n/30 and FOB Destination. Freight costs amounted to $30. You receive a $50 invoice for use of your cell phone. You use the cell phone exclusively for your business. The invoice is for services provided in November, and payment is due on December 15. (Use "Accounts Payable"). Utilize the below T-Charts for accounts you have recorded entries to. Depending on your business type (Sales/Service), you may not utilize all of the below T- **THE SUMS WILL AUTOMATICALLY POPULATE FOR YOU** Cash Inventory Debit Credit Debit Credit End Balance Notes Payable Debit Credit End Balance Supplies End Balance Debit Credit Unearned Revenue Credit Debit End Balance Computer End Balance Debit Credit Accounts Payable Credit Debit End Balance Equipment End Balance Debit Credit Advertising Expense Credit Debit End Balance End Balance Prepaid Insurance Credit Debit Common Stock Debit Credit End Balance Accounts Receivable End Balance Debit Cost of Goods Sold Credit Debit End Balance End Balance Cell Phone Expense Sales Revenue Debit Credit Debit Credit End Balance End Balance Freight-Out Debit Credit End Balance NOVEMBER TRANSACTIONS (I suggest you PRINT this page so that you can utilize for your JE tab.) Date Transaction You found you have some U.S. Savings Bonds laying around from a grandparent. You decide to cash those in and receive $520, which you deposit in your personal bank account. You open a bank account for your business. You purchases $500 of your own business's common stock. Your business purchases paper and other office supplies for $95. (Use Supplies.) You start to gather some equipment to take with you when you begin your business. You have an excellent computer that is old, but works fine. You decides to start using it only for your new business. You estimate that the computer is currently worth $300, and you transfer the computer into the business in exchange for additional common stock. (Use "Computer" as the account type). The company needs more cash to sustain its operations. Your parents lend the company $5,000 cash, in exchange for a two-year, 9% note payable. Interest and the principal are repayable at maturity. Your business pays $900 for additional equipment. FOR SERVICE COMPANIES: You schedule your first service performance for November 29. You will receive $100 on the date of the service. FOR COMPANIES SELLING PRODUCTS: You order some merchandise from a wholesaler in the amount of $200 cash, shipping terms FOB Shipping Point. Freight costs amounted to $40. FOR SERVICE COMPANIES: You book a second service performance for December 5 for $150. You receive a $60 cash down payment, in advance. FOR SERVICE COMPANIES: You fulfill the obligation originated on Nov 18, booked on November 18, and collects the $100 cash. FOR COMPANIES SELLING PRODUCTS: You have your first sale in the amount of $100. These products originally costed you $50. You ship your product to your customer under the terms FOB Destination. Freight Costs amounted to $10 cash. Your CMO develop brochures for your business that the company will use for advertising. He/She charges the company $600 for his/her work, payable at the end of December. Your business pays $1,200 for a one-year insurance policy using cash. FOR SERVICE COMPANIES: You generate additional Service revenue, but your customer cannot pay today in cash. You issue the customer an invoice in the amount of $300. They said it will get paid some time in December. FOR COMPANIES SELLING PRODUCTS: You make another sale to customers in the amount of $300. These products originally costed you $150. Your sale to your customer is under the terms n/30 and FOB Destination. Freight costs amounted to $30. You receive a $50 invoice for use of your cell phone. You use the cell phone exclusively for your business. The invoice is for services provided in November, and payment is due on December 15. (Use "Accounts Payable"). Utilize the below T-Charts for accounts you have recorded entries to. Depending on your business type (Sales/Service), you may not utilize all of the below T- **THE SUMS WILL AUTOMATICALLY POPULATE FOR YOU** Cash Inventory Debit Credit Debit Credit End Balance Notes Payable Debit Credit End Balance Supplies End Balance Debit Credit Unearned Revenue Credit Debit End Balance Computer End Balance Debit Credit Accounts Payable Credit Debit End Balance Equipment End Balance Debit Credit Advertising Expense Credit Debit End Balance End Balance Prepaid Insurance Credit Debit Common Stock Debit Credit End Balance Accounts Receivable End Balance Debit Cost of Goods Sold Credit Debit End Balance End Balance Cell Phone Expense Sales Revenue Debit Credit Debit Credit End Balance End Balance Freight-Out Debit Credit End Balance