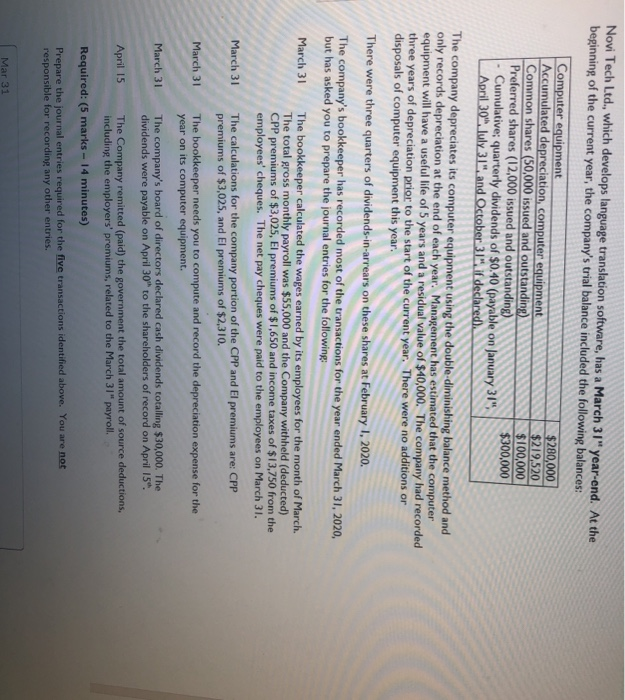

Novi Tech Ltd., which develops language translation software, has a March 31" year-end. At the beginning of the current year, the company's trial balance included the following balances: Computer equipment Accumulated depreciation, computer equipment Common shares (50,000 issued and outstanding) Preferred shares (12,000 issued and outstanding) Cumulative; quarterly dividends of $0.40 (payable on January 31" April 30. Iuly 31" and October 31, if declared). $ 280,000 $219,520 $100,000 $300,000 The company depreciates its computer equipment using the double diminishing balance method and only records depreciation at the end of each year. Management has estimated that the computer equipment will have a useful life of 5 years and a residual value of $40,000. The company had recorded three years of depreciation prior to the start of the current year. There were no additions or disposals of computer equipment this year. There were three quarter's of dividends-in-arrears on these shares at February 1, 2020. The company's bookkeeper has recorded most of the transactions for the year ended March 31, 2020, but has asked you to prepare the journal entries for the following March 31 The bookkeeper calculated the wages earned by its employees for the month of March. The total gross monthly payroll was $55,000 and the Company withheld (deducted) CPP premiums of $3,025, El premiums of $1,650 and income taxes of $13,750 from the employees' cheques. The net pay cheques were paid to the employees on March 31. March 31 The calculations for the company portion of the CPP and El premiums are: CPP premiums of $3,025, and El premiums of $2,310. March 31 The bookkeeper needs you to compute and record the depreciation expense for the year on its computer equipment. March 31 The company's board of directors declared cash dividends totalling $30,000. The dividends were payable on April 30 to the shareholders of record on April 15 April 15 T he Company remitted (paid) the government the total amount of source deductions, including the employers' premiums, related to the March 31"payroll. Required: (5 marks - 14 minutes) Prepare the journal entries required for the five transactions identified above. You are not responsible for recording any other entries. Mar 31