Question

Novo Orders The original order from Novo was for an adhesive Novo was using in the production of a new line of toys for its

Novo Orders

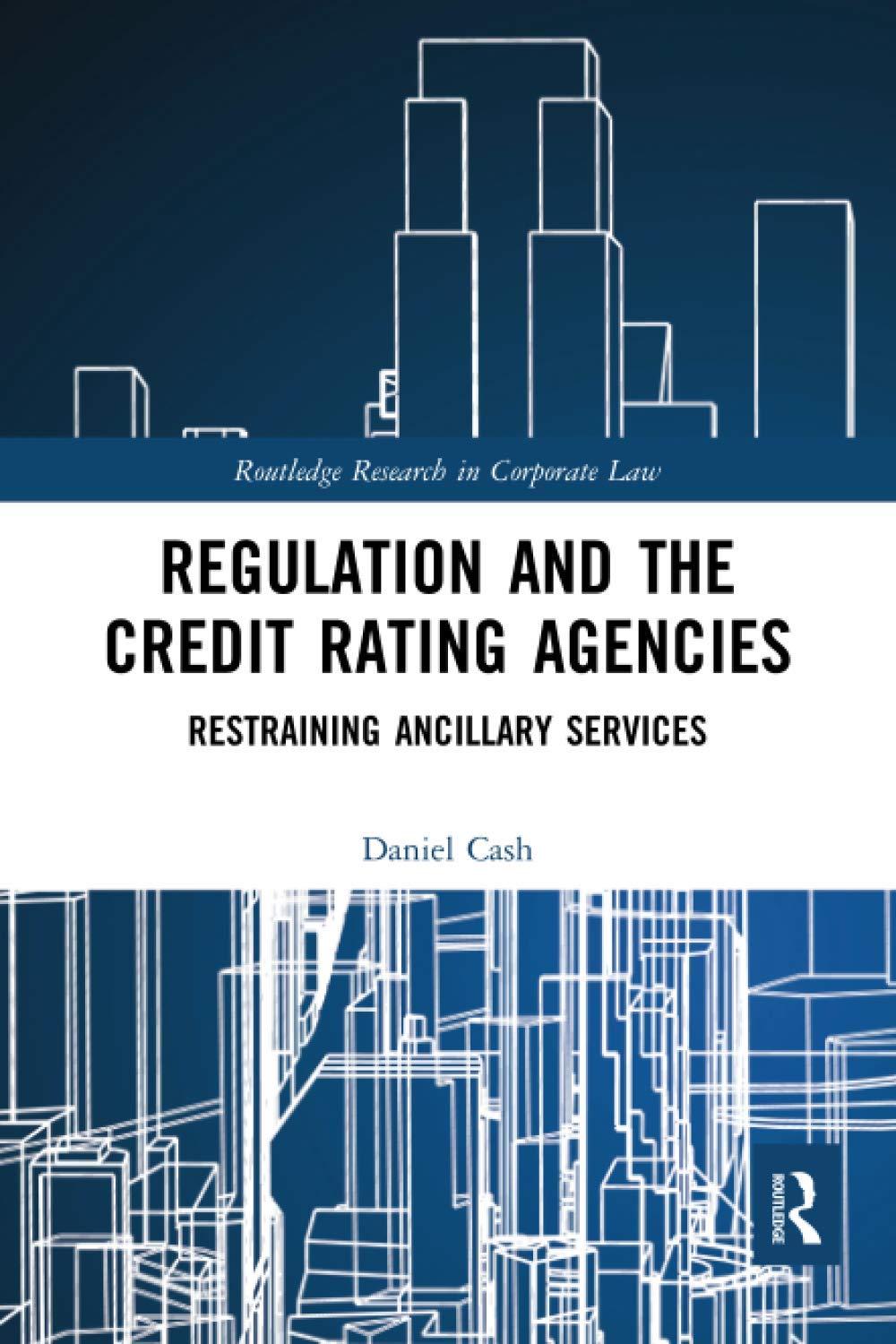

The original order from Novo was for an adhesive Novo was using in the production of a new line of toys for its Brazilian market. The toys needed to be waterproof and the adhesive, therefore, needed very specific properties. Through a mutual friend, Moreno had been introduced to Novos purchasing agent. Working with Doug Baker, she had then negotiated the original order in February (the basis for the pricing of that original order is shown in Exhibit 1). Novo had agreed to pay shipping costs, so Baker Adhesives simply had to deliver the adhesive in 55-gallon drums to a nearby shipping facility.

The proposed new order was similar to the last one. As before, Novo agreed to make payment 30 days after receipt of the adhesives at the shipping facility. Baker anticipated a five- week manufacturing cycle once all the raw materials were in place. All materials would be secured within two weeks. Allowing for some flexibility, Moreno believed payment would be received about three months from order placement; that was about how long the original order took. For this reason, Moreno expected receipt of payment on the new order, assuming it was agreed upon immediately, somewhere around September 5, 2006.

Exchange Risks

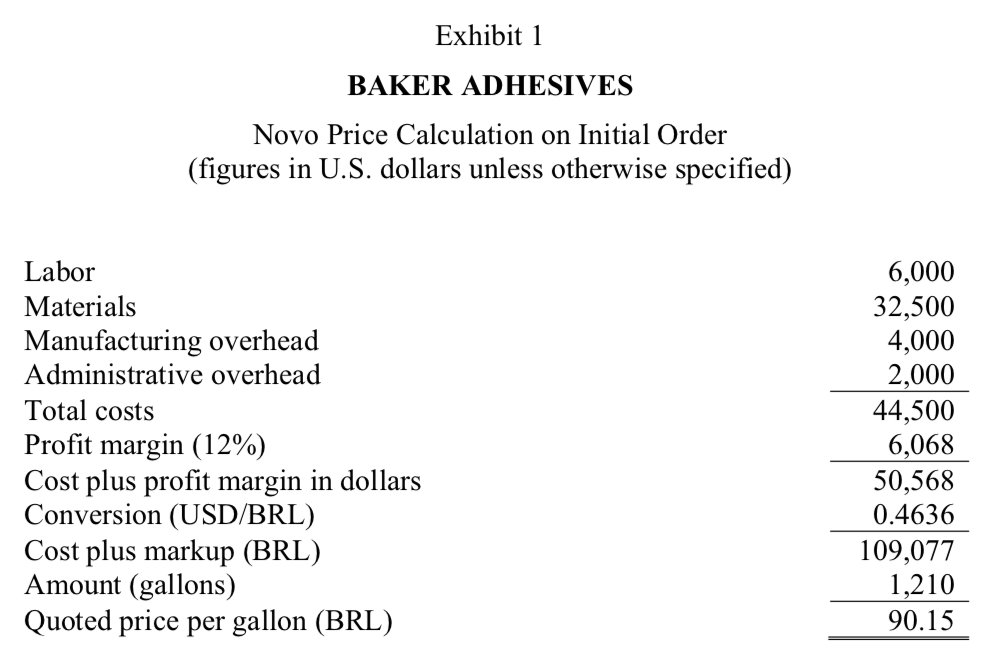

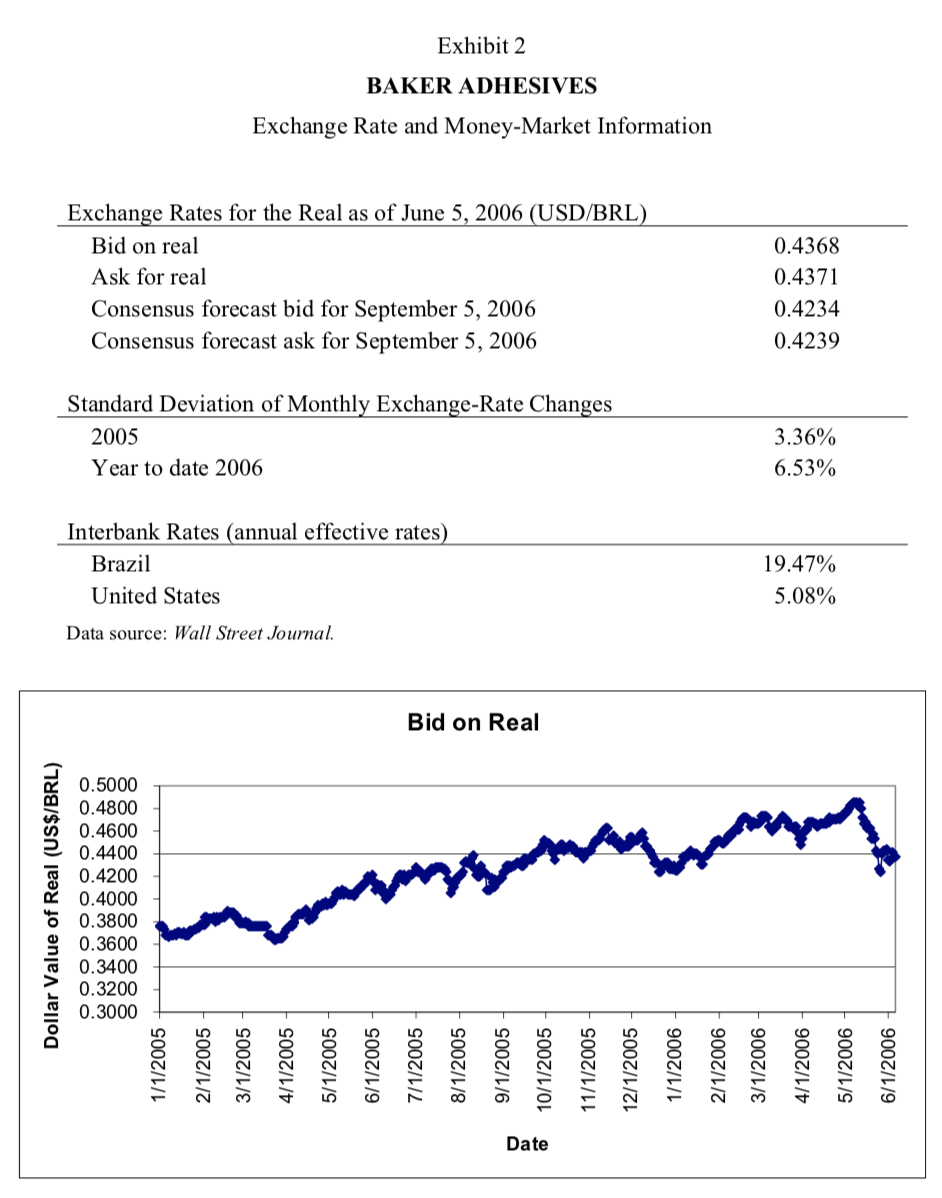

With her newfound awareness of exchange-rate risks, Moreno had gathered additional information on exchange-rate markets before the meeting with Doug Baker. The history of the dollar-to-real exchange rate is shown in Exhibit 2. Furthermore, the data in that exhibit provided the most recent information on money markets and an estimate of the expected future (September 5, 2006) spot rates from a forecasting service.

Moreno had discussed her concerns about exchange-rate changes with the bank when she had arranged for conversion of the original Novo payment.2 The bank, helpful as always, had described two ways in which Baker could mitigate the exchange risk from any new order: hedge in the forward market or hedge in the money markets.

Hedge in the forward market

Banks would often provide their clients with guaranteed exchange rates for the future exchange of currencies (forward rates). These contracts specified a date, an amount to be exchanged, and a rate. Any bank fee would be built into the rate. By securing a forward rate for the date of a foreign-currency-denominated cash flow, a firm could eliminate any risk due to currency fluctuations. In this case, the anticipated future inflow of reais from the sale to Novo could be converted at a rate that would be known today.

Hedge in the money markets

Rather than eliminate exchange risk through a contracted future exchange rate, a firm could make any currency exchanges at the known current spot rate. To do this, of course, the firm needed to convert future expected cash flows into current cash flows. This was done on the money market by borrowing today in a foreign currency against an expected future inflow or making a deposit today in a foreign account so as to be able to meet a future outflow. The amount to be borrowed or deposited would depend on the interest rates in the foreign currency because a firm would not wish to transfer more or less than what would be needed. In this case, Baker Adhesives would borrow in reais against the future inflow from Novo. The amount the company would borrow would be an amount such that the Novo receipt would exactly cover both principal and interest on the borrowing.

1. Determine the present value of the expected future cash flow assuming:

- a. There is no hedge.

- b. The company hedges using a forward contract.

- c. The company hedges using the money market.

- d. Bedsides the forward and money market, long option on $ is another way to hedge the currency risk. Assume the option strike price is $0.4010/Real and 1% fee paid upfront. If the spot exchange rate in 3 months is $0.4234/Real, what is the present option value of the sale? (Hint: discount the option value of the sale in 3 months into present value with 2.15% discount rate)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started