Question

Novotna Ltd. is a public company that manufactures and sells heavy equipment such as cranes and provides service contracts for the maintenance of the equipment.

|

Assuming that Novotna provides the goods and services as and when expected under the contract and Gibson makes its payments as required, determine when and how much revenue Novotna would be able to recognize in each of the first four fiscal years ending December 31 (2020, 2021, 2022, 2023) of the contract. (Round answers to 0 decimal places, e.g. 125.)

| Sales revenue | Service revenue | |||

| 2020 | $ 310,780 | $

| ||

| 2021 | $

| $

| ||

| 2022 | $

| $

| ||

| 2023 | $

| $

|

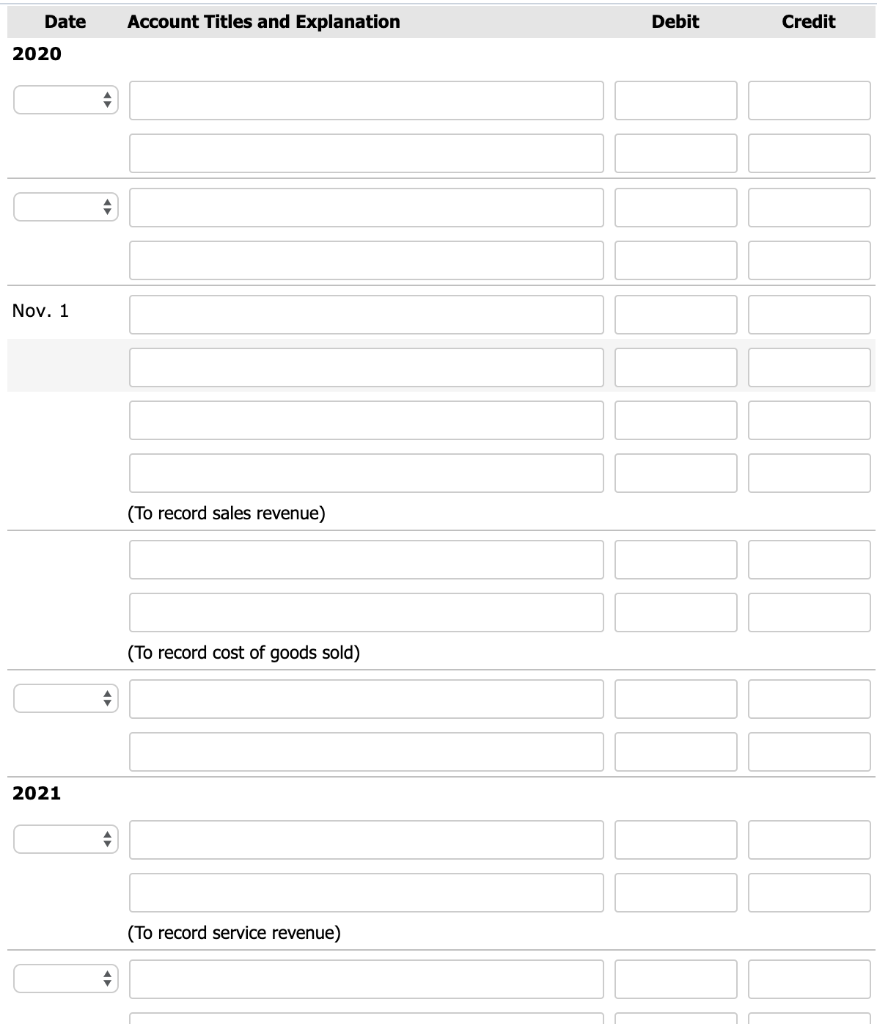

Based on your analysis in part a, prepare the required journal entries for the contract.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started

68,220

68,220

22,740

22,740

22,740

22,740

18,950

18,950