Question

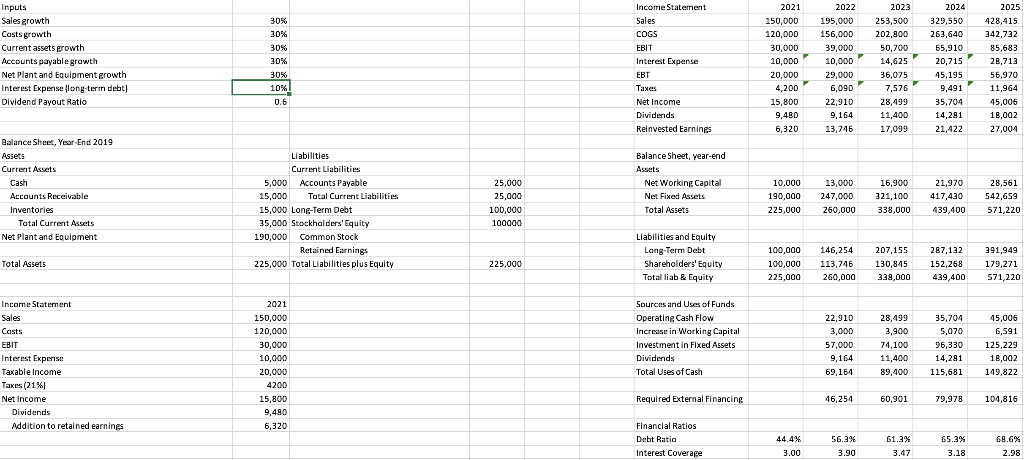

Now a.) assume that the firm due to their incredible growth rate has decided to not pay any dividends and reinvest all of their earnings.

Now a.) assume that the firm due to their incredible growth rate has decided to not pay any dividends and reinvest all of their earnings. What would be in this case the company's debt ratio and interest coverage in 2025?

b.) Assume that the firm is not operating at full capacity, so until 2023 they do not have to increase their fixed assets, in 2024 the firm would need an extra factory, so its fixed assets will double then, and stay at that level in 2025. What would be in this case the company's debt ratio and interest coverage in 2025?

c.) Now consider that current assets and accounts payable do not increase at the same pace than sales, they only grow by 20% a year. What would be in this case the company's debt ratio and interest coverage in 2025?

d.) Imagine that at the beginning of 2023, the firm introduces an innovation in production that allows the firm to reduce its costs to 60% of sales. What would be in this case the company's debt ratio and interest coverage in 2025?

e.) Comment about the changes in general from the pervious results (which are more realistic, areas the firm should concentrate on, viability on the long-term of the chosen strategy,...). Open ended question.

Inputs 30% 30% Income Statement Sales COGS EBIT Sales growth Casts growth Current assets growth Accounts payable growth Net Plant and Equipment growth Interest Experise long-term debt) Dividend Payout Ratio PILATES 30% 30% 30% 10% 0.5 Interest Expense EBT Taxes Net Income Dividends Reinvested Earnings 2021 150,000 120,000 30,000 10,000 20,000 4,200 15,800 9,480 6,320 2022 195,000 156,000 39,000 10,000 29,000 6,090 22,910 9,164 13,746 2023 253,500 202,800 50,700 14,625 36,075 7,576 28,499 11,400 17,099 2024 329,550 263,640 65,910 20,715 45,195 9,491 35,704 14,281 21,422 2025 428,415 342.732 85,683 28,713 56,970 11,964 45,006 18,002 27,004 Balance Sheet, Year-End 2019 Assets Current Assets Cash Accounts Receivable Inventories Total Current Assets Net Plant and Equipment Liabilities Current Liabilities 5,000 Accounts Payable 15,000 Total Current Liabilities 15,000 Long-Term Debt 35,000 Stockholders' Equity 190,000 Common Stock Retained Earnings 225,000 Total Liabilities plus Equity 25,000 25,000 100,000 100000 Balance Sheet, year-end Assets Net Working Capital Net Fixed Assets Total Assets 10,000 190,000 225,000 13,000 247,000 260,000 16,900 321,100 338,000 21,970 417,430 439,400 28,561 542,655 571,220 Liabilities and Equity Long-Term Debt Shareholders' Equity Total liab & Equity Total Assets 225,000 100,000 100,000 225,000 146,254 113,746 260,000 207,155 130,845 339,000 287,132 152,268 439,400 391,949 179,271 571,220 Income Statement Sales Casts EBIT Interest Expense Taxable income Taxes (21%) ( Net Income Dividends Addition to retained earnings 2021 150,000 120,000 30,000 10,000 20,000 4200 15,800 9,490 6,320 Sources and Uses of Funds Operating Cash Flow Increase in Working Capital Investment in Fixed Assets Dividends Total Uses of Cash 22,910 3,000 57,000 9,164 69,164 28,499 3,900 74,100 11,400 89,400 35,704 5,070 96,330 14,281 115,681 45,006 6,591 125,229 18,002 149,822 Required External Financing 46,254 60,901 79,978 104,816 Financial Ratios Debt Ratid Interest Coverage 44.4% 3.00 56.3% 3.90 61.3% 3.47 65.3% 3.18 68.6% 2.98 Inputs 30% 30% Income Statement Sales COGS EBIT Sales growth Casts growth Current assets growth Accounts payable growth Net Plant and Equipment growth Interest Experise long-term debt) Dividend Payout Ratio PILATES 30% 30% 30% 10% 0.5 Interest Expense EBT Taxes Net Income Dividends Reinvested Earnings 2021 150,000 120,000 30,000 10,000 20,000 4,200 15,800 9,480 6,320 2022 195,000 156,000 39,000 10,000 29,000 6,090 22,910 9,164 13,746 2023 253,500 202,800 50,700 14,625 36,075 7,576 28,499 11,400 17,099 2024 329,550 263,640 65,910 20,715 45,195 9,491 35,704 14,281 21,422 2025 428,415 342.732 85,683 28,713 56,970 11,964 45,006 18,002 27,004 Balance Sheet, Year-End 2019 Assets Current Assets Cash Accounts Receivable Inventories Total Current Assets Net Plant and Equipment Liabilities Current Liabilities 5,000 Accounts Payable 15,000 Total Current Liabilities 15,000 Long-Term Debt 35,000 Stockholders' Equity 190,000 Common Stock Retained Earnings 225,000 Total Liabilities plus Equity 25,000 25,000 100,000 100000 Balance Sheet, year-end Assets Net Working Capital Net Fixed Assets Total Assets 10,000 190,000 225,000 13,000 247,000 260,000 16,900 321,100 338,000 21,970 417,430 439,400 28,561 542,655 571,220 Liabilities and Equity Long-Term Debt Shareholders' Equity Total liab & Equity Total Assets 225,000 100,000 100,000 225,000 146,254 113,746 260,000 207,155 130,845 339,000 287,132 152,268 439,400 391,949 179,271 571,220 Income Statement Sales Casts EBIT Interest Expense Taxable income Taxes (21%) ( Net Income Dividends Addition to retained earnings 2021 150,000 120,000 30,000 10,000 20,000 4200 15,800 9,490 6,320 Sources and Uses of Funds Operating Cash Flow Increase in Working Capital Investment in Fixed Assets Dividends Total Uses of Cash 22,910 3,000 57,000 9,164 69,164 28,499 3,900 74,100 11,400 89,400 35,704 5,070 96,330 14,281 115,681 45,006 6,591 125,229 18,002 149,822 Required External Financing 46,254 60,901 79,978 104,816 Financial Ratios Debt Ratid Interest Coverage 44.4% 3.00 56.3% 3.90 61.3% 3.47 65.3% 3.18 68.6% 2.98Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started