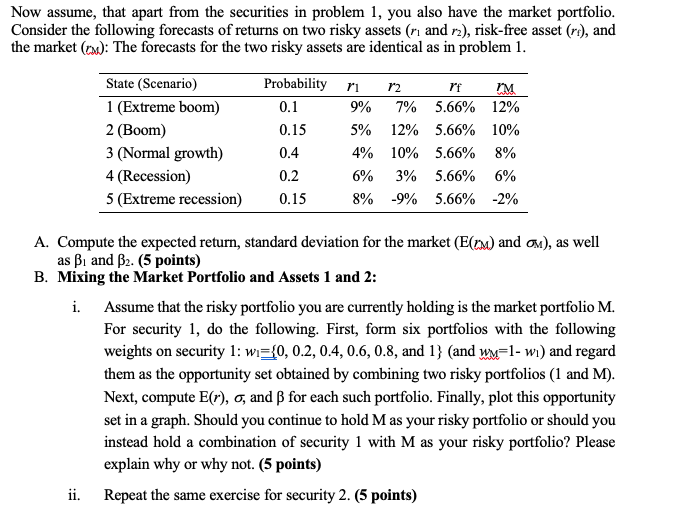

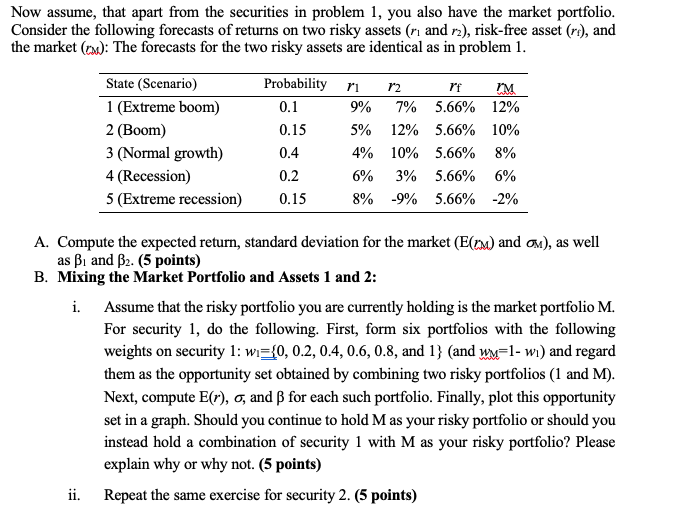

Now assume, that apart from the securities in problem 1 , you also have the market portfolio. Consider the following forecasts of returns on two risky assets (r1 and r2), risk-free asset (rf), and the market (rx) : The forecasts for the two risky assets are identical as in problem 1. A. Compute the expected return, standard deviation for the market (E(rM) and M), as well as 1 and 2. (5 points) B. Mixing the Market Portfolio and Assets 1 and 2: i. Assume that the risky portfolio you are currently holding is the market portfolio M. For security 1, do the following. First, form six portfolios with the following weights on security 1:w1={0,0.2,0.4,0.6,0.8, and 1} (and w1=1w1 ) and regard them as the opportunity set obtained by combining two risky portfolios ( 1 and M). Next, compute E(r),, and for each such portfolio. Finally, plot this opportunity set in a graph. Should you continue to hold M as your risky portfolio or should you instead hold a combination of security 1 with M as your risky portfolio? Please explain why or why not. (5 points) ii. Repeat the same exercise for security 2. (5 points) Now assume, that apart from the securities in problem 1 , you also have the market portfolio. Consider the following forecasts of returns on two risky assets (r1 and r2), risk-free asset (rf), and the market (rx) : The forecasts for the two risky assets are identical as in problem 1. A. Compute the expected return, standard deviation for the market (E(rM) and M), as well as 1 and 2. (5 points) B. Mixing the Market Portfolio and Assets 1 and 2: i. Assume that the risky portfolio you are currently holding is the market portfolio M. For security 1, do the following. First, form six portfolios with the following weights on security 1:w1={0,0.2,0.4,0.6,0.8, and 1} (and w1=1w1 ) and regard them as the opportunity set obtained by combining two risky portfolios ( 1 and M). Next, compute E(r),, and for each such portfolio. Finally, plot this opportunity set in a graph. Should you continue to hold M as your risky portfolio or should you instead hold a combination of security 1 with M as your risky portfolio? Please explain why or why not. (5 points) ii. Repeat the same exercise for security 2. (5 points)