Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Now, assume that the investment portfolio held by Neon Corp. is classified as FVOCI (b) --Prepare the journal entries for sale of investments --Prepare

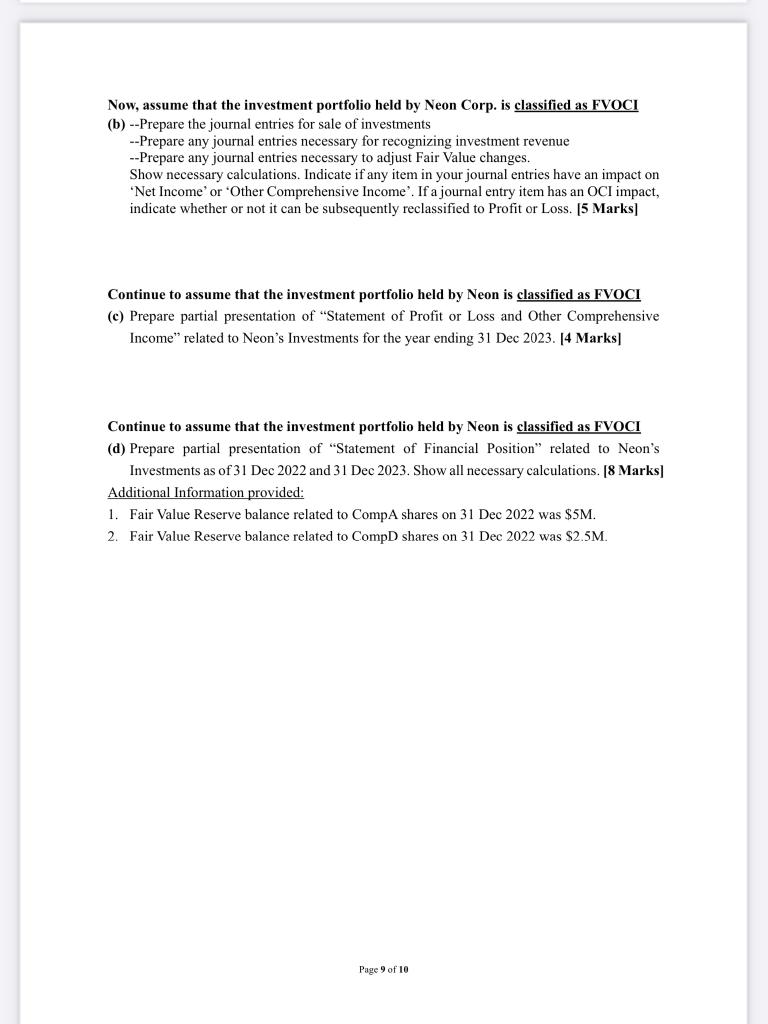

Now, assume that the investment portfolio held by Neon Corp. is classified as FVOCI (b) --Prepare the journal entries for sale of investments --Prepare any journal entries necessary for recognizing investment revenue --Prepare any journal entries necessary to adjust Fair Value changes. Show necessary calculations. Indicate if any item in your journal entries have an impact on 'Net Income' or 'Other Comprehensive Income'. If a journal entry item has an OCI impact, indicate whether or not it can be subsequently reclassified to Profit or Loss. [5 Marks] Continue to assume that the investment portfolio held by Neon is classified as FVOCI (c) Prepare partial presentation of "Statement of Profit or Loss and Other Comprehensive Income" related to Neon's Investments for the year ending 31 Dec 2023. [4 Marks] Continue to assume that the investment portfolio held by Neon is classified as FVOCI (d) Prepare partial presentation of "Statement of Financial Position" related to Neon's Investments as of 31 Dec 2022 and 31 Dec 2023. Show all necessary calculations. [8 Marks] Additional Information provided: 1. Fair Value Reserve balance related to CompA shares on 31 Dec 2022 was $5M. 2. Fair Value Reserve balance related to CompD shares on 31 Dec 2022 was $2.5M. Page 9 of 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer B Date Particular Debit Credit Jun03 Cash 1800 Fair value reserve CompA shares 500 Gain on sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started