Question

Now, consider a case that you buy the Green Energy Company but due to an unexpected liability, you are unable to go into production. This

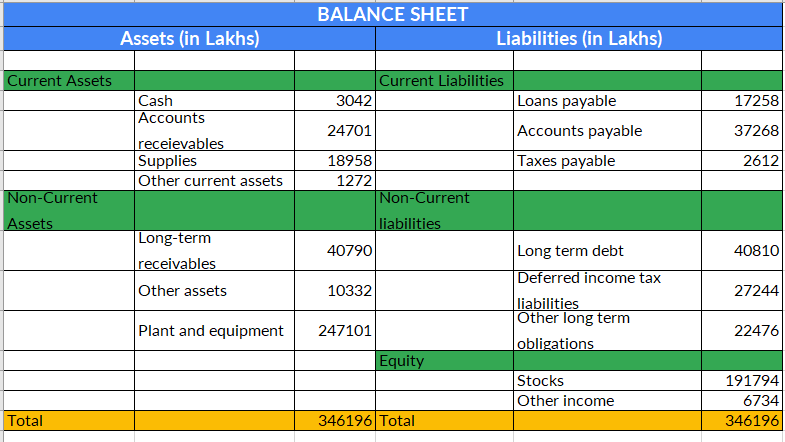

Now, consider a case that you buy the Green Energy Company but due to an unexpected liability, you are unable to go into production. This would mean that there is no extra benefit that the company would be able to generate post-acquisition. How much would you be willing to pay for the company in this case? Show the calculations in the submission document. (3 marks) Assumptions: Consider that you would be able to utilise all the plants and equipment The account receivables are from the customers, with a possibility of collecting 90% of the amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started