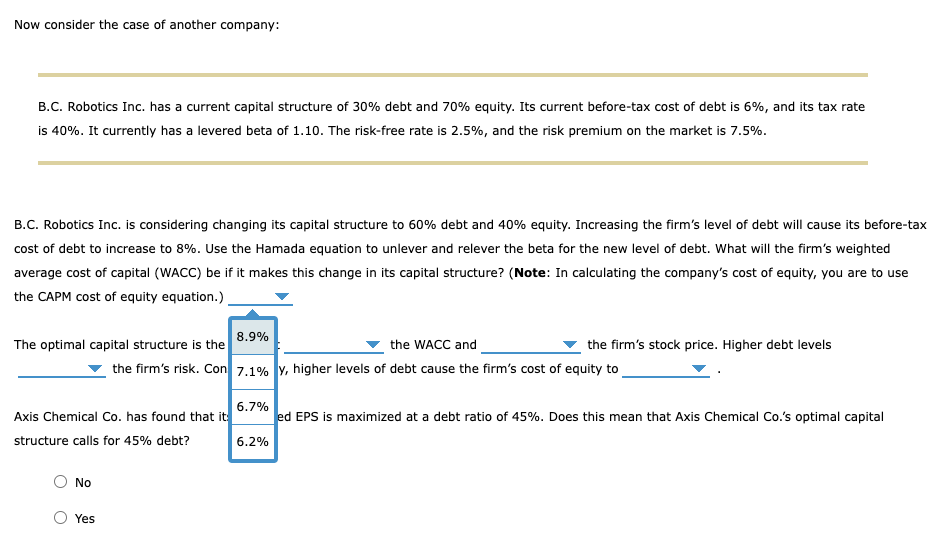

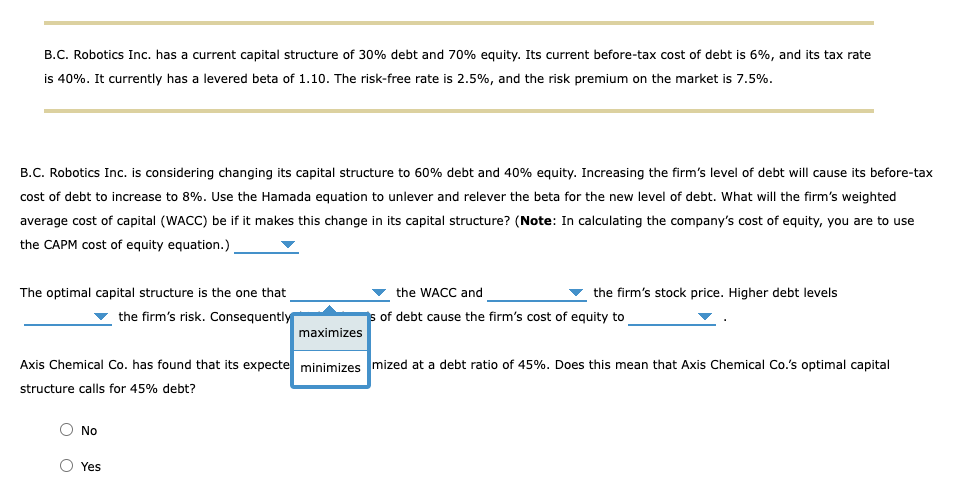

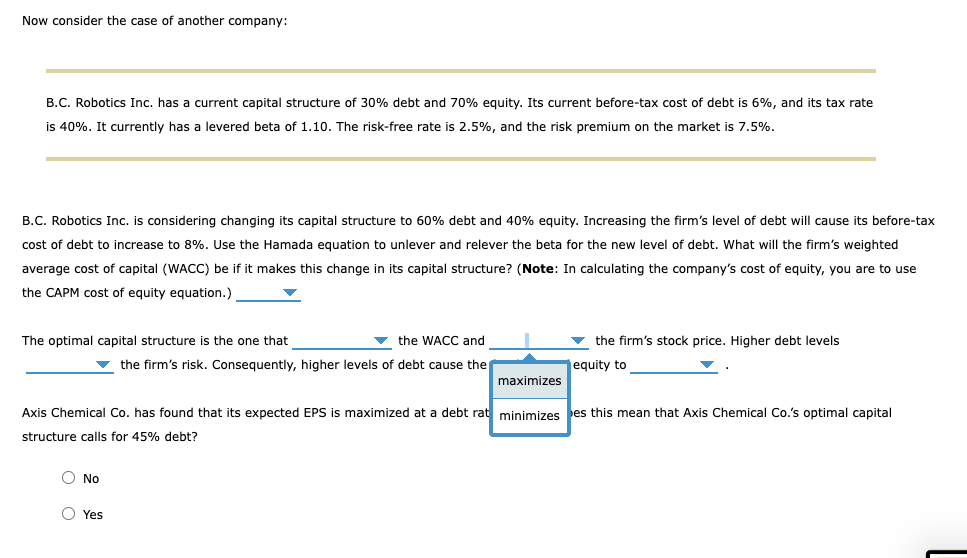

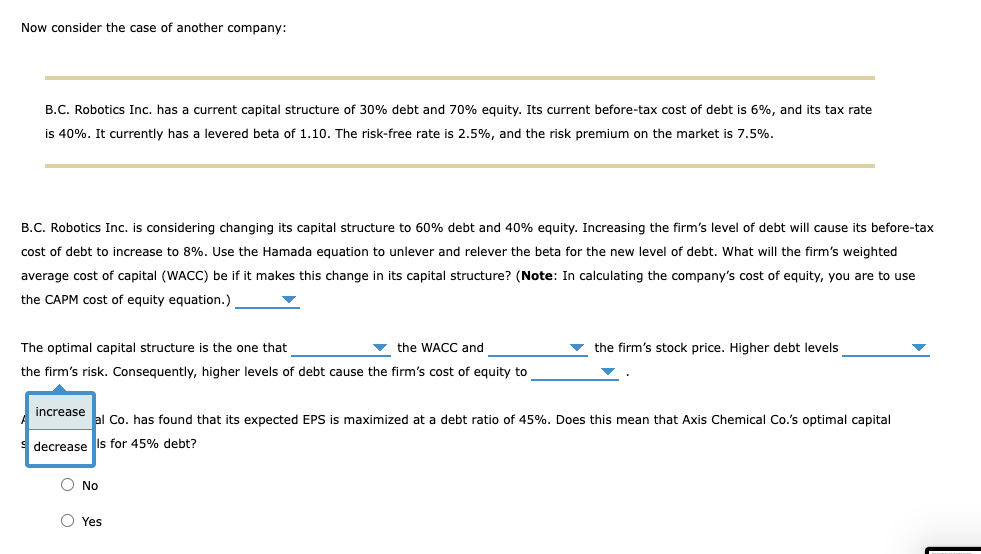

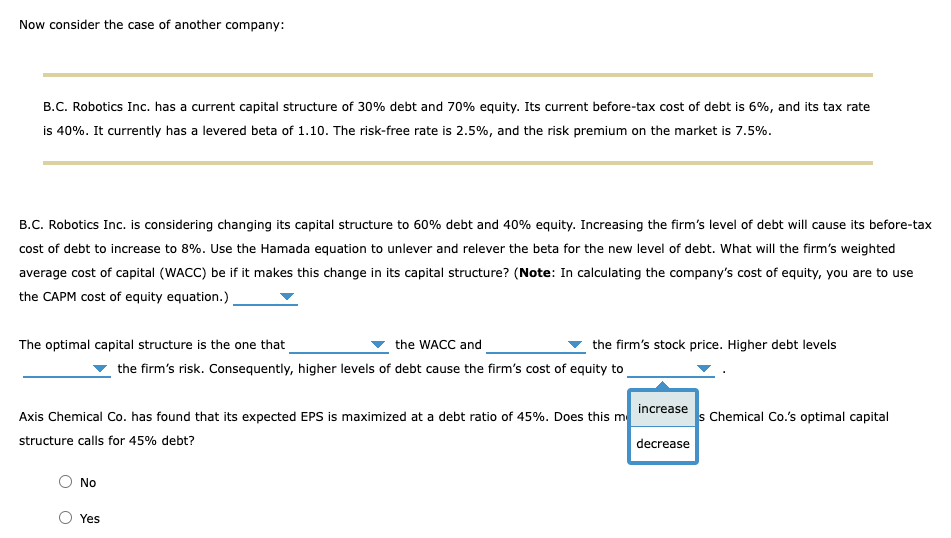

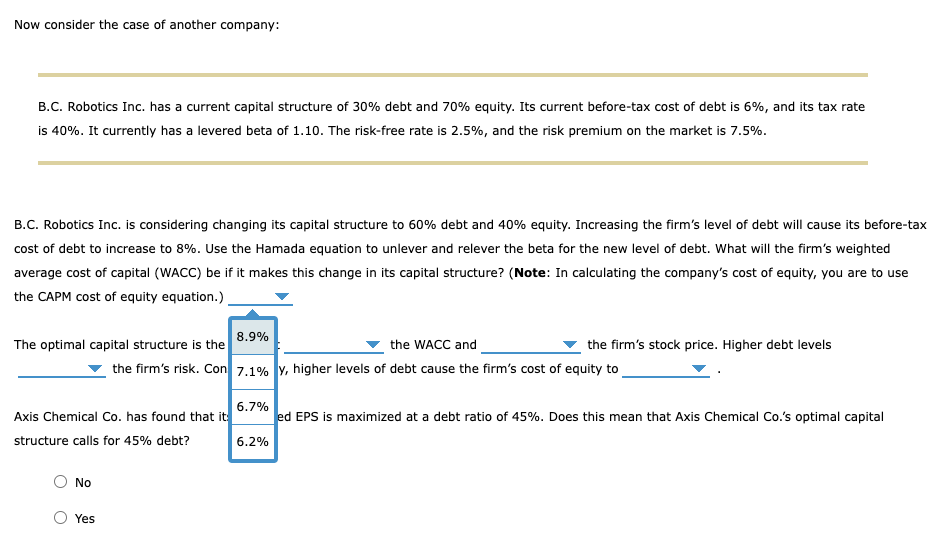

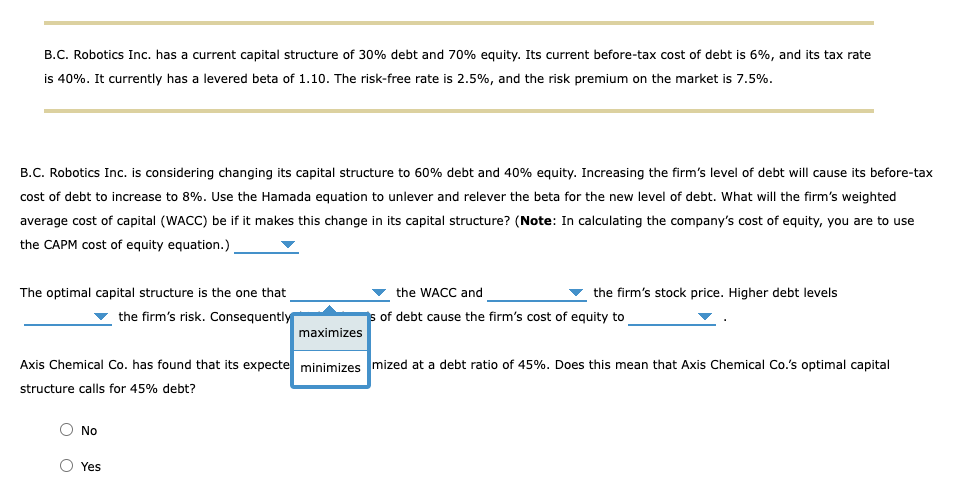

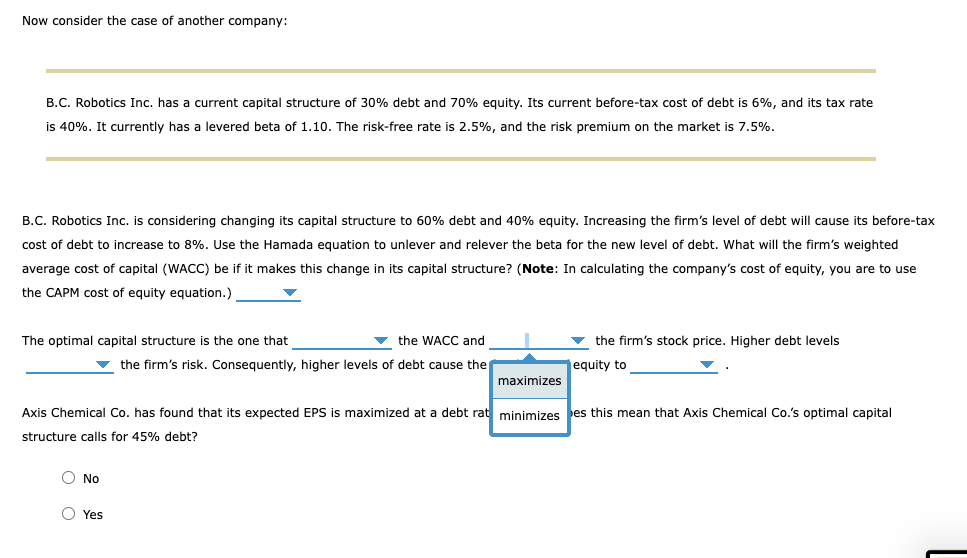

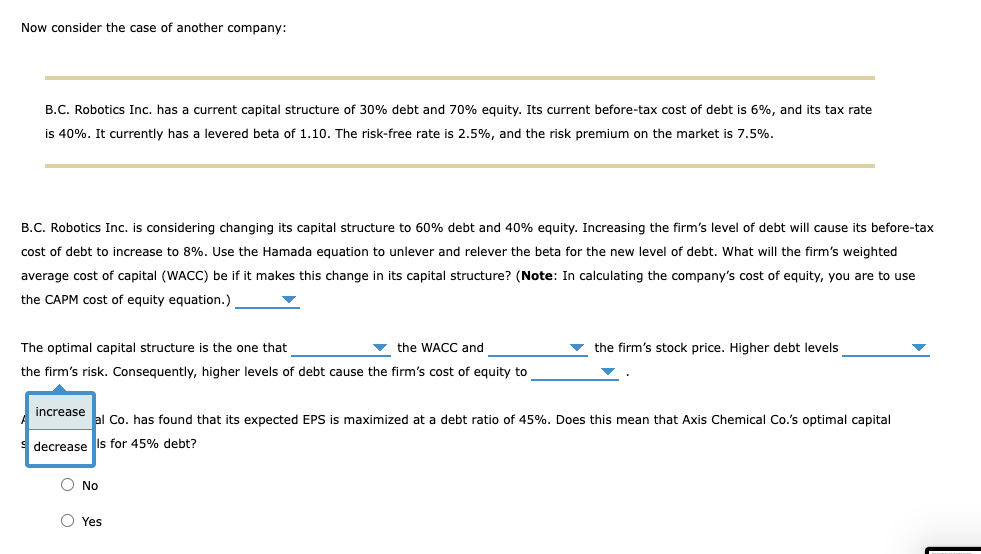

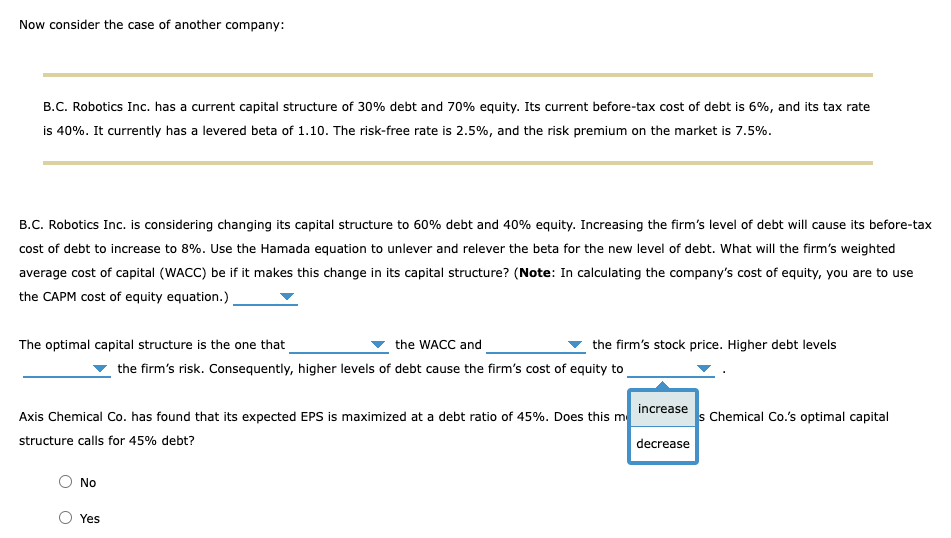

Now consider the case of another company: B.C. Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 6%, and its tax rate is 40%. It currently has a levered beta of 1.10. The risk-free rate is 2.5%, and the risk premium on the market is 7.5%. B.C. Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's level of debt will cause its before-tax cost of debt to increase to 8%. Use the Hamada equation to unlever and relever the beta for the new level of debt. What will the firm's average cost of capital (WACC) be if it makes this change in its capital structure? (Note: In calculating the company's cost of equity, you are to use the CAPM cost of equity equation.) The optimal capital structure is the 8.9% the WACC and the firm's stock price. Higher debt level the firm's risk. Con 7.1% y, higher levels of debt cause the firm's cost of equity to structure calls for 45% debt? 6.2% No Yes B.C. Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 6%, and its tax rate is 40%. It currently has a levered beta of 1.10. The risk-free rate is 2.5%, and the risk premium on the market is 7.5%. B.C. Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's level of debt will cause its before-ta cost of debt to increase to 8%. Use the Hamada equation to unlever and relever the beta for the new level of debt. What the firm average cost of capital (WACC) be if it makes this change in its capital structure? (Note: In calculating the company's cost of equity, you are to use the CAPM cost of equity equation.) The optimal capital structure is the one that the WACC and firm's stock price. Higher debt levels the firm's risk. Consequently i of debt cause the firm's cost of equity to Axis Chemical Co. has found that its expecte nized at debt ratio of 45%. Does this mean that Ae.'s optimal chemis structure calls for 45% debt? No Yes Now consider the case of another company: B.C. Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 6%, and its tax rate is 40%. It currently has a levered beta of 1.10. The risk-free rate is 2.5%, and the risk premium on the market is 7.5%. B.C. Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's level of debt will cause its before cost of debt to increase to 8%. Use the Hamada equation to unlever and relever the beta for the new level of debt. What the firm's average cost of capital (WACC) be if it makes this change in its capital structure? (Note: In calculating the company's cost of equity, you are to use the CAPM cost of equity equation.) The optimal capital structure is the one that the WACC and the firm's stock price. Higher debt levels the firm's risk. Consequently, higher levels of debt cause the equity to Axis Chemical Co. has found that its expected EPS is maximized at a debt ral Co. structure calls for 45% debt? No Yes Now consider the case of another company: B.C. Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 6%, and its tax rate is 40%. It currently has a levered beta of 1.10. The risk-free rate is 2.5%, and the risk premium on the market is 7.5%. B.C. Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's level of debt will cause its before-tax cost of debt to increase to 8%. Use the Hamada equation to unlever and relever the beta for the new level of debt. What will the firm's weighte average cost of capital (WACC) be if it makes this change in its capital structure? (Note: In calculating the company's cost of equity, you are to use the CAPM cost of equity equation.) The optimal capital structure is the one that the WACC and the firm's stock price. Higher debt levels the firm's risk. Consequently, higher levels of debt cause the firm's cost of equity to al Co. has found that its expected EPS is maximized at a debt ratio of 45%. Does this mean that Axis Chemical Co.'s optimal capital Is for 45% debt? No Yes Now consider the case of another company: B.C. Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 6%, and its tax rate is 40%. It currently has a levered beta of 1.10. The risk-free rate is 2.5%, and the risk premium on the market is 7.5%. B.C. Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's level of debt will cause its before-ta: cost of debt to increase to 8%. Use the Hamada equation to unlever and relever the beta for the new level of debt. What wirm the firme average cost of capital (WACC) be if it makes this change in its capital structure? (Note: In calculating the company's cost of equity, you are to use the CAPM cost of equity equation.) The optimal capital structure is the one that the WACC and the firm's stock price. Higher debt levels the firm's risk. Consequently, higher levels of debt cause the firm's cost of equity to Axis Chemical Co. has found that its expected EPS is maximized at a debt ratio of 45%. Does this m ; Chemical Co.'s optimal capital structure calls for 45% debt? No Yes