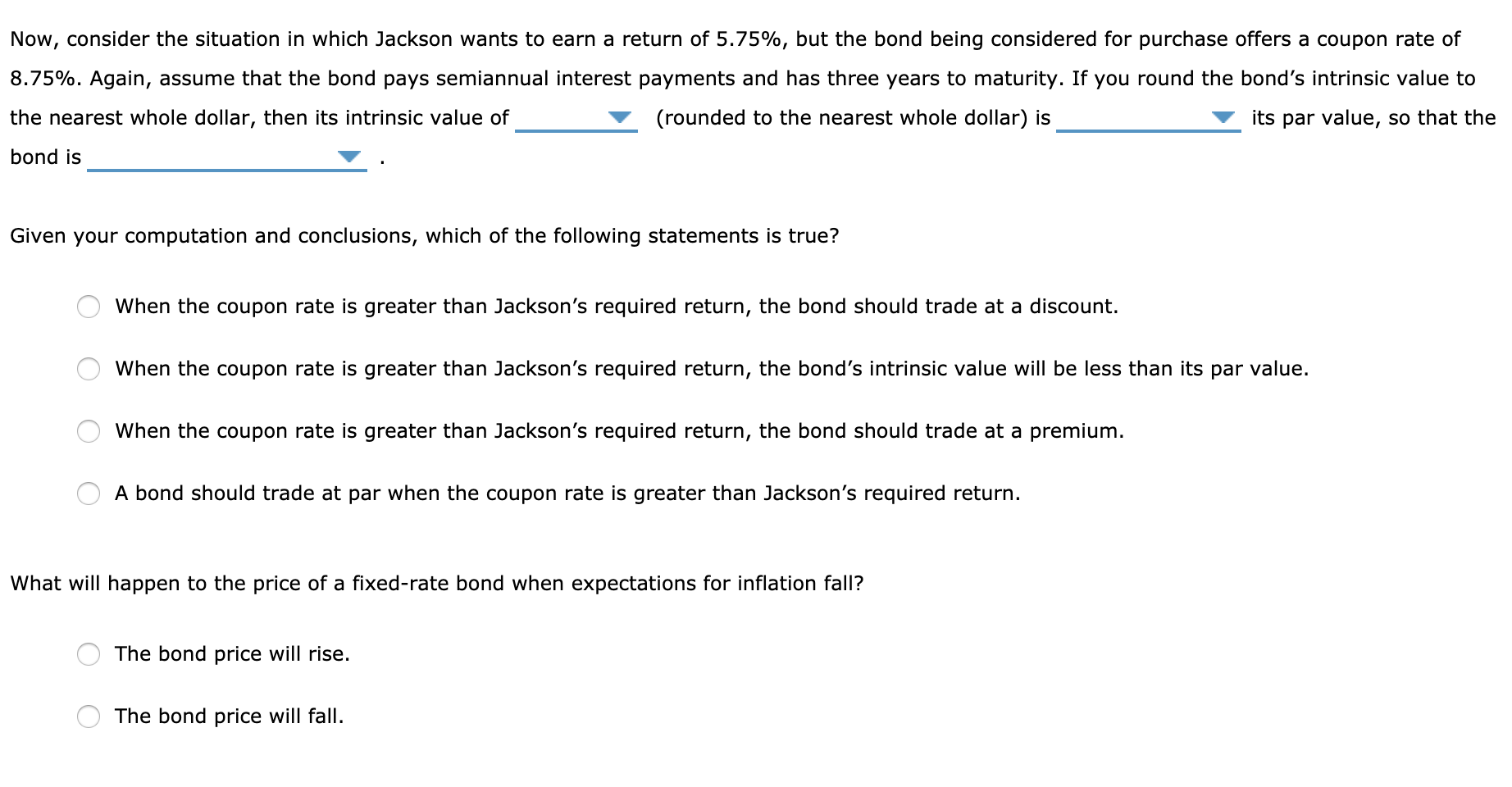

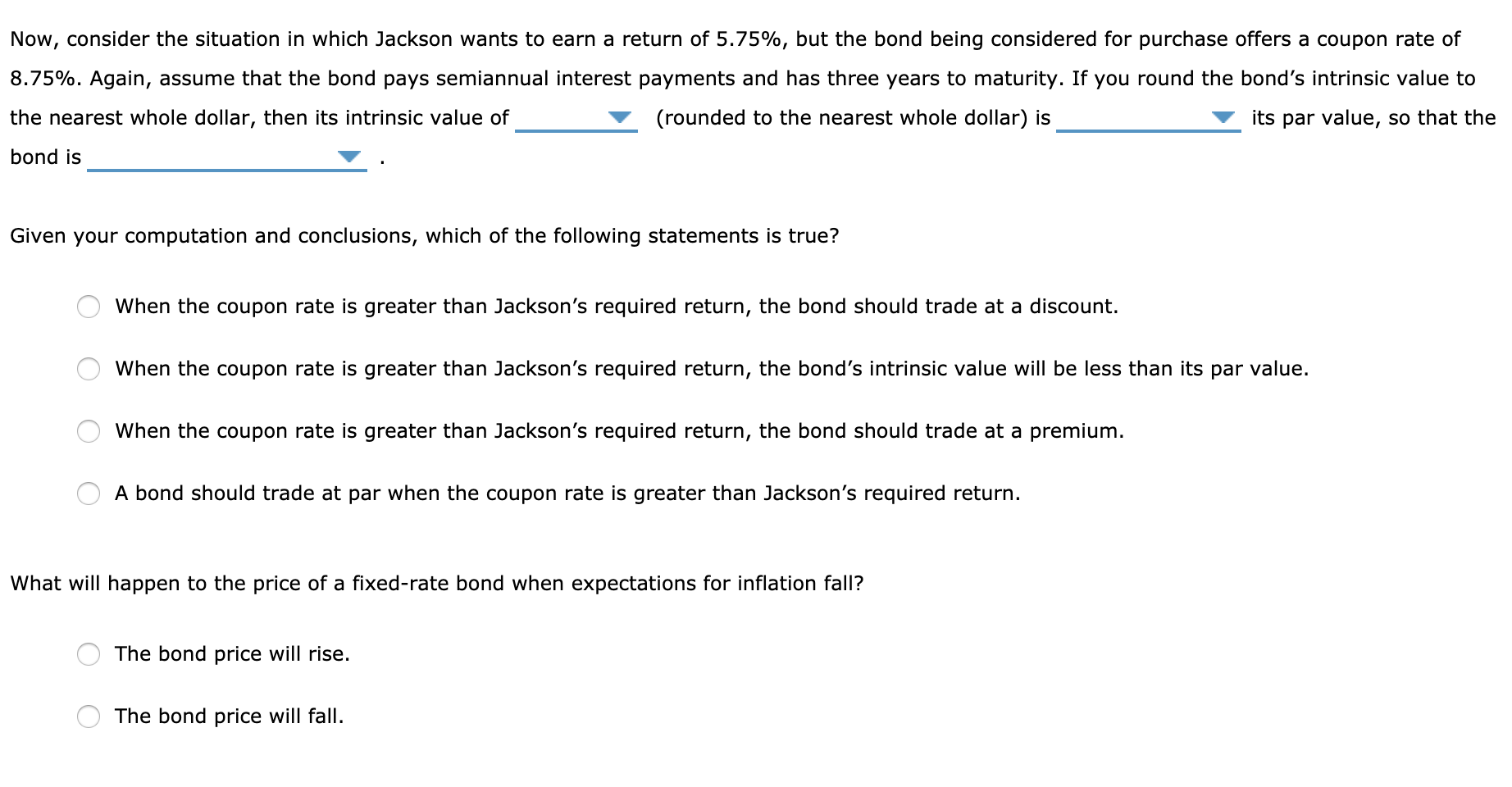

Now, consider the situation in which Jackson wants to earn a return of 5.75%, but the bond being considered for purchase offers a coupon rate of 8.75%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to the nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is its par value, so that the bond is Given your computation and conclusions, which of the following statements is true? O When the coupon rate is greater than Jackson's required return, the bond should trade at a discount. O When the coupon rate is greater than Jackson's required return, the bond's intrinsic value will be less than its par value. O When the coupon rate is greater than Jackson's required return, the bond should trade at a premium. O A bond should trade at par when the coupon rate is greater than Jackson's required return. What will happen to the price of a fixed-rate bond when expectations for inflation fall? O The bond price will rise. O The bond price will fall. Now, consider the situation in which Jackson wants to earn a return of 5.75%, but the bond being considered for purchase offers a coupon rate of 8.75%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to the nearest whole dollar, then its intrinsic value of (rounded to the nearest whole dollar) is its par value, so that the bond is Given your computation and conclusions, which of the following statements is true? O When the coupon rate is greater than Jackson's required return, the bond should trade at a discount. O When the coupon rate is greater than Jackson's required return, the bond's intrinsic value will be less than its par value. O When the coupon rate is greater than Jackson's required return, the bond should trade at a premium. O A bond should trade at par when the coupon rate is greater than Jackson's required return. What will happen to the price of a fixed-rate bond when expectations for inflation fall? O The bond price will rise. O The bond price will fall