Now, imagine that Lowes is considering adding a new store near the Columbia University campus in New York City. Download the following document containing partial information about the assumptions related to opening a new store.

- Lowes New Store Assumptions

Your task is to decide if Lowes should move forward with this opportunity. Author a brief (300) word overview of the new store. In your overview, be sure to define:

- What assumptions you have made about the investment and where you have gotten your data.

- Include a calculation of the NPV and IRR of the investment opportunity. You will need to project financial statements for Lowes.

- Based on your financial analysis in Part I, explain why you believe Lowes should or should not move forward with the investment. What other strategic and operational factors should be considered in addition to the financial analysis?

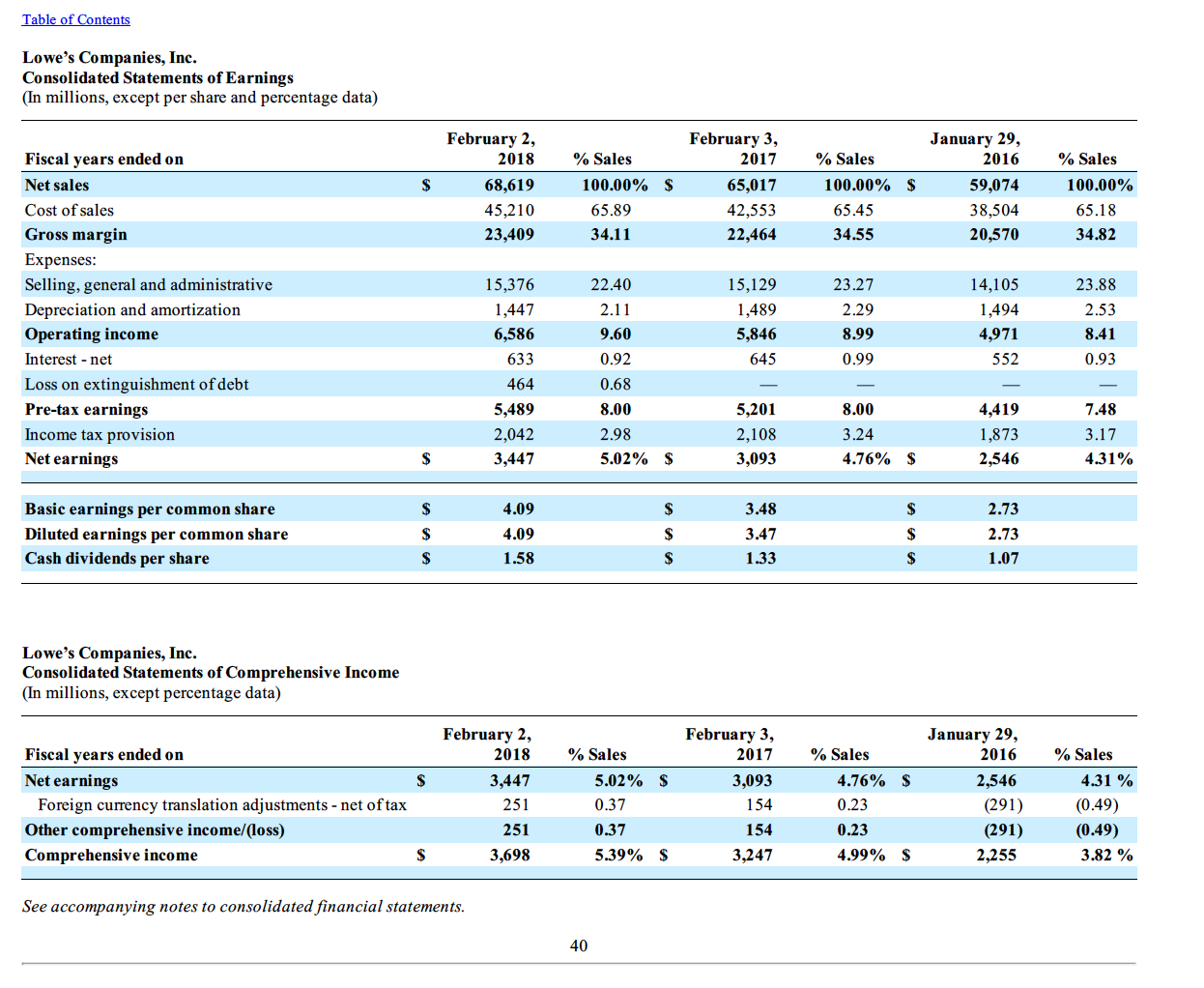

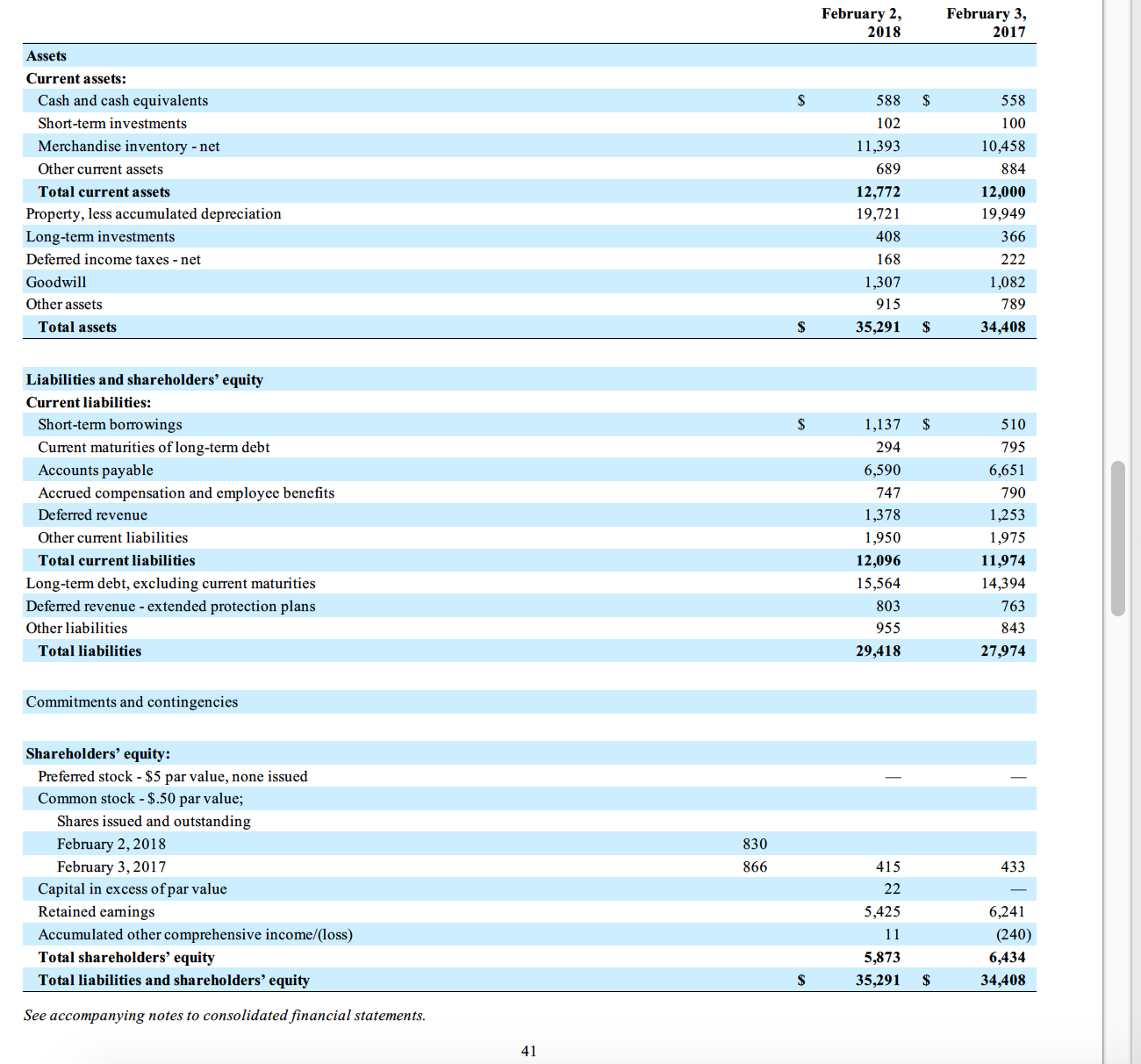

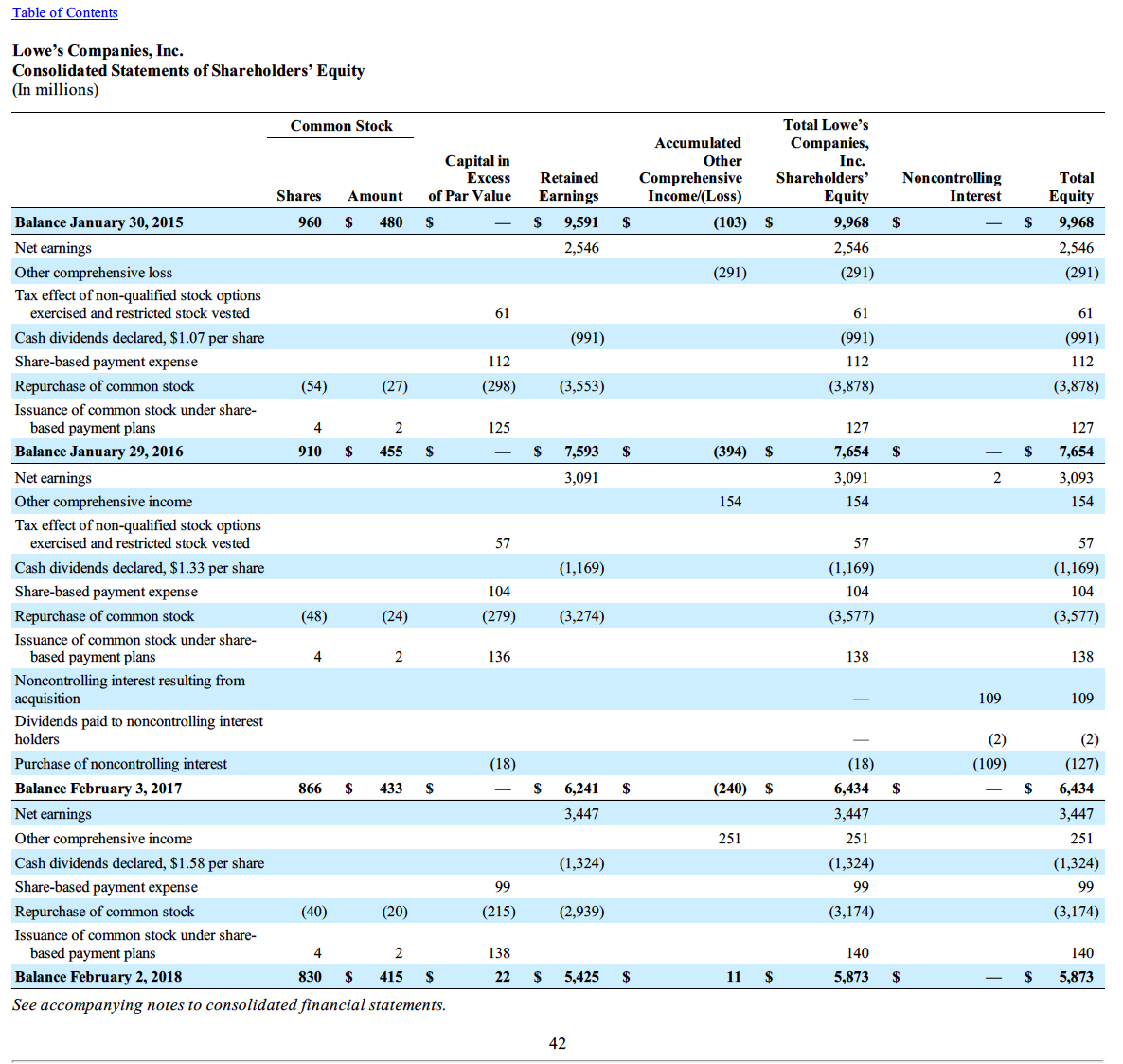

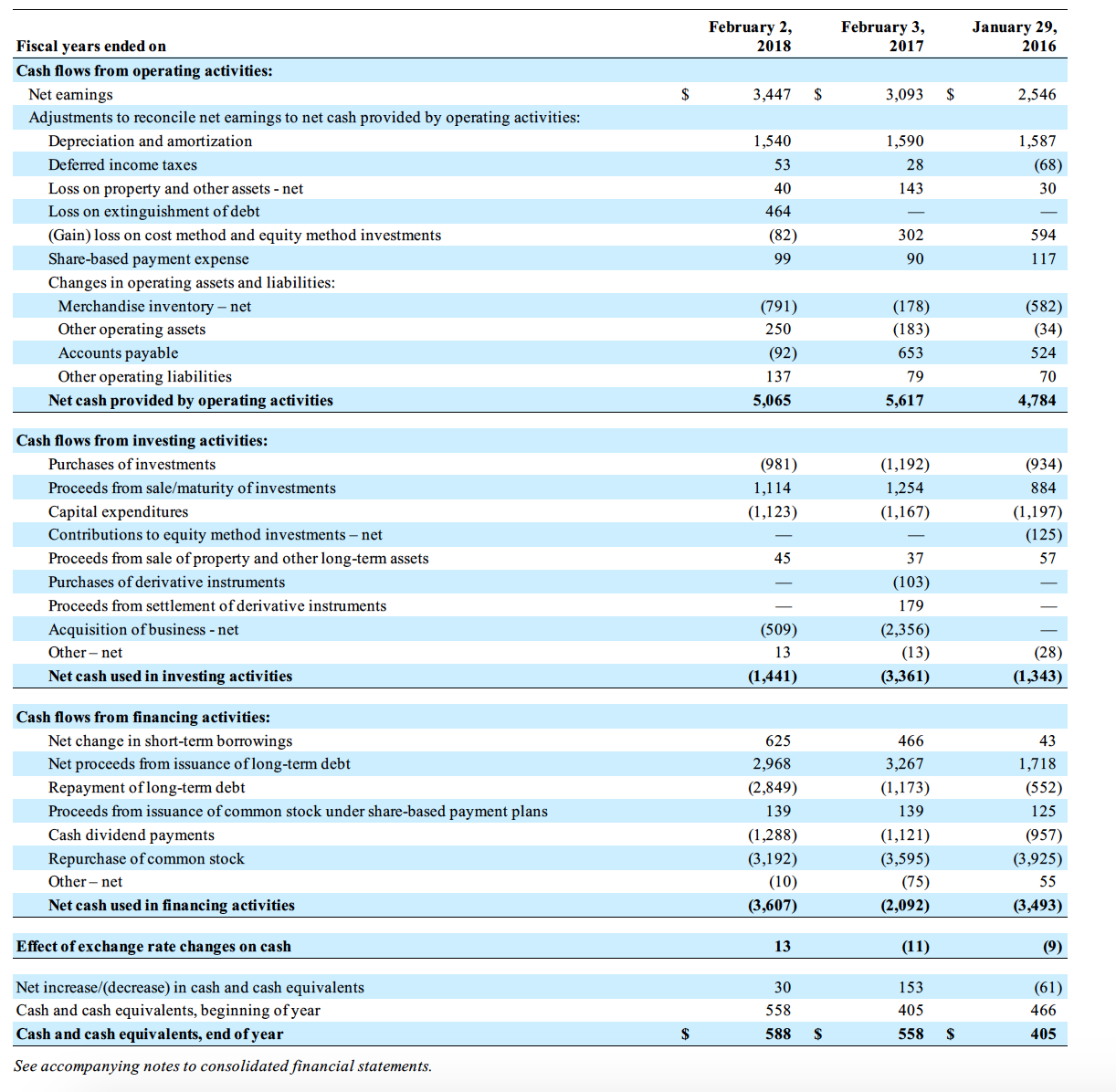

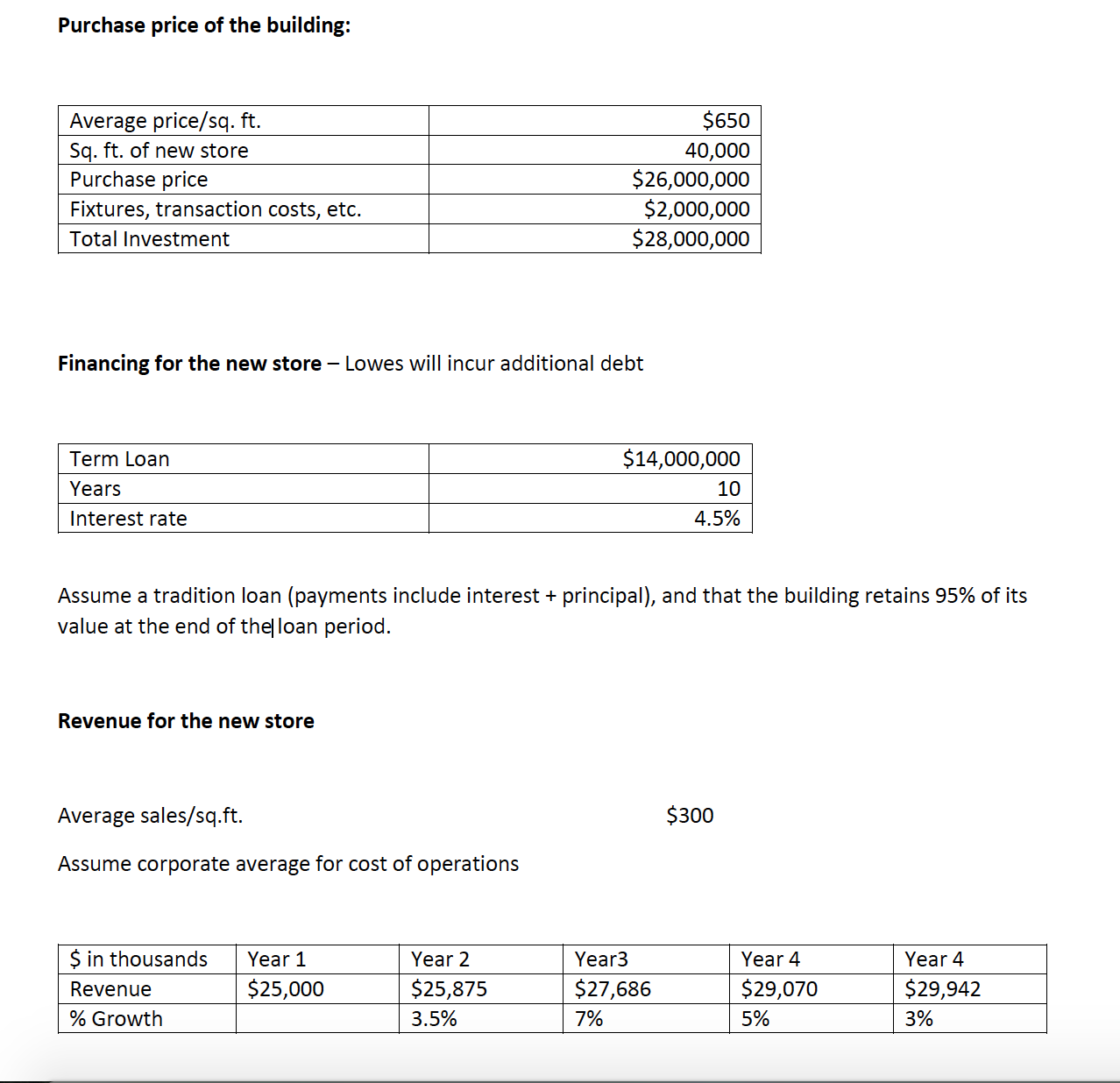

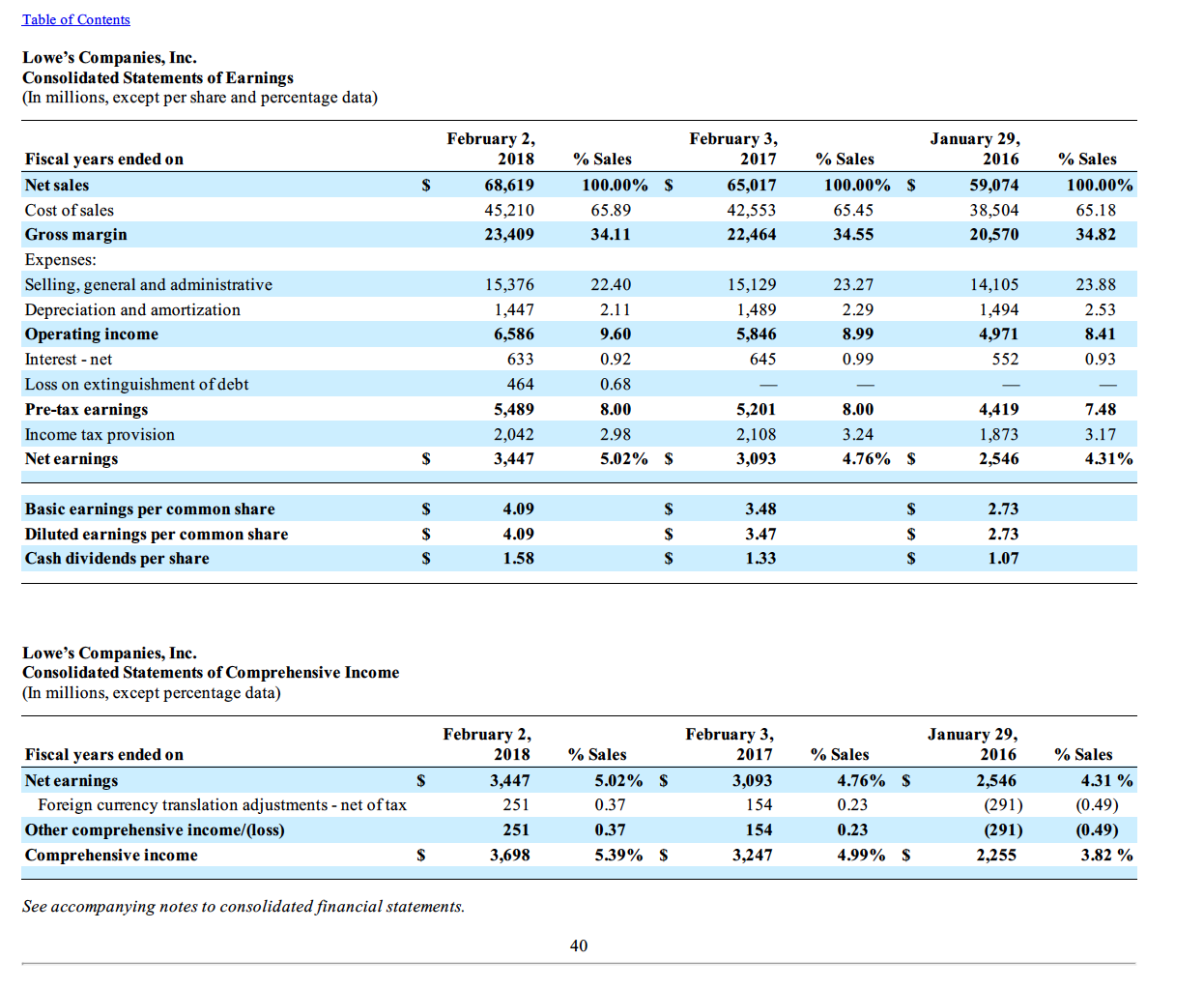

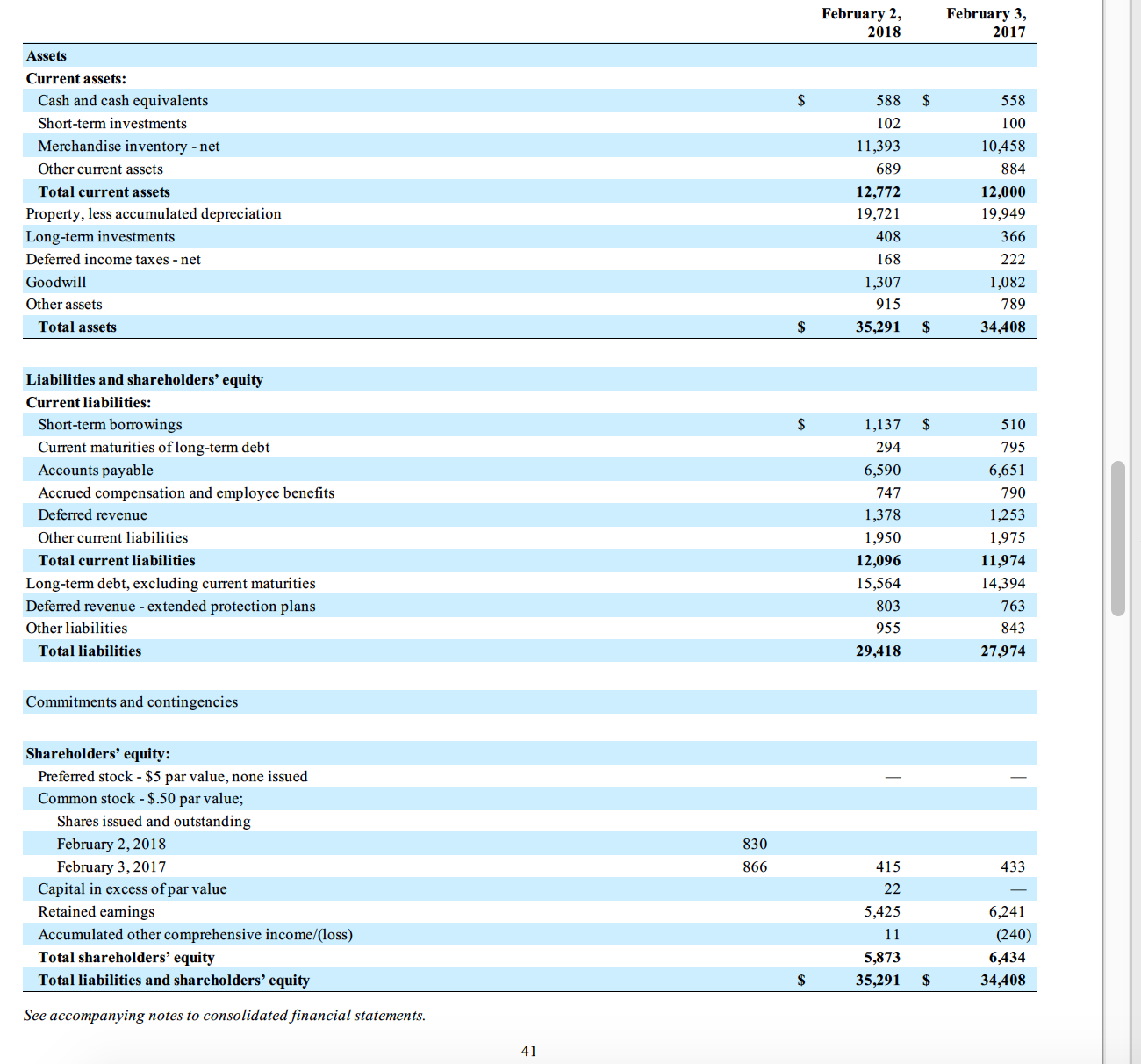

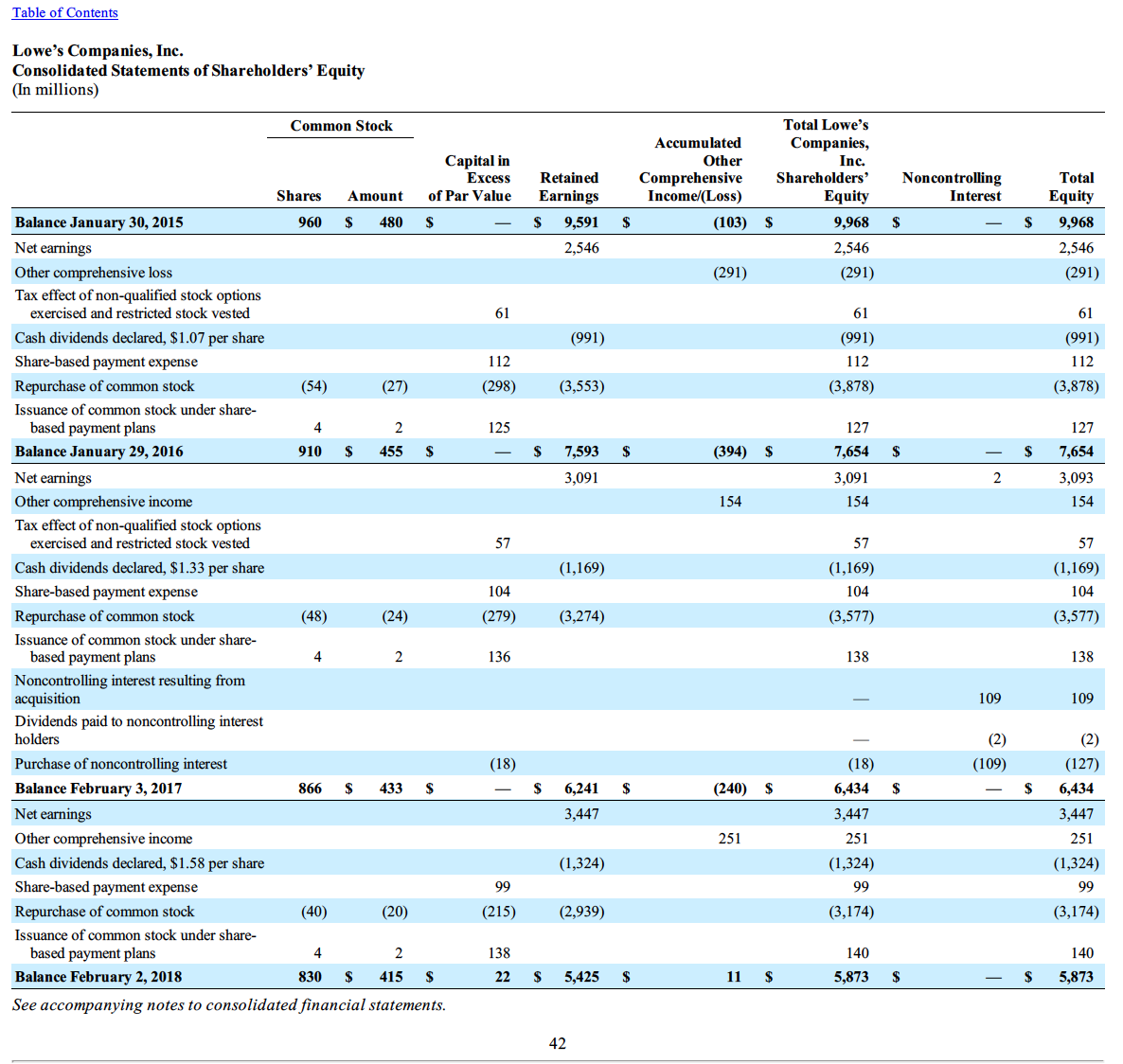

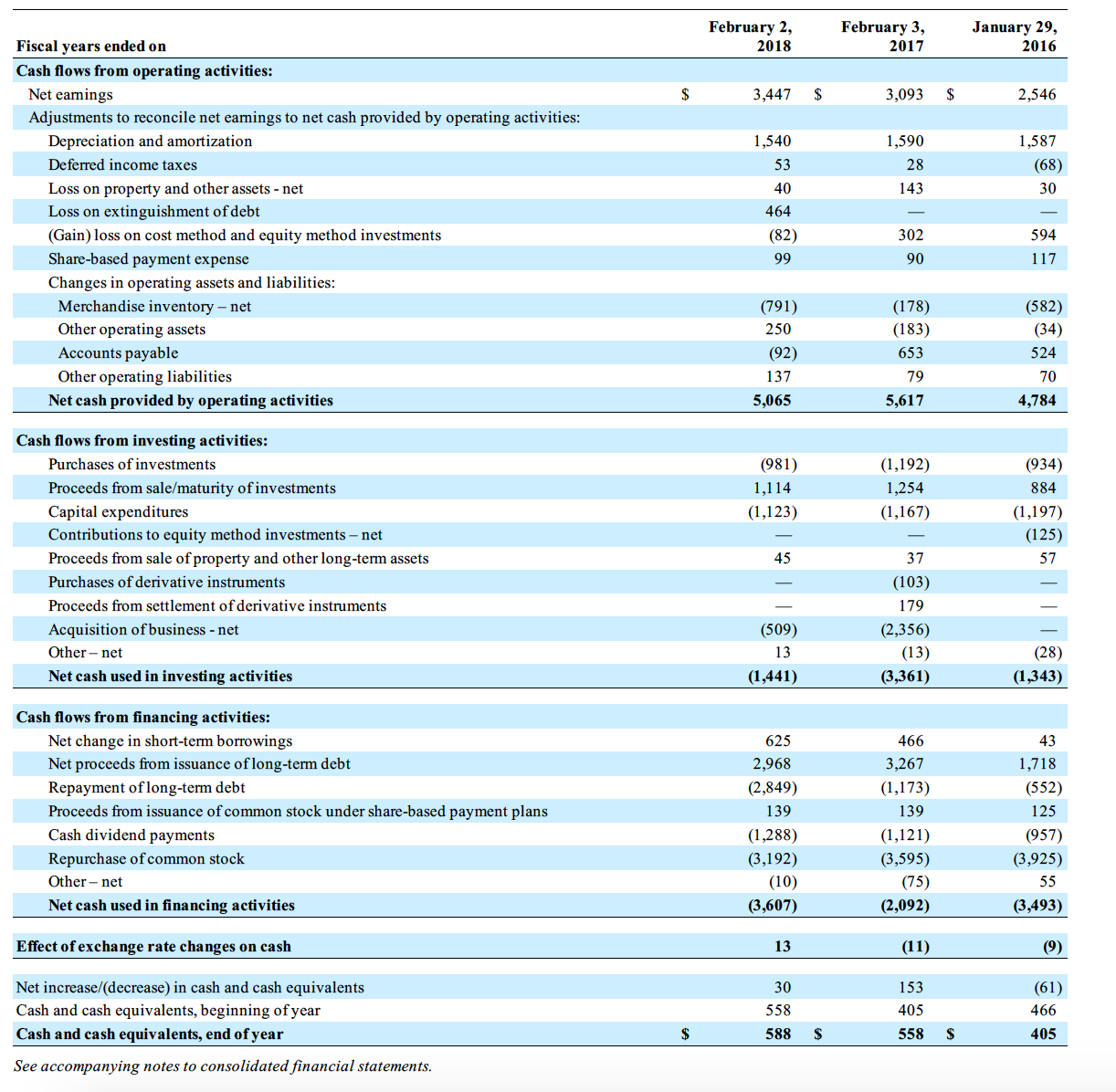

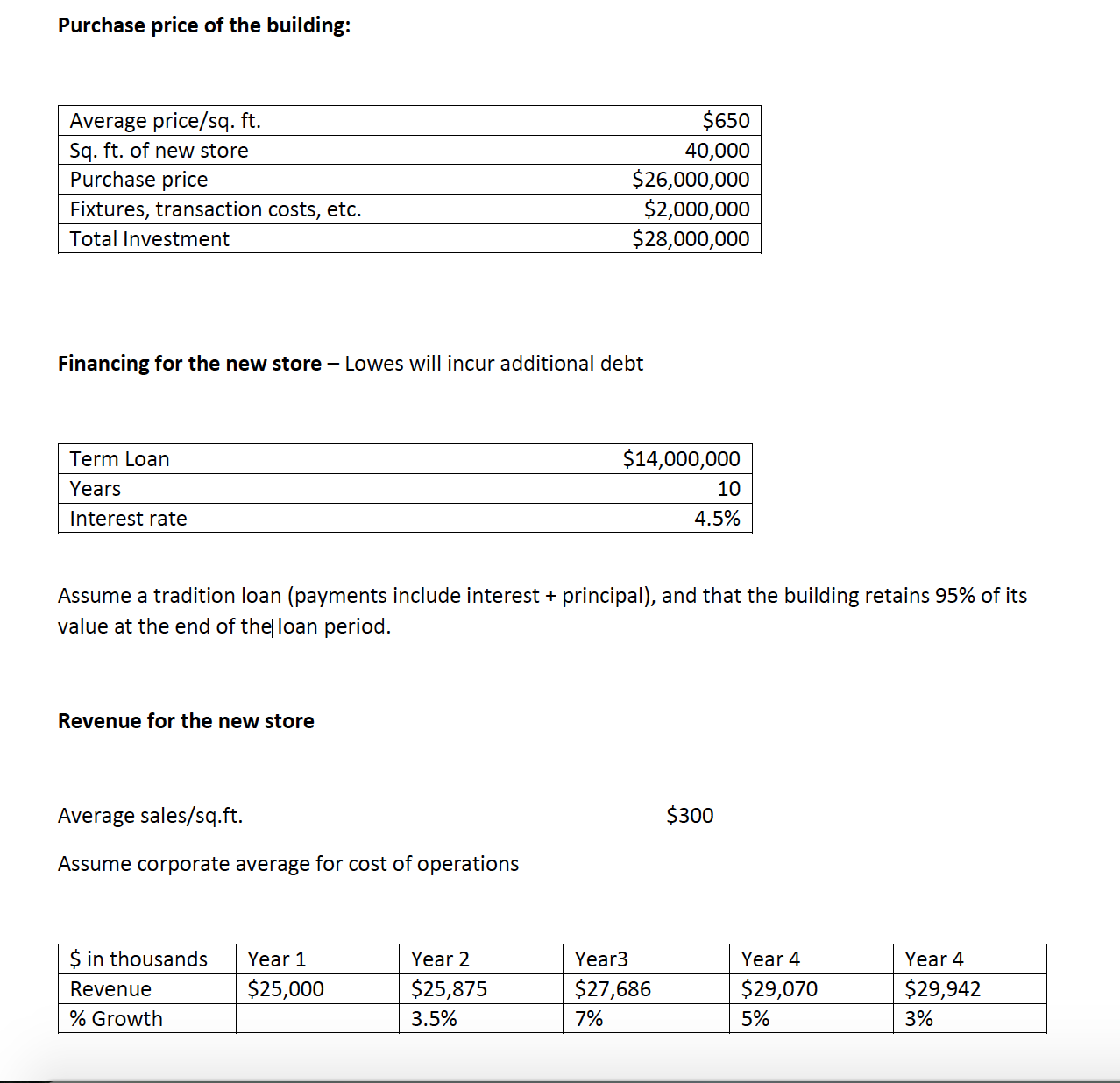

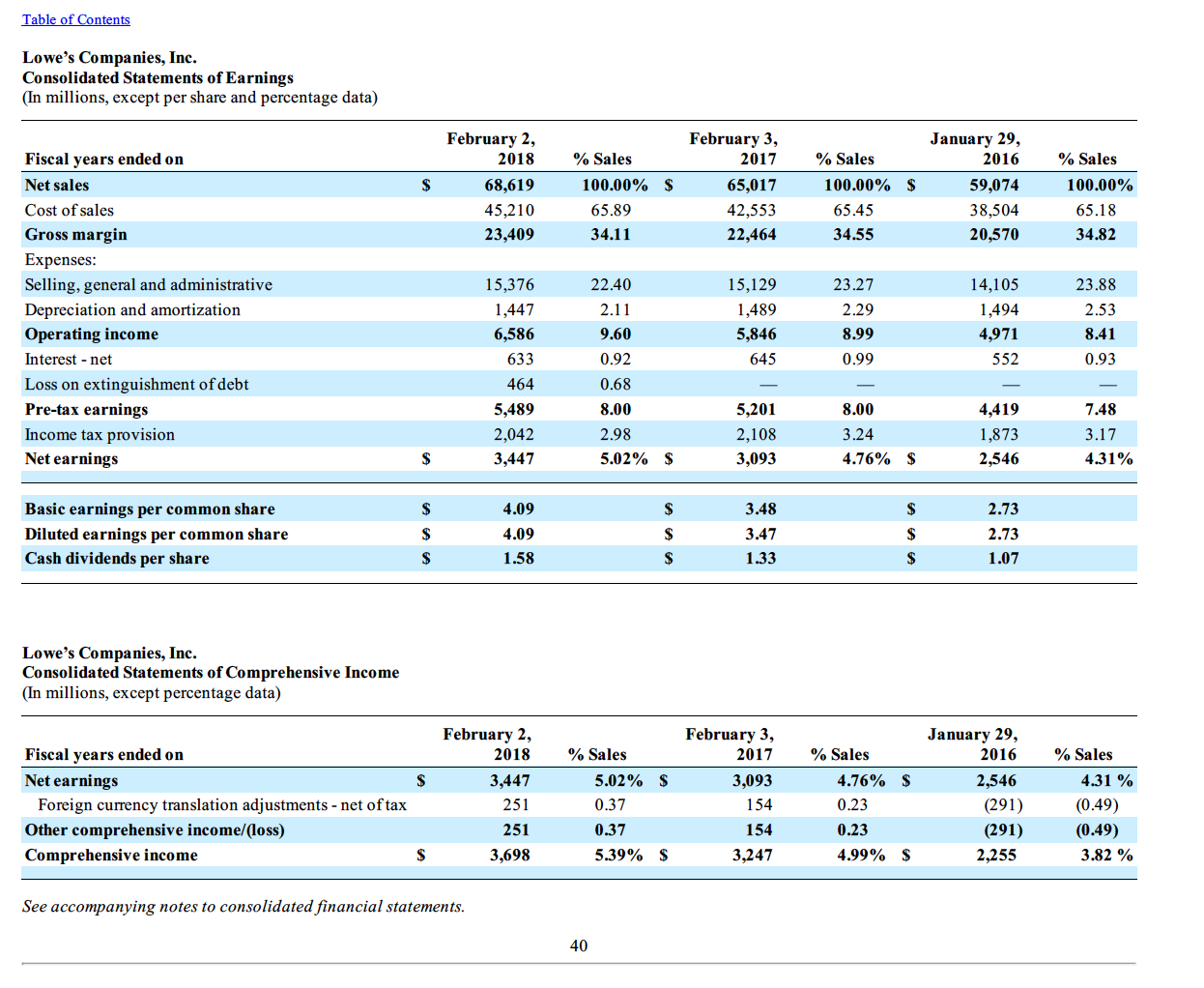

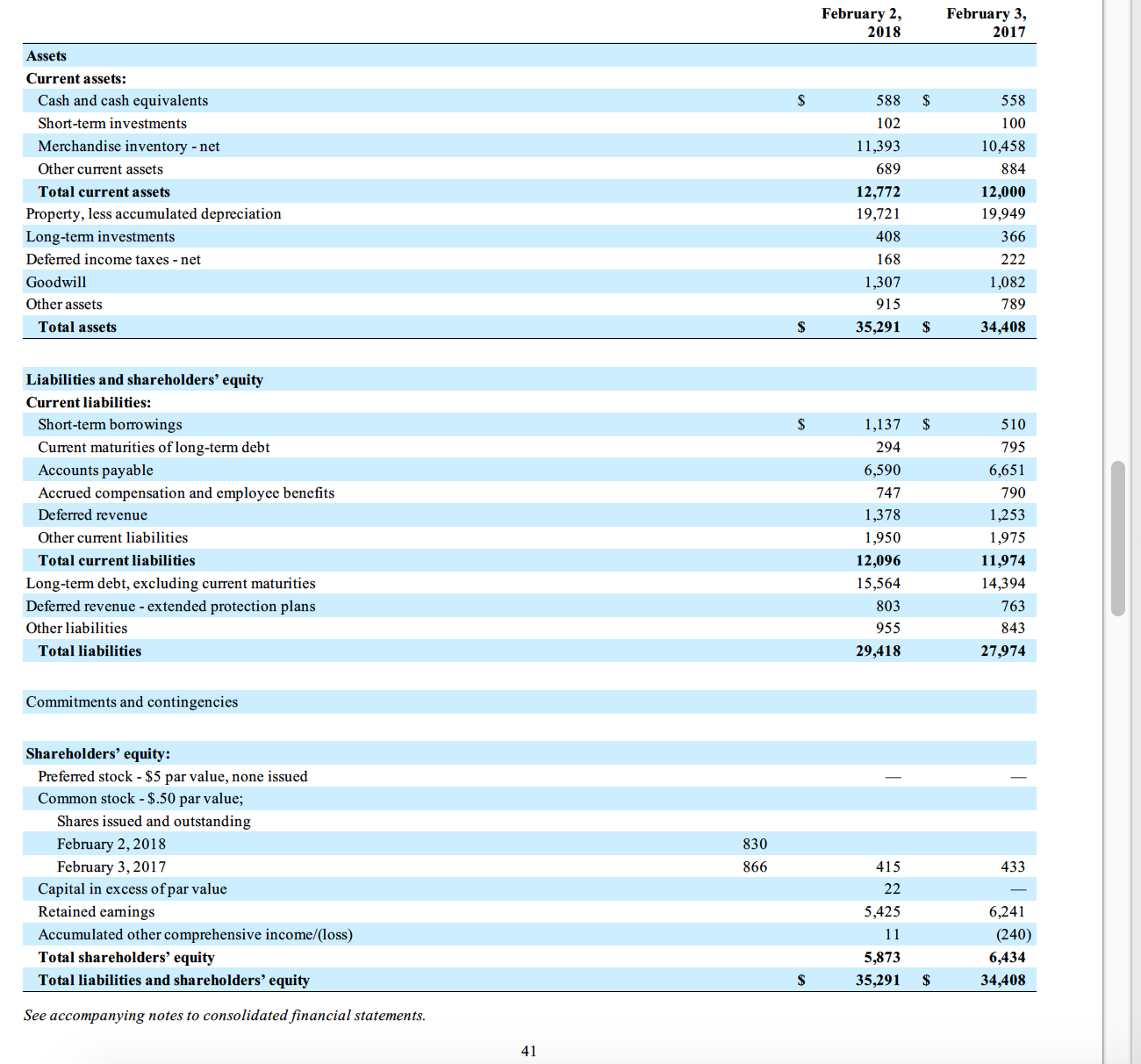

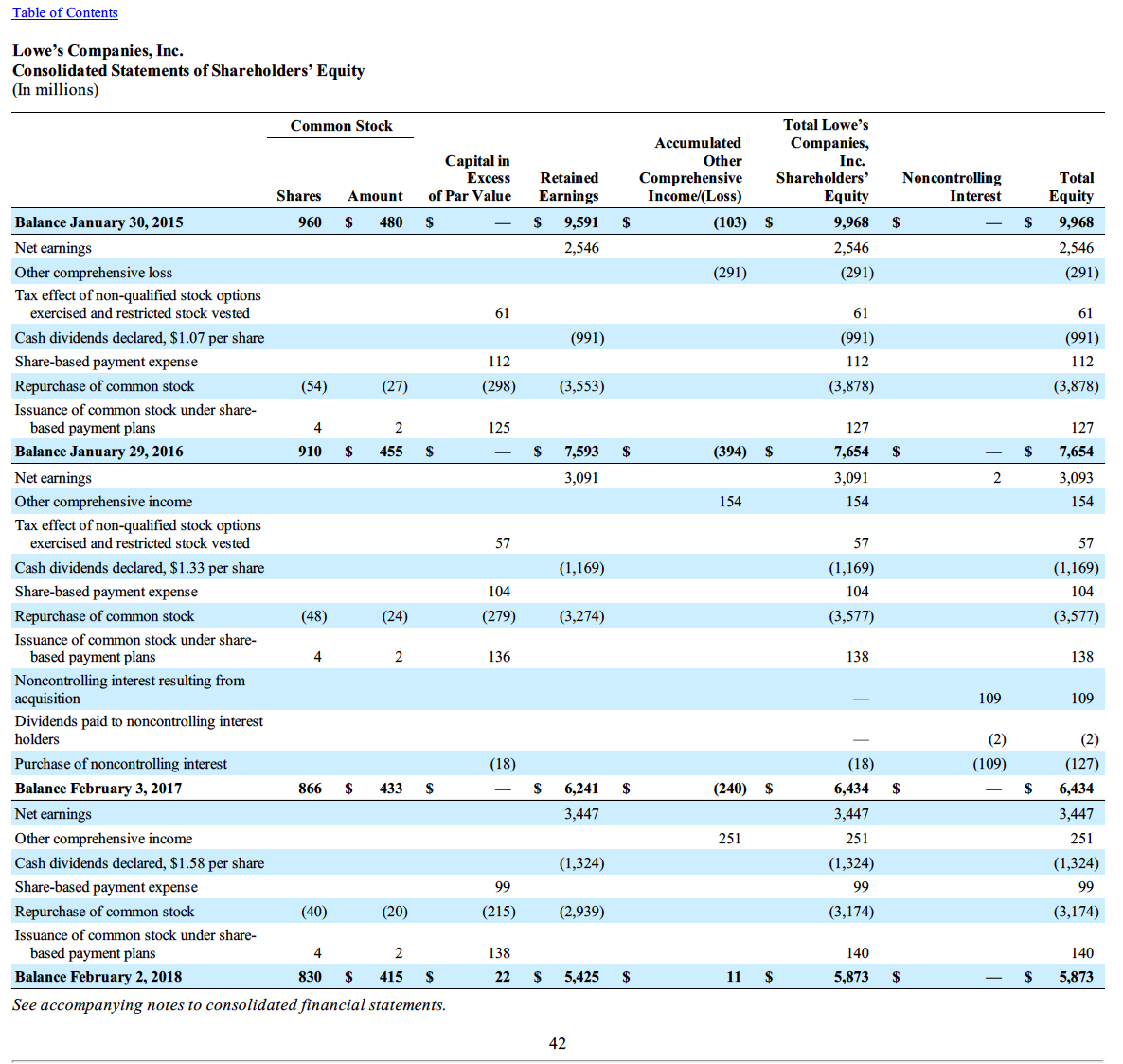

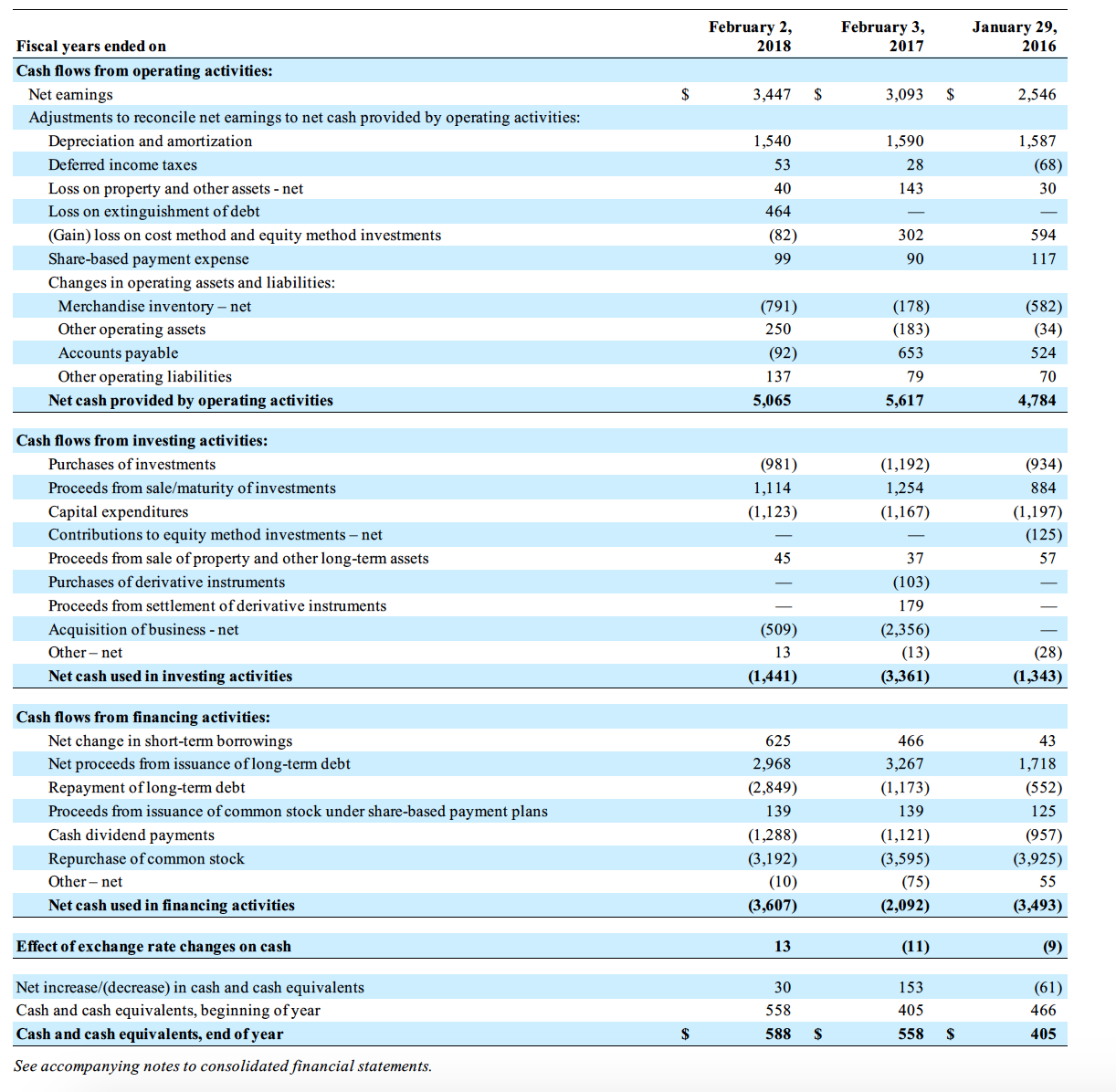

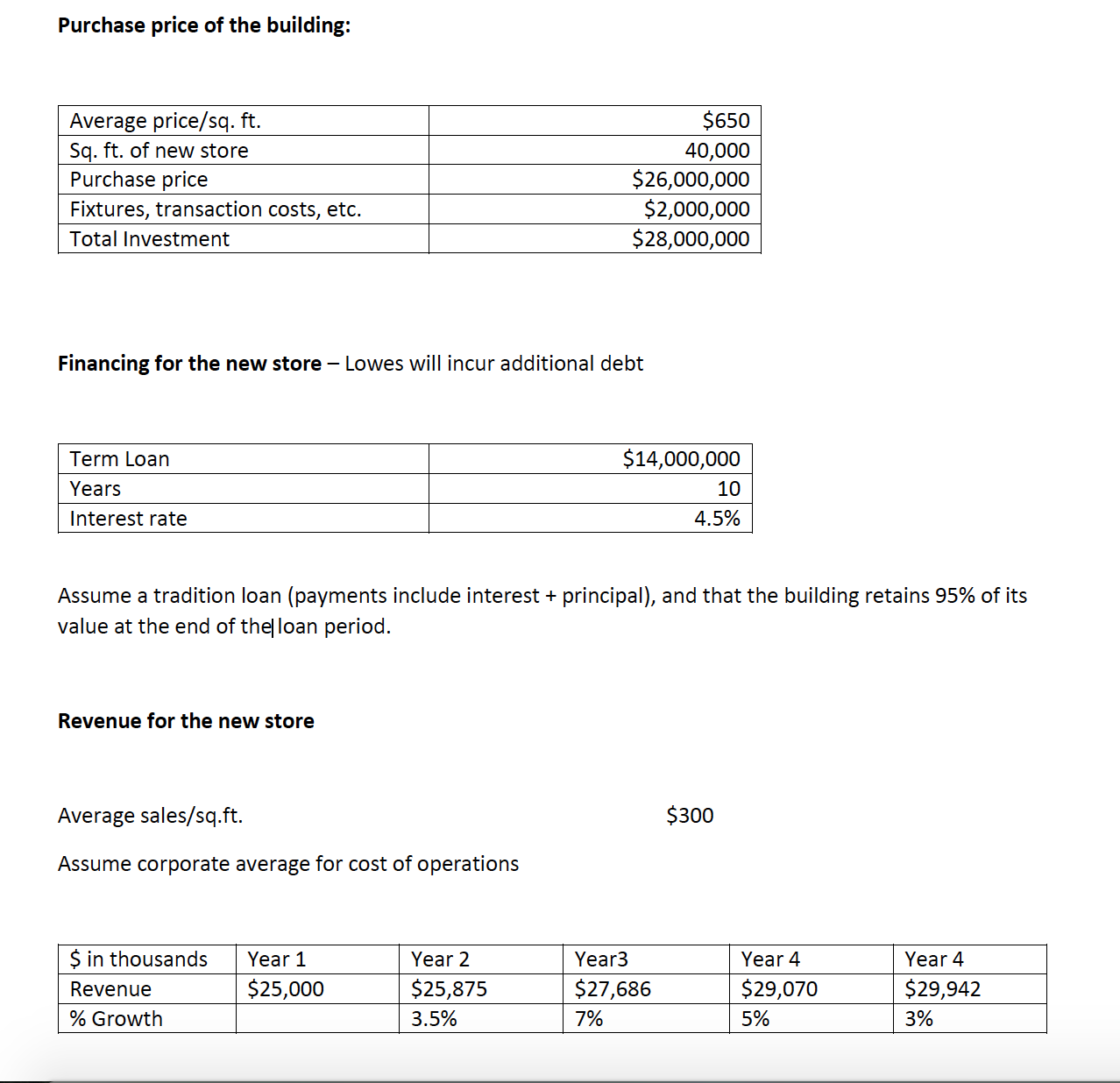

Table of Contents Lowe's Companies, Inc. Consolidated Statements of Earnings (In millions, except per share and percentage data) February 2, February 3 January 29, Fiscal years ended on 2018 % Sales 2017 % Sales 2016 % Sales Net sales $ 68,619 100.00% $ 65,017 100.00% $ 59,074 100.00% Cost of sales 45,210 65.89 42,553 65.45 38,504 65.18 Gross margin 23,409 34.11 22,464 34.55 20,570 34.82 Expenses: Selling, general and administrative 15,376 22.40 15,129 23.27 14,105 23.88 Depreciation and amortization 1,447 2.11 1,489 2.29 1,494 2.53 Operating income 6,586 9.60 5,846 8.99 4,971 8.41 Interest - net 633 0.92 645 0.99 552 0.93 Loss on extinguishment of debt 464 .68 Pre-tax earnings 5,489 8.00 5,201 8.00 4,419 7.48 Income tax provision 2,042 2.98 2,108 3.24 1,873 3.17 Net earnings $ 3,447 5.02% $ 3.093 4.76% $ 2,546 4.31% Basic earnings per common share 4.09 3.48 2.73 Diluted earnings per common share 4.09 3.47 2.73 Cash dividends per share 1.58 1.33 1.07 Lowe's Companies, Inc. Consolidated Statements of Comprehensive Income (In millions, except percentage data) February 2, February 3, January 29, Fiscal years ended on 2018 % Sales 2017 % Sales 2016 % Sales Net earnings $ 3,447 5.02% 3,093 4.76% 2,546 4.31 % Foreign currency translation adjustments - net of tax 251 0.37 154 ).23 (291) (0.49) Other comprehensive income/(loss) 251 ).37 154 0.2 291) (0.49) Comprehensive income $ 3,698 5.39% $ 3,247 4.99% $ 2,255 3.82% See accompanying notes to consolidated financial statements. 40February 2, February 3, 2018 2017 Assets Current assets: Cash and cash equivalents $ 588 $ 558 Sh ort-term investments 102 1 00 Merchandise inventory - net 1 1,393 10,458 Other current assets 689 884 Total current assets 12,772 12,000 Property, less accumulated depreciation 19,721 19,949 Long-term investments 408 366 Deferred income taxes - net 168 222 Goodwill 1,307 1,082 Other assets 915 789 Total assets S 35.29] S 341,408 Liabilities and shareholders' equity Current liabilities: Short-term borrowings $ 1,137 $ 510 Current maturities of long-term debt 294 795 Accounts payable 6,590 6,651 Accrued compensation and employee benets 747 790 Deferred revenue 1,378 1,253 Other current liabilities 1,950 1,9 75 Total current liabilities 12.096 11,974 Long-term debt, excluding current maturities 15.564 14,3 94 Defer-red revenue - extended protection plans 803 763 Other liabilities 955 843 Total liabilities 29,418 27,9 74 Commitments and contingencies Shareholders' equity: Preferred stock - $5 par value, none issued _ _ Common stock - $.50 par value; Shares issued and outstanding February2,2018 830 February 3,2017r 866 415 433 Capital in excess of par value 22 _ Retained earnings 5,425 6,241 Accumulated other comprehensive incomefoss) 1 1 (240) Total shareholders' equity 5,873 6,434 Total liabilities and shareholders' equity 3 35,291 $ 34,408 See accompanying notes (0 Consolidated nancial Statements. 41 Table of Contents Lowe's Companies, Inc. Consolidated Statements of Shareholders' Equity (In millions) Common Stock Total Lowe's Accumulated Companies Capital in Other Inc. Excess Retained Shareholders Noncontrolling Total Shares Comprehensive Amount of Par Value Earnings Income/(Loss) Equity Interest Equity Balance January 30, 2015 960 $ 480 $ S 9.591 (103) $ 9.968 $ $ ,968 Net earnings 2,546 2,546 2,546 Other comprehensive loss (291) (291) 291) Tax effect of non-qualified stock options exercised and restricted stock vested 61 61 61 Cash dividends declared, $1.07 per share 991) (991) (991) Share-based payment expense 112 112 112 Repurchase of common stock (54) (27) (298) (3,553) (3,878) (3,878) Issuance of common stock under share- based payment plans 4 2 125 127 127 Balance January 29, 2016 910 $ 455 $ $ 7,593 $ (394) $ 7,654 $ $ 7,654 Net earnings 3,091 3,091 2 3,093 Other comprehensive income 154 154 154 Tax effect of non-qualified stock options exercised and restricted stock vested 57 57 57 Cash dividends declared, $1.33 per share (1,169) (1,169) (1,169) Share-based payment expense 104 104 104 Repurchase of common stock (48) (24) (279) (3,274) (3,577) (3,577) Issuance of common stock under share- based payment plans 4 2 136 138 138 Noncontrolling interest resulting from acquisition 109 109 Dividends paid to noncontrolling interest holders (2) (2) Purchase of noncontrolling interest (18) (18) (109) (127 Balance February 3, 2017 866 $ 433 $ 6,241 $ (240) $ 6.434 $ $ 6,434 Net earnings 3,447 3,447 ,447 Other comprehensive income 251 251 251 Cash dividends declared, $1.58 per share (1,324) (1,324) (1,324) Share-based payment expense 99 9 99 Repurchase of common stock (40) (20) (215) (2,939) (3,174) (3,174) Issuance of common stock under share- based payment plans 2 138 140 140 Balance February 2, 2018 830 $ 415 22 5,425 $ 11 $ 5,873 $ - $ 5,873 See accompanying notes to consolidated financial statements. 42February 2, February 3, January 29, Fiscal years ended on 2018 2017 2016 Cash flows from operating activities: Net earnings $ 3,447 $ 3,093 $ 2,546 Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation and amortization 1,540 1,590 1,587 Deferred income taxes 53 28 (68) Loss on property and other assets - net 40 143 30 Loss on extinguishment of debt 464 Gain) loss on cost method and equity method investments (82) 302 594 Share-based payment expense 99 90 117 Changes in operating assets and liabilities: Merchandise inventory - net (791) (178 (582 Other operating assets 250 (183 (34) Accounts payable (92) 653 524 Other operating liabilities 137 79 70 Net cash provided by operating activities 5,065 5,617 4,784 Cash flows from investing activities: Purchases of investments (981) (1,192) (934) Proceeds from sale/maturity of investments 1,114 ,254 884 Capital expenditures (1,123) (1,167) (1,197) Contributions to equity method investments - net (125) Proceeds from sale of property and other long-term assets 45 37 57 Purchases of derivative instruments (103) Proceeds from settlement of derivative instruments 179 Acquisition of business - net (509) (2,356) Other - net 13 (13) (28) Net cash used in investing activities (1,441) (3,361) (1,343) Cash flows from financing activities: Net change in short-term borrowings 625 466 43 Net proceeds from issuance of long-term debt 2,968 3,267 1,718 Repayment of long-term debt (2,849) (1,173) (552) Proceeds from issuance of common stock under share-based payment plans 139 139 125 Cash dividend payments (1,288) (1,121) (957 Repurchase of common stock (3,192) (3,595) (3,925) Other - net (10) (75) 55 Net cash used in financing activities (3,607) (2,092) (3,493) Effect of exchange rate changes on cash 13 (11) (9) Net increase/(decrease) in cash and cash equivalents 30 153 (61) Cash and cash equivalents, beginning of year 558 405 466 Cash and cash equivalents, end of year $ 588 $ 558 $ 405 See accompanying notes to consolidated financial statements.Purchase price of the building: Average price/sq. ft. $650 Sq. ft. of new store 40,000 Purchase price $26,000,000 Fixtures, transaction costs, etc. $2,000,000 Total Investment $28,000,000 Financing for the new store Lowes will incur additional debt Term Loan $14,000,000 Years 10 Interest rate 4.5% Assume a tradition loan (payments include interest + principal), and that the building retains 95% of its value at the end of the| loan period. Revenue for the new store Average sales/sq.ft. $300 Assume corporate average for cost of operations $ in thousands Yearl Year2 Year3 Year4 Year4 Revenue $25,000 $25,875 $27,686 $29,070 $29,942 % Growth 3.5% 7% 5% 3%