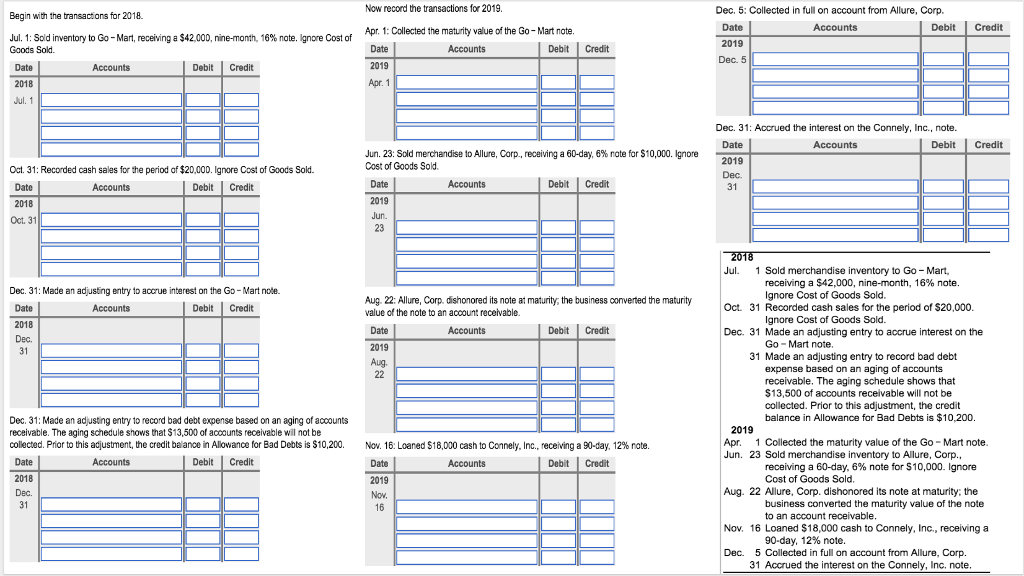

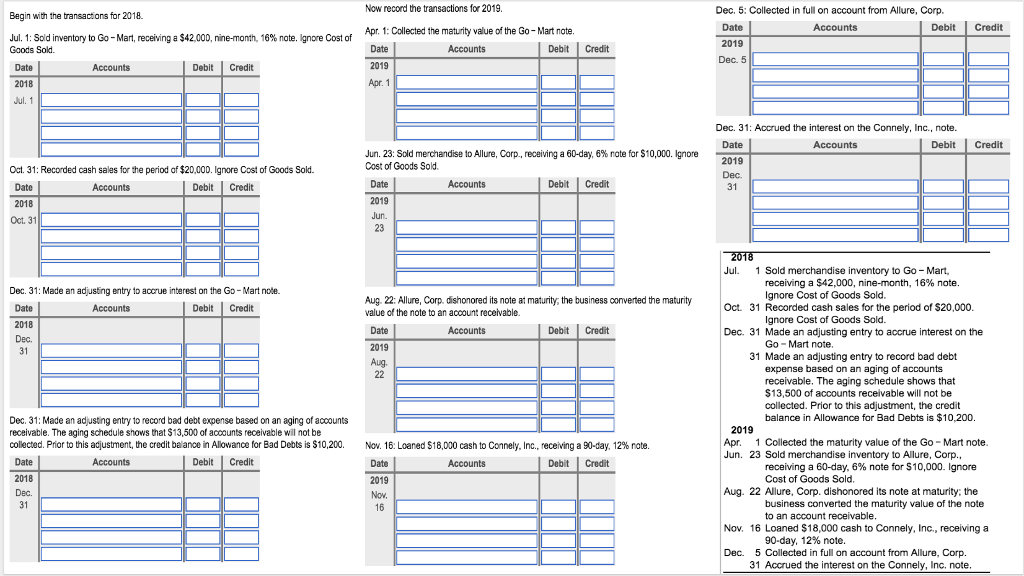

Now record the transactions for 2019. Dec. 5: Collected in full on account from Allure, Corp. Begin with the transactons for 2018. DebitCredit Apr. 1:Collected the maturity value of the Go-Mart nate. Jul. 1: Sold inventory to Go-Mart, receiving a $42.000, nine-month, 16% note. Ignore Cost of Goods Sold. Debit Credit Dec. 5 Debit Credit 2019 2018 Jul. 1 Dec. 31: Accrued the interest on the Connely, Inc., note. DebitCredit Jun, 23: Sold merchandise to Allure. Corp., receiving a 60-day, 6% note for $10,000. Ignore Cost of Goods Sold 2019 Oct. 31: Recorded cash sales for the period of $20,000. Ignore Cost of Goods Sold. Debit Credit Debit Credit 2018 2019 Oct. 31 Jul. 1 Sold merchandise inventory to Go-Mart, receiving a $42,000, nine-month, 16% note. Ignore Cost of Goods Sold. Dec. 31: Made an adjusting entry to accrue inberest on the Go-Mart note. Aug. 22: Allure, Corp. dishonored its note at maturity, the business converted the maturity value of the note to an account recervable. Debit Credit Oct. 31 Recorded cash sales for the period of $20,000 lgnore Cost of Goods Sold. 2018 Debit Credit Dec. 31 Made an adjusting entry to accrue interest on the 2019 Go-Mart note 31 Made an adjusting entry to record bad debt expense based on an aging of accounts receivable. The aging schedule shows that $13,500 of accounts receivable will not be collected. Prior to this adjustment, the credit balance in Allowance for Bad Debts is $10,200 Dec. 31: Made an adjusting entry to record bad debt expense based on an aging of accounts receivable. The aging schedule shows that $13,500 of accounts receivable will not be colected. Prior to this adjustment, the credit balance in Allowance for Bad Debts is $10.200. 2019 Apr. 1 Collected the maturity value of the Go- Mart note. Jun. 23 Sold merchandise inventory to Allure, Corp 2 Nov 16: Loaned $18,000 cash to Connely, Inc., receiving a 90-day 12% note. Debit Credit Debit Credit receiving a 60-day, 6% note for S 10,000. Ignore Cost of Goods Sold 2018 2019 Aug. 22 Allure, Corp. dishonored its note at maturity; the business converted the maturity value of the note to an account receivable Nov. 16 Loaned $18,000 cash to Connely, Inc., receiving a 90-day, 12% note. 5 Collected in full on account from Allure, Corp. 31 Accrued the interest on the Connely, Inc, note Dec