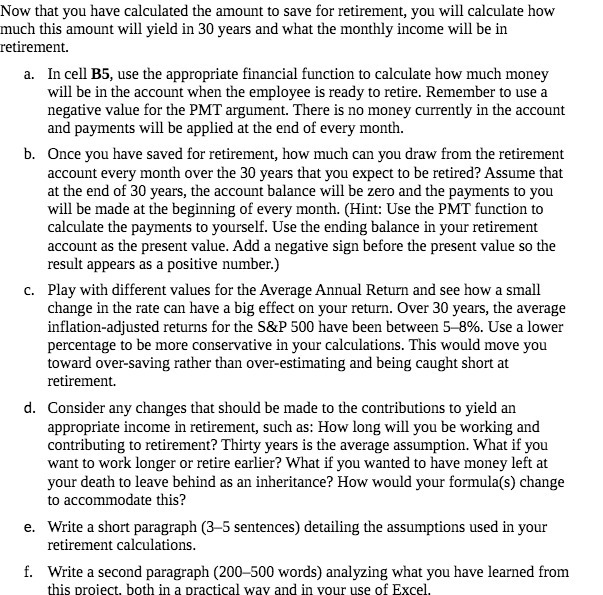

Now that you have calculated the amount to save for retirement, you will calculate how much this amount will yield in 31\".} years and what the monthly income will be in retirement. a. In cell HE, use the appropriate financial function to calculate how much money will be in the account when the employee is ready to retire. Remember to use a negative value for the Pluf'I' argument. There is no money currently in the account and payments will be applied at the end of every month. b. Dnce you have saved for retirement, how much can you draw from the retirement account every month over the Si] years that you expect to he retired? Assume that at the end of 3D years, the account balance will be zero and the payments to you will be made at the beginning of every month. III-lint: Use the Plv' function to calculate the payments to yourself. Use the ending balance in your retirement account as the present value. Add a negative sign before the present value so the result appears as a positive number.) c. Play with different values for the Average Annual Return and see how a small change in the rate can have a big effect on your return. ver 3i] years, the average ination-adjusted returns for the SHIP EDD have been between 543%. Use a lower percentage to be more conservative in your calculations. This would move you toward over-saving rather than over-estimating and being caught short at retiremenL d. Consider any changes that should be made to the contributions to yield an appropriate income in retirement, such as: How long will you be working and contributing to retirement? Thirty years is the average assumption. What if you want to work longer or retire earlier? What if you wanted to have money left at your death to leave behind as an inheritance? How would your fom'tula(s) change to accommodate this? e. Write a short paragraph [3-5 sentences} detailing d'te assumptions used in your retirement calculations. f. Write a second paragraph [EDD-Ebb words} analysing what you have learned from this oroiecL both in a practical wav and in vour use of Excel