Question

Now that you have reviewed and corrected most of the steps in the accounting cycle, it is time to complete the cycle with the last

Now that you have reviewed and corrected most of the steps in the accounting cycle, it is time to complete the cycle with the last steps. This week, you are to prepare the multiple-step income statement, statement of changes in shareholders equity, and classified balance sheet. Prepare the closing entries and the post-closing trial balance. You should use the corrected information completed in prior weeks.

Prepare the income statement, where net income will be carried through to the statement of changes in shareholders equity as one of the adjustments to the final balance in the equity account. You will then need to prepare the balance sheet, where you will show the updated shareholders equity balances.

- Prepare a May (xxxx) multiple-step income statement, a May (xxxx) statement of changes to shareholders equity, and a May 31, (xxxx), classified balance sheet. Note the corporation has authorized 100,000 shares at $1.00 par value.

Prepare the closing entries and prepare a post-closing trial balance

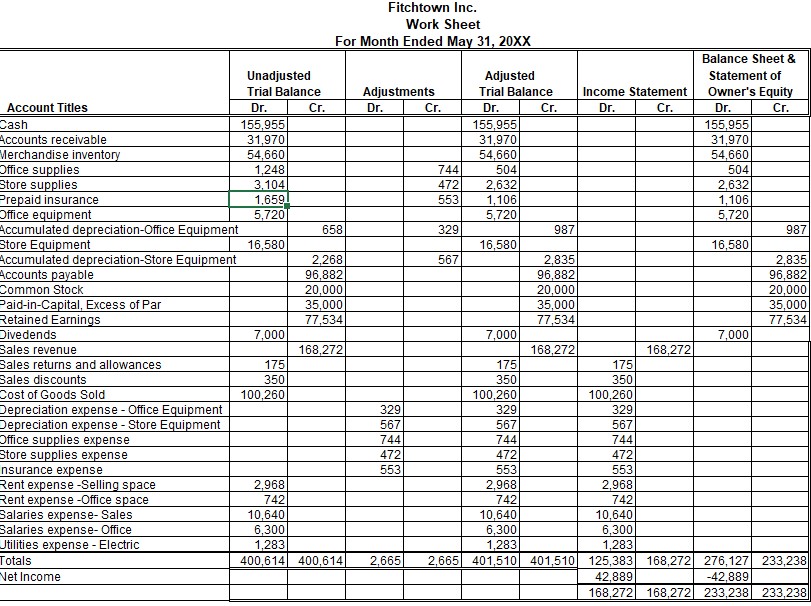

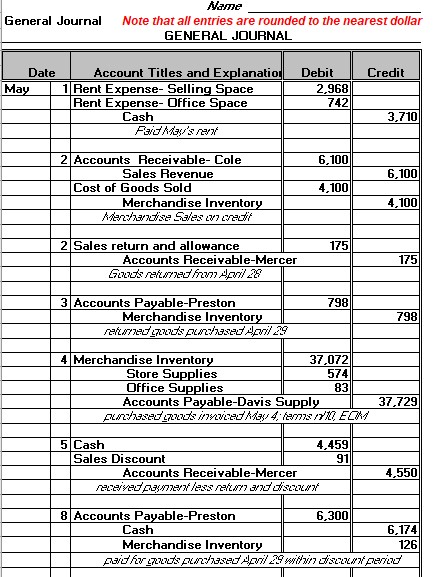

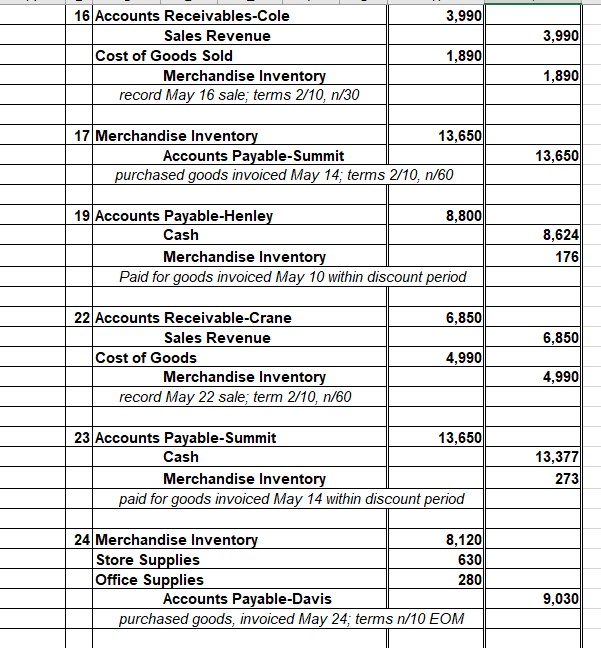

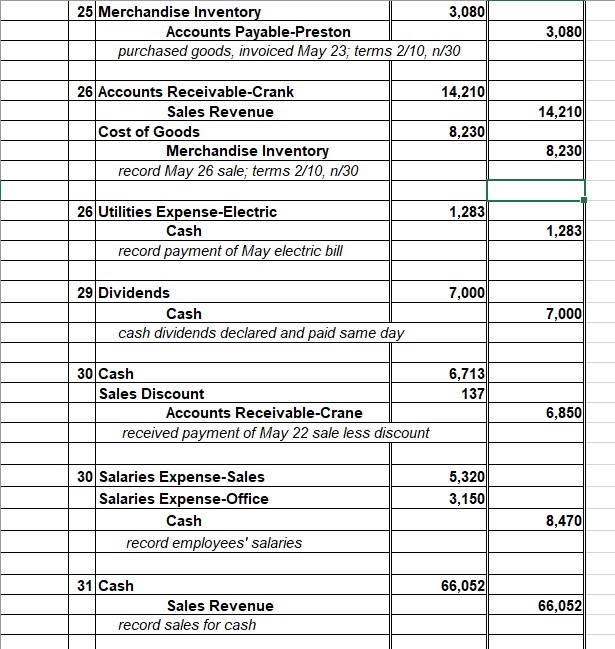

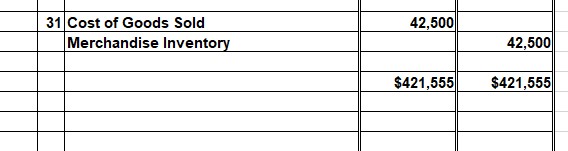

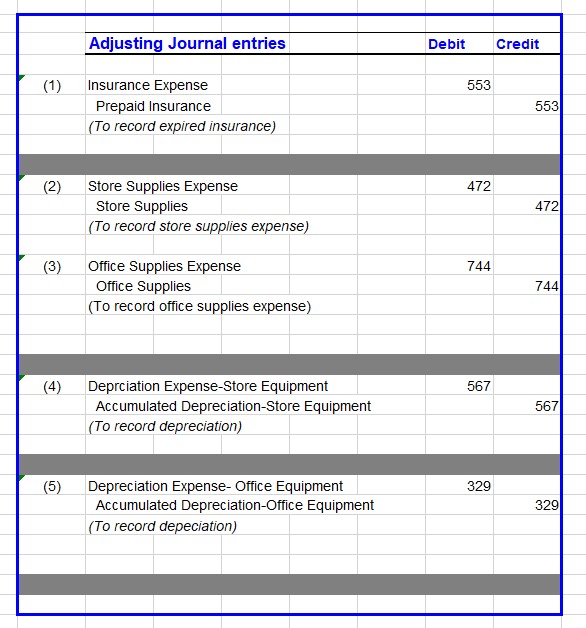

Name General Journal Note that all entries are rounded to the nearest dollar GENERAL JOURNAL \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Date } & Account Titles and Explanation & Debit & Credit \\ \hline May & & Rent Expense- Selling Space & 2,968 & \\ \hline & & Rent Expense- Office Space & 742 & \\ \hline & & Cash & & 3,710 \\ \hline & & & & \\ \hline & & & & \\ \hline & 2 & Accounts Receivable- Cole & 6,100 & \\ \hline & & Sales Revenue & & 6,100 \\ \hline & & Cost of Goods Sold & 4,100 & \\ \hline & & Merchandise Inventory & & 4,100 \\ \hline & & & & \\ \hline & & & & \\ \hline & 2 & Sales return and allowance & 175 & \\ \hline & & Accounts Receivable-Merc & & 175 \\ \hline & & & & \\ \hline & & & & \\ \hline & 3 & Accounts Payable-Preston & 798 & \\ \hline & & Merchandise Inventory & & 798 \\ \hline & & & & \\ \hline & & & & \\ \hline & 4 & Merchandise Inventory & 37,072 & \\ \hline & & Store Supplies & 574 & \\ \hline & & Office Supplies & 83 & \\ \hline & & Accounts Payable-Davis 5 & pply & 37,729 \\ \hline & & & m//h/E & \\ \hline & & & & \\ \hline & 5 & Cash & 4,459 & \\ \hline & & Sales Discount & 91 & \\ \hline & & Accounts Receivable-Merc & & 4,550 \\ \hline & & & aZ/276 & \\ \hline & & & & \\ \hline & 8 & Accounts Payable-Preston & 6,300 & \\ \hline & & Cash & & 6,174 \\ \hline & & Merchandise Inventory & & 126 \\ \hline & & & bif & \\ \hline \end{tabular} \begin{tabular}{|l|l|l||r||r||} \hline & 31 & Cost of Goods Sold & 42,500 & \\ \hline & & Merchandise Inventory & & 42,500 \\ \hline & & & \\ \hline & & & $421,555 & $421,555 \\ \hline & & & \\ \hline & & & & \\ \hline & & & \end{tabular} Fitchtown Inc. Work Sheet For Month Ended May 31, 20XX \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Account Titles } & \multicolumn{2}{|c|}{UnadjustedTrialBalance} & \multicolumn{2}{|c|}{ Adjustments } & \multicolumn{2}{|c|}{AdjustedTrialBalance} & \multicolumn{2}{|c|}{ Income Statement } & \multicolumn{2}{|c|}{BalanceSheet&StatementofOwnersEquity} \\ \hline & Dr. & Cr. & Dr. & Cr. & Dr. & Cr. & Dr. & Cr. & Dr. & Cr. \\ \hline Cash & 155,955 & & & & 155,955 & & & & 155,955 & \\ \hline Accounts receivable & 31,970 & & & & 31,970 & & & & 31,970 & \\ \hline Merchandise inventory & 54,660 & & & & 54,660 & & & & 54,660 & \\ \hline Office supplies & 1,248 & & & 744 & 504 & & & & 504 & \\ \hline Store supplies & 3,104 & & & 472 & 2,632 & & & & 2,632 & \\ \hline repaid insurance & 1,659 & & & 553 & 1,106 & & & & 1,106 & \\ \hline Office equipment & 5,720 & & & & 5,720 & & & & 5,720 & \\ \hline Accumulated depreciation-Office Equipme & & 658 & & 329 & & 987 & & & & 987 \\ \hline Store Equipment & 16,580 & & & & 16,580 & & & & 16,580 & \\ \hline Accumulated depreciation-Store Equipmen & & 2,268 & & 567 & & 2,835 & & & & 2,835 \\ \hline Accounts payable & & 96,882 & & & & 96,882 & & & & 96,882 \\ \hline Common Stock & & 20,000 & & & & 20,000 & & & & 20,000 \\ \hline Daid-in-Capital, Excess of Par & & 35,000 & & & & 35,000 & & & & 35,000 \\ \hline Retained Earnings & & 77,534 & & & & 77,534 & & & & 77,534 \\ \hline Divedends & 7,000 & & & & 7,000 & & & & 7,000 & \\ \hline Sales revenue & & 168,272 & & & & 168,272 & & 168,272 & & \\ \hline Sales returns and allowances & 175 & & & & 175 & & 175 & & & \\ \hline Sales discounts & 350 & & & & 350 & & 350 & & & \\ \hline Cost of Goods Sold & 100,260 & & & & 100,260 & & 100,260 & & & \\ \hline Depreciation expense - Office Equipment & & & 329 & & 329 & & 329 & & & \\ \hline Depreciation expense - Store Equipment & & & 567 & & 567 & & 567 & & & \\ \hline Office supplies expense & & & 744 & & 744 & & 744 & & & \\ \hline Store supplies expense & & & 472 & & 472 & & & & & \\ \hline nsurance expense & & & 553 & & 553 & & 553 & & & \\ \hline Rent expense -Selling space & 2,968 & & & & 2,968 & & 2,968 & & & \\ \hline Rent expense -Office space & 742 & & & & 742 & & 742 & & & \\ \hline Salaries expense- Sales & 10,640 & & & & 10,640 & & 10,640 & & & \\ \hline Salaries expense-Office & 6,300 & & & & 6,300 & & 6,300 & & & \\ \hline Jtilities expense - Electric & 1,283 & & & & 1,283 & & 1,283 & & & \\ \hline Totals & 400,614 & 400,614 & 2,665 & 2,665 & 401,510 & 401,510 & 125,383 & 168,272 & 276,127 & 233,238 \\ \hline Vet Income & & & & & & & 42,889 & & 42,889 & \\ \hline & & & & & & & 168,272 & 168,272 & 233,238 & 233,238 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started