Question

Now you plan to account for the following December 2020 transactions: Coffee and dessert sales totaled $437,825. All customers are required to pay by cash,

Now you plan to account for the following December 2020 transactions:

Coffee and dessert sales totaled $437,825. All customers are required to pay by cash, debit card or credit card with electronic payment methods preferred. Cost of goods sold for these sales totaled $131,350.

On occasion, BRI has agreed to provide coffee and desserts for businesses in the surrounding area. BRI collected $22,000 of the accounts receivable outstanding from its business customers.

According to its strategic plan, BRI intends to grow its business customers. For the first time, BRI sold gift baskets featuring coffees, liqueurs and gourmet desserts for businesses to gift to employees and customers. Total gift basket sales were $77,500 with payment due no later than January 31, 2021. Cost of goods sold for these sales totaled $29,060.

BRI purchased $123,200 of inventory from its suppliers on account.

BRI made payments totalling $277,350 to its suppliers.

The November 30 balance of salaries and wages payable was paid.

BRI incurred utilities costs totaling $3,900 and other operating expenses totaling $5,730. These amounts will be paid on the January 31, 2021 due date.

BRI paid the $8,250 premium for its insurance policy for January 1 to December 31, 2021.

You intend to journalize the transactions (in good form) for the general managers review and approval. To facilitate the general managers review, you plan to provide detailed supporting calculations and round all amounts to the nearest dollar.

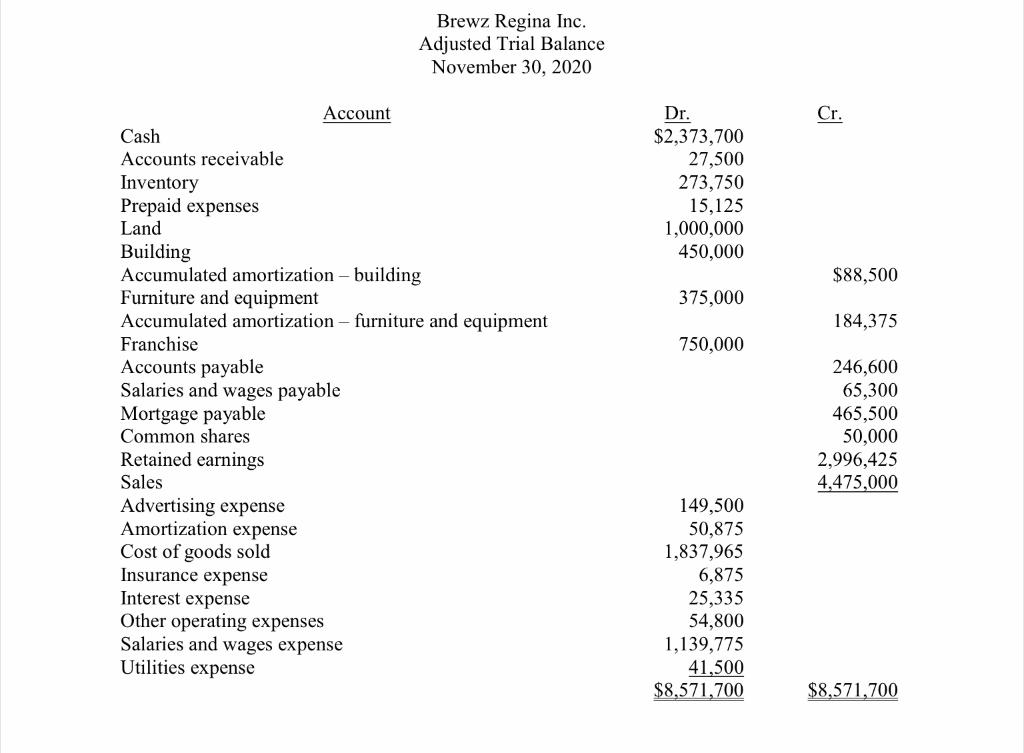

Brewz Regina Inc. Adjusted Trial Balance November 30, 2020 Cr. Dr. $2,373,700 27,500 273,750 15,125 1,000,000 450,000 $88,500 375,000 184,375 750,000 Account Cash Accounts receivable Inventory Prepaid expenses Land Building Accumulated amortization - building Furniture and equipment Accumulated amortization - furniture and equipment Franchise Accounts payable Salaries and wages payable Mortgage payable Common shares Retained earnings Sales Advertising expense Amortization expense Cost of goods sold Insurance expense Interest expense Other operating expenses Salaries and wages expense Utilities expense 246,600 65,300 465,500 50,000 2,996,425 4,475,000 149,500 50,875 1,837,965 6,875 25,335 54,800 1,139,775 41,500 $8,571,700 $8,571,700Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started