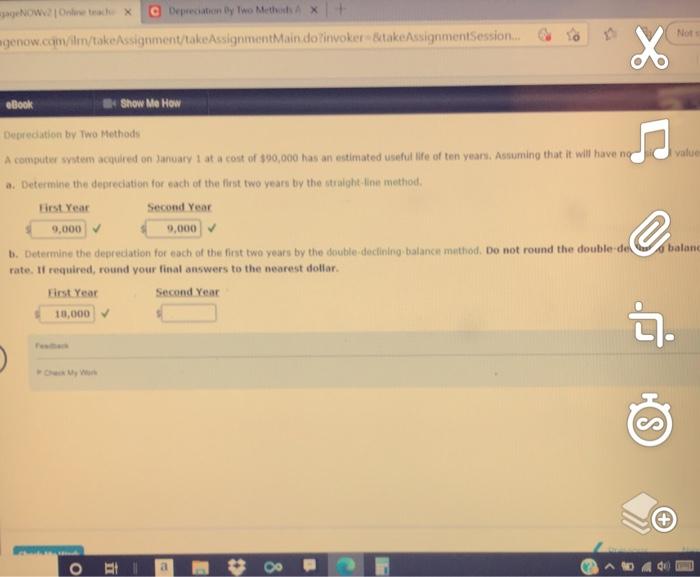

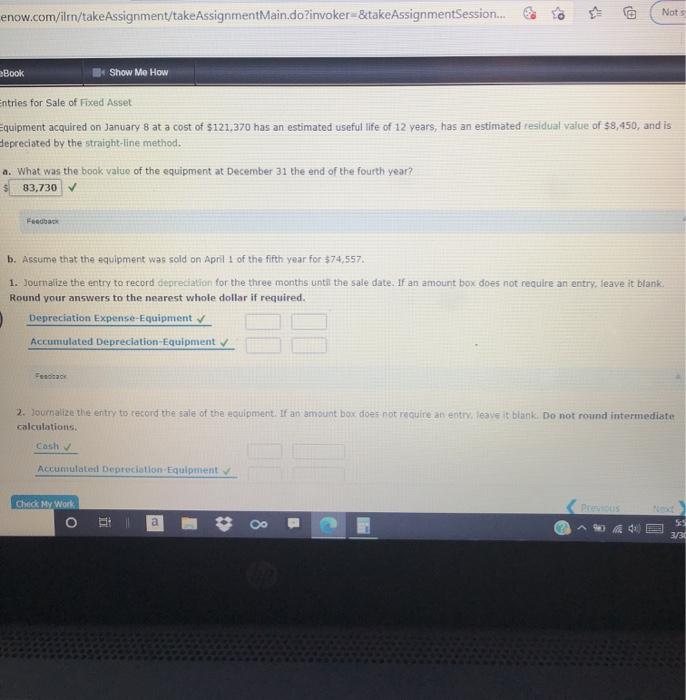

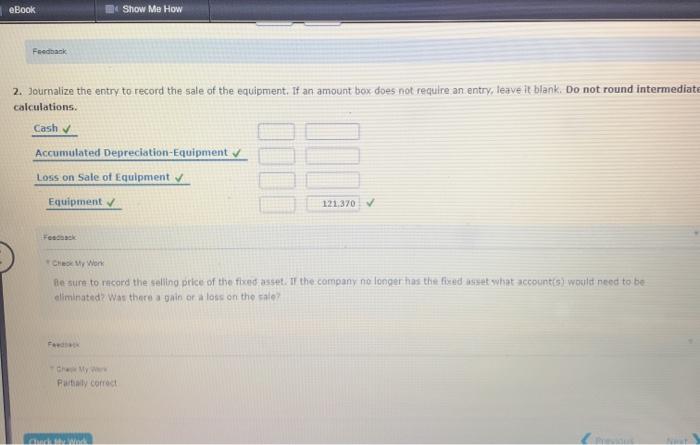

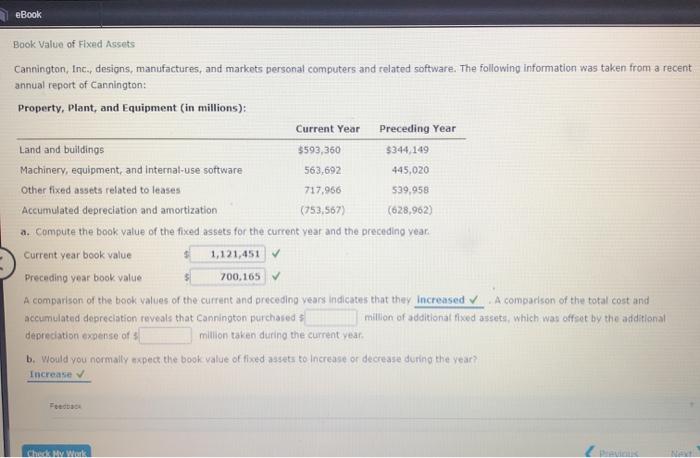

NOWOX Depreciation By Two MetAX agenow.com/ilm/takeAssignment/takeAssignment Main doinvoker-takeAssignmentSession... Not X ebook Show Me How I value Deprecation by Two Methods A computer system acquired on January 1 at a cost of $90,000 has an estimated useful life of ten years. Assuming that it will have ng a. Determine the depreciation for each of the first two years by the straight-line method First Year Second Year 9,000 9,000 e baland b. Determine the depredation for each of the first two years by the double declining balance method. Do not round the double del rate. If required, round your final answers to the nearest dollar. First Year Second Year 10,000 . + o 8 enow.com/ilm/takeAssignment/takeAssignment Main.do?invoker=&take AssignmentSession... 62 OP Nots * Book Show Me How Entries for Sale of Fixed Asset Equipment acquired on January 8 at a cost of $121.370 has an estimated useful life of 12 years, has an estimated residual value of $8,450, and is Depreciated by the straight-line method. a. What was the book value of the equipment at December 31 the end of the fourth year? 83.730 Feedback b. Assume that the equipment was sold on April 1 of the fifth year for $74,557 1. Journalize the entry to record depreciation for the three months until the sate date. If an amount box does not require an entry, leave it blank, Round your answers to the nearest whole dollar if required. Depreciation Expense-Equipment Accumulated Depreciation Equipment Foto 2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry leave it blank. Do not round intermediate calculations Cash Accumulated Depreciation Equipment Check My Work o i a 5 3/3 eBook Show Me How Feedback 2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. Cash Accumulated Depreciation Equipment Loss on Sale of Equipment Equipment 121.370 Focak Cho My Work Be sure to record the selling price of the fixed asset. If the company no longer has the fixed asset what accounts would need to be eliminated? Was there again or loss on the tale Partly correct eBook Book Value of Fixed Assets Cannington, Inc., designs, manufactures, and markets personal computers and related software. The following information was taken from a recent annual report of Cannington: Property, Plant, and Equipment (in millions): Current Year Preceding Year Land and buildings $593,360 $344,149 Machinery, equipment, and internal-use software 563,692 445,020 Other fixed assets related to leases 717,956 539,958 Accumulated depreciation and amortization (753,567) (628,962) a. Compute the book value of the fixed assets for the current year and the preceding vear. Current year book value 1,121,451 Preceding year book value 700,165 A comparison of the book values of the current and preceding years indicates that they increased A comparison of the total cost and accumulated depreciation reveals that Cannington purchased $ million of additional fixed assets, which was offset by the additional depreciation expense of s million taken during the current wear. b. Would you normally expect the book value of fixed assets to Increase or decrease during the vear? Increase NA