Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NPV and IRR Analysis After discovering a new gold vein in the Colorado mountains, CTC Mining Corporation must decide whether to go ahead and develop

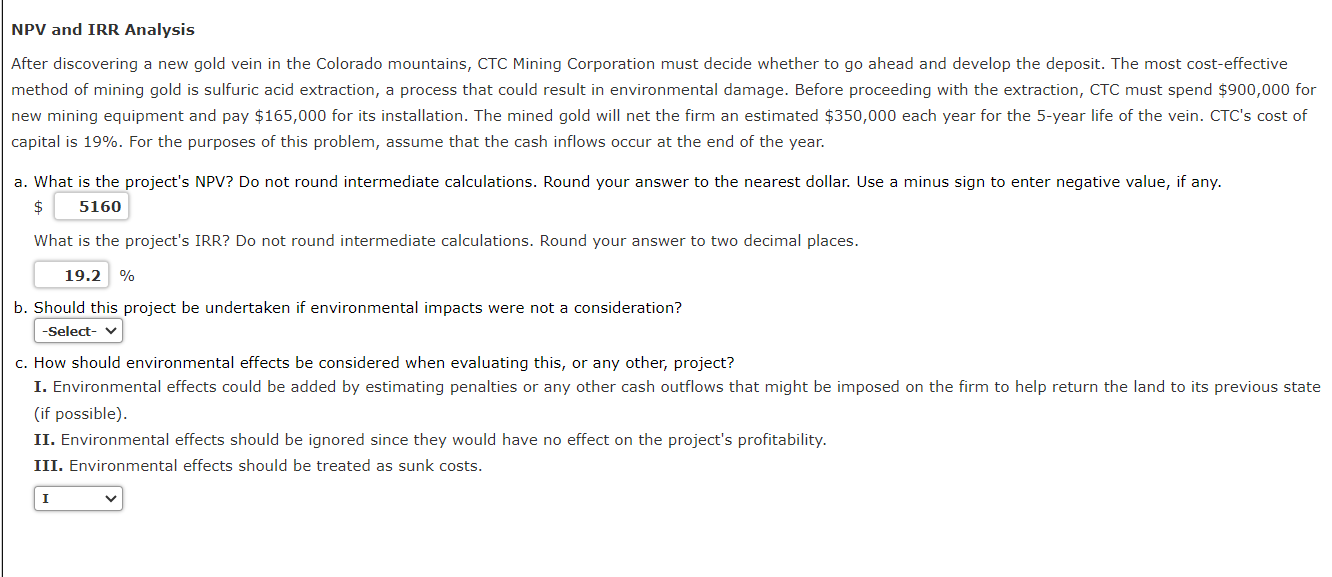

NPV and IRR Analysis After discovering a new gold vein in the Colorado mountains, CTC Mining Corporation must decide whether to go ahead and develop the deposit. The most cost-effective method of mining gold is sulfuric acid extraction, a process that could result in environmental damage. Before proceeding with the extraction, CTC must spend $900,000 for new mining equipment and pay $165,000 for its installation. The mined gold will net the firm an estimated $350,000 each year for the 5-year life of the vein. CTC's cost of capital is 19%. For the purposes of this problem, assume that the cash inflows occur at the end of the year. a. What is the project's NPV? Do not round intermediate calculations. Round your answer to the nearest dollar. Use a minus sign to enter negative value, if any. $ What is the project's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % b. Should this project be undertaken if environmental impacts were not a consideration? c. How should environmental effects be considered when evaluating this, or any other, project? I. Environmental effects could be added by estimating penalties or any other cash outflows that might be imposed on the firm to help return the land to its previous state (if possible). II. Environmental effects should be ignored since they would have no effect on the project's profitability. III. Environmental effects should be treated as sunk costs

NPV and IRR Analysis After discovering a new gold vein in the Colorado mountains, CTC Mining Corporation must decide whether to go ahead and develop the deposit. The most cost-effective method of mining gold is sulfuric acid extraction, a process that could result in environmental damage. Before proceeding with the extraction, CTC must spend $900,000 for new mining equipment and pay $165,000 for its installation. The mined gold will net the firm an estimated $350,000 each year for the 5-year life of the vein. CTC's cost of capital is 19%. For the purposes of this problem, assume that the cash inflows occur at the end of the year. a. What is the project's NPV? Do not round intermediate calculations. Round your answer to the nearest dollar. Use a minus sign to enter negative value, if any. $ What is the project's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % b. Should this project be undertaken if environmental impacts were not a consideration? c. How should environmental effects be considered when evaluating this, or any other, project? I. Environmental effects could be added by estimating penalties or any other cash outflows that might be imposed on the firm to help return the land to its previous state (if possible). II. Environmental effects should be ignored since they would have no effect on the project's profitability. III. Environmental effects should be treated as sunk costs Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started