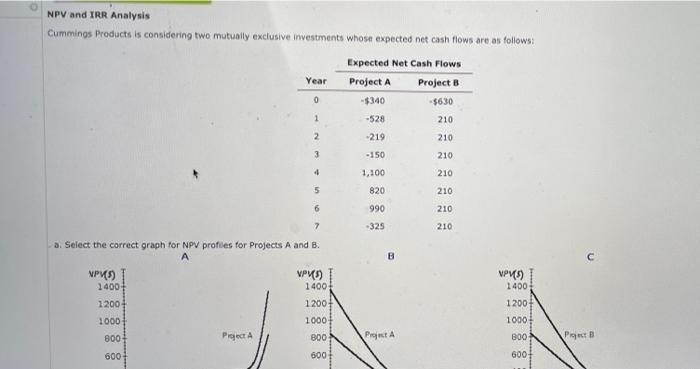

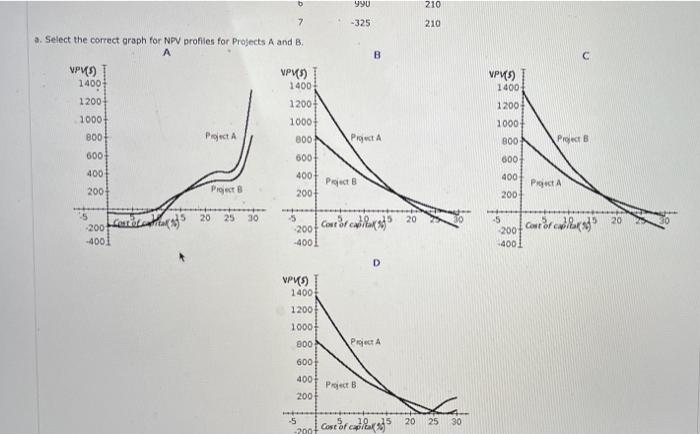

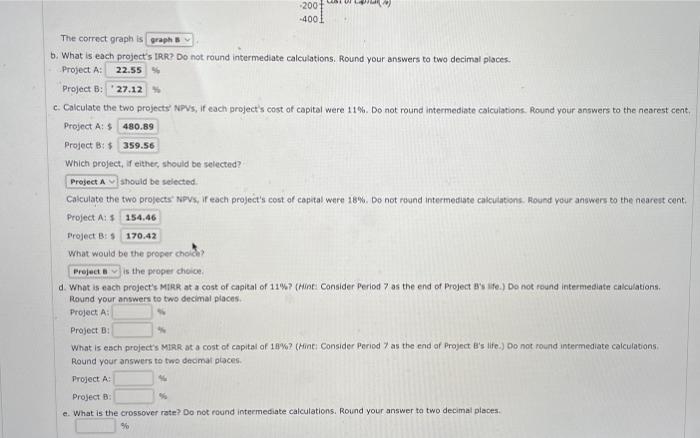

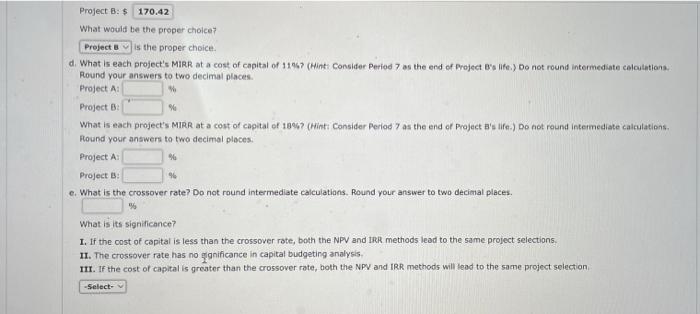

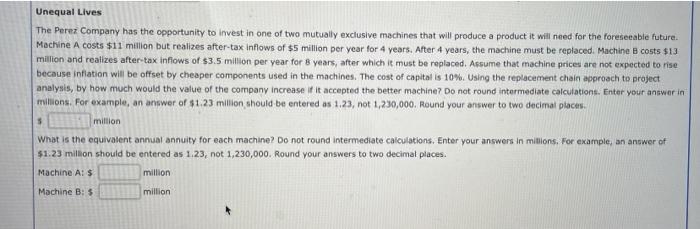

NPV and IRR Analysis Cummings Products is considering two mutually exclusive investments whose expected net cash flows are as follows: Year Expected Net Cash Flows Project A Project B -$340 -5630 -528 210 0 1 2 -219 210 3 -150 210 4 210 1,100 820 5 210 6 990 210 210 7 -325 B a. Select the correct graph for NPV profiles for Projects A and B. A VPVC5) VPVC5) 1400 1400 1200 12001 VPMO) 1400 1200 1000 1000 800 600 1000 B00 Piget A PORTA B00 Pot 600+ 600 b 990 210 7 -325 210 B VPMS a. Select the correct graph for NPV profiles for Projects A and B A NPV) VPMS) 14001 1400 1200 1200 1000 1000 800 Polecta 800 1400 1 200 1000+ Proact 800 Project 600 000 400 600+ 400 2007 4001 Project Prot 200 Project B 200 25 30 200 ferebatara 20 -5 2001 -4001 Cortar cabloxado contar ca 20 -4001 2007 -4001 D VPMS) 14001 1200 1000 000 Per A 600 4007 2001 Project B -5 -2007 contar com ara 20 25 30 -2001 -4001 The correct graph is graphs b. What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A: 22.555 Project B: 27.12 % c. Calculate the two projects News, If each project's cost of capital were 11%. Do not round intermediate calculations. Round your answers to the nearest cent, Project A: $ 480.89 Project B: $ 359.56 Which project, if either, should be selected? Project should be selected. Calculate the two projects NPVS, I each project's cost of capital were 18%. Do not round intermediate calutations. Round your answers to the nearest cent Project Ais 154.46 Project B: 170.42 What would be the proper cold Project is the proper choice d what is each project's MIRR at a cost of capital of 116.7. Consider Period 7 as the end of Project este.) Do not found intermediate calculations Round your answers to two decimal places Project A Project : what is each project's MIRR at a cost of capital of 10%? (Honti Consider Period as the end of Project B's life.) Do not round intermediate calculations Round your answers to two decimal places Project A: Project : e. What is the crossover rate? Do not round intermediate calculations. Round your answer to two decimal places Project B: $ 170.42 What would be the proper choice? Project is the proper choice d. What is each project's MIRR at a cost of capital of 1147 (Hint: Consider Period 7 as the end of Projecte) Do not round Intermediate calculations Round your answers to two decimal places Project A: Project B What is each project's MIRR at a cost of capital of 1897 (Hint: Consider Perlod 7 as the end of Project's le) Do not round Intermediate calculations Round your answers to two decimal places. Project A Project : 96 e. What is the crossover rate? Do not round intermediate calculations. Round your answer to two decimal places. What is its significance? 1. If the cost of capital is less than the crossover rate, both the NPV and IRR methods lead to the same project selections, II. The crossover rate has no significance in capital budgeting analysis III. If the cost of capital is greater than the crossover rate, both the NPV and IRR methods will lead to the same project selection -Select- Unequal Lives The Perez Company has the opportunity to invest in one of two mutually exclusive machines that will produce a product it will need for the foreseeable future. Machine A costs $11 million but realizes after-tax inflows of $5 million per year for 4 years. After 4 years, the machine must be replaced. Machine B costs $13 million and realizes after tax inflows of $3.5 million per year for 8 years, after which it must be replaced. Assume that machine prices are not expected to rise because inflation will be offset by cheaper components used in the machines. The cost of capital is 10%. Using the replacement chain approach to project analysis, by how much would the value of the company increase if it accepted the better machine? Do not round intermediate calculations. Enter your answer in millons. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answer to two decimal places. million What is the equivalent annual annuity for each machine? Do not round intermediate calculations. Enter your answers in millions. For example, an answer of $1.23 milion should be entered as 1.23, not 1,230,000. Round your answers to two decimal places. Machine A: $ million Machine B: $ million 5