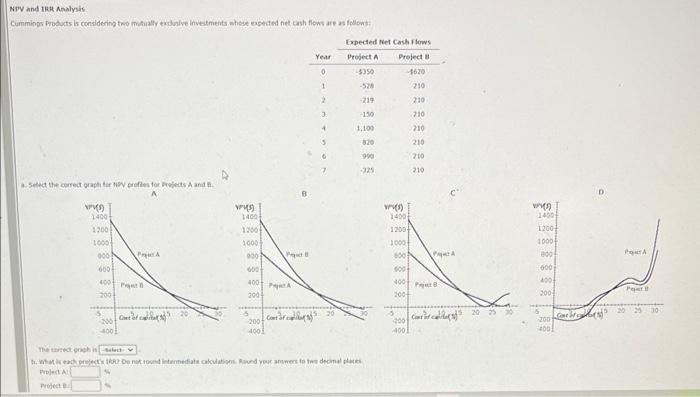

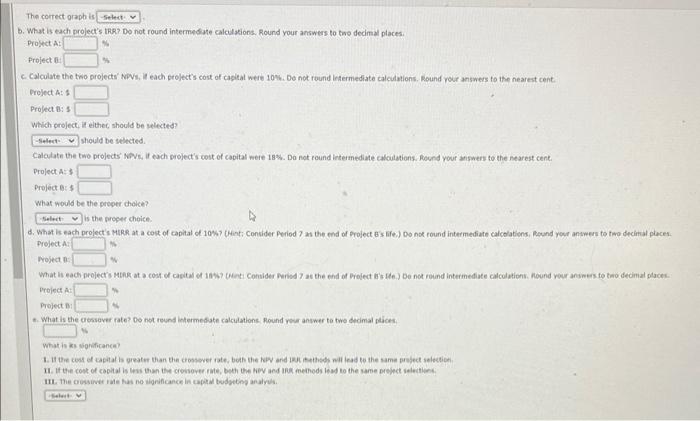

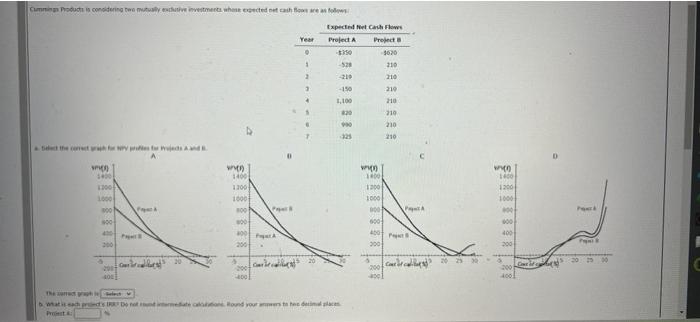

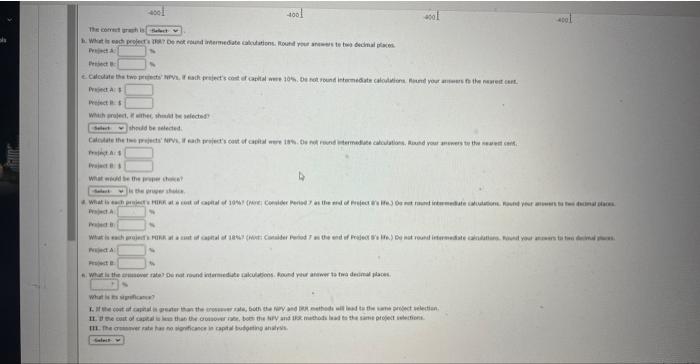

NPV and IRR Analysis Cummings Products is considering two mutually exclusive investments whose expected net cash flows are as follows: a. Select the correct graph for NPV profiles for Projects A and B VV(1) 1400 1200 1000 000 600 400 P 200 200 4001 yorky Contac | Gha 1400 1200 1000 900 600 400 200 200 400 Paquet yok Conta Year 0 1 2 C 4 S 9 Expected Net Cash Flows Project A Project B -$620 210 210 210 210 210 210 $350 -528 -219 -150 1,100 820 990 -325 The torrect graph is select What is each project's RR2 Do not round intermediate calculations. Round your answers to two decimal places Project Al Project B (s) 1400 1200 1000 800 600 400 200 200 400 012 Paper & Project B 20 (han 1400 1200 1000 800 600 400 200 -200 400 Come PA Pe The correct graph is select b. What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A Project B c. Calculate the two projects' NPVS, if each project's cost of capital were 10%. Do not round Intermediate calculations. Round your answers to the nearest cent. Project A: S Project : which project, if either should be selected? Select should be selected. Calculate the two projects' NPVS, if each project's cost of capital were 18%. Do not round intermediate calculations. Round your answers to the nearest cent. Project A: $ Project B: $ What would be the proper choice? -Select is the proper choice. d. What is each project's MIRR at a cost of capital of 10%? (Hint: Consider Period 7 as the end of Project 8's life.) Do not round intermediate calcolations, Round your answers to two decimal places. Project A Project B What is each project's MIRR at a cost of capital of 1897 (Hint: Consider Period 7 as the end of Project is de.) Do not round intermediate calculations. Round your answers to two decimal places. Project A Project B e. What is the crossover rate? Do not round intermediate calculations. Round your answer to two decimal places What is its significance) 1. If the cost of capital is greater than the crossover rate, both the NPV and IRUL methods will lead to the same project selection. II. If the cost of capital is less than the crossover rate, both the NPV and IRR methods lead to the same project selections III. The crossover rate has no significance in capital budgeting analysis. Select Cummings Products is considering two mutually exclusive investments whose expected net cash flows are as follows sp 1400 1300 1000 800 900 200 Pr C 200 -4001 Frag Wha 1400 1200 1000 800 OOK voor 200 Papak 200 [combli Year 1 2 2 4 V B Expected Net Cash Flows Project A -$350 -528 219 -150 1,100 820 9:00 325 The caract graph what is each projects IRR Do not und intermediate calaton Round your answers to he decimal places Project & Project 8 $620 210 210 219 210 210 210 210 Wha 1400 1200 1000 000 600 400 300 200 4001 PA Uha 1400 1200 1000 400 600 400 200 400 F 20 25 00 400 The correct graph is 3. What is each project's R? Do not round intermediate calculations. Round your answers to two decimal places Project Project B Calculate the two projects NPVS, each project's cost of capital were 10%. De not round intermediate calculations Round your answers to the nearest cart Project A Project S which project, it wither, should be selected should be selected. Calculate the two projects PVs I each project's cost of capital were 18%. De not round intermediate calculations, Round your answers to the neare cent A Project What would be the proper choice? is the proper shoke What is each projects PIR at a cost of capital of 10%7 (Consider Period 7 as the end of Prefect as ife) Projec Pred B What is aches PORK at a cut of capital of 18% (Conaider Period 7 as the end of Project 8's e) De not round intermediate calculations. Round your an Project What is the cover rate? De not round intermediate calculations. Round your answer to two decimal places. intermediate calculations. Round your answers to decimal places What is its spricana? 1. If the cost of capital is greater than the crossever sale, both the Ny and DRR methods will lead to the same project selection. methods lead to the same project selections 11. the cost of capital is less than the crossover rate, both the NPV and 1 III. The cover rate has no significance in capital budgeting analysis. Select