Answered step by step

Verified Expert Solution

Question

1 Approved Answer

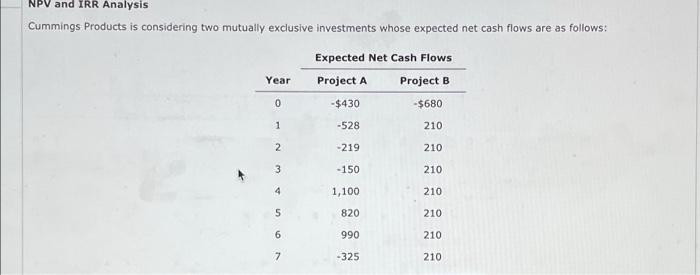

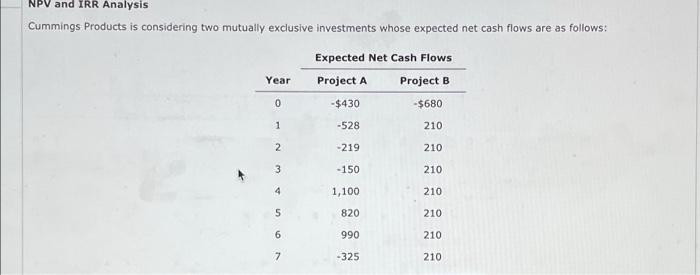

NPV and IRR analysis NPV and IRR Analysis Cummings Products is considering two mutually exclusive investments whose expected net cash flows are as follows: Year

NPV and IRR analysis

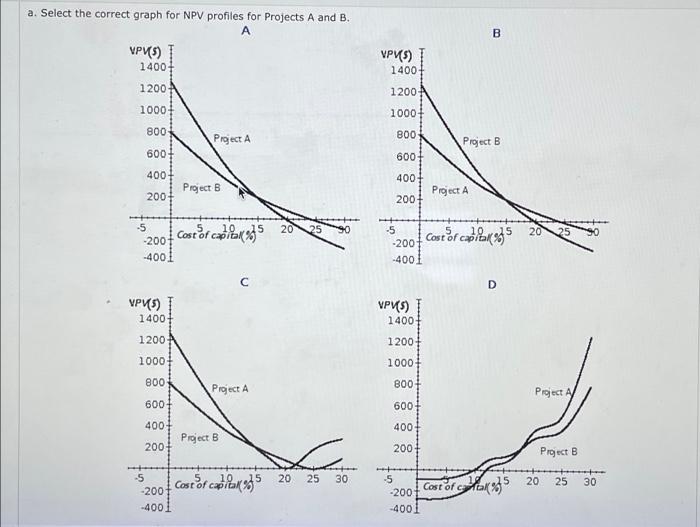

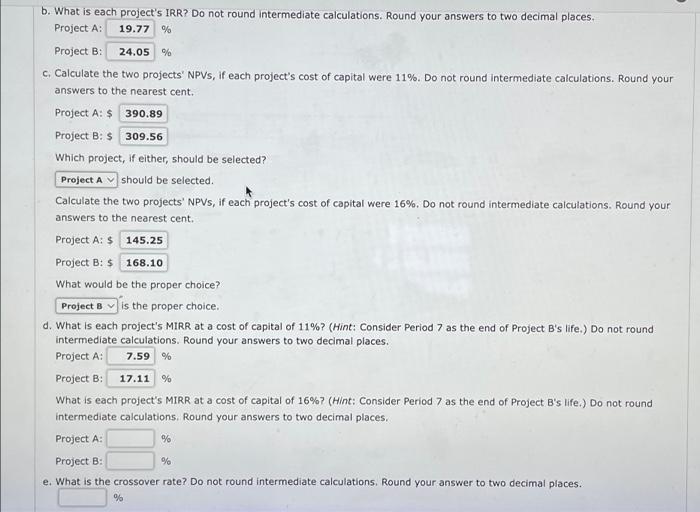

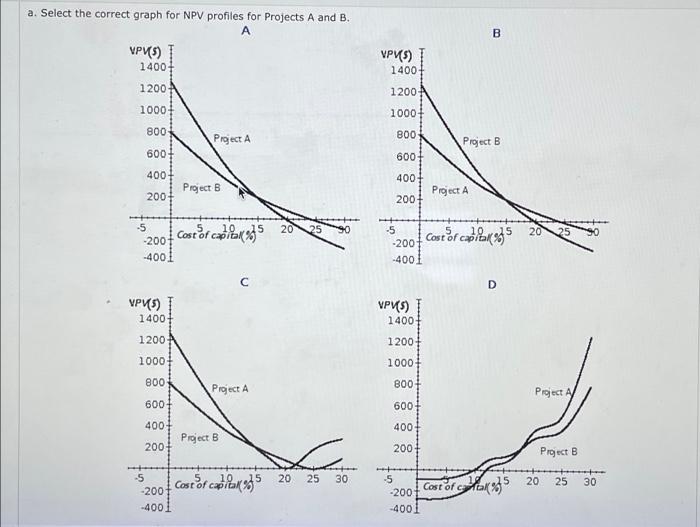

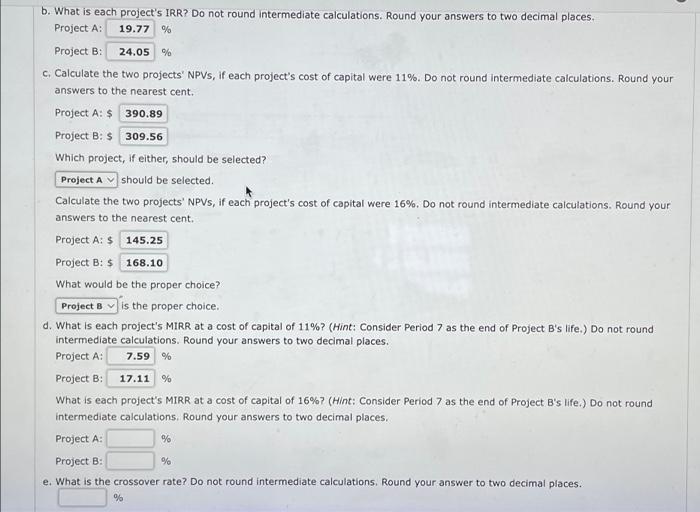

NPV and IRR Analysis Cummings Products is considering two mutually exclusive investments whose expected net cash flows are as follows: Year Expected Net Cash Flows Project A Project B -$430 -$680 0 1 -528 210 2 -219 210 3 - 150 210 4 1,100 210 5 820 210 6 990 210 7 -325 210 B a. Select the correct graph for NPV profiles for Projects A and B. VPMS) 1400 1200 VPVS) 1 1400 12001 1000 1000 800 B00 Project A Project B 600 600 400 400 Project B 200 Project A 200 cost of capitanos 20 25 -5 -200 -4001 25 -5 -200 -400 cost of colors D VPV (5) 1400 VPVS) 1400 1200 1200 1000 1000 800 800 Project A Project A/ 600 600 400 400 Project B 200 200 Project B 10 15 25 30 Cost or capilaret 20 25 25 -5 -200 -400 30 -5 -200 -4001 Cost of care5 20 b. What is each project's IRR? Do not round Intermediate calculations. Round your answers to two decimal places. Project A: 19.77 % Project B: 24.05 % c. Calculate the two projects' NPVS, if each project's cost of capital were 11%. Do not round Intermediate calculations. Round your answers to the nearest cent. Project A: $ 390.89 Project B: $ 309.56 Which project, if either, should be selected? Project A should be selected. Calculate the two projects' NPVs, if each project's cost of capital were 16%. Do not round intermediate calculations. Round your answers to the nearest cent. Project A: $ 145.25 Project B: $ 168.10 What would be the proper choice? Project BV is the proper choice. d. What is each project's MIRR at a cost of capital of 11%? (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations. Round your answers to two decimal places. Project A: 7.59 % Project B: 17.11% What is each project's MIRR at a cost of capital of 16%? (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations. Round your answers to two decimal places. Project A: % Project B: % e. What is the crossover rate? Do not round intermediate calculations. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started