Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NPV and IRR The first two scenarios are independent. All cash flows are after-tax cash flows. The present value tables provided in Exhibit 19B.1 and

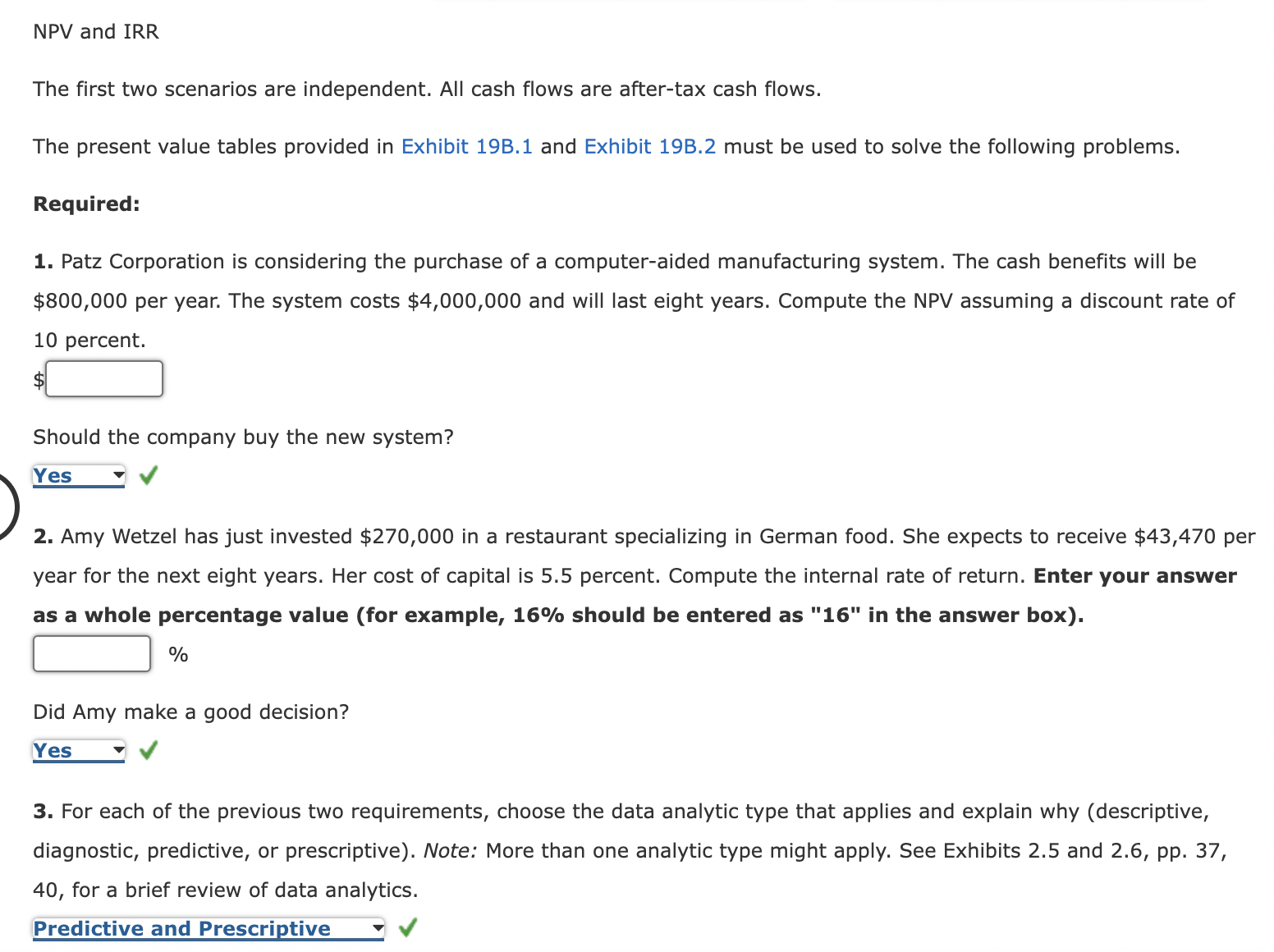

NPV and IRR The first two scenarios are independent. All cash flows are after-tax cash flows. The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems. Required: 1. Patz Corporation is considering the purchase of a computer-aided manufacturing system. The cash benefits will be $800,000 per year. The system costs $4,000,000 and will last eight years. Compute the NPV assuming a discount rate of 10 percent. $ Should the company buy the new system? 2. Amy Wetzel has just invested $270,000 in a restaurant specializing in German food. She expects to receive $43,470 per year for the next eight years. Her cost of capital is 5.5 percent. Compute the internal rate of return. Enter your answer as a whole percentage value (for example, 16% should be entered as "16" in the answer box). % Did Amy make a good decision? 3. For each of the previous two requirements, choose the data analytic type that applies and explain why (descriptive, diagnostic, predictive, or prescriptive). Note: More than one analytic type might apply. See Exhibits 2.5 and 2.6, pp. 37, 40 , for a brief review of data analytics

NPV and IRR The first two scenarios are independent. All cash flows are after-tax cash flows. The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems. Required: 1. Patz Corporation is considering the purchase of a computer-aided manufacturing system. The cash benefits will be $800,000 per year. The system costs $4,000,000 and will last eight years. Compute the NPV assuming a discount rate of 10 percent. $ Should the company buy the new system? 2. Amy Wetzel has just invested $270,000 in a restaurant specializing in German food. She expects to receive $43,470 per year for the next eight years. Her cost of capital is 5.5 percent. Compute the internal rate of return. Enter your answer as a whole percentage value (for example, 16% should be entered as "16" in the answer box). % Did Amy make a good decision? 3. For each of the previous two requirements, choose the data analytic type that applies and explain why (descriptive, diagnostic, predictive, or prescriptive). Note: More than one analytic type might apply. See Exhibits 2.5 and 2.6, pp. 37, 40 , for a brief review of data analytics Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started