Answered step by step

Verified Expert Solution

Question

1 Approved Answer

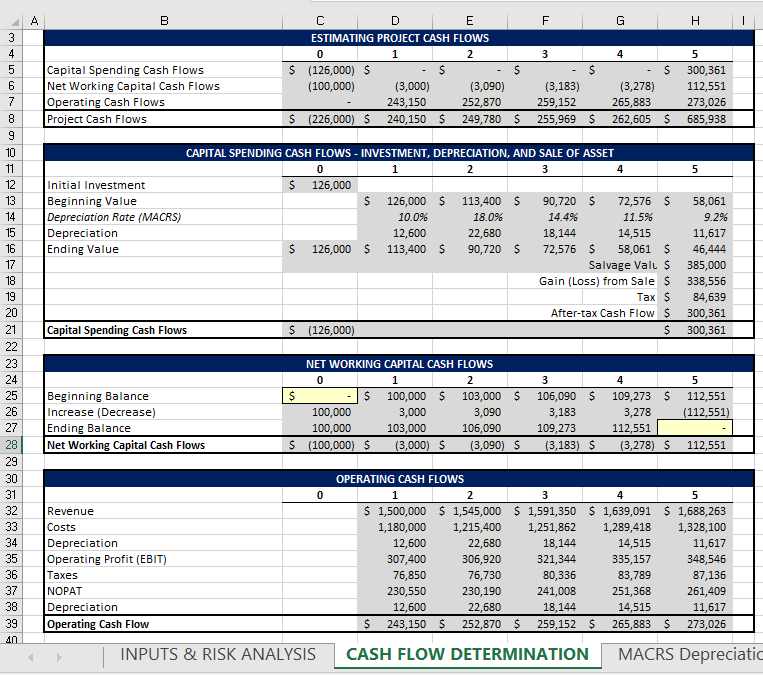

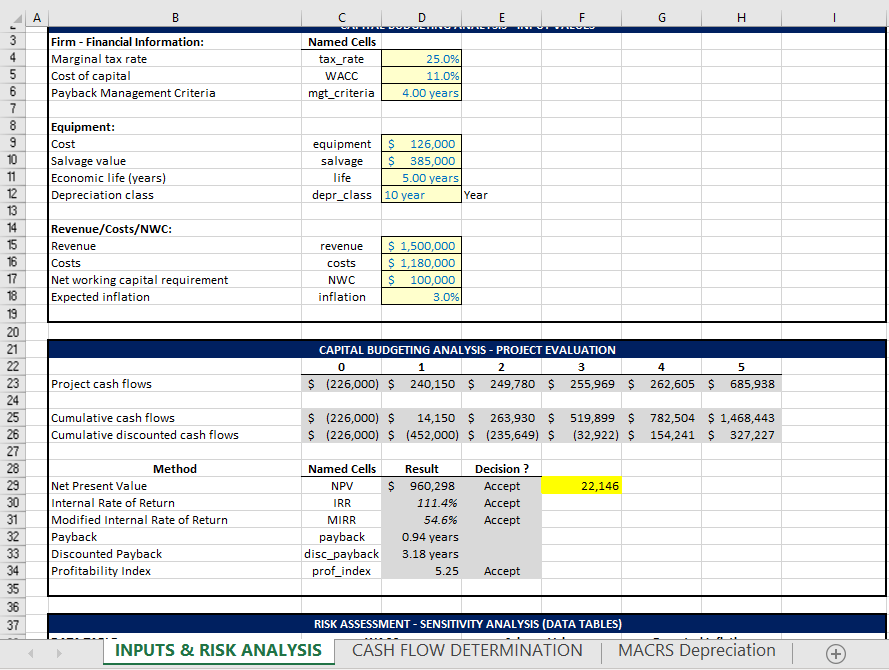

NPV is supposed to be 22,146 can you explain ? 356~0002 2 4 7 8 9 10 11 12 13 14 15 16 17 18

NPV is supposed to be 22,146 can you explain ?

356~0002 2 4 7 8 9 10 11 12 13 14 15 16 17 18 19 20 5222222222XXNXNNNNNN 21 23 24 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 A Capital Spending Cash Flows Net Working Capital Cash Flows Initial Investment Beginning Value m Operating Cash Flows Project Cash Flows Depreciation Rate (MACRS) Depreciation Ending Value Revenue Costs Capital Spending Cash Flows Beginning Balance Increase (Decrease) Ending Balance Net Working Capital Cash Flows Depreciation Operating Cash Flow Depreciation Operating Profit (EBIT) Taxes NOPAT D E ESTIMATING PROJECT CASH FLOWS 1 2 C 0 $ (126,000) $ (100,000) $ $ 126,000 $ $ (126,000) CAPITAL SPENDING CASH FLOWS - INVESTMENT, DEPRECIATION, AND SALE OF ASSET 0 1 2 3 $ 126,000 $ (3,090) (3,183) (3,278) 252,870 259,152 265,883 $ (226,000) $ 240,150 $ 249,780 $ 255,969 $ 262,605 0 100,000 100,000 $ (100,000) $ INPUTS & RISK ANALYSIS $ (3,000) 243,150 NET WORKING CAPITAL CASH FLOWS 0 2 $ $ 126,000 $ 113,400 $ 10.0% 18.0% 22,680 113,400 $ 90,720 $ 12,600 1 100,000 $ 3,000 103,000 (3,000) $ 103,000 3,090 106,090 F $ 3 (3,090) $ $ G 90,720 $ 14.4% 4 4 3,183 109,273 (3,183) $ $ 72,576 $ 11.5% 14,515 18,144 72,576 $ 58,061 $ Salvage Valu $ Gain (Loss) from Sale $ Tax $ $ After-tax Cash Flow $ $ 3 4 106,090 $ 109,273 $ 3,278 112,551 (3,278) $ H 5 300,361 112,551 273,026 685,938 5 58,061 9.2% 11,617 46,444 385,000 338,556 84,639 300,361 300,361 5 112,551 (112,551) 112,551 OPERATING CASH FLOWS 1 2 3 4 5 $ 1,500,000 $ 1,545,000 $1,591,350 $ 1,639,091 $1,688,263 1,215,400 1,251,862 1,289,418 1,328,100 1,180,000 12,600 22,680 18,144 14,515 11,617 307,400 306,920 321,344 335,157 348,546 76,850 76,730 80,336 83,789 87,136 230,550 230,190 241,008 251,368 261,409 12,600 22,680 18,144 14,515 11,617 $ 243,150 $ 252,870 $ 259,152 $ 265,883 $ 273,026 CASH FLOW DETERMINATION MACRS Depreciatic

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started