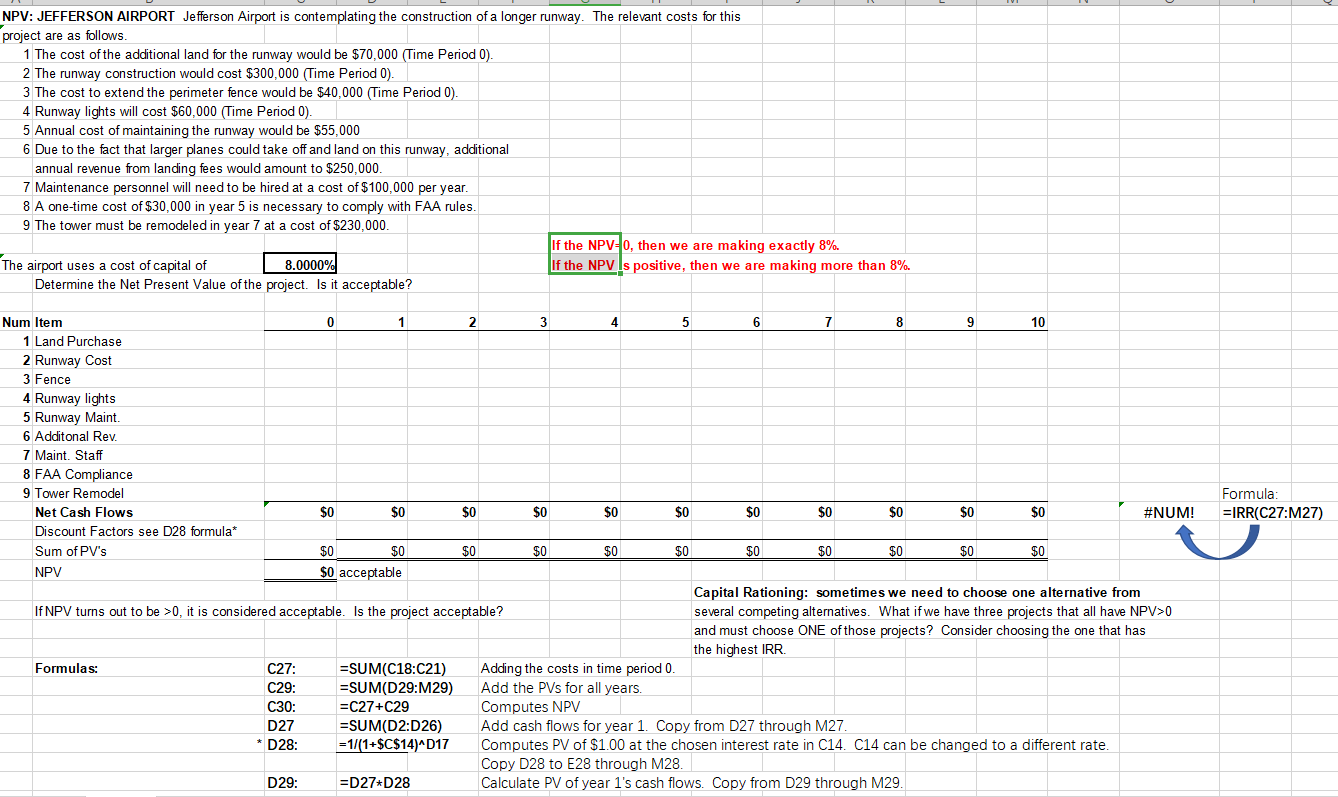

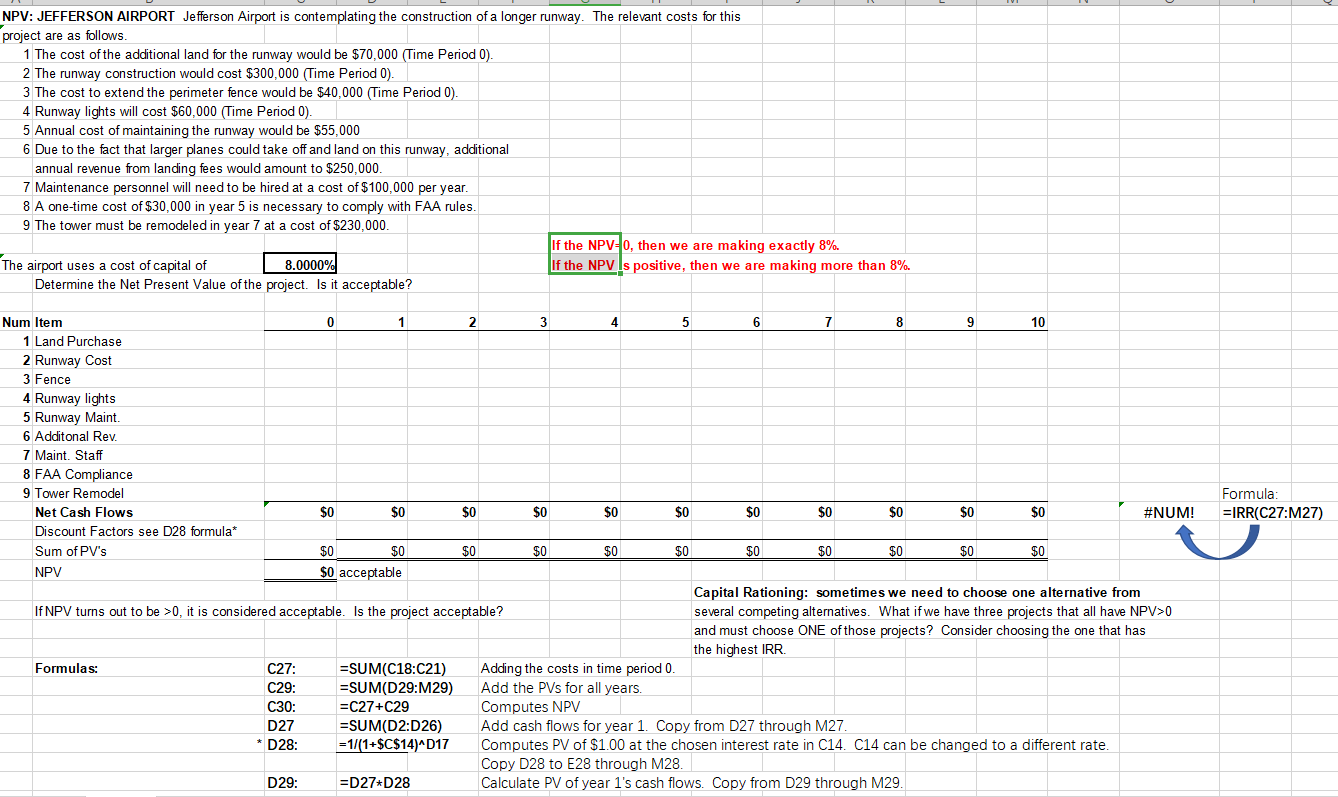

NPV: JEFFERSON AIRPORT Jefferson Airport is contemplating the construction of a longer runway. The relevant costs for this project are as follows. 1 The cost of the additional land for the runway would be $70,000 (Time Period 0). 2 The runway construction would cost $300,000 (Time Period 0). 3 The cost to extend the perimeter fence would be $40,000 (Time Period 0). 4 Runway lights will cost $60,000 (Time Period 0). 5 Annual cost of maintaining the runway would be $55,000 6 Due to the fact that larger planes could take off and land on this runway, additional annual revenue from landing fees would amount to $250,000. 7 Maintenance personnel will need to be hired at a cost of $100,000 per year. 8 A one-time cost of $30,000 in year 5 is necessary to comply with FAA rules. 9 The tower must be remodeled in year 7 at a cost of $230,000. If the NPV-0, then we are making exactly 8%. The airport uses a cost of capital of 8.0000% If the NPV Is positive, then we are making more than 8%. Determine the Net Present Value of the project. Is it acceptable? Formula: =IRR(C27:M27) Num Item 0 1 2 3 4 5 6 7 8 9 10 1 Land Purchase 2 Runway Cost 3 Fence 4 Runway lights 5 Runway Maint. 6 Additonal Rev. 7 Maint. Staff 8 FAA Compliance 9 Tower Remodel Net Cash Flows $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 #NUM! Discount Factors see D28 formula Sum of PV's $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 NPV $0 acceptable Capital Rationing: sometimes we need to choose one alternative from If NPV turns out to be >0, it is considered acceptable. Is the project acceptable? several competing alternatives. What if we have three projects that all have NPV>0 and must choose ONE of those projects? Consider choosing the one that has the highest IRR. Formulas: C27: =SUM(C18:C21) Adding the costs in time period 0. C29: =SUM(D29:M29) Add the PVs for all years. C30: =C27+C29 Computes NPV D27 =SUM(D2:D26) Add cash flows for year 1. Copy from D27 through M27. * D28: = 1/(1+$C$14)^D17 Computes PV of $1.00 at the chosen interest rate in C14. C14 can be changed to a different rate. Copy D28 to E28 through M28. D29: =D27 D28 Calculate PV of year 1's cash flows. Copy from D29 through M29