Answered step by step

Verified Expert Solution

Question

1 Approved Answer

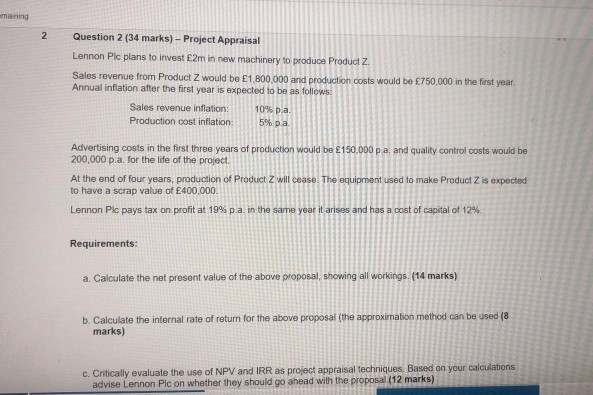

NPV table NPV table Annuity table Annuity table emaining 2 Question 2 (34 marks) - Project Appraisal Lennon Pic plans to invest 2m in new

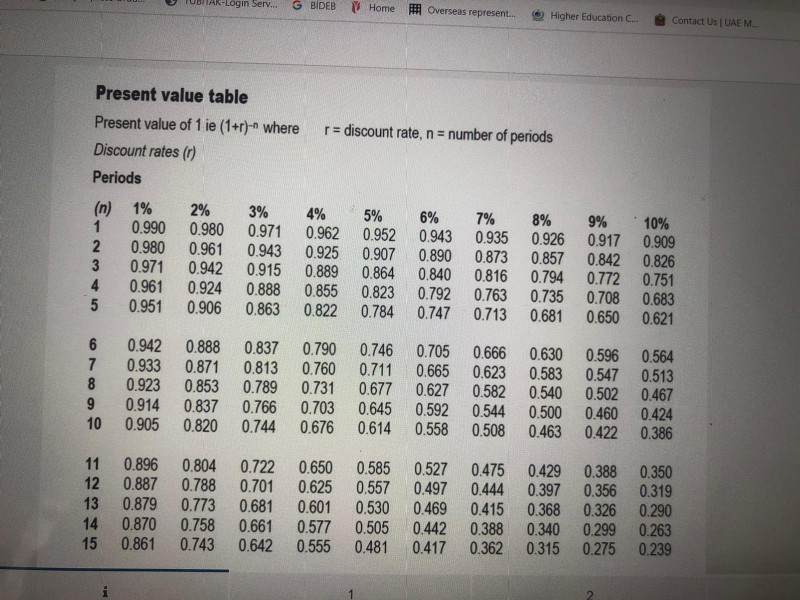

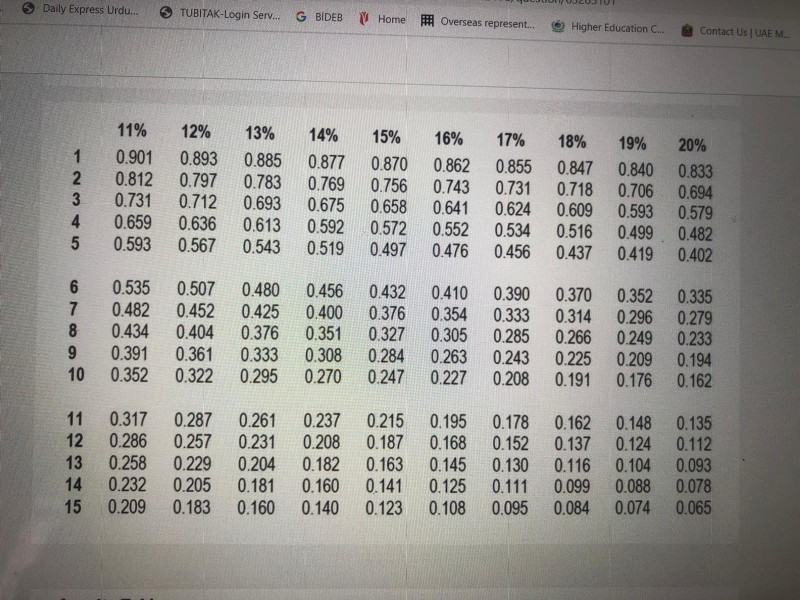

NPV table

NPV table

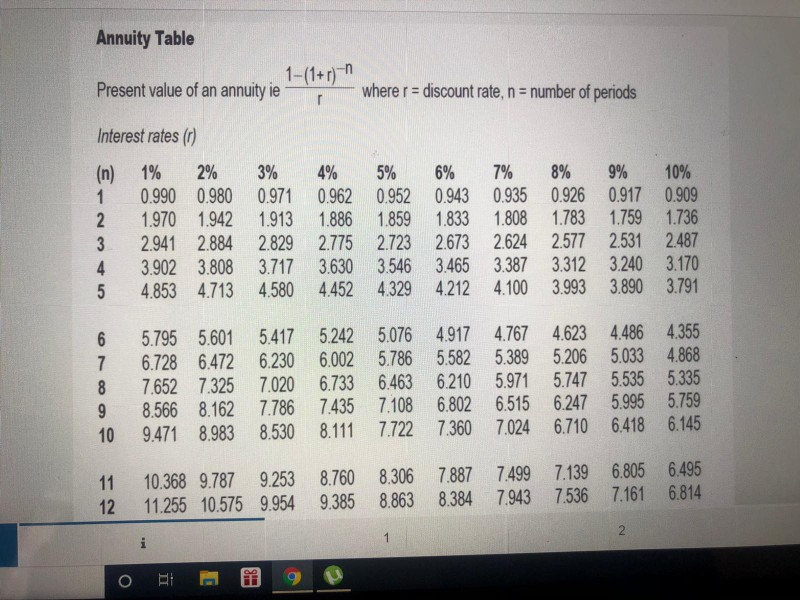

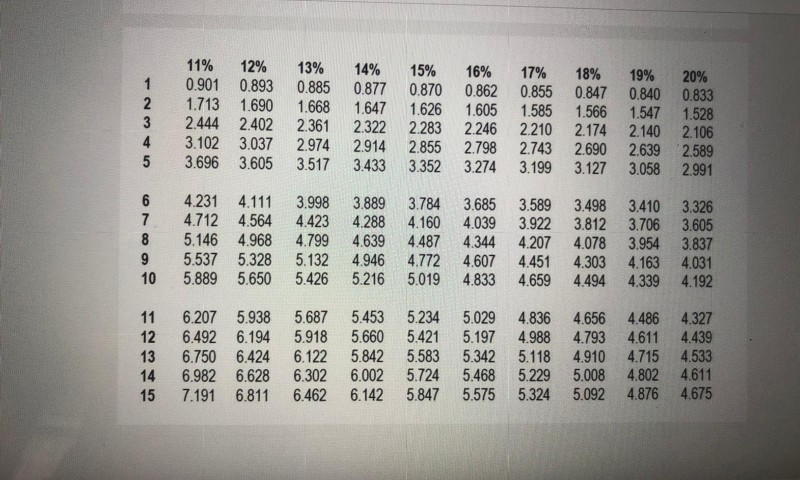

Annuity table

Annuity table

emaining 2 Question 2 (34 marks) - Project Appraisal Lennon Pic plans to invest 2m in new machinery to produce Product Z. Sales revenue from Product Z would be 1,800,000 and production costs would be 750,000 in the first year. Annual inflation after the first year is expected to be as follows: Sales revenue inflation: 10% pa Production cost inflation 5% pa Advertising costs in the first three years of production would be 150,000 pa and quality control costs would be 200,000 p.a. for the life of the project. At the end of four years, production of Product Z will cease. The equipment used to make Product Z is expected to have a scrap value of 400,000. Lennon Plc pays tax on profit at 19% p.a. in the same year it arises and has a cost of capital of 12% Requirements: a. Calculate the net prosent value of the above proposal, showing all workings. (14 marks) b. Calculate the internal rate of return for the above proposal (the approximation method can be used (8 marks) C. Critically evaluate the use of NPV and IRR as project appraisal techniques. Based on your calculations advise Lennon Plc on whether they should go ahead with the proposal (12 marks) AR-Login Serv... G BIDEB Home #Overseas represent... Higher Education C... Contact Us UAEM Present value table Present value of 1 ie (1+r)- where Discount rates (0) Periods r = discount rate, n = number of periods (n) 1% 2% 1 0.990 0.980 0.980 0.961 3 0.971 0.942 4 0.961 0.924 5 0.951 0.906 3% 4% 5% 6% 0.971 0.962 0.952 0.943 0.943 0.925 0.907 0.890 0.915 0.889 0.864 0.840 0.888 0.855 0.823 0.792 0.863 0.822 0.784 0.747 7% 8% 9% 10% 0.935 0.926 0.917 0.909 0.873 0.857 0.842 0.826 0.816 0.794 0.772 0.751 0.763 0.735 0.708 0.683 0.713 0.681 0.650 0.621 6 7 8 9 10 0.942 0.888 0.837 0.933 0.871 0.813 0.923 0.853 0.789 0.914 0.837 0.766 0.905 0.820 0.744 0.790 0.746 0.705 0.760 0.711 0.665 0.731 0.677 0.627 0.703 0.645 0.592 0.676 0.614 0.558 0.666 0.630 0.596 0.623 0.583 0.547 0.582 0.540 0.502 0.544 0.500 0.460 0.508 0.463 0.422 0.564 0.513 0.467 0.424 0.386 11 12 13 14 15 0.896 0.804 0.887 0.788 0.879 0.773 0.870 0.758 0.861 0.743 0.722 0.650 0.701 0.625 0.681 0.601 0.661 0.577 0.642 0.555 0.585 0.557 0.530 0.505 0.481 0.527 0.475 0.429 0.497 0.444 0.397 0.469 0.415 0.368 0.442 0.388 0.340 0.417 0.362 0.315 0.388 0.356 0.326 0.299 0.275 0.350 0.319 0.290 0.263 0.239 Daily Express Urdu... TUBITAK-Login Serv. G BIDEB Home Overseas represent. Higher Education C... Contact Us UAEM 1 2 3 4 5 11% 12% 13% 0.901 0.893 0.885 0.812 0.797 0.783 0.731 0.712 0.693 0.659 0.636 0.613 0.593 0.567 0.543 14% 0.877 0.769 0.675 0.592 0.519 15% 16% 17% 18% 19% 20% 0.870 0.862 0.855 0.847 0.840 0.833 0.756 0.743 0.731 0.718 0.706 0.694 0.658 0.641 0.624 0.609 0.593 0.579 0.572 0.552 0.534 0.516 0.499 0.482 0.497 0.476 0.456 0.437 0.419 0.402 6 7 8 9 10 0.535 0.482 0.434 0.391 0.352 0.507 0.480 0.452 0.425 0.404 0.376 0.361 0.333 0.322 0.295 0.456 0.400 0.351 0.308 0.270 0.432 0.376 0.327 0.284 0.247 0.410 0.354 0.305 0.263 0.227 0.390 0.370 0.333 0.314 0.285 0.266 0.243 0.225 0.208 0.191 0.352 0.335 0.296 0.279 0.249 0.233 0.209 0.194 0.176 0.162 11 0.317 0.287 12 0.286 0.257 13 0.258 0.229 0.232 0.205 15 0.209 0.183 0.261 0.231 0.204 0.181 0.160 0.237 0.208 0.182 0.160 0.140 0.215 0.187 0.163 0.141 0.123 0.195 0.168 0.145 0.125 0.108 0.178 0.162 0.148 0.135 0.152 0.137 0.124 0.112 0.130 0.116 0.104 0.093 0.111 0.099 0.088 0.078 0.095 0.084 0.074 0.065 14 Annuity Table 1-(1+r)" Present value of an annuity ie n where r = discount rate, n = number of periods Interest rates (0) 4% (n) 1% 2% 3% 5% 6% 7% 8% 9% 10% 1 0.990 0.980 0.971 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 5 4.853 4.713 4.580 4.452 4.329 4.212 4.212 4.100 3.993 3.890 3.791 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 11 12 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 2 i b 1 2 3 4 5 11% 12% 0.901 0.893 1713 1.690 2444 2402 3.102 3.037 3696 3.605 13% 0.885 1.668 2.361 2974 3517 14% 0877 1647 2.322 2914 3.433 15% 0870 1626 2.283 2.855 3.352 16% 0.862 1.605 2.246 2798 3.274 17% 0.855 1.585 2210 2743 13.199 18% 19% 20% 0.847 0840 0.833 1.566 1.547 1.528 2.174 2140 2.106 2.690 2.639 2.589 3.127 3.058 2991 6 7 8 9 10 4.231 4.111 4.712 4.564 5.146 4.968 5.537 5.328 5.889 5.650 3.998 4.423 4.799 5.132 5426 3889 4288 4.639 4.946 5.216 13.784 4.160 4.487 4.772 5.019 3.685 4.039 4.344 4.607 4.833 3.589 13.922 4.207 4.451 4.659 3.498 3.812 4.078 4.303 4.494 3410 3.326 3706 3.605 3.954 3.837 4.163 4.031 4.339 4.192 1 12 13 14 15 6.207 5.938 6.492 6194 6.750 6.424 6.982 6.628 7.191 6811 5.687 5.453 5.234 5.029 5.918 5660 5.421 5.197 6.122 5.842 5.583 5.342 6.302 6.002 5.7245.468 6.462 6.142 5.847 5.575 4.836 4.988 5.118 5.229 5.324 4.656 4.793 4.910 5.008 5.092 4.486 4.611 4.715 4.802 4.876 4.327 4.439 4.533 4.611 4.675

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started