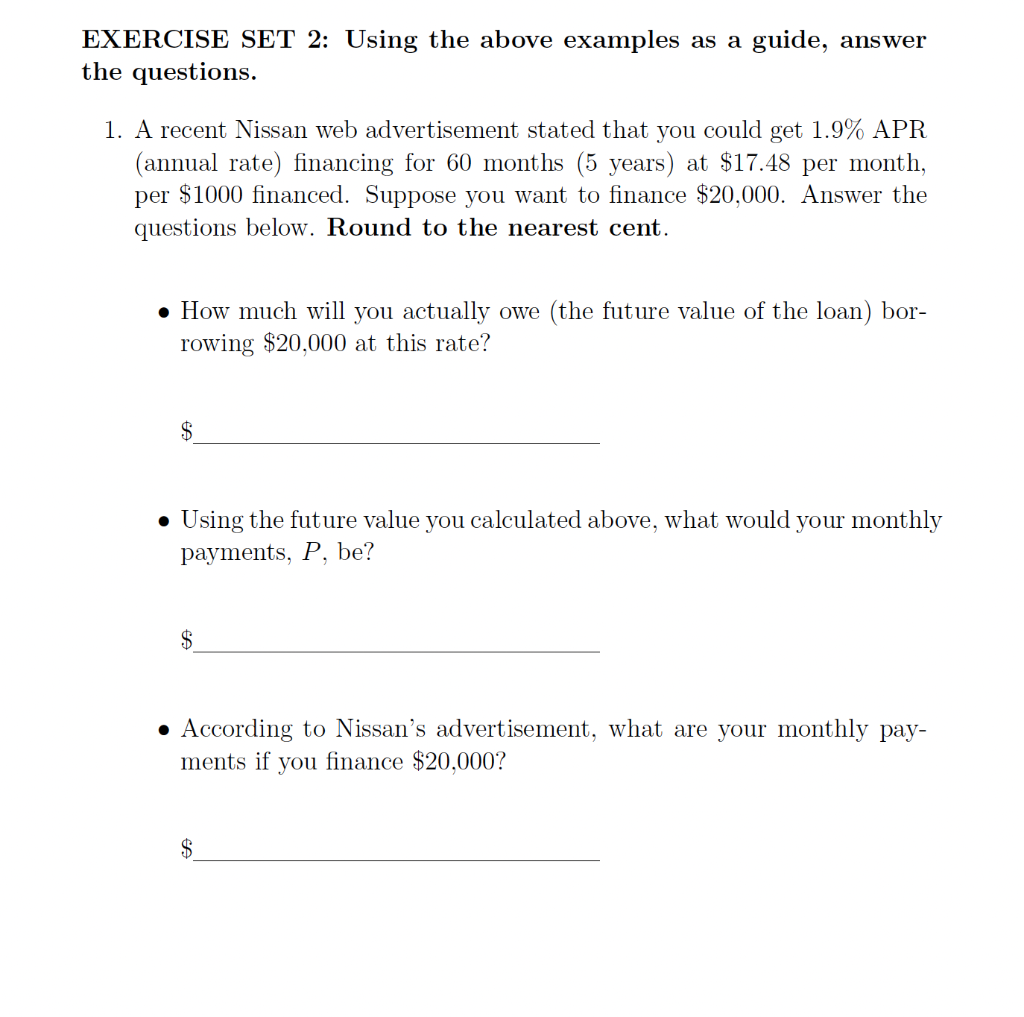

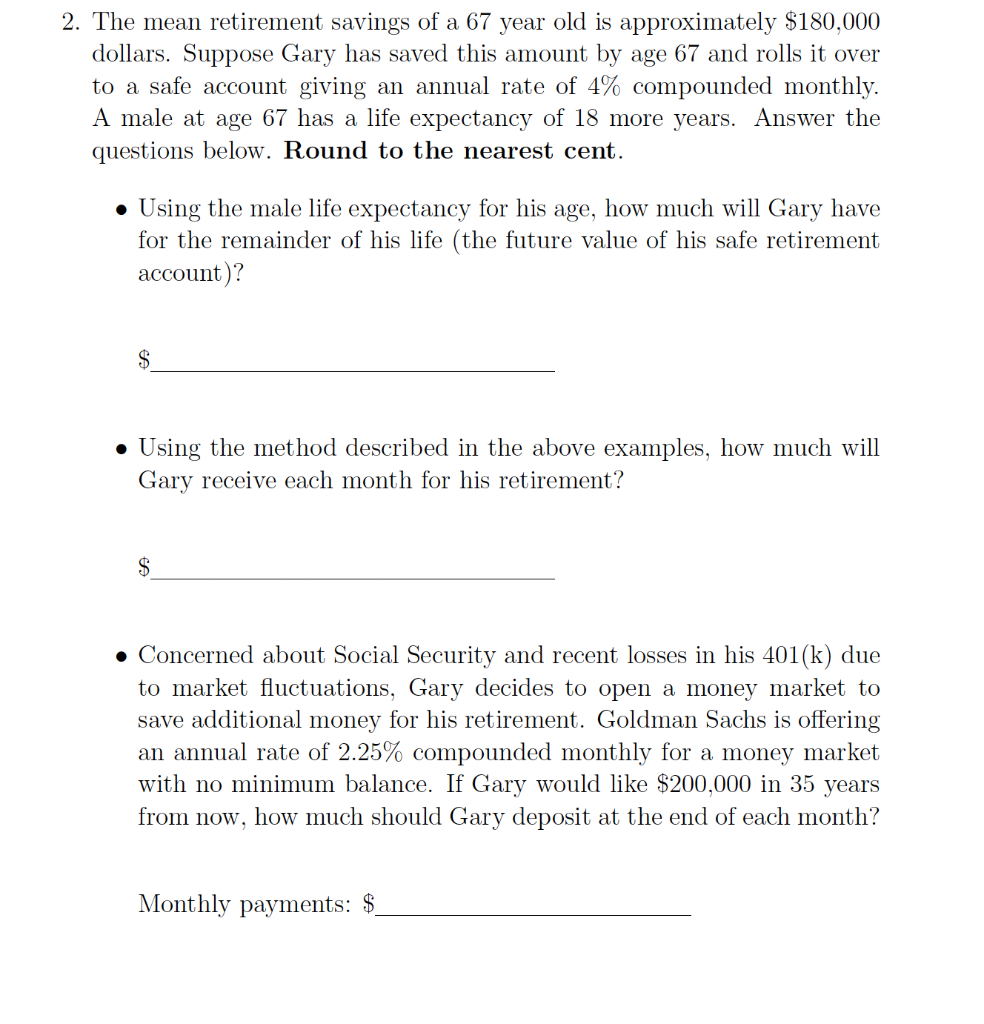

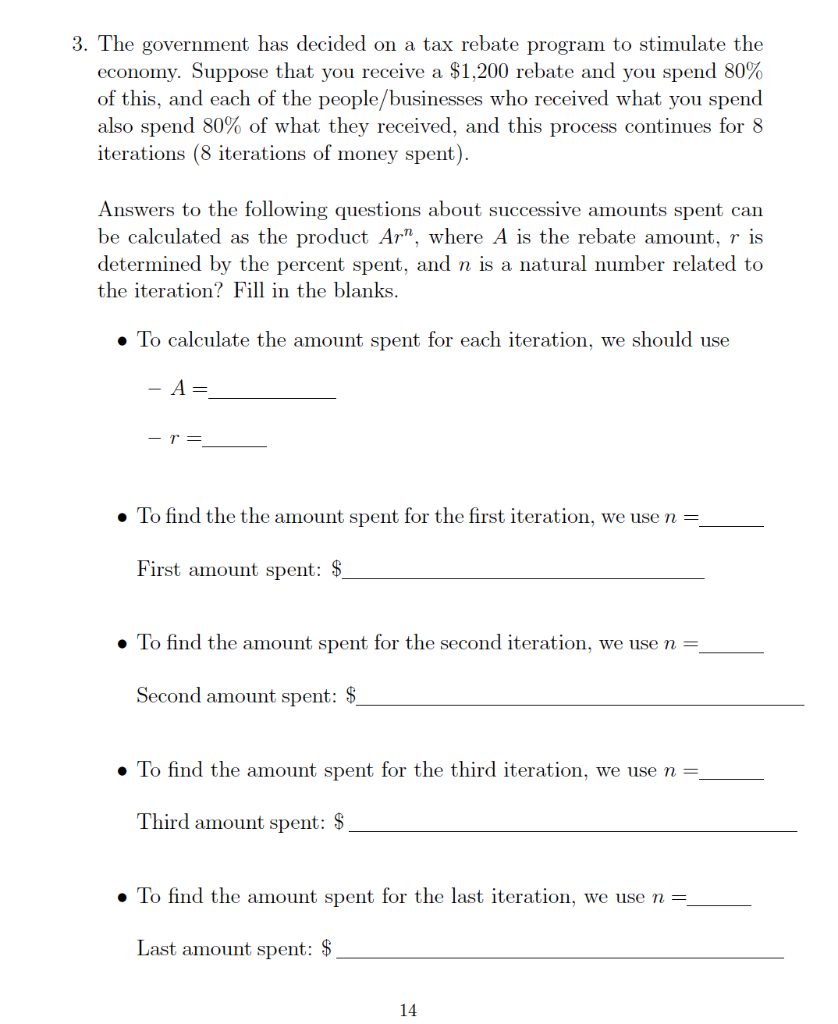

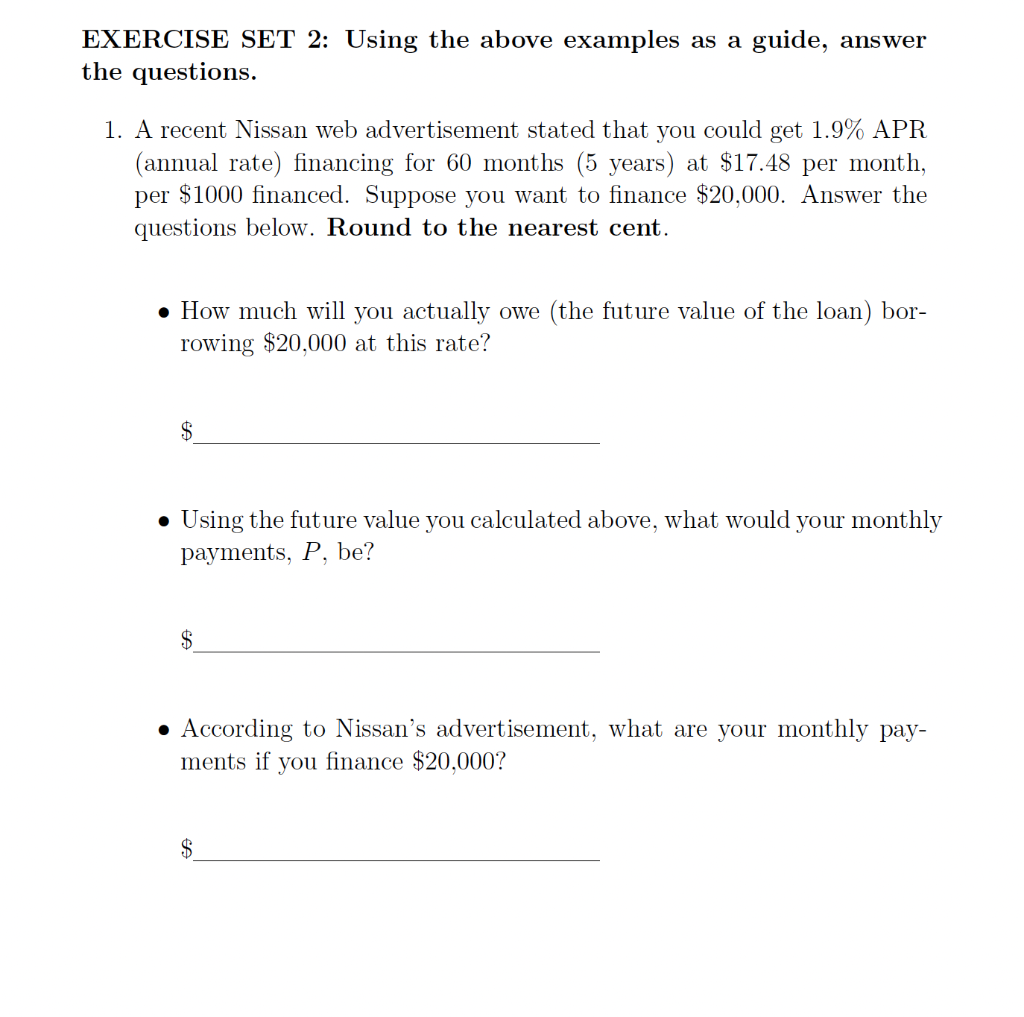

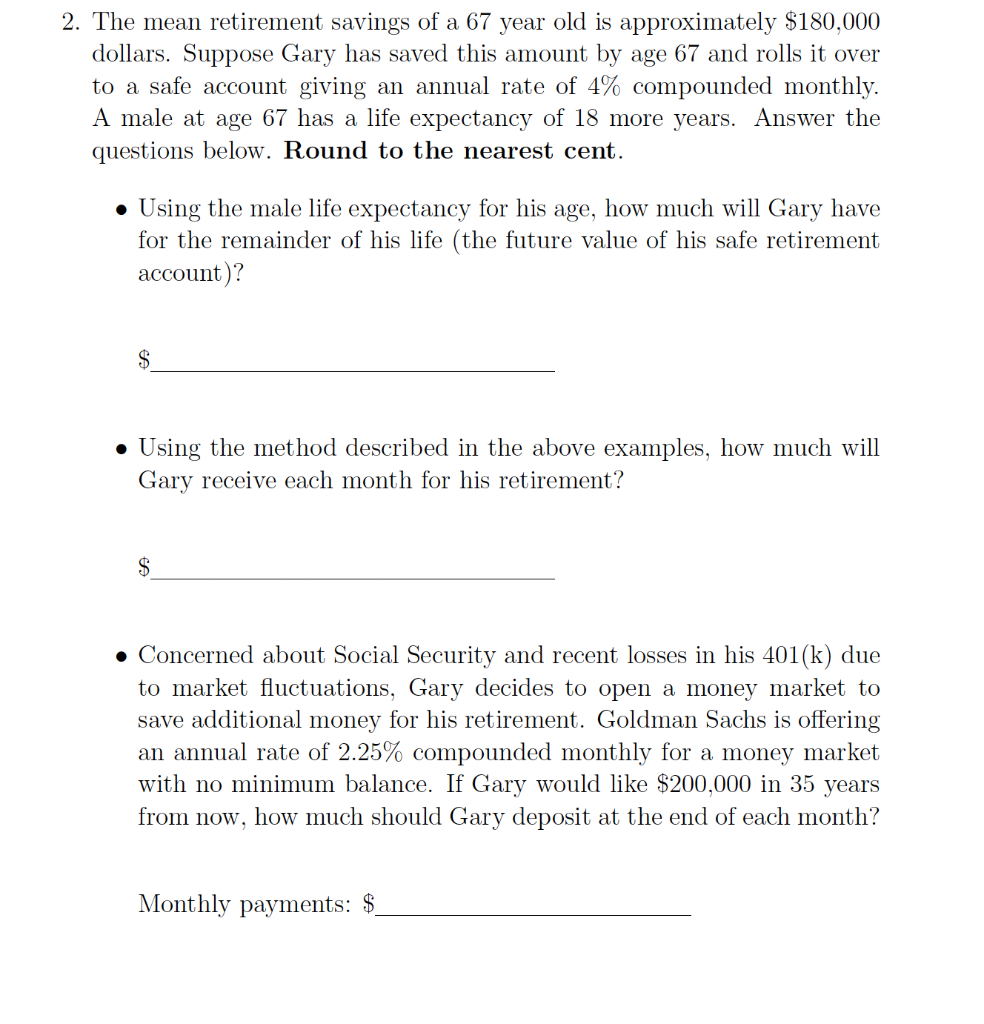

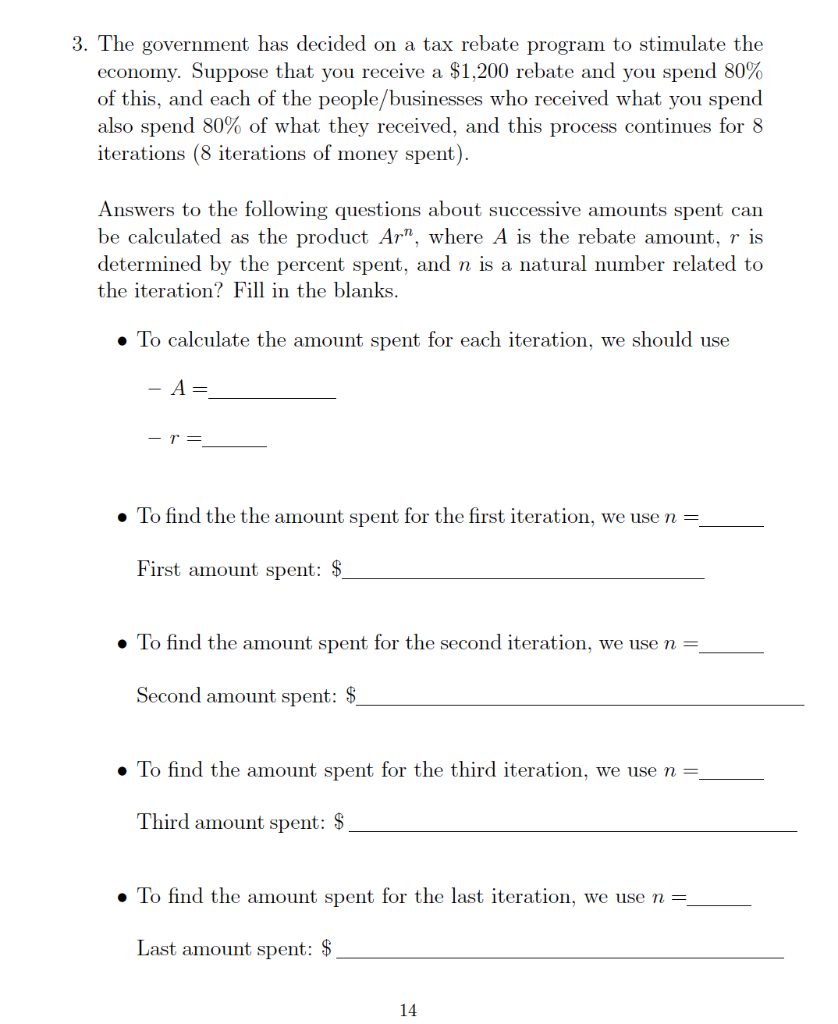

EXERCISE SET 2: Using the above examples as a guide, answer the questions. 1. A recent Nissan web advertisement stated that you could get 1.9% APR (annual rate) financing for 60 months (5 years) at $17.48 per month, per $1000 financed. Suppose you want to finance $20,000. Answer the questions below. Round to the nearest cent. How much will you actually owe (the future value of the loan) bor- rowing $20,000 at this rate? $ Using the future value you calculated above, what would your monthly payments, P, be? $ According to Nissan's advertisement, what are your monthly pay- ments if you finance $20,000? $ 2. The mean retirement savings of a 67 year old is approximately $180,000 dollars. Suppose Gary has saved this amount by age 67 and rolls it over to a safe account giving an annual rate of 4% compounded monthly. A male at age 67 has a life expectancy of 18 more years. Answer the questions below. Round to the nearest cent. O Using the male life expectancy for his age, how much will Gary have for the remainder of his life (the future value of his safe retirement account)? $ Using the method described in the above examples, how much will Gary receive each month for his retirement? $ Concerned about Social Security and recent losses in his 401(k) due to market fluctuations, Gary decides to open a money market to save additional money for his retirement. Goldman Sachs is offering an annual rate of 2.25% compounded monthly for a money market with no minimum balance. If Gary would like $200,000 in 35 years from now, how much should Gary deposit at the end of each month? Monthly payments: $ 3. The government has decided on a tax rebate program to stimulate the economy. Suppose that you receive a $1,200 rebate and you spend 80% of this, and each of the people/businesses who received what you spend also spend 80% of what they received, and this process continues for 8 iterations (8 iterations of money spent). Answers to the following questions about successive amounts spent can be calculated as the product Ar, where A is the rebate amount, r is determined by the percent spent, and n is a natural number related to the iteration? Fill in the blanks. To calculate the amount spent for each iteration, we should use - A= -r To find the the amount spent for the first iteration, we use n = First amount spent: $ To find the amount spent for the second iteration, we use n = Second amount spent: $ To find the amount spent for the third iteration, we use n= Third amount spent: $ To find the amount spent for the last iteration, we use n= Last amount spent: $ 14 To find the total amount of money injected into the economy in this scenario, we have to add up all the iterated amounts spent. Now, each term in the sum has a common factor of Ar, which can be factored out of the sum. So, what we are looking for is Total Amount = Ar(1 + Ar + Ara + ... + Arn-1) where n is the total number of iterations. Fill in the blanks below to calculate the total amount that went into the economy from this rebate. Ar and n = Note: Your answers to the last two questions will be very large num- bers. Please use commas to make them readable. You can use formula (0.1) at the top of page 6 for the sum in paren- thesis. Doing that, you will get 1+Ar+Ar2+...+Arn-1 Finally, the total amount of money injected into the economy in this scenario is $ EXERCISE SET 2: Using the above examples as a guide, answer the questions. 1. A recent Nissan web advertisement stated that you could get 1.9% APR (annual rate) financing for 60 months (5 years) at $17.48 per month, per $1000 financed. Suppose you want to finance $20,000. Answer the questions below. Round to the nearest cent. How much will you actually owe (the future value of the loan) bor- rowing $20,000 at this rate? $ Using the future value you calculated above, what would your monthly payments, P, be? $ According to Nissan's advertisement, what are your monthly pay- ments if you finance $20,000? $ 2. The mean retirement savings of a 67 year old is approximately $180,000 dollars. Suppose Gary has saved this amount by age 67 and rolls it over to a safe account giving an annual rate of 4% compounded monthly. A male at age 67 has a life expectancy of 18 more years. Answer the questions below. Round to the nearest cent. O Using the male life expectancy for his age, how much will Gary have for the remainder of his life (the future value of his safe retirement account)? $ Using the method described in the above examples, how much will Gary receive each month for his retirement? $ Concerned about Social Security and recent losses in his 401(k) due to market fluctuations, Gary decides to open a money market to save additional money for his retirement. Goldman Sachs is offering an annual rate of 2.25% compounded monthly for a money market with no minimum balance. If Gary would like $200,000 in 35 years from now, how much should Gary deposit at the end of each month? Monthly payments: $ 3. The government has decided on a tax rebate program to stimulate the economy. Suppose that you receive a $1,200 rebate and you spend 80% of this, and each of the people/businesses who received what you spend also spend 80% of what they received, and this process continues for 8 iterations (8 iterations of money spent). Answers to the following questions about successive amounts spent can be calculated as the product Ar, where A is the rebate amount, r is determined by the percent spent, and n is a natural number related to the iteration? Fill in the blanks. To calculate the amount spent for each iteration, we should use - A= -r To find the the amount spent for the first iteration, we use n = First amount spent: $ To find the amount spent for the second iteration, we use n = Second amount spent: $ To find the amount spent for the third iteration, we use n= Third amount spent: $ To find the amount spent for the last iteration, we use n= Last amount spent: $ 14 To find the total amount of money injected into the economy in this scenario, we have to add up all the iterated amounts spent. Now, each term in the sum has a common factor of Ar, which can be factored out of the sum. So, what we are looking for is Total Amount = Ar(1 + Ar + Ara + ... + Arn-1) where n is the total number of iterations. Fill in the blanks below to calculate the total amount that went into the economy from this rebate. Ar and n = Note: Your answers to the last two questions will be very large num- bers. Please use commas to make them readable. You can use formula (0.1) at the top of page 6 for the sum in paren- thesis. Doing that, you will get 1+Ar+Ar2+...+Arn-1 Finally, the total amount of money injected into the economy in this scenario is $