Answered step by step

Verified Expert Solution

Question

1 Approved Answer

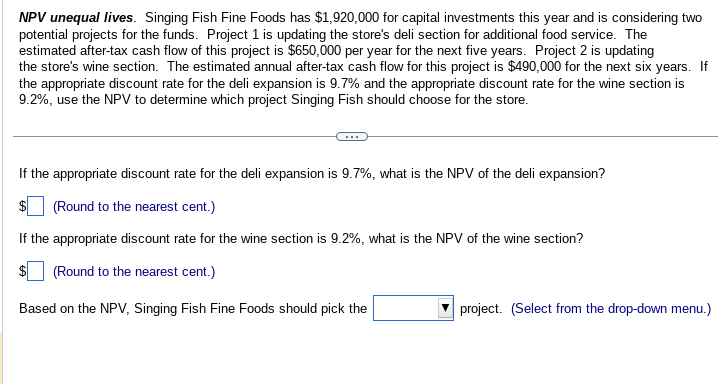

NPV unequal lives. Singing Fish Fine Foods has $ 1 , 9 2 0 , 0 0 0 for capital investments this year and is

NPV unequal lives. Singing Fish Fine Foods has $ for capital investments this year and is considering two

potential projects for the funds. Project is updating the store's deli section for additional food service. The

estimated aftertax cash flow of this project is $ per year for the next five years. Project is updating

the store's wine section. The estimated annual aftertax cash flow for this project is $ for the next six years. If

the appropriate discount rate for the deli expansion is and the appropriate discount rate for the wine section is

use the NPV to determine which project Singing Fish should choose for the store.

If the appropriate discount rate for the deli expansion is what is the NPV of the deli expansion?

$Round to the nearest cent.

If the appropriate discount rate for the wine section is what is the NPV of the wine section?

$ Round to the nearest cent.

Based on the NPV Singing Fish Fine Foods should pick the

project. Select from the dropdown menu.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started