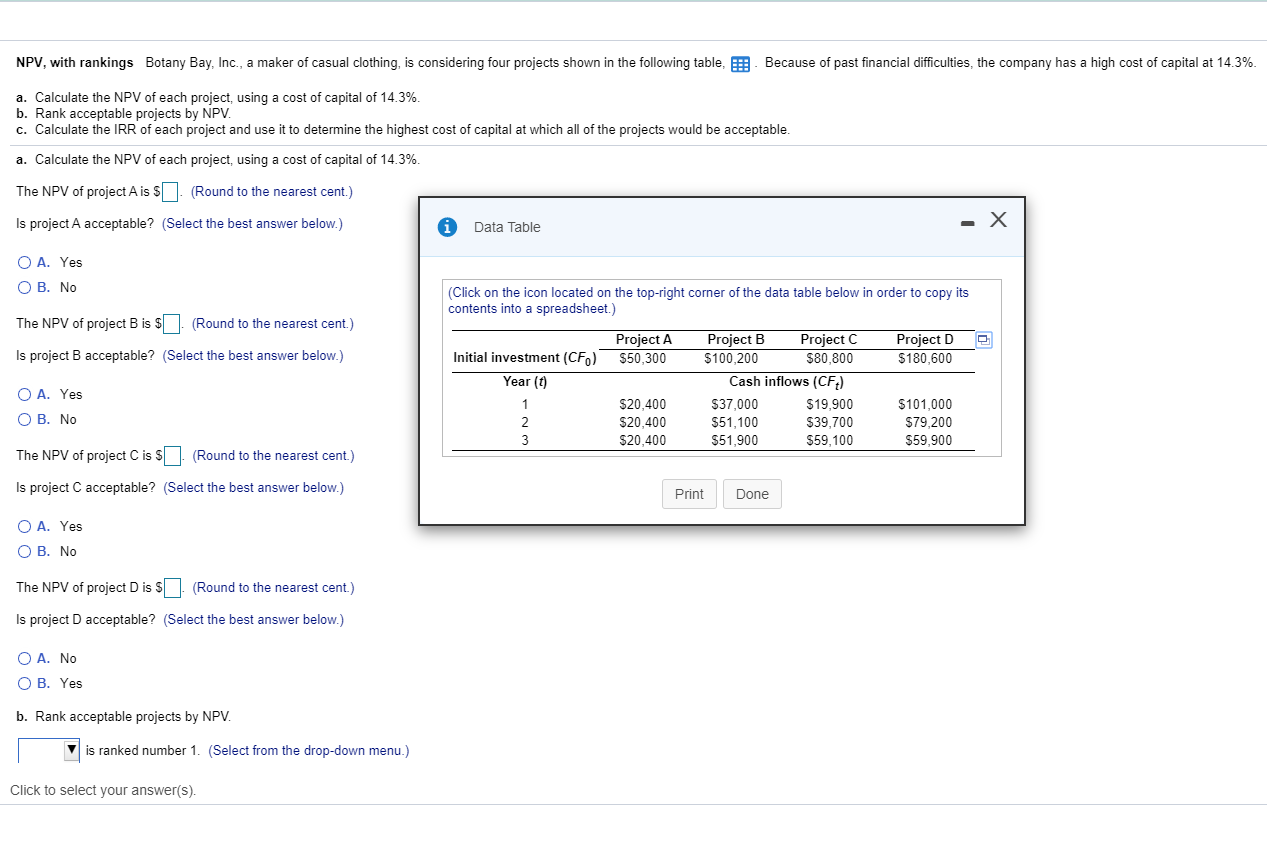

NPV, with rankings Botany Bay, Inc., a maker of casual clothing, is considering four projects shown in the following table, : Because of past financial difficulties, the company has a high cost of capital at 14.3%. a. Calculate the NPV of each project, using a cost of capital of 14.3%. b. Rank acceptable projects by NPV. c. Calculate the IRR of each project and use it to determine the highest cost of capital at which all of the projects would be acceptable. a. Calculate the NPV of each project, using a cost of capital of 14.3%. The NPV of project A is 5 (Round to the nearest cent.) Is project A acceptable? (Select the best answer below.) Data Table O A. Yes OB. No (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) The NPV of project B is $ . (Round to the nearest cent.) . Is project B acceptable? (Select the best answer below.) Project $50,300 Project D $180,600 Initial investment (CF) Year (1) O A. Yes OB. No Project B Project C $100,200 $80,800 Cash inflows (CFt) $37,000 $19,900 $51,100 $39,700 $51,900 $59,100 $20,400 $20,400 $20,400 $101,000 $79,200 $59,900 The NPV of project is $ (Round to the nearest cent.) Is project C acceptable? (Select the best answer below.) Print Done O A. Yes O B. No The NPV of project Dis $ (Round to the nearest cent.) Is project D acceptable? (Select the best answer below.) O A. No O B. Yes b. Rank acceptable projects by NPV. V is ranked number 1. (Select from the drop-down menu.) Click to select your answer(s). b. Rank acceptable projects by NPV. v is ranked number 1. (Select from the drop-down menu.) is ranked number 2 (Select from the drop-down menu.) is ranked number 3. (Select from the drop-down menu.) c. Calculate the IRR of each project and use it to determine the highest cost of capital at which all of the projects would be acceptable. The IRR of project A is %. (Round to two decimal places.) The IRR of project B is %. (Round to two decimal places.) The IRR of project Cis %. (Round to two decimal places.) The IRR of project Dis %. (Round to two decimal places.) What is the highest cost of capital at which all of the projects would be acceptable? (Choose the correct answer.) O A. 17.37% O B. 18.36% O C. 10.49% OD. 17.67%