Question

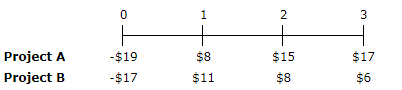

NPV Your division is considering two projects with the following cash flows (in millions): a. What are the projects' NPVs assuming the WACC is 5%?

NPV Your division is considering two projects with the following cash flows (in millions):

a. What are the projects' NPVs assuming the WACC is 5%? Round your answer to two decimal places. Do not round your intermediate calculations. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative value should be indicated by a minus sign.

What are the projects' NPVs assuming the WACC is 10%? Round your answer to two decimal places. Do not round your intermediate calculations. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative value should be indicated by a minus sign.

What are the projects' NPVs assuming the WACC is 15%? Round your answer to two decimal places. Do not round your intermediate calculations. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative value should be indicated by a minus sign.

b. What are the projects' IRRs assuming the WACC is 5%? Round your answer to two decimal places. Do not round your intermediate calculations.

What are the projects' IRRs assuming the WACC is 10%? Round your answer to two decimal places. Do not round your intermediate calculations.

What are the projects' IRRs assuming the WACC is 15%? Round your answer to two decimal places. Do not round your intermediate calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started