NS Child Benefit (NSCB) In continuing their efforts to combat poverty, Nova Scotia's government supports lower income individuals and families through the NS Child Benefit. Based upon personal tax returns, an individual or household income from 0-$25,999 will receive $1525 per child annually and a household income of $26,000-$33,999 will receive $1525 annually for one child with declining amounts for additional children ($2,287.50, $3,050 respectively for up to 3 children and $762.50 for each child thereafter). This amount is issued monthly in conjunction with the federal benefit Canada Child Benefit. This benefit is aimed towards low income ($0-$33,999) Nova Scotians, who may be unemployed, employed part or full time, and of great benefit to the clients we serve in tax clinics offered through the Brunswick Street Mission and at MSVU. The form RC66, application for Canada Child Benefits, is utilized by the Federal and Provincial governments to determine a household's eligibility for CCB and NSCB benefits. The initial form is lengthy, especially to those who are newcomers to Canada. If you are a newcomer, an additional form RC66SCH is required for status and income information. This form includes complex language, especially for those whose first fanguage is not English. This could be very overwhelming without a support person to help them through. Located on the CRA website is a 14-page booklet pertaining to T4114(E) Child Care Benefit (and related provincial and territorial programs). This lengthy booklet references Folio S5-F1-C1 which helps to determine an individual's residence status, as needed for NSCB. However, the language in this folio

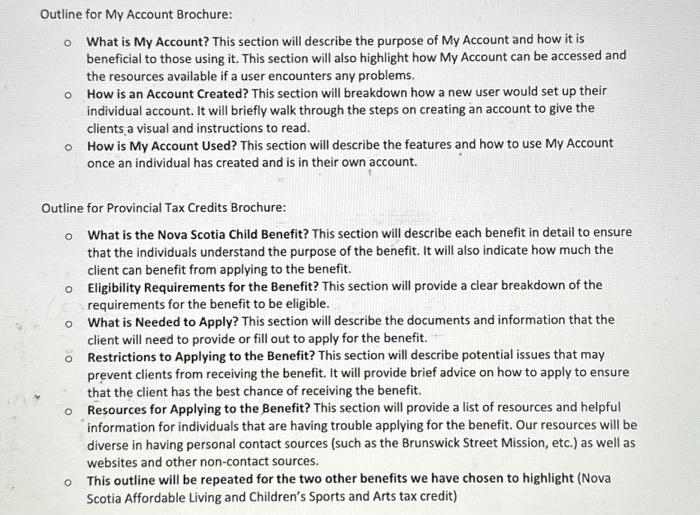

In continuing their efforts to combat poverty, Nova Scotia's government supports lower income individuals and families through the NS Child Benefit. Based upon personal tax returns, an individual or household income from 0$25,999 will receive $1525 per child annually and a household income of $26,000$33,999 will receive $1525 annually for one child with declining amounts for additional children ($2,287.50,$3,050 respectively for up to 3 children and $762.50 for each child thereafter). This amount is issued monthly in conjunction with the federal benefit Canada Child Benefit. This benefit is aimed towards low income ($0$33,999) Nova Scotians, who may be unemployed, employed part or full time, and of great benefit to the clients we serve in tax clinics offered through the Brunswick Street Mission and at MSVU. The form RC66, application for Canada Child Benefits, is utilized by the Federal and Provincial governments to determine a household's eligibility for CCB and NSCB benefits. The initial form is lengthy, especially to those who are newcomers to Canada. If you are a newcomer, an additional form RC66SCH is required for status and income information. This form includes complex language, especially for those whose first fanguage is not English. This could be very overwhelming without a support person to help them through. Located on the CRA website is a 14-page booklet pertaining to T4114(E) Child Care Benefit (and related provincial and territorial programs). This lengthy booklet references Folio S5-F1-C1 which helps to determine an individual's residence status, as needed for NSCB. However, the language in this folio NS Affordable Living Tax Credit (NSALTC) NSALTC is a tax-free credit fully funded by the NS Government to support low- and modestincome Nova Scotians. This credit is offered to help offset the increase in HST and therefore increasing household income. For this period (July 2023-June 2024), a maximum credit of $255 per couple and $60 per child is combined with the quarterly federal GST/HST credit. For a household adjusted income over $30,000 the credit is reduced by 5% ( $0.05 for every dollar). Again, this credit is aimed towards the lower to modest income earners - with the most benefit towards the lower income households (under $30,000). These households may be unemployed, part- or full-time employment, of any age 18+, and of any location throughout Nova Scotia. Nova Scotia's finance department has a brief write-up regarding NSALTC. The wording is very ambiguous and that payments are made with the quarterly GST/HST payments, but the amount listed is an annual amount per individual/couple and child(ren). Located on the CRA website is a statement "The credit is reduced by 5% of adjusted family net income over $30,000 could be easily misinterpreted. Upon first review of this credit, I understpod this to be a 5% reduction on any income over $30,000. But after researching a little deeper it is a rctiuction of $0.05 for each dollar over $30,000 of income, this is a huge difference and a little cryptic to those who may not have a well-developed reading level or comprehension issues. CRA My Account CRA's My Account is a secure portal offered by Government of Canada (GOC) that allows you to view your personal tax and benefit information, update your personal information, and even dispute issues. It is convenient, easy to use (once registered), and fast, however the daunting issue is registering for a login. To gain access to My Account, an individual is required to have their SIN, date of birth, current postal code, and your income tax return (current or prior year). This portal is aimed towards all tax paying/benefit receiving individuals however is very unknown to those new in Canada or may be difficult to access due to homelessness or lack of internet accessibility. Located on the GOC's website (Canada.ca) My Account has many gaps for users including: - Lack of accessibility for those who are homeless or may not be able to afford internet access. - Those who are homeless may not have their Notice of Assessment or tax returns available to register for an account. - Lack of education surrounding the requirement of filing a tax return and the benefits you receive. - Lack of education surrounding this portal and the benefits it provides. - May be difficult to understand how to register (i.e., Needing a line \# from your tax return) - Ways you can register: through banking, creating a UID, et: but what happens if you use banking information, and you close the account? Think of the impact and choose carefullynewcomers may not think of this. - Describe the content you will create. Explain your choice of medium, e.g., Why did you choose to produce an online webinar? (This must relate back to your target client group.) How will this content be consumed or used, by whom, where, when? Are there any barriers that may prevent your target clients from accessing this content? How will you overcome these barriers? Based on the problems we have identified; our group has decided to create two brochures to aide in filling the gaps. Our first brochure will be specifically covering how to use My Account on the CRA website. Our second brochure will be focusing on three provincial tax credits that we identified as being relevant to the individuals that both the Brunswick Street Mission and the International Education Center see. These tax credits include Nova Scotia Child Benefit, Nova Scotia Affordable Living and the Children's Sports and Arts tax credit. We chose to use brochures because the information we want to share can easily be broken down into different sections and simplified for the individuals. The volunteers can use the brochures during their face-to-face meetings with their clients and then the clients can keep the brochures afterwards should they need to refer to them. The text in the brochures can also be translated into the four most common languages that they encounter (English, French, Arabic, Ukrainian). One barrier that may prevent our target clients from accessing this content is that there is a small population of clients that are unable to read and write. To overcome this barrier, we will simplify the language used as much as possible. As mentioned before, the volunteers can also read the information to the tax clients where they can answer questions and give more information as needed. Outline for My Account Brochure: - What is My Account? This section will describe the purpose of My Account and how it is beneficial to those using it. This section will also highlight how My Account can be accessed and the resources available if a user encounters any problems. - How is an Account Created? This section will breakdown how a new user would set up their individual account. It will briefly walk through the steps on creating an account to give the clients a visual and instructions to read. - How is My Account Used? This section will describe the features and how to use My Account once an individual has created and is in their own account. Outline for Provincial Tax Credits Brochure: - What is the Nova Scotia Child Benefit? This section will describe each benefit in detail to ensure that the individuals understand the purpose of the benefit. It will also indicate how much the client can benefit from applying to the benefit. - Eligibility Requirements for the Benefit? This section will provide a clear breakdown of the requirements for the benefit to be eligible. - What is Needed to Apply? This section will describe the documents and information that the client will need to provide or fill out to apply for the benefit. - Restrictions to Applying to the Benefit? This section will describe potential issues that may prevent clients from receiving the benefit. It will provide brief advice on how to apply to ensure that the client has the best chance of receiving the benefit. - Resources for Applying to the Benefit? This section will provide a list of resources and helpful information for individuals that are having trouble applying for the benefit. Our resources will be diverse in having personal contact sources (such as the Brunswick Street Mission, etc.) as well as websites and other non-contact sources. - This outline will be repeated for the two other benefits we have chosen to highlight (Nova Scotia Affordable Living and Children's Sports and Arts tax credit) - How does this content fill the gaps described in the Main problem? - Are there any other solutions you considered to fill the gaps? Why were they rejected? - What resources will you need to create/deliver this content, e.g., prining services, software, camera, meeting space, etc