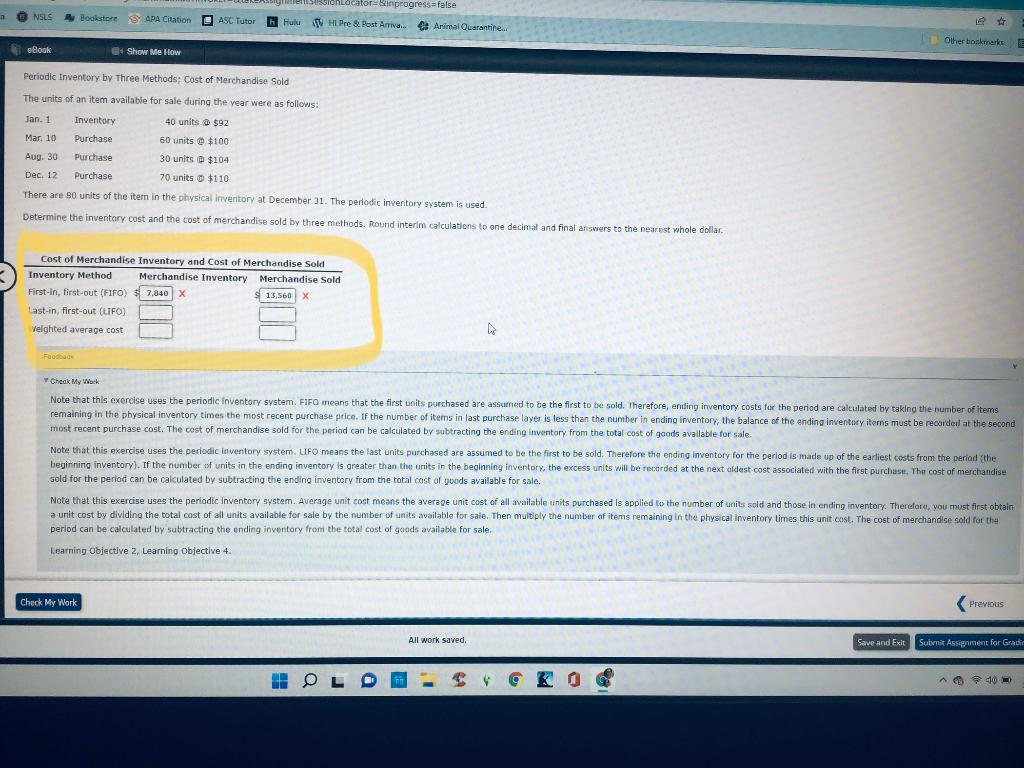

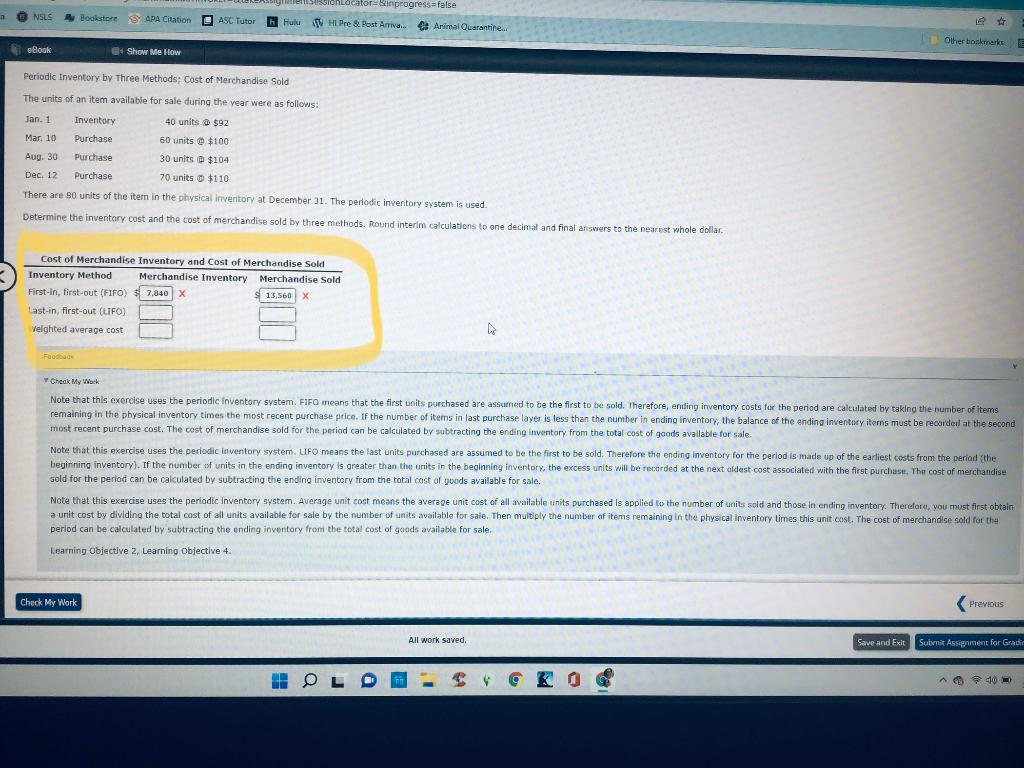

NSLS A Bookstore SAPA Citation Locator-einprogress-false Hulu HL Pre & Post Anriva..es Arimal Quarantine. ASC Tutor Other bookmarks Book E Show Me How Periodic Inventory by Three Methods: Cost of Merchandise Sold The units of an item available for sale during the year were as follows: Jan. 1 Inventory 40 units @ $92 Mar. 10 Purchase 60 units $100 Aug. 30 Purchase 30 units $104 Dec. 12 Purchase 70 units $110 O There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost and the cost of merchandise sold by three methods. Round interim calculations to one decimal and final answers to the nearest whole dollar. Cost of Merchandise Inventory and cost of Merchandise Sold Inventory Method Merchandise Inventory Merchandise Sold First-in, first-out (FIFO) $7,840 x , - $ 13,560 X Last-in, first-out (LIFO) Velghted average cost Check My Work Note that this exercise uses the periodic inventory system. FIFO means that the first units purchased are assumed to be the first to be sold. Therefore, ending inventory costs for the period are calculated by taking the number of items remaining in the physical inventory times the most recent purchase price. If the number of items in last purchase layer is less than the number in ending inventory, the balance of the ending inventory iterns must be recorded at the second most recent purchase cost. The cost of merchandise sold for the period can be calculated by subtracting the ending inventory from the total cost of goods available for sale. Note that this exercise uses the periodic Inventory system. LIFO means the last units purchased are assumed to be the first to be sold. Therefore the ending inventory for the period is made up of the earliest costs from the period (the beginning inventory). If the number of units in the ending inventory is greater than the units in the beginning inventory, the excess units will be recorded at the next oldest cost associated with the first purchase. The cost of merchandise sold for the period can be calculated by subtracting the ending inventory from the total cost of goods available for sale. . Note that this exercise uses the periodic Inventory system. Average unit cost means the average unit cost of all available units purchased is applied to the number of units sold and those in ending inventory. Therefore, you must first obtain a unit cost by dividing the total cost of all units available for sale by the number of units available for sale. Then multiply the number of items remaining in the physical inventory times this unit cost. The cost of merchandise sold for the period can be calculated by subtracting the ending inventory from the total cost of goods available for sale, Learning Objective 2. Learning objective 4. Check My Work Previous All work saved Save and Exit Submit Assignment for Gradie + OL A8 10