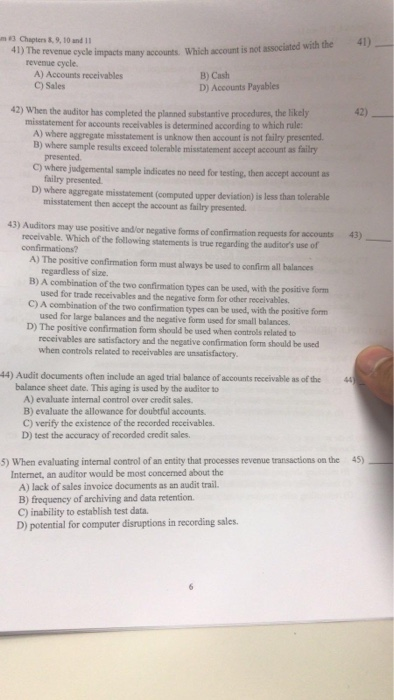

nt3Chapter, 8, 9, 10 and 11 41) The revenue revenue cycle. A) Accounts receivables C) Sales B) Cash D) Accounts Payables 4 42) When the auditor has completed the planned sabstantive procedures, the likely misstatement for accounts recelvables is determined according to which rule 42) A) where aggregate misstatement is unknow then account is not failry presented accept account as failry B) where sample results exceed tolerable mistatement a presented C) where judgemental sample indicntes no need for testing, then accept account as failry presented D) where aggregate misstatement (computed upper deviation) is less than tolerable misstatement then accept the account as failry presented 43) Auditors may use positive and/or negative forms of confirmation requests for accounts receivable. Which of the following statements is true regarding the auditor's use of 43) confirmations? A) The positive confirmation form must always be used to confirm all balances regardless of size. B) A combination of the two confirmation types can be used, with the positive form C) A combination of the two confirmation types can be used, with the positive form D) The positive confirmation form shoald be used when controls related to used for trade receivables and the negative form for other receivables. used for large balances and the negative form used for small balances. receivables are satisfactory and the negative confirmation form should be used when controls related to receivables are unsatisfactory 44) Audit documents often include an aged trial balance of accounts receivable as of the 44 balance sheet date. This aging is used by the auditor to A) evaluate internal control over credit sales. B) evaluate the allowance for doubtful accounts C) verify the existence of the recorded receivables D) test the accuracy of recorded credit sales 45) 5) When evaluating internal control of an entity that processes revenue transactions on the Internet, an auditor would be most concerned about the A) lack of sales invoice documents as an audit trail. B) frequency of archiving and data retention. C) inability to establish test data. pe r