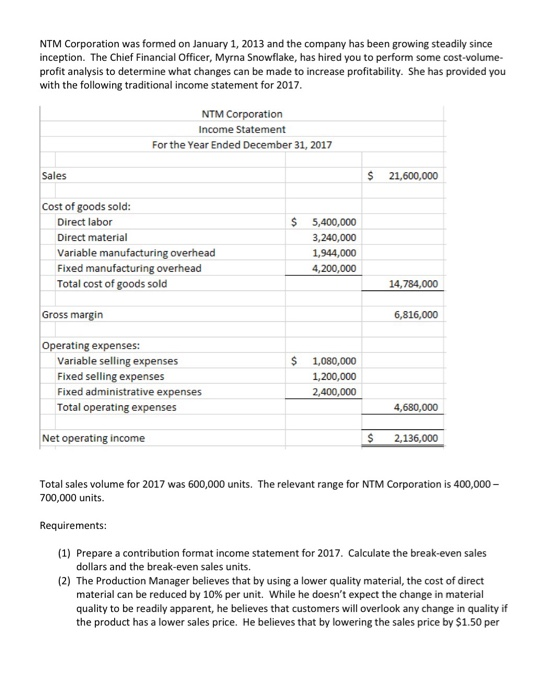

NTM Corporation was formed on January 1, 2013 and the company has been growing steadily since inception. The Chief Financial Officer, Myrna Snowflake, has hired you to perform some cost-volume- profit analysis to determine what changes can be made to increase profitability. She has provided you with the following traditional income statement for 2017 Income Statement For the Year Ended December 31, 2017 Sales $21,600,000 Cost of goods sold Direct labor Direct material Variable manufacturing overhead Fixed manufacturing overhead Total cost of goods sold 5,400,000 3,240,000 1,944,000 4,200,000 14,784,000 Gross margin 6,816,000 Operating expenses Variable selling expenses Fixed selling expenses Fixed administrative expenses Total operating expenses $1,080,000 1,200,000 2,400,000 4,680,000 Net operating income $2,136,000 Total sales volume for 2017 was 600,000 units. The relevant range for NTM Corporation is 400,000- 700,000 units. Requirements: (1) Prepare a contribution format income statement for 2017. Calculate the break-even sales dollars and the break-even sales units (2) The Production Manager believes that by using a lower quality material, the cost of direct material can be reduced by 10% per unit, while he doesn't expect the change in material quality to be readily apparent, he believes that customers will overlook any change in quality if the product has a lower sales price. He believes that by lowering the sales price by $1.50 per unit, there will be an 8% increase in sales volume. Prepare a contribution format income statement for this alternative. Calculate the break-even sales dollars and the break-even sales units. (3) The Quality Control Manager does not agree with the Production Manager's suggestion and has a different idea. He believes that an additional piece of equipment can be purchased. The nevw piece of equipment will allow the company to decrease Direct Labor to 20% of Sales. The new piece of equipment will increase fixed costs by $600,000 per year. The Quality Control Manager also believes an increased marketing effort will lead to additional sales volume. He has proposed spending an additional $10,000 per month on advertising which he believes will lead to an increase in sales volume of 1%. Coupled with an increase in sales price per unit of $0.50 the company should see increase profitability. Prepare a contribution format income statement for this alternative. Calculate the break-even sales dollars and the break-even sales units. 4) The Sales Manager also believes that an additional piece of equipment is the answer to increased profitability. She agrees with the Quality Control Manager that a new piece of manufacturing equipment can lead to cost savings. She has located a similar piece of equipment to that suggested by the Quality Control Manager but at a cost of $500,000. The Sales Manager believes that a decrease in sales price of $5 per unit will increase sales volume by 10%. In addition, she believes the new piece of equipment will allow the company to eliminate some direct labor which will change the revised direct labor percentage to be 15% of sales, with the decrease in direct labor necessary to produce the merchandise, she is proposing laying off three manufacturing managers for a total savings of $450,000. She also believes a change in the Sales Department is necessary and has proposed eliminating all sales commissions and other variable selling costs so that variable selling costs will be totally eliminated but sales salaries will be increased by $75,000 per year. Prepare a contribution format income statement for this alternative. Calculate the break-even sales dollars and the break-even sales units. (5) Prepare a memo to the Chief Financial Officer summarizing the results of your analysis and your recommendation for the best plan for the company. Include specific financial information fromm your analysis. Also include any non-financial information that was part of your decision making process