Answered step by step

Verified Expert Solution

Question

1 Approved Answer

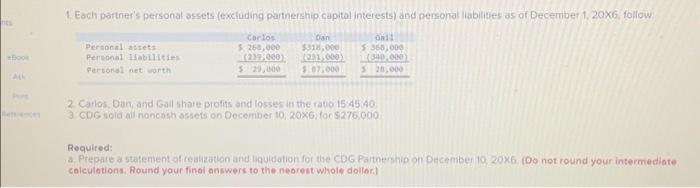

nts eBook Ask Print References 1. Each partner's personal assets (excluding partnership capital interests) and personal liabilities as of December 1, 20X6, follow: Gail $368,000

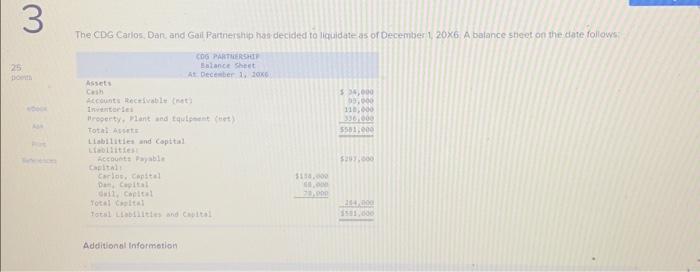

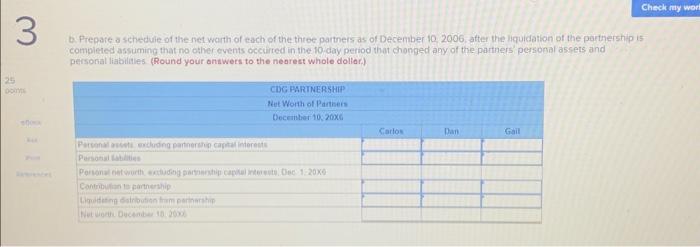

nts eBook Ask Print References 1. Each partner's personal assets (excluding partnership capital interests) and personal liabilities as of December 1, 20X6, follow: Gail $368,000 (340,000) $ 28,000 Personal assets Personal liabilities Personal net worth Carlos $ 268,000 (239,000) $ 29,000 Dan $318,000 (231,000) $ 87,000 2. Carlos, Dan, and Gail share profits and losses in the ratio 15:45:40. 3. CDG sold all noncash assets on December 10, 20X6, for $276,000. Required: a. Prepare a statement of realization and liquidation for the CDG Partnership on December 10, 20X6. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started