Answered step by step

Verified Expert Solution

Question

1 Approved Answer

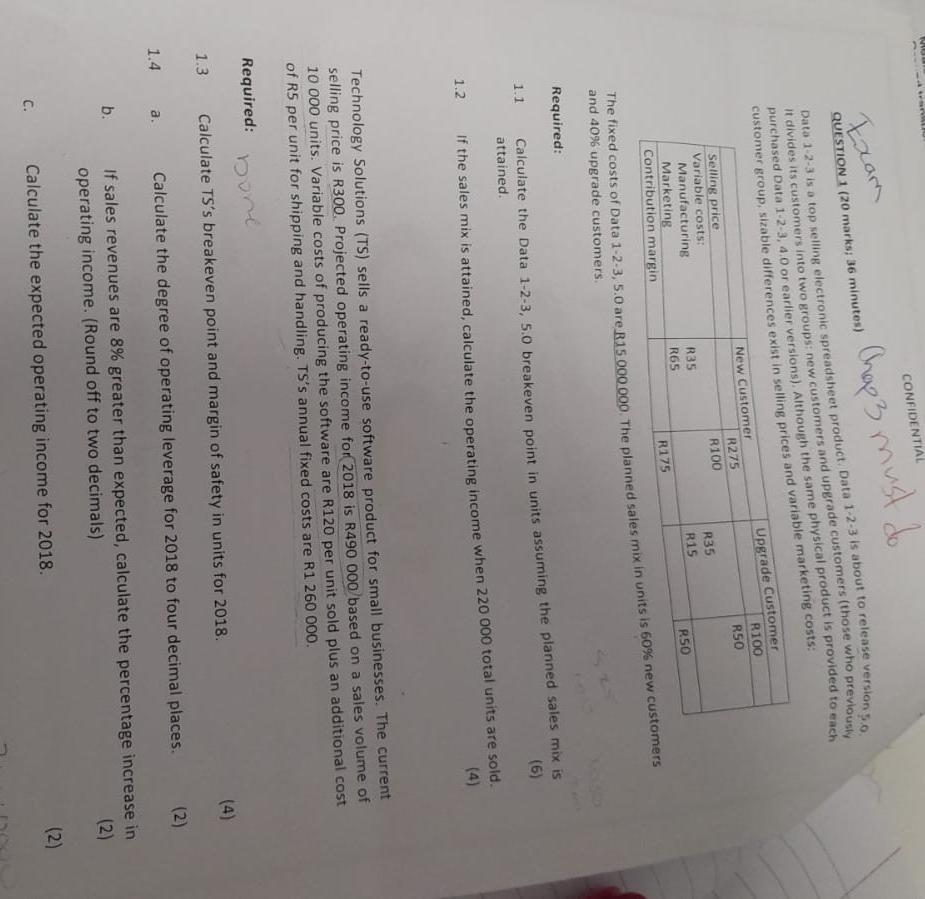

NU CONFIDENTIAL Exam Chap3 must do it divides its customers into two groups: new customers and upgrade customers (those who previously QUESTION 1 (20 marks:

NU CONFIDENTIAL Exam Chap3 must do it divides its customers into two groups: new customers and upgrade customers (those who previously QUESTION 1 (20 marks: 36 minutes) so purchased Data 1-2-3, 4.0 or earlier versions). Although the same physical product is provided to each customer group, sizable differences exist in selling prices and variable marketing costs: Upgrade Customer R100 R50 R35 R15 R175 R50 New Customer R275 R100 R35 R65 Selling price Variable costs: Manufacturing Marketing Contribution margin The fixed costs of Data 1-2-3, 5.0 are R15.000.000. The planned sales mix in units is 60% new customers and 40% upgrade customers. Required: 1.1 Calculate the Data 1-2-3, 5.0 breakeven point in units assuming the planned sales mix is attained. (6) 1.2 If the sales mix is attained, calculate the operating income when 220 000 total units are sold. (4) Technology Solutions (TS) sells a ready-to-use software product for small businesses. The current selling price is R300. Projected operating income for 2018 is R490 000/based on a sales volume of 10 000 units. Variable costs of producing the software are R120 per unit sold plus an additional cost of R5 per unit for shipping and handling. TS's annual fixed costs are R1 260 000 Required: none 1.3 Calculate TS's breakeven point and margin of safety in units for 2018. (4) (2) 2 1.4 a. Calculate the degree of operating leverage for 2018 to four decimal places. b. If sales revenues are 8% greater than expected, calculate the percentage increase in operating income. (Round off to two decimals) (2) (2) C. Calculate the expected operating income for 2018. NU CONFIDENTIAL Exam Chap3 must do it divides its customers into two groups: new customers and upgrade customers (those who previously QUESTION 1 (20 marks: 36 minutes) so purchased Data 1-2-3, 4.0 or earlier versions). Although the same physical product is provided to each customer group, sizable differences exist in selling prices and variable marketing costs: Upgrade Customer R100 R50 R35 R15 R175 R50 New Customer R275 R100 R35 R65 Selling price Variable costs: Manufacturing Marketing Contribution margin The fixed costs of Data 1-2-3, 5.0 are R15.000.000. The planned sales mix in units is 60% new customers and 40% upgrade customers. Required: 1.1 Calculate the Data 1-2-3, 5.0 breakeven point in units assuming the planned sales mix is attained. (6) 1.2 If the sales mix is attained, calculate the operating income when 220 000 total units are sold. (4) Technology Solutions (TS) sells a ready-to-use software product for small businesses. The current selling price is R300. Projected operating income for 2018 is R490 000/based on a sales volume of 10 000 units. Variable costs of producing the software are R120 per unit sold plus an additional cost of R5 per unit for shipping and handling. TS's annual fixed costs are R1 260 000 Required: none 1.3 Calculate TS's breakeven point and margin of safety in units for 2018. (4) (2) 2 1.4 a. Calculate the degree of operating leverage for 2018 to four decimal places. b. If sales revenues are 8% greater than expected, calculate the percentage increase in operating income. (Round off to two decimals) (2) (2) C. Calculate the expected operating income for 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started