Answered step by step

Verified Expert Solution

Question

1 Approved Answer

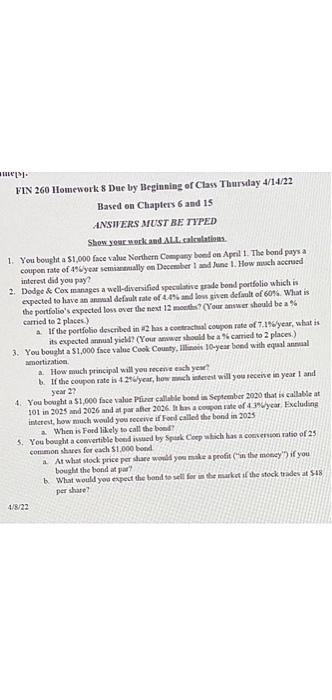

nukber 2,3,4, 5 please me FIN 260 Homework & Due by Beginning of Class Thursday 4/14/22 Based on Chapters 6 and 18 ANSWERS MUST BE

nukber 2,3,4, 5 please

me FIN 260 Homework & Due by Beginning of Class Thursday 4/14/22 Based on Chapters 6 and 18 ANSWERS MUST BE TYPED Show york andALL. calculations 1. You bought a $1.000 face value Northern Company bond on April 1. The bond pays a coupon rate of year smaally on December 1 and June 1. How much accrued interest did you pay? 2. Dodge & Cox manages a well-diversified speculative rade bon portfolio which is expected to have an an default rate of 44% and low given default of 60%. What is the portfolio's expected loss over the next 12 (Your owwe should be a cared to 2 places) If the portfolio described in has a contracheal coupon rate of 7.196/year, what is its expected annual yie? (Your wer should be a "e carried to 2 places) 3. You bought a $1,000 face value Cook County, I 10-year bond with equal anal amortization a How much principal will you recen each year If the coupon rate is 428year, how much interest will you receive in year and 4. You bought a $1,000 face value Para Callable bondis September 2020 lat i calable at 101 in 2025 and 2026 and at grafter 2026 hapon sale of 139year Excluding interest, how much would you receive if Fond called the band in 2025 . When is Ford likely to call the bood! 5. You bought a convertible bed wed by Sk Cloep which has ratio of 25 Comon shares for each $1.000 bood At what stock price per dare would you make a profit in the money) if you bought the bond at What would you expect the band to sell for in the market the stock trades a $48 perde 4/8/22 year 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started