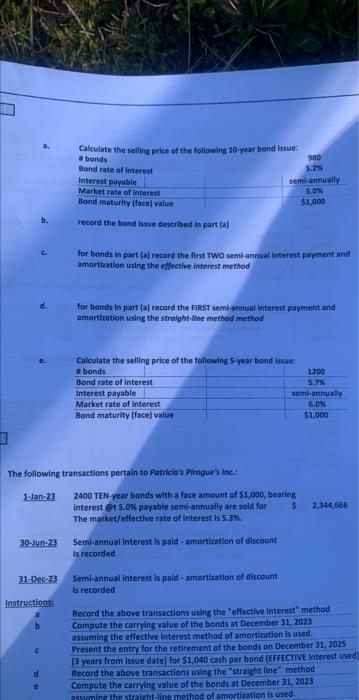

number 1

b. record the bond issue detcribed in part (a) c. for bonds in part (b) record the first TWO sembannual interest payment and amorthation using the effective interest method d. for bends in part {a ) recaed the FiRSt semh-arnial laterest pavmient and amortitation using the stroight-Wne methad method C. Calculate the sellins price of the followina 5 -wear bond issuer The following transactions pertaln to Patricio's Pirogue' inc.t. 1-han-23 2400 TEN-Year bonds with a foce ameunt af 51,000 , bearinig interest \&. 5.0%6 payable semi-annually are sold for 51,344,666 The market/affective rate of interest is 5.3K. 30-1un-23 Sem-annual interest is paid - amortitation of eiscount Is recarded 31-Dec-23 Semi-annuat interest is paid - amortiation of dicount is tecorded instructions: Record the above transactions using the "effective interest method Compute the carrying value of the bonds at December 31,2023 assuming the efiective Interest method of amartiration is used. Present the entry for the retirement of the bonds on December 31, 2025 (3 years from issve date) for $1,040 cash per bond (5FFECTIVE laterest used Pecord the above transactions using the "straight line" method Compute the carrying vaiue of the bonds at December 31,2023 b. record the bond issue detcribed in part (a) c. for bonds in part (b) record the first TWO sembannual interest payment and amorthation using the effective interest method d. for bends in part {a ) recaed the FiRSt semh-arnial laterest pavmient and amortitation using the stroight-Wne methad method C. Calculate the sellins price of the followina 5 -wear bond issuer The following transactions pertaln to Patricio's Pirogue' inc.t. 1-han-23 2400 TEN-Year bonds with a foce ameunt af 51,000 , bearinig interest \&. 5.0%6 payable semi-annually are sold for 51,344,666 The market/affective rate of interest is 5.3K. 30-1un-23 Sem-annual interest is paid - amortitation of eiscount Is recarded 31-Dec-23 Semi-annuat interest is paid - amortiation of dicount is tecorded instructions: Record the above transactions using the "effective interest method Compute the carrying value of the bonds at December 31,2023 assuming the efiective Interest method of amartiration is used. Present the entry for the retirement of the bonds on December 31, 2025 (3 years from issve date) for $1,040 cash per bond (5FFECTIVE laterest used Pecord the above transactions using the "straight line" method Compute the carrying vaiue of the bonds at December 31,2023