Answered step by step

Verified Expert Solution

Question

1 Approved Answer

number 1 ease put your hame section number and assignment number on the header of the email. No docs, no pdfs and no other attachments.

number 1

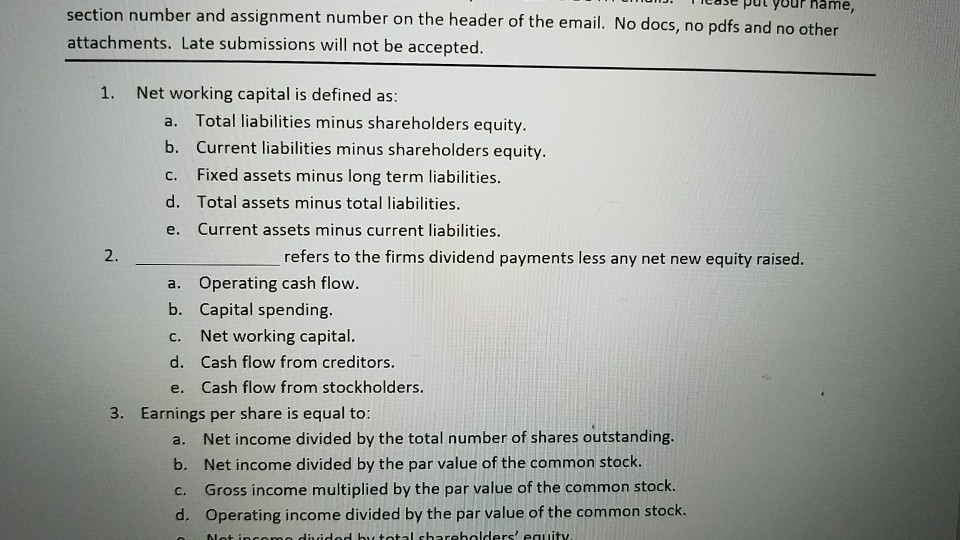

ease put your hame section number and assignment number on the header of the email. No docs, no pdfs and no other attachments. Late submissions will not be accepted. 1. Net working capital is defined as: a. b. c. d. e. Total liabilities minus shareholders equity Current liabilities minus shareholders equity. Fixed assets minus long term liabilities. Total assets minus total liabilities. Current assets minus current liabilities. 2. refers to the firms dividend payments less any net new equity raised. a. Operating cash flow. b. Capital spending c. Net working capital. d. Cash flow from creditors. e. Cash flow from stockholders. 3. Earnings per share is equal to: a. b. c. d. Net income divided by the total number of shares outstanding. Net income divided by the par value of the common stock. Gross income multiplied by the par value of the common stock. Operating income divided by the par value of the common stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started