number 1

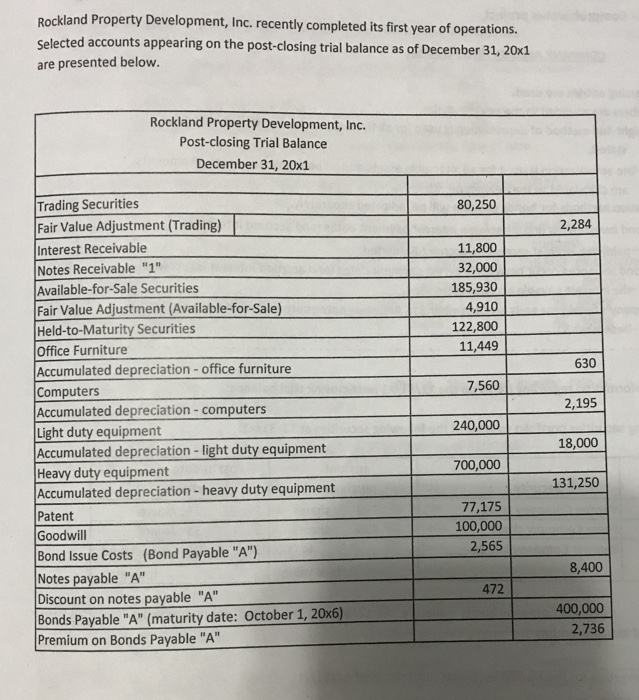

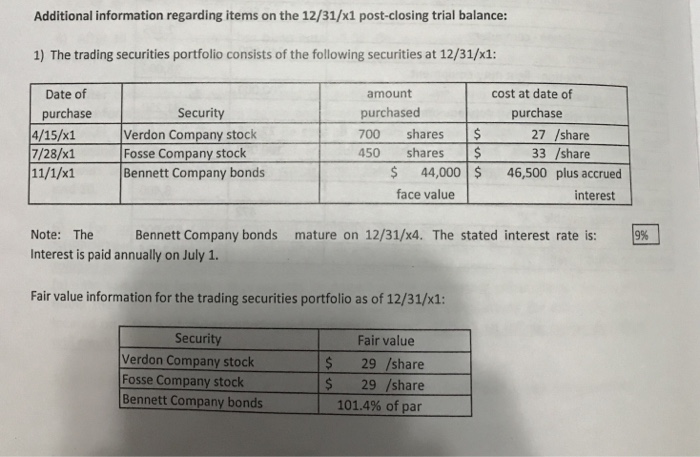

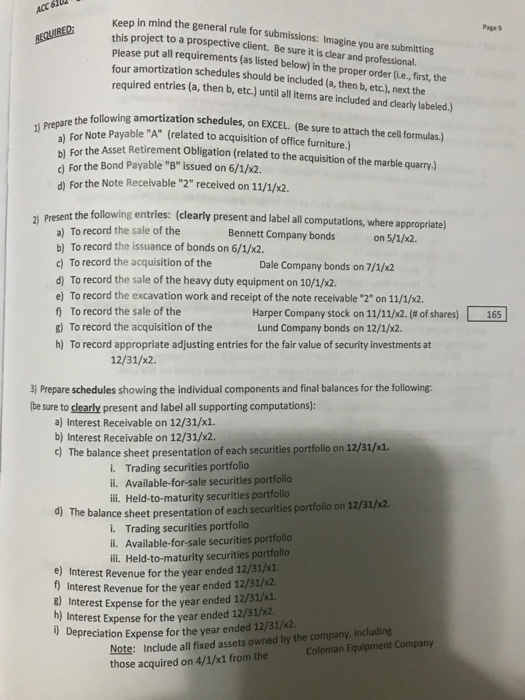

Rockland Property Development, Inc. recently completed its first year of operations Selected accounts appearing on the post-closing trial balance as of December 31, 20k1 are presented below. Rockland Property Development, Inc. Post-closing Trial Balance December 31, 20x1 80,250 Trading Securities 2,284 Fair Value Adjustment (Trading) Interest Receivable Notes Receivable "1" Available-for-Sale Securities Fair Value Adjustment (Available-for-Sale) Held-to-Maturity Securities Office Furniture Accumulated depreciation-office furniture Computers Accumulated depreciation - computers Light duty equipment Accumulated depreciation - light duty equipment Heavy duty equipment Accumulated depreciation - heavy duty equipment Patent Goodwill Bond Issue Costs (Bond Payable "A") Notes payable "A" Discount on notes payable "A" Bonds Payable "A" (maturity date: October 1, 20x6) Premium on Bonds Payable "A" 11,800 32,000 185,930 4,910 122,800 11,449 630 7,560 240,000 700,000 2,195 18,000 131,250 77,175 100,000 2,565 8,400 472 400,000 2,736 Additional information regarding items on the 12/31/x1 post-closing trial balance: 1) The trading securities portfolio consists of the following securities at 12/31/x1: cost at date of Date of amount purchased 700 shares 450 shares $ purchase 4/15/x1Verdon Co 7/28/x1 Fosse Company stock 11/1/x1 Security purchase 27 /share 33 /share 46,500 plus accrued 44,000 face value Bennett Company bonds interest mature on 12/31/x4. The stated interest rate is: Note: The Bennett Company bonds Interest is paid annually on July 1. Fair value information for the trading securities portfolio as of 12/31/x1: Security Fair value Verdon Company stock Fosse Company stock Bennett Company bonds s 29 /share s 29 /share 101.4% of par ACC 610 Keep in mind the general rule for submissions: Imagine you are submitting this project to a prospective client. Be sure it is clear and professional. Please put all requirements (as listed below) in the proper order (i.e., first, the four amortization schedules should be included (a, then b, etc.), next the required entries (a, then b, etc.) until all items are included and clearly labeled.) Page 9 ortization schedules, on EXCEL. (Be sure to attach the cell formulas.) 1) Prepare the following s al For Note Payable "A" (related to acquisition of office furniture.) the Asset Retirement Obligation (related to the acquisition of the marble quarry) b) For c) For the Bond Payable "3" issued on 6/1/x2. d) For the Note Receivable "2" received on 11/1/x2. t the following entries: (clearly present and label all computations, where appropriate) a) To record the sale of the b) To record the issuance of bonds on 6/1/x2. c) To record the acquisition of the d) To record the sale of the heavy duty equipment on 10/1/x2. e) To record the excavation work and receipt of the note receivable "2" on 11/1/x2. f) To record the sale of the g) To record the acquisition of the h) To record appropriate adjusting entries for the fair value of security investments at Bennett Company bonds on 5/1/x2. Dale Company bonds on 7/1/x2 -163 Harper Company stock on 11/11/x2,(# of shares) Lund Company bonds on 12/1/x2. 12/31/x2 3) Prepare schedules showing the individual components and final balances for the following: be sure to clearly present and label all supporting computations): a) Interest Receivable on 12/31/x1. b) Interest Receivable on 12/31/x2. d) The balance sheet presentation of each securities portfolio on 12/31/x1. i. Trading securities portfolio li. Available-for-sale securities portfolio ii. Held-to-maturity securities portfolio The balance sheet presentation of each securities portfolio on 12/31/x2 i. Trading securities portfolio li. Available-for-sale securities portfolio ii. Held-to-maturity securities portfolio nterest Revenue for the year ended 12/31/x1. Interest Revenue for the year ended 12/31/x2. 8) Interest Expense for the year ended 12/31/k1 interest Expense for the year ended 12/31/2 Depreciation Expense for the year ended 12/31/x2 Note: Include all fixed assets owned by the company, including those acquired on 4/1/x1 from the Coleman Equipment Company Rockland Property Development, Inc. recently completed its first year of operations Selected accounts appearing on the post-closing trial balance as of December 31, 20k1 are presented below. Rockland Property Development, Inc. Post-closing Trial Balance December 31, 20x1 80,250 Trading Securities 2,284 Fair Value Adjustment (Trading) Interest Receivable Notes Receivable "1" Available-for-Sale Securities Fair Value Adjustment (Available-for-Sale) Held-to-Maturity Securities Office Furniture Accumulated depreciation-office furniture Computers Accumulated depreciation - computers Light duty equipment Accumulated depreciation - light duty equipment Heavy duty equipment Accumulated depreciation - heavy duty equipment Patent Goodwill Bond Issue Costs (Bond Payable "A") Notes payable "A" Discount on notes payable "A" Bonds Payable "A" (maturity date: October 1, 20x6) Premium on Bonds Payable "A" 11,800 32,000 185,930 4,910 122,800 11,449 630 7,560 240,000 700,000 2,195 18,000 131,250 77,175 100,000 2,565 8,400 472 400,000 2,736 Additional information regarding items on the 12/31/x1 post-closing trial balance: 1) The trading securities portfolio consists of the following securities at 12/31/x1: cost at date of Date of amount purchased 700 shares 450 shares $ purchase 4/15/x1Verdon Co 7/28/x1 Fosse Company stock 11/1/x1 Security purchase 27 /share 33 /share 46,500 plus accrued 44,000 face value Bennett Company bonds interest mature on 12/31/x4. The stated interest rate is: Note: The Bennett Company bonds Interest is paid annually on July 1. Fair value information for the trading securities portfolio as of 12/31/x1: Security Fair value Verdon Company stock Fosse Company stock Bennett Company bonds s 29 /share s 29 /share 101.4% of par ACC 610 Keep in mind the general rule for submissions: Imagine you are submitting this project to a prospective client. Be sure it is clear and professional. Please put all requirements (as listed below) in the proper order (i.e., first, the four amortization schedules should be included (a, then b, etc.), next the required entries (a, then b, etc.) until all items are included and clearly labeled.) Page 9 ortization schedules, on EXCEL. (Be sure to attach the cell formulas.) 1) Prepare the following s al For Note Payable "A" (related to acquisition of office furniture.) the Asset Retirement Obligation (related to the acquisition of the marble quarry) b) For c) For the Bond Payable "3" issued on 6/1/x2. d) For the Note Receivable "2" received on 11/1/x2. t the following entries: (clearly present and label all computations, where appropriate) a) To record the sale of the b) To record the issuance of bonds on 6/1/x2. c) To record the acquisition of the d) To record the sale of the heavy duty equipment on 10/1/x2. e) To record the excavation work and receipt of the note receivable "2" on 11/1/x2. f) To record the sale of the g) To record the acquisition of the h) To record appropriate adjusting entries for the fair value of security investments at Bennett Company bonds on 5/1/x2. Dale Company bonds on 7/1/x2 -163 Harper Company stock on 11/11/x2,(# of shares) Lund Company bonds on 12/1/x2. 12/31/x2 3) Prepare schedules showing the individual components and final balances for the following: be sure to clearly present and label all supporting computations): a) Interest Receivable on 12/31/x1. b) Interest Receivable on 12/31/x2. d) The balance sheet presentation of each securities portfolio on 12/31/x1. i. Trading securities portfolio li. Available-for-sale securities portfolio ii. Held-to-maturity securities portfolio The balance sheet presentation of each securities portfolio on 12/31/x2 i. Trading securities portfolio li. Available-for-sale securities portfolio ii. Held-to-maturity securities portfolio nterest Revenue for the year ended 12/31/x1. Interest Revenue for the year ended 12/31/x2. 8) Interest Expense for the year ended 12/31/k1 interest Expense for the year ended 12/31/2 Depreciation Expense for the year ended 12/31/x2 Note: Include all fixed assets owned by the company, including those acquired on 4/1/x1 from the Coleman Equipment Company