Answered step by step

Verified Expert Solution

Question

1 Approved Answer

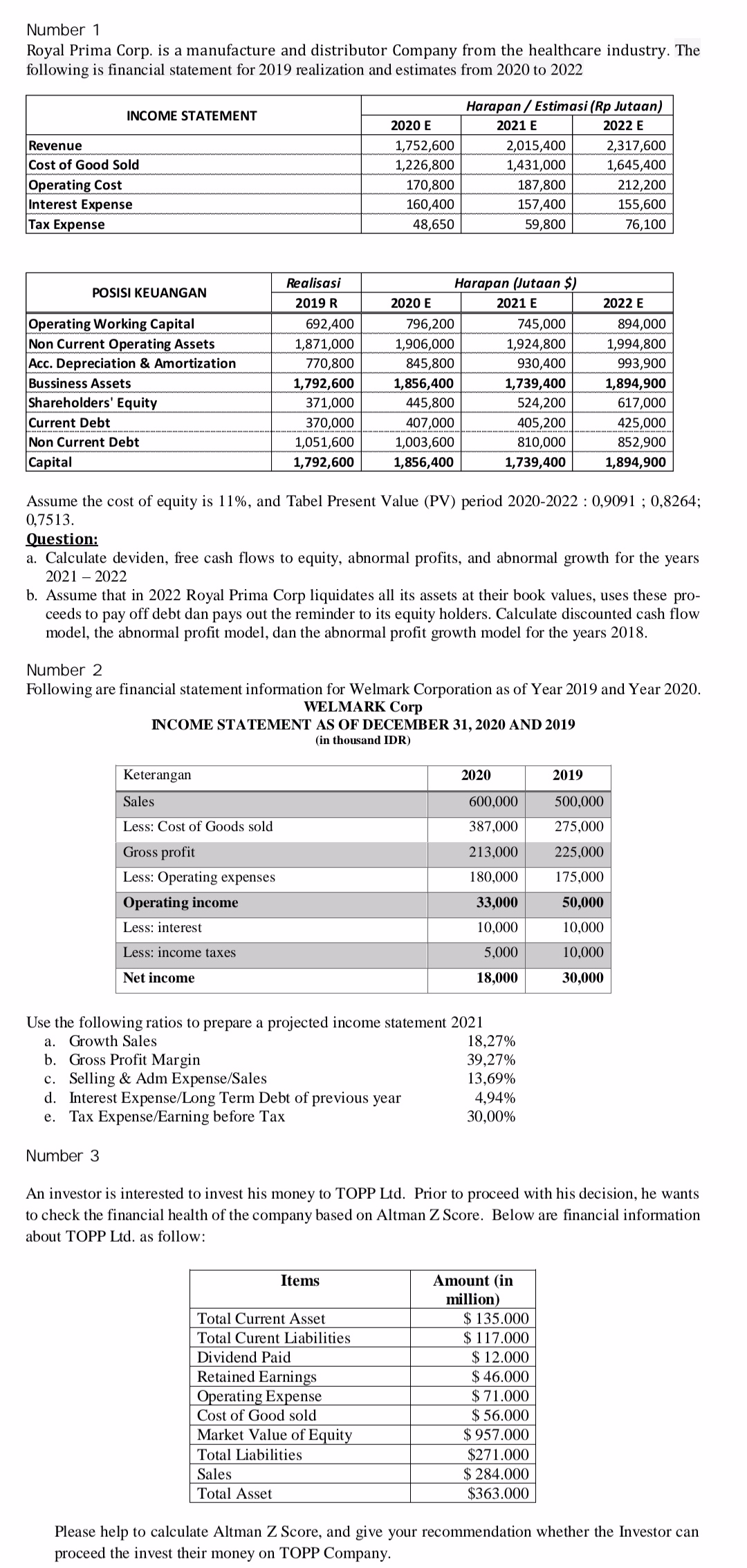

Number 1 Royal Prima Corp. is a manufacture and distributor Company from the healthcare industry. The following is financial statement for 2019 realization and

Number 1 Royal Prima Corp. is a manufacture and distributor Company from the healthcare industry. The following is financial statement for 2019 realization and estimates from 2020 to 2022 INCOME STATEMENT Revenue Cost of Good Sold Operating Cost Interest Expense Tax Expense POSISI KEUANGAN Operating Working Capital Non Current Operating Assets Acc. Depreciation & Amortization Bussiness Assets Shareholders' Equity Current Debt Non Current Debt Capital Realisasi 2019 R 692,400 1,871,000 770,800 1,792,600 371,000 370,000 1,051,600 1,792,600 Keterangan Sales Less: Cost of Goods sold Gross profit Less: Operating expenses Operating income Less: interest Less: income taxes Net income 2020 E 1,752,600 1,226,800 170,800 160,400 48,650 Items 2020 E Total Current Asset Total Curent Liabilities Dividend Paid Retained Earnings Operating Expense Cost of Good sold Harapan / Estimasi (Rp Jutaan) 2021 E 2022 E 796,200 1,906,000 845,800 1,856,400 445,800 407,000 1,003,600 1,856,400 Market Value of Equity Total Liabilities Sales Total Asset Harapan (Jutaan $) 2021 E 2,015,400 1,431,000 187,800 157,400 59,800 Use the following ratios to prepare a projected income statement 2021 a. Growth Sales b. Gross Profit Margin c. Selling & Adm Expense/Sales d. Interest Expense/Long Term Debt of previous year e. Tax Expense/Earning before Tax Number 3 745,000 1,924,800 930,400 2020 1,739,400 524,200 Assume the cost of equity is 11%, and Tabel Present Value (PV) period 2020-2022 : 0,9091; 0,8264; 0,7513. 405,200 810,000 1,739,400 Question: a. Calculate deviden, free cash flows to equity, abnormal profits, and abnormal growth for the years 2021 2022 b. Assume that in 2022 Royal Prima Corp liquidates all its assets at their book values, uses these pro- ceeds to pay off debt dan pays out the reminder to its equity holders. Calculate discounted cash flow model, the abnormal profit model, dan the abnormal profit growth model for the years 2018. Number 2 Following are financial statement information for Welmark Corporation as of Year 2019 and Year 2020. WELMARK Corp INCOME STATEMENT AS OF DECEMBER 31, 2020 AND 2019 (in thousand IDR) 600,000 387,000 213,000 180,000 33,000 10,000 5,000 18,000 18,27% 39,27% 13,69% 4,94% 30,00% 2,317,600 1,645,400 212,200 155,600 76,100 2022 E Amount (in million) An investor is interested to invest his money to TOPP Ltd. Prior to proceed with his decision, he wants to check the financial health of the company based on Altman Z Score. Below are financial information about TOPP Ltd. as follow: $135.000 $117.000 $12.000 $ 46.000 $71.000 $ 56.000 $957.000 $271.000 $ 284.000 $363.000 894,000 1,994,800 993,900 2019 500,000 275,000 225,000 175,000 50,000 10,000 10,000 30,000 1,894,900 617,000 425,000 852,900 1,894,900 Please help to calculate Altman Z Score, and give your recommendation whether the Investor can proceed the invest their money on TOPP Company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Altman ZScore for TOPP Ltd we need the following financial ratios 1 Working CapitalTotal Assets 2 Retained EarningsTotal Assets 3 Earnings Before Interest and Taxes EBITTotal Assets 4 Market Value of EquityTotal Liabilities 5 SalesTotal Assets Lets calculate each ratio and then compute the Altman ZScore 1 Working CapitalTotal Assets Working Capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started