Answered step by step

Verified Expert Solution

Question

1 Approved Answer

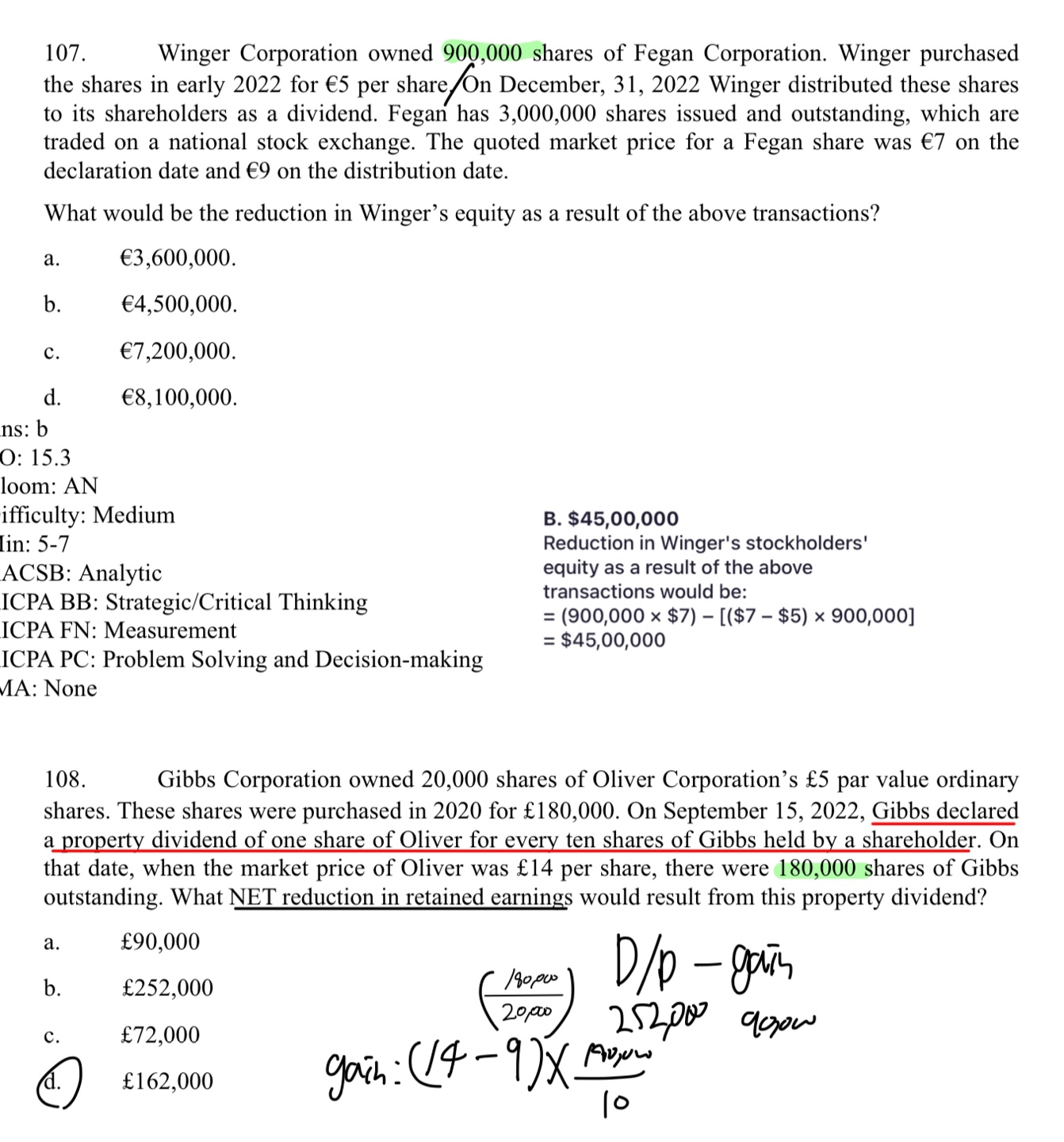

Number 107 has 900000 shares used to solve the problem (fluorescent fan) 108 is using 18000 shares to solve the problem (fluorescent fan) I already

Number 107 has 900000 shares used to solve the problem (fluorescent fan) 108 is using 18000 shares to solve the problem (fluorescent fan) I already know the answer, but the gist of the question is, in what situation do I have to choose a number when solving the problem. Does the red underline I drew play a role in choosing numbers? I'm sorry for the difficult question.

107. Winger Corporation owned 900,000 shares of Fegan Corporation. Winger purchased the shares in early 2022 for 5 per share/On December, 31, 2022 Winger distributed these shares to its shareholders as a dividend. Fegan has 3,000,000 shares issued and outstanding, which are traded on a national stock exchange. The quoted market price for a Fegan share was 7 on the declaration date and 9 on the distribution date. What would be the reduction in Winger's equity as a result of the above transactions? a. 3,600,000. b. 4,500,000. c. 7,200,000. d. 8,100,000. s: b :15.3 om: AN ficulty: Medium n: 57 CSB: Analytic CPA BB: Strategic/Critical Thinking CPA FN: Measurement CPA PC: Problem Solving and Decision-making B. $45,00,000 Reduction in Winger's stockholders' equity as a result of the above transactions would be: =(900,000$7)[($7$5)900,000] =$45,00,000 A: None 108. Gibbs Corporation owned 20,000 shares of Oliver Corporation's 5 par value ordinary shares. These shares were purchased in 2020 for 180,000. On September 15, 2022, Gibbs declared a property dividend of one share of Oliver for every ten shares of Gibbs held by a shareholder. On that date, when the market price of Oliver was 14 per share, there were 180,000 shares of Gibbs outstanding. What NET reduction in retained earnings would result from this property dividend? a. 90,000 b. 252,000 c. 72,000 (d.) 162,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started