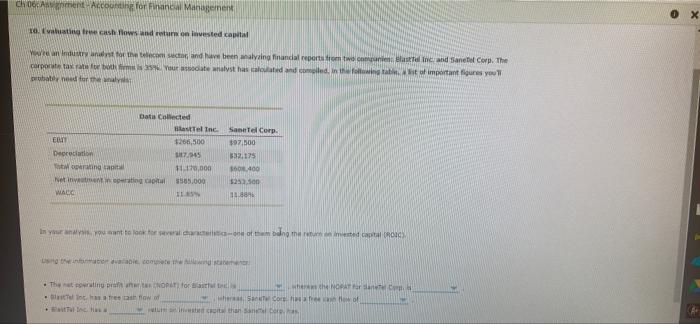

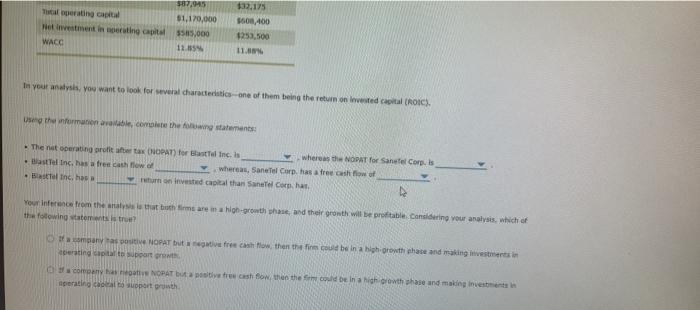

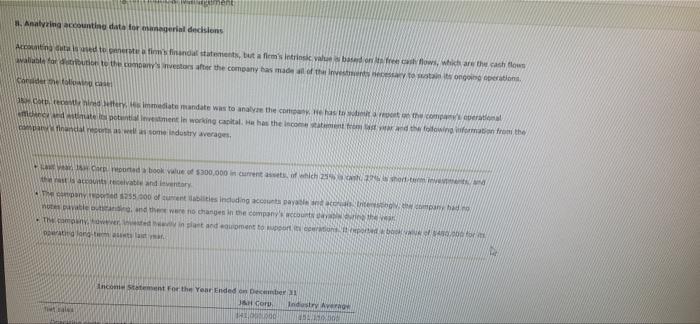

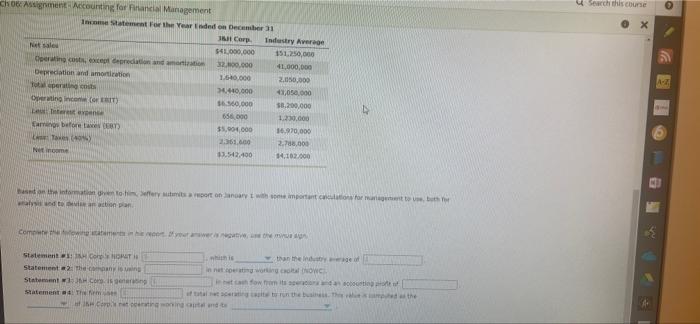

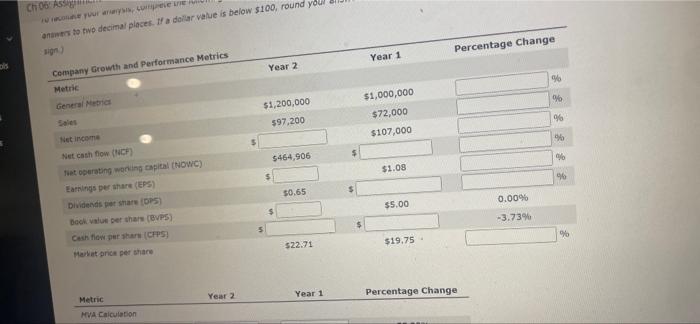

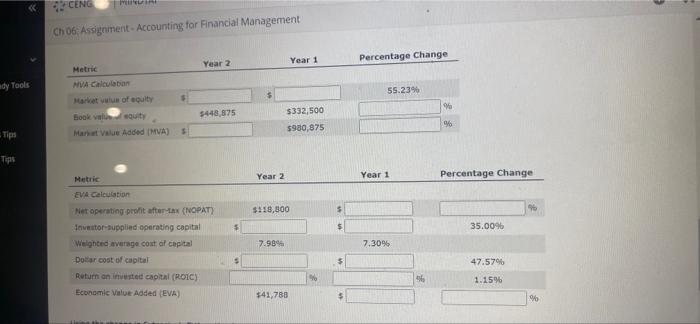

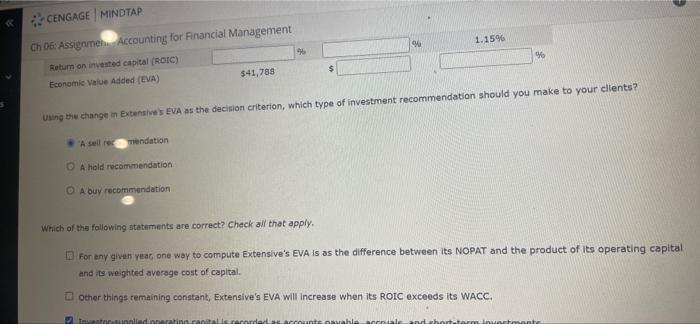

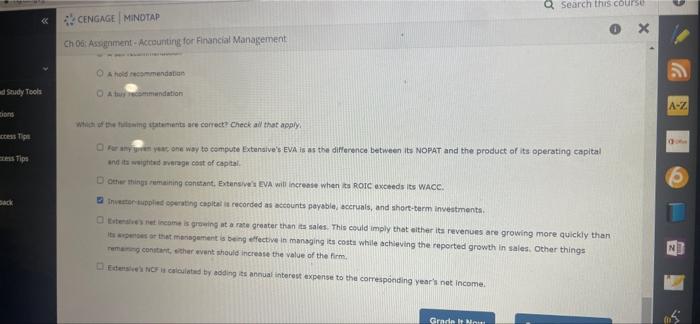

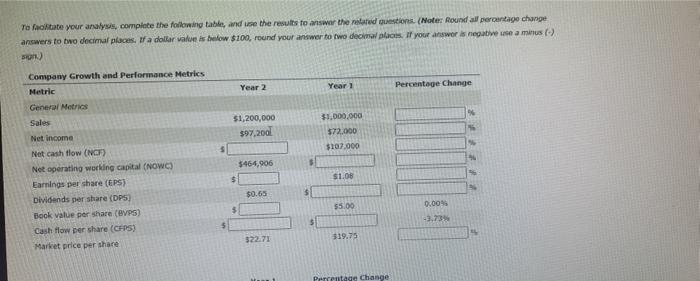

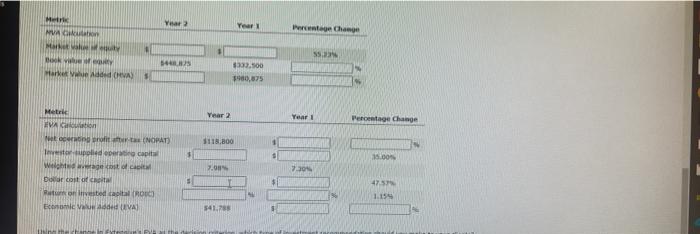

chorament Accounting for Financial Management 0 x Ovating the cash flows and turn on invested capital Yn durant for the telecomandave been malying Finandal reports from west in and Sanet Corp. The carport tax rate for both your te walthas calculated and cooled. In the two important figures you petite to Date Collected Bestel Inc ET 266,500 Depreciation 117.95 htting 11170,000 Netting 5565.000 WACO 11 Sanntel Corp. $97.500 $32.175 10400 525 50 In your usant to save the marted capital Salon . The wine for te catre now of Inc where the NORTH Sort of thansa $87.945 Terting Gil 61,170,000 Net investment in orating capital 585,000 WACC 11. 32,175 50,400 1253,500 11. In your analysis, you want to look for several characteristics one of them being the return on invested capital (ROC). Use the information avecome the statements The net operating profitta NOPAT) for Bestel Inc. is whereas the NODAT for Santel Corgis stel Inc. has a free cachowo whereas, Santel Corp. has a free cash flow of al Inc. has who invested capital than Santel Corhan Your inference from the statut both firms are in a high-growth phase, and their growth be profitable considering your which of the following statement is true? Omanas positive NORAT free how then the could be in a growth phase and making investments bertind cipta sport con NOPAT but other cash sow, then there could be a Nightshase and making investment perating to support growth Inent 1. Analyzing accounting data for agerial decisions Accounting and tools, but a firm'sininko free shows, which are the cash flow wall for to the man's store the company has made of the tongoperations Corside Concert mandate was to the comes to the comparati et potatoen working capital has the income the format from the maandalosomeindestry average Cod book of 5300,000 which the con elvatanda pony 955.000 of mente indeding accompanhado nation were no changes in the company the Two were and womento por portebo Dertig long tumata con Statement For the Year Ended December JS Coru Industry Aven HER Such this course chossignment Accounting for Financial Management In Statement for the Yearded on December 31 1 Corp Industry Average Nese $41.000.000 151.250,000 Dorline concept denean 32.100.000 41,000,000 Deprecation and amortization 1.600.000 2.000.000 operating 40.000 41,050.000 Operating incor) 0.000 53,200.000 Lite 656.000 1.200.000 am before ) $5,000,000 16.970,000 TA 261,600 2.700.000 Nicome 13.542.400 14.102.000 basahintomatoery Mortonnante important for the wa do pan Comments Statement com his trantendo Statement 2They net cowocow Statement with come How to Statement to run the heathe Egmond Ch 06' Ass your name as to two decimal places. Ita della value is below $100, round you Percentage Change Year 1 Year 2 Company Growth and Performance Metrics Metric General Need 9 $1,200,000 $97,200 $1,000,000 $72,000 $107.000 96 96 $464,906 16 $1.08 96 $0.65 $ Net income Net cash flow (NICH tersting woning Capital (NOWC) Earnings per share (EPS) Dividends pershane DP5) book value per share (BPS) Cash flow per share (CPS) Market price per share $5.00 0.00% -3.73% 5 9 $22.71 $19.75 Year 2 Year 1 Percentage Change Metric HVA Calculation 12 CENG Ch 06 Assignment - Accounting for Financial Management Year 1 Percentage Change Year 2 dy Tools 55.239 $ Metric NVA Calculator Harket wwlue of equity Book valuequity Mart Value Added (VA) 5448,875 $332,500 $930,875 9 $ Tips Tips Year 2 Year 1 Percentage Change $118,300 $ 35.00% Metric EVA Calculation Net operating profit after-tax (NOPAT) Investor supplied operating capital Weighted average cost of capital Dollar cost of capital Return on invested capital (ROIC) Economic Value Added (EVA) 7.93 7.3096 47.57% 1.15% $41,788 1.15% M CENGAGE MINDTAP Ch 06: Assignmen Accounting for Financial Management Return on invested capital (ROIC) Economie Value Added (EVA) $41,788 9 $ Uuring the change in Exterie EVA as the decision criterion, which type of investment recommendation should you make to your clients? A sell remendation O A hold recommendation D A buy recommendation Which of the following statements are correct? Check all that apply. For any given year, one way to compute Extensive's EVA is as the difference between its NOPAT and the product of its operating capital and its weighted average cost of capital. other things remaining constant, Extensive's EVA will increase when its ROIC exceeds its WACC. Inwestoruliad onerating can taliscarded as nahlaacha tante Search this course CENGAGE MINDTAP 0 x Choo Asognment - Accounting for Financial Management Oh commendation Study Tools A commendation A-Z Which of the humans are correct? Check all that apply Tim Tips One year one way to compute Extensive's EVA is as the difference between its NOPAT and the product of its operating capital nawierage cost of capital other things remaining constant. Extensive EVA will increase when ts ROIC exceeds its WACC. Sack topped ting capital is recorded as accounts payable, accruals, and short-term investments bet income is growing at a rate greater than its sales. This could imply that either its revenues are growing more quickly than so that management is being effective in managing its costs while achieving the reported growth in sales. Other things memang constant the event should increase the value of the form de Fiscaled by adding its annual interest expense to the corresponding year's net income Grade In Mount To Rotate your analysis, complete the following table, and use the results to answer the related questions (Note: Round all percentage change answers to two decimal places. If a dollar value is below $100, round your answer to two decimal plans. If your answer is negative use a minus) son) Year 2 Year 1 Percentage Change $1,200,000 597,2001 51.000.000 372.000 $107.000 Company Growth and Performance Metrics Metric General Metrics Sales Net income Net cash flow (NGF) Net operating working capital (NOWC) Earnings per share (EPS) Dividends per share (DPS) Book value per share (BPS) Cash flow per share (CERS) Market price per share $464,906 $ $1.06 1:1 $0.65 $ $ 55.00 0.00% -3,73 $22.71 319.75 Percentage Change Year Yeart Perintage Change Me NVA Mietwa SS BV Market Added CHIVA) SS 3 $3,500 1900,75 Metre EVAC Year 2 Year Percentage Change 1118.800 15.00 ud 2.0 (NOPAT) Topplied to capital Witt Docotofa constata (RO) Economie de VA 230 5 47.57 1.154 541.78 Then FY chorament Accounting for Financial Management 0 x Ovating the cash flows and turn on invested capital Yn durant for the telecomandave been malying Finandal reports from west in and Sanet Corp. The carport tax rate for both your te walthas calculated and cooled. In the two important figures you petite to Date Collected Bestel Inc ET 266,500 Depreciation 117.95 htting 11170,000 Netting 5565.000 WACO 11 Sanntel Corp. $97.500 $32.175 10400 525 50 In your usant to save the marted capital Salon . The wine for te catre now of Inc where the NORTH Sort of thansa $87.945 Terting Gil 61,170,000 Net investment in orating capital 585,000 WACC 11. 32,175 50,400 1253,500 11. In your analysis, you want to look for several characteristics one of them being the return on invested capital (ROC). Use the information avecome the statements The net operating profitta NOPAT) for Bestel Inc. is whereas the NODAT for Santel Corgis stel Inc. has a free cachowo whereas, Santel Corp. has a free cash flow of al Inc. has who invested capital than Santel Corhan Your inference from the statut both firms are in a high-growth phase, and their growth be profitable considering your which of the following statement is true? Omanas positive NORAT free how then the could be in a growth phase and making investments bertind cipta sport con NOPAT but other cash sow, then there could be a Nightshase and making investment perating to support growth Inent 1. Analyzing accounting data for agerial decisions Accounting and tools, but a firm'sininko free shows, which are the cash flow wall for to the man's store the company has made of the tongoperations Corside Concert mandate was to the comes to the comparati et potatoen working capital has the income the format from the maandalosomeindestry average Cod book of 5300,000 which the con elvatanda pony 955.000 of mente indeding accompanhado nation were no changes in the company the Two were and womento por portebo Dertig long tumata con Statement For the Year Ended December JS Coru Industry Aven HER Such this course chossignment Accounting for Financial Management In Statement for the Yearded on December 31 1 Corp Industry Average Nese $41.000.000 151.250,000 Dorline concept denean 32.100.000 41,000,000 Deprecation and amortization 1.600.000 2.000.000 operating 40.000 41,050.000 Operating incor) 0.000 53,200.000 Lite 656.000 1.200.000 am before ) $5,000,000 16.970,000 TA 261,600 2.700.000 Nicome 13.542.400 14.102.000 basahintomatoery Mortonnante important for the wa do pan Comments Statement com his trantendo Statement 2They net cowocow Statement with come How to Statement to run the heathe Egmond Ch 06' Ass your name as to two decimal places. Ita della value is below $100, round you Percentage Change Year 1 Year 2 Company Growth and Performance Metrics Metric General Need 9 $1,200,000 $97,200 $1,000,000 $72,000 $107.000 96 96 $464,906 16 $1.08 96 $0.65 $ Net income Net cash flow (NICH tersting woning Capital (NOWC) Earnings per share (EPS) Dividends pershane DP5) book value per share (BPS) Cash flow per share (CPS) Market price per share $5.00 0.00% -3.73% 5 9 $22.71 $19.75 Year 2 Year 1 Percentage Change Metric HVA Calculation 12 CENG Ch 06 Assignment - Accounting for Financial Management Year 1 Percentage Change Year 2 dy Tools 55.239 $ Metric NVA Calculator Harket wwlue of equity Book valuequity Mart Value Added (VA) 5448,875 $332,500 $930,875 9 $ Tips Tips Year 2 Year 1 Percentage Change $118,300 $ 35.00% Metric EVA Calculation Net operating profit after-tax (NOPAT) Investor supplied operating capital Weighted average cost of capital Dollar cost of capital Return on invested capital (ROIC) Economic Value Added (EVA) 7.93 7.3096 47.57% 1.15% $41,788 1.15% M CENGAGE MINDTAP Ch 06: Assignmen Accounting for Financial Management Return on invested capital (ROIC) Economie Value Added (EVA) $41,788 9 $ Uuring the change in Exterie EVA as the decision criterion, which type of investment recommendation should you make to your clients? A sell remendation O A hold recommendation D A buy recommendation Which of the following statements are correct? Check all that apply. For any given year, one way to compute Extensive's EVA is as the difference between its NOPAT and the product of its operating capital and its weighted average cost of capital. other things remaining constant, Extensive's EVA will increase when its ROIC exceeds its WACC. Inwestoruliad onerating can taliscarded as nahlaacha tante Search this course CENGAGE MINDTAP 0 x Choo Asognment - Accounting for Financial Management Oh commendation Study Tools A commendation A-Z Which of the humans are correct? Check all that apply Tim Tips One year one way to compute Extensive's EVA is as the difference between its NOPAT and the product of its operating capital nawierage cost of capital other things remaining constant. Extensive EVA will increase when ts ROIC exceeds its WACC. Sack topped ting capital is recorded as accounts payable, accruals, and short-term investments bet income is growing at a rate greater than its sales. This could imply that either its revenues are growing more quickly than so that management is being effective in managing its costs while achieving the reported growth in sales. Other things memang constant the event should increase the value of the form de Fiscaled by adding its annual interest expense to the corresponding year's net income Grade In Mount To Rotate your analysis, complete the following table, and use the results to answer the related questions (Note: Round all percentage change answers to two decimal places. If a dollar value is below $100, round your answer to two decimal plans. If your answer is negative use a minus) son) Year 2 Year 1 Percentage Change $1,200,000 597,2001 51.000.000 372.000 $107.000 Company Growth and Performance Metrics Metric General Metrics Sales Net income Net cash flow (NGF) Net operating working capital (NOWC) Earnings per share (EPS) Dividends per share (DPS) Book value per share (BPS) Cash flow per share (CERS) Market price per share $464,906 $ $1.06 1:1 $0.65 $ $ 55.00 0.00% -3,73 $22.71 319.75 Percentage Change Year Yeart Perintage Change Me NVA Mietwa SS BV Market Added CHIVA) SS 3 $3,500 1900,75 Metre EVAC Year 2 Year Percentage Change 1118.800 15.00 ud 2.0 (NOPAT) Topplied to capital Witt Docotofa constata (RO) Economie de VA 230 5 47.57 1.154 541.78 Then FY