Answered step by step

Verified Expert Solution

Question

1 Approved Answer

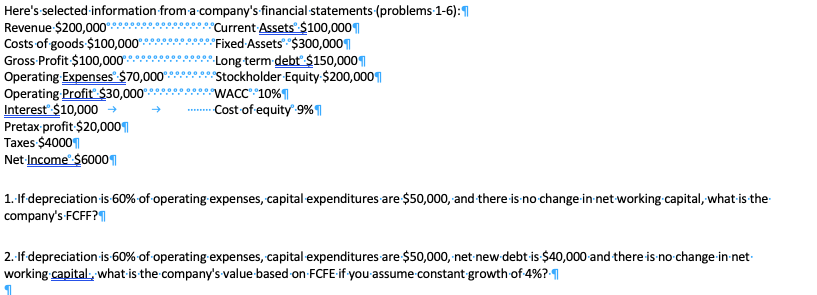

Number 2 please. I don't get what the growth rate is for? Here's selected information from a company's financial statements (problems-1-6): 1 Revenue $200,000 Current

Number 2 please. I don't get what the growth rate is for?

Here's selected information from a company's financial statements (problems-1-6): 1 Revenue $200,000 Current Assets $100,000 Costs of goods $100,000 "Fixed Assets $300,000 Gross Profit $100,000 Long term debt $150,000 Operating Expenses $70,000 Stockholder Equity $200,0001 Operating Profit $30,000 WACC 10% Interest $10,000 Cost of equity 9% Pretax profit$20,000 Taxes $40001 Net Income $60009 1. If depreciation is-60% of operating-expenses, capital expenditures are $50,000, and there is no change in net-working capital, what is the company's FCFF?1 2. If depreciation-is-60% of operating expenses, capital expenditures are $50,000, net-new-debt is $40,000 and there is no change in net working capital, what is the company's value based on FCFE-if-you-assume constant growth of 4%?-1 Here's selected information from a company's financial statements (problems-1-6): 1 Revenue $200,000 Current Assets $100,000 Costs of goods $100,000 "Fixed Assets $300,000 Gross Profit $100,000 Long term debt $150,000 Operating Expenses $70,000 Stockholder Equity $200,0001 Operating Profit $30,000 WACC 10% Interest $10,000 Cost of equity 9% Pretax profit$20,000 Taxes $40001 Net Income $60009 1. If depreciation is-60% of operating-expenses, capital expenditures are $50,000, and there is no change in net-working capital, what is the company's FCFF?1 2. If depreciation-is-60% of operating expenses, capital expenditures are $50,000, net-new-debt is $40,000 and there is no change in net working capital, what is the company's value based on FCFE-if-you-assume constant growth of 4%?-1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started