Answered step by step

Verified Expert Solution

Question

1 Approved Answer

number 22 Question 20-What is the correct statement? a. This project has negative cash flows and should not be undertaken. b. This project has positive

number 22

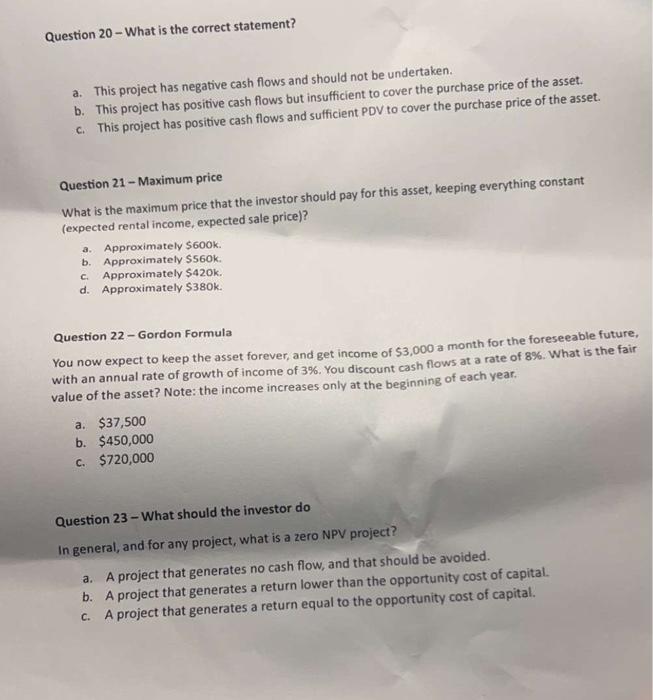

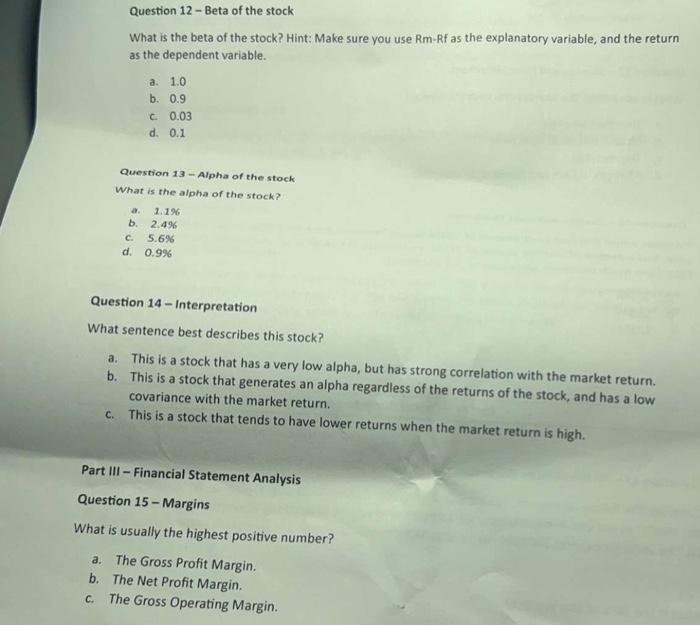

Question 20-What is the correct statement? a. This project has negative cash flows and should not be undertaken. b. This project has positive cash flows but insufficient to cover the purchase price of the asset. c. This project has positive cash flows and sufficient PDV to cover the purchase price of the asset. Question 21 - Maximum price What is the maximum price that the investor should pay for this asset, keeping everything constant (expected rental income, expected sale price)? a. Approximately $600k. b. Approximately $560k. c. Approximately $420k. d. Approximately $380k. Question 22 - Gordon Formula You now expect to keep the asset forever, and get income of $3,000 a month for the foreseeable future, with an annual rate of growth of income of 3%. You discount cash flows at a rate of 8%. What is the fair value of the asset? Note: the income increases only at the beginning of each year. a. $37,500 b. $450,000 c. $720,000 Question 23 - What should the investor do In general, and for any project, what is a zero NPV project? a. A project that generates no cash flow, and that should be avoided. b. A project that generates a return lower than the opportunity cost of capital. c. A project that generates a return equal to the opportunity cost of capital. What is the beta of the stock? Hint: Make sure you use Rm-Rf as the explanatory variable, and the return as the dependent variable. a. 1.0 b. 0.9 c. 0.03 d. 0.1 Question 13 - Alpha of the stock What is the alpha of the stock? a. 1.1% b. 2.49 c. 5.6% d. 0.9%6 Question 14-Interpretation What sentence best describes this stock? a. This is a stock that has a very low alpha, but has strong correlation with the market return. b. This is a stock that generates an alpha regardless of the returns of the stock, and has a low covariance with the market return. c. This is a stock that tends to have lower returns when the market return is high. Part III - Financial Statement Analysis Question 15-Margins What is usually the highest positive number? a. The Gross Profit Margin. b. The Net Profit Margin. c. The Gross Operating Margin Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started