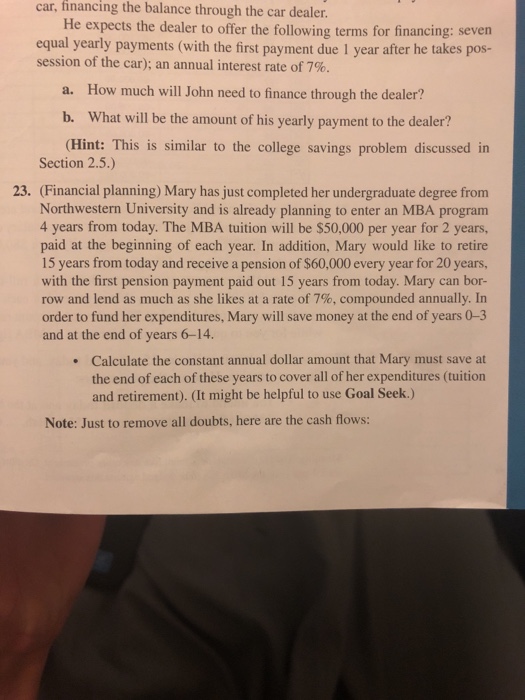

financing the balance through the car dealer. car, He expects the dealer to offer the following terms for financing: seven equal yearly payments (with the first payment due 1 year after he ta session of the car); an annual interest rate of 7%. How much will John need to finance through the dealer? What will be the amount of his yearly payment to the dealer? a. b. (Hint: This is similar to the college savings problem discussed in Section 2.5.) 23. (Financial planning) Mary has just completed her undergraduate degree from Northwestern University and is already planning to enter an MBA program 4 years from today. The MBA tuition will be $50,000 per year for 2 years, paid at the beginning of each year. In addition, Mary would like to retire 15 years from today and receive a pension of $60,000 every year for 20 years, with the first pension payment paid out 15 years from today. Mary can bor- row and lend as much as she likes at a rate of 7%, compounded annually. In order to fund her expenditures, Mary will save money at the end of years 0-3 and at the end of years 6-14. Calculate the constant annual dollar amount that Mary must save at the end of each of these years to cover all of her expenditures (tuition and retirement). (It might be helpful to use Goal Seek.) Note: Just to remove all doubts, here are the cash flows: financing the balance through the car dealer. car, He expects the dealer to offer the following terms for financing: seven equal yearly payments (with the first payment due 1 year after he ta session of the car); an annual interest rate of 7%. How much will John need to finance through the dealer? What will be the amount of his yearly payment to the dealer? a. b. (Hint: This is similar to the college savings problem discussed in Section 2.5.) 23. (Financial planning) Mary has just completed her undergraduate degree from Northwestern University and is already planning to enter an MBA program 4 years from today. The MBA tuition will be $50,000 per year for 2 years, paid at the beginning of each year. In addition, Mary would like to retire 15 years from today and receive a pension of $60,000 every year for 20 years, with the first pension payment paid out 15 years from today. Mary can bor- row and lend as much as she likes at a rate of 7%, compounded annually. In order to fund her expenditures, Mary will save money at the end of years 0-3 and at the end of years 6-14. Calculate the constant annual dollar amount that Mary must save at the end of each of these years to cover all of her expenditures (tuition and retirement). (It might be helpful to use Goal Seek.) Note: Just to remove all doubts, here are the cash flows