Answered step by step

Verified Expert Solution

Question

1 Approved Answer

number 28 and 30 please. LO 1 LO 1 on the company's stock over the next year? What does this tell you about the implied

number 28 and 30 please.

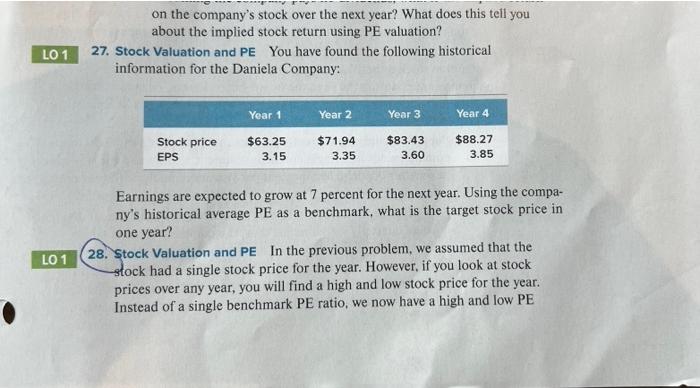

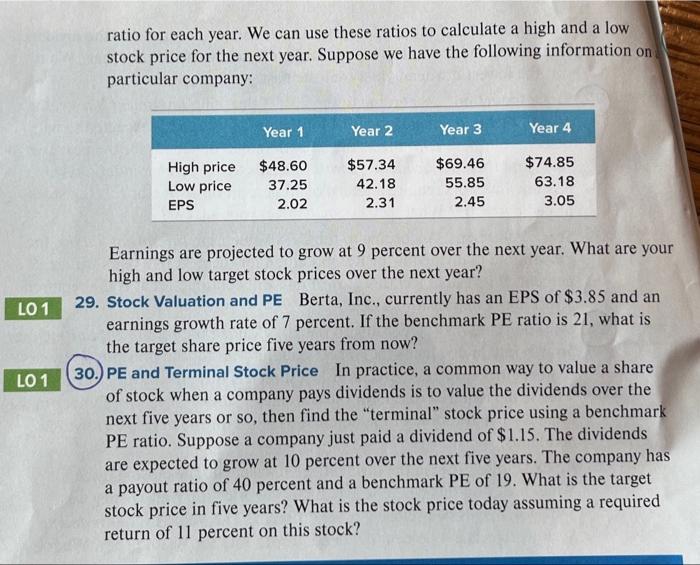

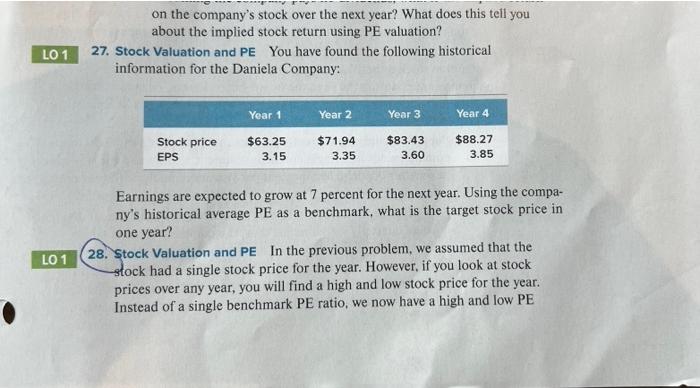

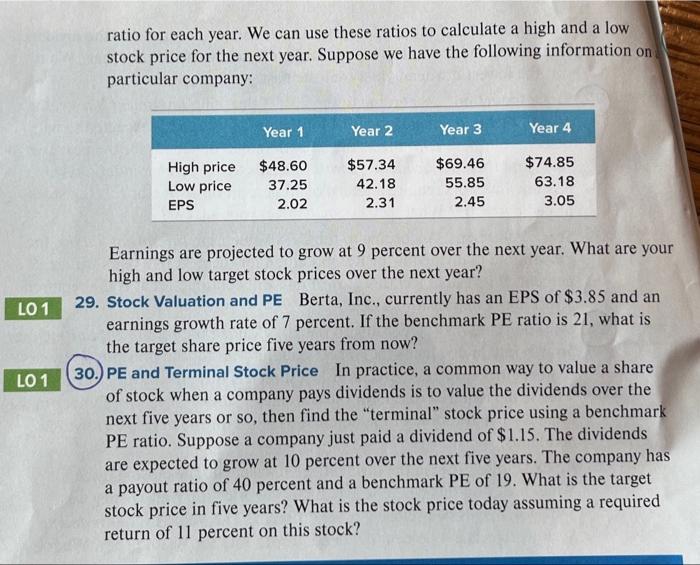

LO 1 LO 1 on the company's stock over the next year? What does this tell you about the implied stock return using PE valuation? 27. Stock Valuation and PE You have found the following historical information for the Daniela Company: Year 1 Year 2 Year 3 Year 4 $63.25 $71.94 $83.43 $88.27 Stock price EPS 3.15 3.35 3.60 3.85 Earnings are expected to grow at 7 percent for the next year. Using the compa- ny's historical average PE as a benchmark, what is the target stock price in one year? 28. Stock Valuation and PE In the previous problem, we assumed that the stock had a single stock price for the year. However, if you look at stock prices over any year, you will find a high and low stock price for the year. Instead of a single benchmark PE ratio, we now have a high and low PE ratio for each year. We can use these ratios to calculate a high and a low stock price for the next year. Suppose we have the following information on particular company: Year 1 Year 2 Year 3 Year 4 High price $48.60 $57.34 $69.46 $74.85 37.25 42.18 55.85 63.18 Low price EPS 2.02 2.31 2.45 3.05 Earnings are projected to grow at 9 percent over the next year. What are your high and low target stock prices over the next year? LO 1 29. Stock Valuation and PE LO 1 Berta, Inc., currently has an EPS of $3.85 and an earnings growth rate of 7 percent. If the benchmark PE ratio is 21, what is the target share price five years from now? (30.) PE and Terminal Stock Price In practice, a common way to value a share of stock when a company pays dividends is to value the dividends over the next five years or so, then find the "terminal" stock price using a benchmark. PE ratio. Suppose a company just paid a dividend of $1.15. The dividends are expected to grow at 10 percent over the next five years. The company has a payout ratio of 40 percent and a benchmark PE of 19. What is the target stock price in five years? What is the stock price today assuming a required return of 11 percent on this stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started